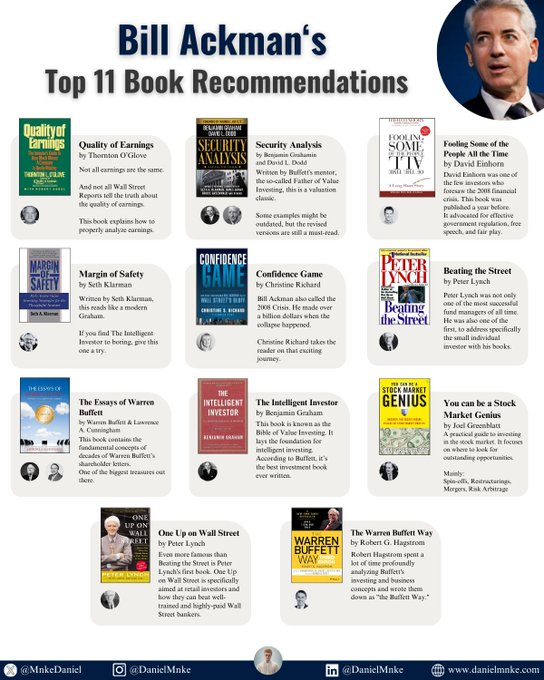

American hedge fund billionaire Bill Ackman is a big fan of self-studying investing.

"You can learn investing by reading books."

Here is the 11-Book-List that he recommends to everyone who wants to learn about Investing👇

"You can learn investing by reading books."

Here is the 11-Book-List that he recommends to everyone who wants to learn about Investing👇

1. Quality of Earnings by Thornton O’Glove

Earnings are one if not the most important driver of investment performance.

Thornton O'Glove does a phenomenal job of explaining how to analyze earnings and their sustainability/quality.

Earnings are one if not the most important driver of investment performance.

Thornton O'Glove does a phenomenal job of explaining how to analyze earnings and their sustainability/quality.

2. Fooling Some of the People All of the Time by David Einhorn

David Einhorn was one of the few investors who foresaw the 2008 financial crisis.

This book was published a year before, in 2007.

It advocated for effective government regulation, free speech, and fair play.

David Einhorn was one of the few investors who foresaw the 2008 financial crisis.

This book was published a year before, in 2007.

It advocated for effective government regulation, free speech, and fair play.

3. Security Analysis by Benjamin Graham and David L. Dodd

Written by Buffett's mentor, the so-called Father of Value Investing, this is a valuation classic.

It might be too complex for beginners but is a necessary read for more experienced investors.

Written by Buffett's mentor, the so-called Father of Value Investing, this is a valuation classic.

It might be too complex for beginners but is a necessary read for more experienced investors.

4. Margin of Safety by Seth Klarman

This book is similar to Graham's The Intelligent Investor.

However, I find it easier to read because of its modern touch.

By the way, it costs over $2000. But I've heard that there's a PDF online...🤫

This book is similar to Graham's The Intelligent Investor.

However, I find it easier to read because of its modern touch.

By the way, it costs over $2000. But I've heard that there's a PDF online...🤫

5. Confidence Game by Christine Richard

Another investor who called the 2008 crisis was the person that recommended all these books, Bill Ackman.

He made over a billion dollars when the collapse happened.

Christine Richard takes the reader on that exciting journey.

Another investor who called the 2008 crisis was the person that recommended all these books, Bill Ackman.

He made over a billion dollars when the collapse happened.

Christine Richard takes the reader on that exciting journey.

6. Beating the Street by Peter Lynch

Lynch wasn't just the most successful fund manager of all time. He's also a great author.

This book is full of investing wisdom and a great start to the investing world.

Lynch wasn't just the most successful fund manager of all time. He's also a great author.

This book is full of investing wisdom and a great start to the investing world.

7. The Essays of Warren Buffett by Warren Buffett & Lawrence A. Cunningham

This book contains the fundamental concepts of decades of Warren Buffett’s shareholder letters.

A must-read for every Buffett fan and aspiring investor.

This book contains the fundamental concepts of decades of Warren Buffett’s shareholder letters.

A must-read for every Buffett fan and aspiring investor.

8. The Intelligent Investor by Benjamin Graham

This book is known as the Bible of Value Investing.

It lays the foundation for intelligent investing.

According to Buffett, it’s the best investment book ever written.

This book is known as the Bible of Value Investing.

It lays the foundation for intelligent investing.

According to Buffett, it’s the best investment book ever written.

9. You can be a Stock Market Genius by Joel Greenblatt

A practical guide to investing in the stock market.

It explains where individual investors should look for opportunities and how to exploit them.

Focus on:

- Spin-offs

- Restructurings

- Mergers

- Risk Arbitrage

A practical guide to investing in the stock market.

It explains where individual investors should look for opportunities and how to exploit them.

Focus on:

- Spin-offs

- Restructurings

- Mergers

- Risk Arbitrage

10. One Up on Wall Street by Peter Lynch

Even more famous than Beating the Street is Peter Lynch's first book.

One Up on Wall Street is specifically aimed at retail investors and how they can beat well-trained and highly-paid Wall Street bankers.

Even more famous than Beating the Street is Peter Lynch's first book.

One Up on Wall Street is specifically aimed at retail investors and how they can beat well-trained and highly-paid Wall Street bankers.

11. The Warren Buffett Way by Robert G. Hagstrom

Robert Hagstrom spent a lot of time profoundly analyzing Buffett's investing and business concepts.

This book summarizes the "the Buffett Way" of investing and business.

Robert Hagstrom spent a lot of time profoundly analyzing Buffett's investing and business concepts.

This book summarizes the "the Buffett Way" of investing and business.

Those were eleven book recommendations by Bill Ackman.

To find even more, by Buffett but also Munger, Marks, Pabrai, and more, check out the "Bookshelf" on my Website:

danielmnke.com/p/bookshelf-in…

To find even more, by Buffett but also Munger, Marks, Pabrai, and more, check out the "Bookshelf" on my Website:

danielmnke.com/p/bookshelf-in…

Thanks for reading!

1. Please Like and Retweet if you enjoyed it!

2. You want the best Investing Ideas? Visit my Research Platform (link in bio)

3. Follow me @MnkeDaniel to learn more about Investing!

Have a great day!

1. Please Like and Retweet if you enjoyed it!

2. You want the best Investing Ideas? Visit my Research Platform (link in bio)

3. Follow me @MnkeDaniel to learn more about Investing!

Have a great day!

https://twitter.com/1349031693122998272/status/1792508663174688963

• • •

Missing some Tweet in this thread? You can try to

force a refresh