1. Sanctions have had a very significant negative effect on aviation safety in Iran.

But the idea that they contributed to the recent crash and the deaths of Raisi and Abdollahian makes little sense.

Recent reports by FT, NYT, and others taking that line miss some key details.

But the idea that they contributed to the recent crash and the deaths of Raisi and Abdollahian makes little sense.

Recent reports by FT, NYT, and others taking that line miss some key details.

2. Old aircraft are not *necessarily* unsafe. The helicopter carrying Raisi was built in 1994.

Until a few years ago, the fleet of Marine Helicopter Squadron One, which transports the US president, included old Sikorsky VH-3Ds, including one from late 1970s.

Until a few years ago, the fleet of Marine Helicopter Squadron One, which transports the US president, included old Sikorsky VH-3Ds, including one from late 1970s.

3. The maintenance and refurbishment of the aircraft are what really matter.

Here, sanctions may have had an impact by making it more difficult for Iran to procure parts for the Bell 212, which is an American-made helicopter.

Here, sanctions may have had an impact by making it more difficult for Iran to procure parts for the Bell 212, which is an American-made helicopter.

4. But the Bell 212 was widely produced and remains in operation across the Middle East. Parts would be available in the region.

For Iran, a 1990s helicopter is actually going to be easier to maintain and operate given less reliance on complex tech and advanced avionics.

For Iran, a 1990s helicopter is actually going to be easier to maintain and operate given less reliance on complex tech and advanced avionics.

5. The accident history of Bell 212s in Iran supports this view.

There are four accidents to date recorded in the ASN database (same as UAE and Iraq), of which three were fatal.

Weather and human error are the reasons for these accidents.

There are four accidents to date recorded in the ASN database (same as UAE and Iraq), of which three were fatal.

Weather and human error are the reasons for these accidents.

6. You can actually read the Iran Civil Aviation Organization investigation into the April 2018 accident which killed four people.

They concluded pilot error caused the accident.

aviation-safety.net/reports/2018/2…

They concluded pilot error caused the accident.

aviation-safety.net/reports/2018/2…

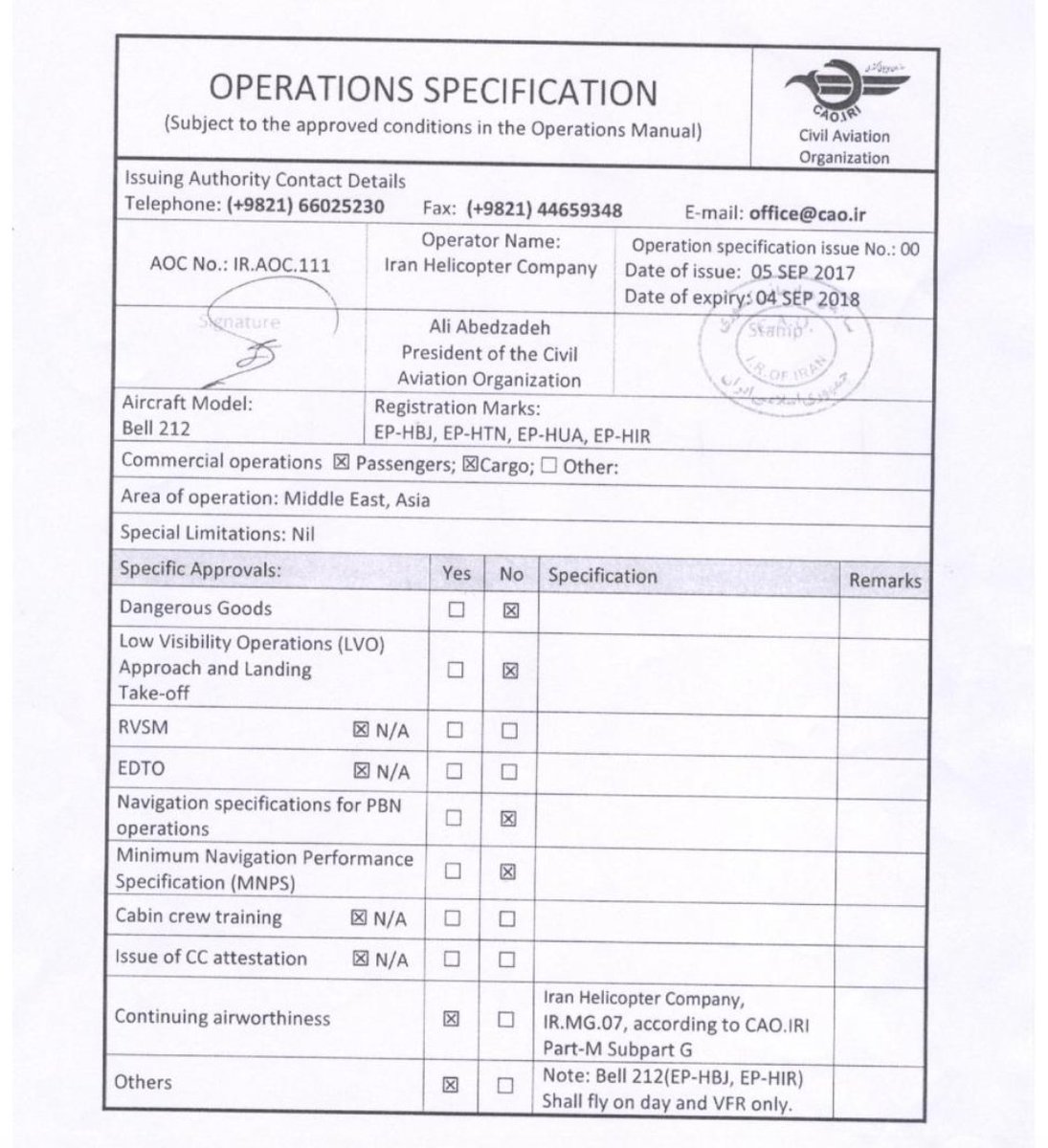

7. The aircraft, which was built in 1981, had been inspected and deemed airworthy ICAO that year. The operator was a civilian company.

If a civilian operator can get parts to keep a Bell 212 airworthy in Iran, then surely the Iranian Air Force and HESA can manage to do the same.

If a civilian operator can get parts to keep a Bell 212 airworthy in Iran, then surely the Iranian Air Force and HESA can manage to do the same.

8. Notably, one of the four accidents recorded in Iraq was investigated by the NTSB because the aircraft was a Bell 212 operated by the U.S. Department of State.

The cause was pilot error... but the old bird was built in 1971!

That's way older than the helicopter in Iran.

The cause was pilot error... but the old bird was built in 1971!

That's way older than the helicopter in Iran.

9. We also need to think through what aviation safety means in this context.

When we say sanctions impact aviation safety in Iran, small increases in risk accumulate across large fleets, especially in airplanes.

I've written about these impacts before.

bourseandbazaar.com/articles/2018/…

When we say sanctions impact aviation safety in Iran, small increases in risk accumulate across large fleets, especially in airplanes.

I've written about these impacts before.

bourseandbazaar.com/articles/2018/…

10. Selecting a helicopter to transport the president is a different proposition. It's a single aircraft.

To suggest sanctions had a role implies that Raisi and Abdollahian were transported in an aircraft known to have technical vulnerabilities and there was no other choice.

To suggest sanctions had a role implies that Raisi and Abdollahian were transported in an aircraft known to have technical vulnerabilities and there was no other choice.

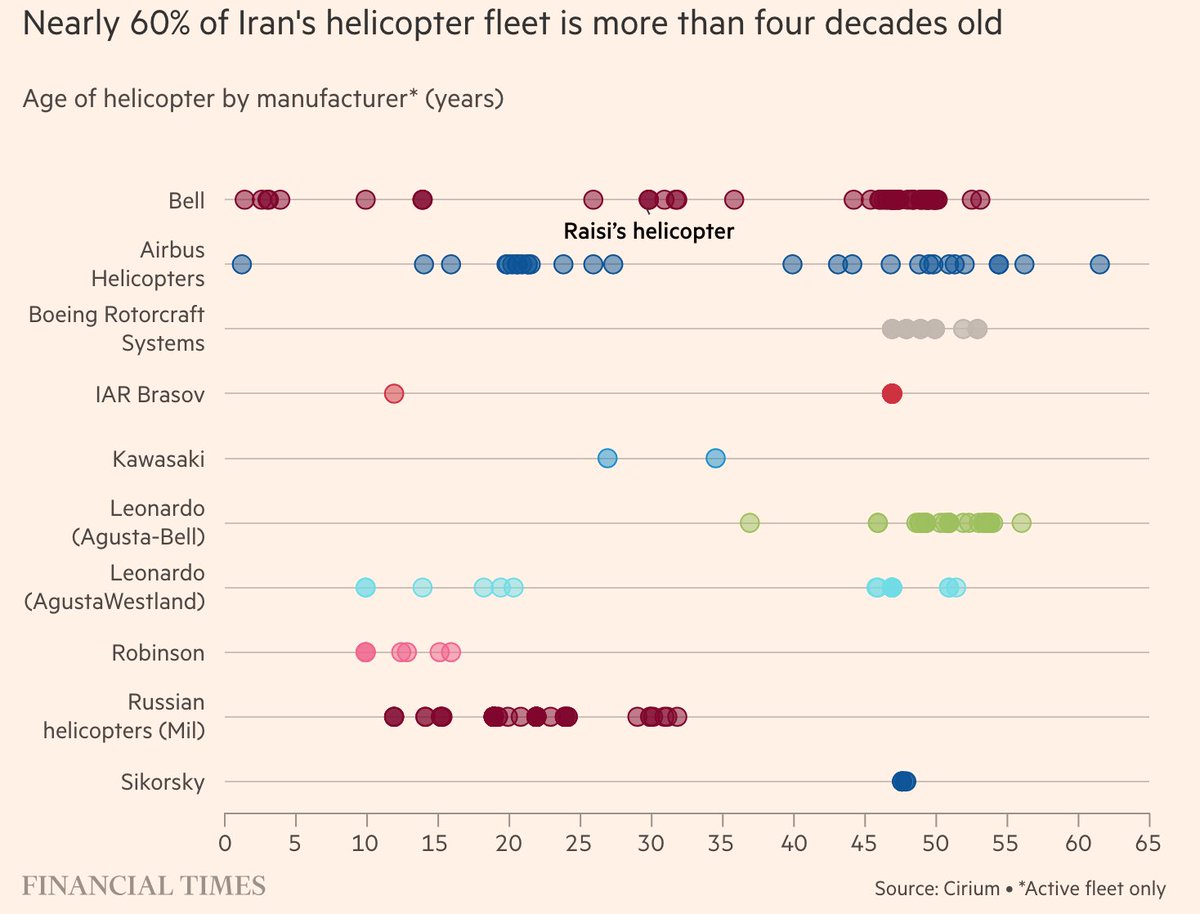

11. The FT's own graphic shows that Iran has several Bell helicopters in active service that are less than 5 years old.

This suggests there was no concern about the aircraft used by the president, which had the tail number 6-9207. Otherwise a newer aircraft would've been used.

This suggests there was no concern about the aircraft used by the president, which had the tail number 6-9207. Otherwise a newer aircraft would've been used.

12. Have sanctions prevented Iran from procuring more modern helicopters, possibly with better safety technology?

Yes. Most of Iran's helicopters are very old.

Did sanctions force the president and foreign minister to be transported in an aircraft with known faults?

No.

Yes. Most of Iran's helicopters are very old.

Did sanctions force the president and foreign minister to be transported in an aircraft with known faults?

No.

13. Finally, there could have been some kind of catastrophic failure with the aircraft that could be connected to some defective part or substandard maintenance.

But we can't ignore the *obvious* reason for the crash.

The Bell 212 is not cleared for low visibility flying.

But we can't ignore the *obvious* reason for the crash.

The Bell 212 is not cleared for low visibility flying.

14. The helicopter got caught in bad weather, there was no visibility, the pilot got disoriented, and the chopper clipped some trees before crashing into the mountainside.

The question is why they were flying in bad weather? Was it negligence? Did the weather suddenly change?

The question is why they were flying in bad weather? Was it negligence? Did the weather suddenly change?

15. Those are the questions that the investigation will need to answer.

There are lots of stories to tell about sanctions making lives harder, more miserable, and more dangerous in Iran.

But the demise of Raisi and Abdollahian in a helicopter accident isn't one of them.

There are lots of stories to tell about sanctions making lives harder, more miserable, and more dangerous in Iran.

But the demise of Raisi and Abdollahian in a helicopter accident isn't one of them.

16. Small postscript to say "that year" in Tweet 7 refers to the year of the accident, not 1981.

The Bell 212 in that incident was inspected and deemed airworthy the year it crashed.

The Bell 212 in that incident was inspected and deemed airworthy the year it crashed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh