Short thread on the most important aspect of the FIT 21 bill - the five prong decentralization test to determine whether or not an asset is a digital commodity.

Expect all protocols with goals of decentralizing to be paying very close attention to this test.

Bill text below 👇

Expect all protocols with goals of decentralizing to be paying very close attention to this test.

Bill text below 👇

Prong 1 - Power Rule

Prong 1 has two subdivisions concerning the previous 12 month period.

(I) - no person* can change the code

*more on what a person is at the end of the thread

Prong 1 has two subdivisions concerning the previous 12 month period.

(I) - no person* can change the code

*more on what a person is at the end of the thread

(ii) - no person can prohibit any other person from using the system in any way

Prong 1 thus requires protocols not to have admin censorship powers!

Prong 1 thus requires protocols not to have admin censorship powers!

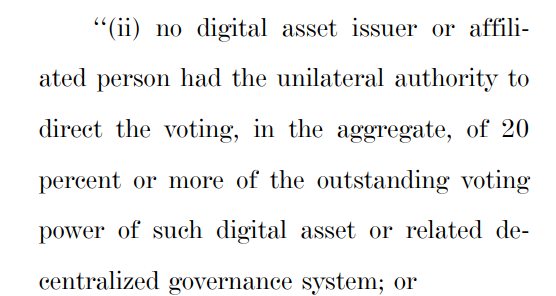

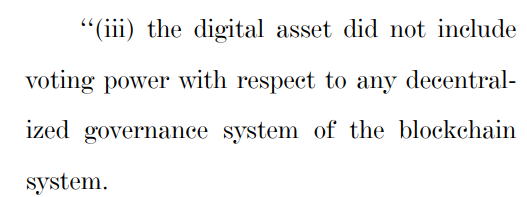

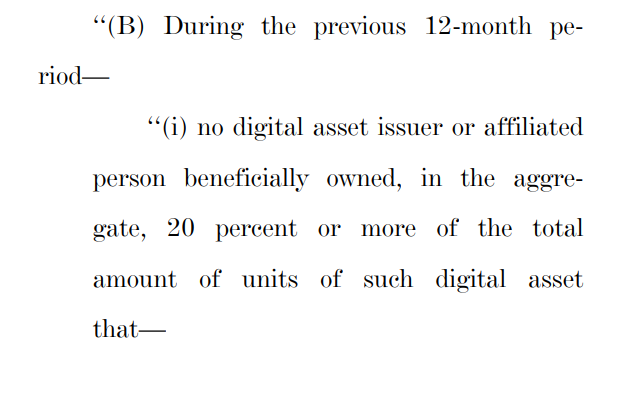

Prong 2 - Ownership and Voting

The 2nd prong has three subdivisions

(i) - in the last year, no 'affiliated person' can own 20% of the asset

The 2nd prong has three subdivisions

(i) - in the last year, no 'affiliated person' can own 20% of the asset

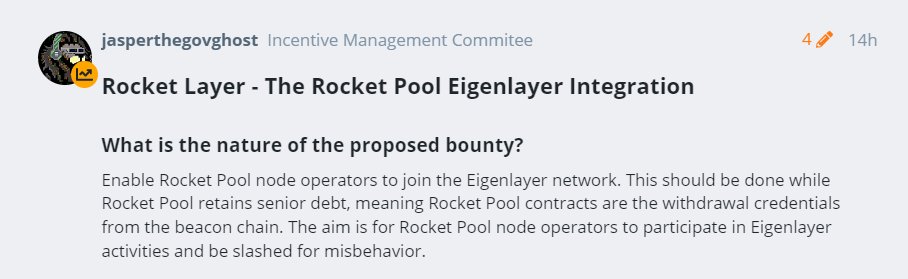

Think about that. Prong 2 is powerful.

No affiliated person can own 20% would immediately hurt many token generation event plans. Further, dissolution means nothing if the founder/founder's delegates own >20% voting power

*cough* Rune *cough*

No affiliated person can own 20% would immediately hurt many token generation event plans. Further, dissolution means nothing if the founder/founder's delegates own >20% voting power

*cough* Rune *cough*

Prong 3 - Code Changes

The 3rd prong has two subdivisions.

(i) in the last three(!) months no changes were made to the code by 'persons' except for maintenance, bugs, and vulnerabilities or...

The 3rd prong has two subdivisions.

(i) in the last three(!) months no changes were made to the code by 'persons' except for maintenance, bugs, and vulnerabilities or...

(ii) in the last three months no changes were made unless "adopted through the consensus or agreement of a decentralized governance system."

Prong 3 makes it clear that development teams must take a backseat to DAOs.

Prong 3 makes it clear that development teams must take a backseat to DAOs.

Prong 4 - No Marketing as Investment

Doesn't get any simpler - don't market the asset as an investment within the past 3 months

Doesn't get any simpler - don't market the asset as an investment within the past 3 months

Prong 5 - Rules of Inflation

Token issuance in the last 12 months must be an end user distribution - government talk for an airdrop that: 1 is broadly distributed, 2 relates to the nature of the chain, or 3 is based on the holdings of another asset.

Token issuance in the last 12 months must be an end user distribution - government talk for an airdrop that: 1 is broadly distributed, 2 relates to the nature of the chain, or 3 is based on the holdings of another asset.

Inflation seemingly cannot go to DAOs based on prong 5 but can be used to incentivize activity like mining or staking.

What is an 'affiliated person'? What is a 'related person'?

Pretty much anyone who has had a formal connection to the founding team or company. This is quite broad and it does not appear that the dissolution of a company would offer any protection to the quasi-separate members.

Pretty much anyone who has had a formal connection to the founding team or company. This is quite broad and it does not appear that the dissolution of a company would offer any protection to the quasi-separate members.

All in all, these five prongs would end up classifying many popular gov tokens as securities, perhaps rightly so.

The prongs are surprisingly thorough and reflect the nuance of crypto. If all assets lived up to these standards we would see less fraud.

The prongs are surprisingly thorough and reflect the nuance of crypto. If all assets lived up to these standards we would see less fraud.

I believe FIT 21 is the right decision for crypto and America.

Thank you to all the dems who crossed the aisle today and I'll be on your phonelines for the next bill :)

Thank you to all the dems who crossed the aisle today and I'll be on your phonelines for the next bill :)

If i've misinterpreted anything pls let me know 🙏 @lex_node

• • •

Missing some Tweet in this thread? You can try to

force a refresh