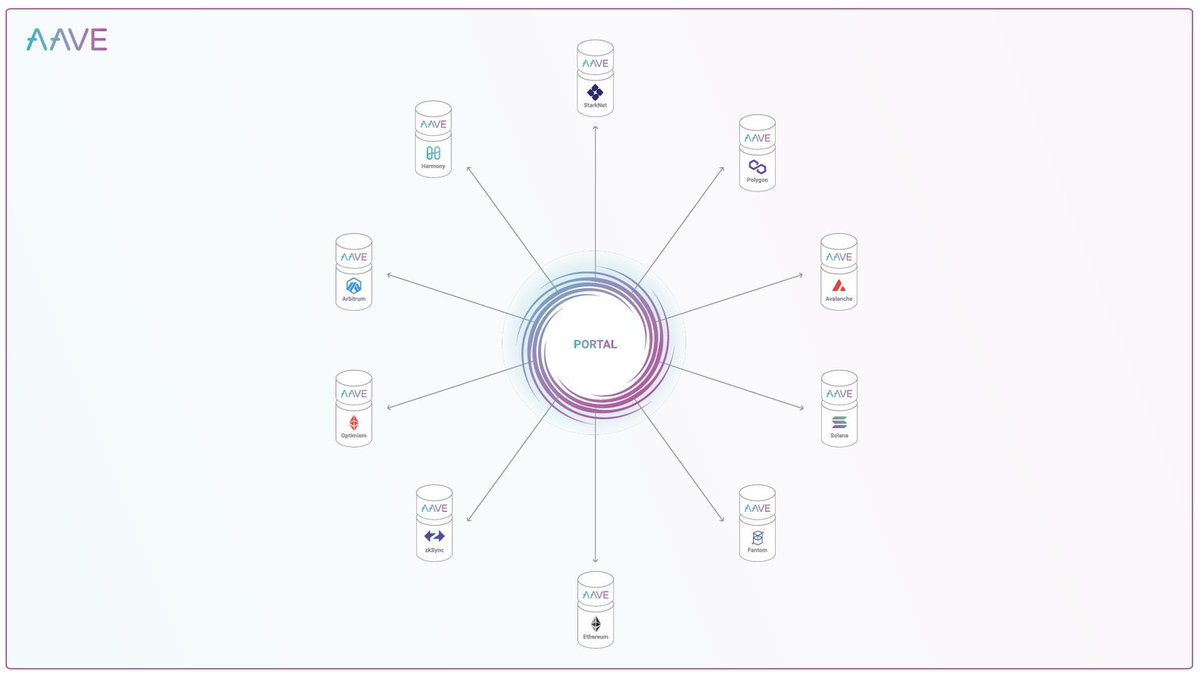

1/ Aave V4 has a new feature called the Unified Liquidity Layer, which generalizes the concept of the Portal. The Portal is one of the cool features of Aave V3 that not many people recognize and use. Let’s explore how the Portal is evolved to the Unified Liquidity Layer and more!

https://twitter.com/lemiscate/status/1794999405096927738

2/ Portal: The Portal is designed to provide a bridge for supplied assets across Aave markets on different networks. It allows whitelisted bridges to burn aTokens on the source network while instantly minting the aTokens on the destination network.

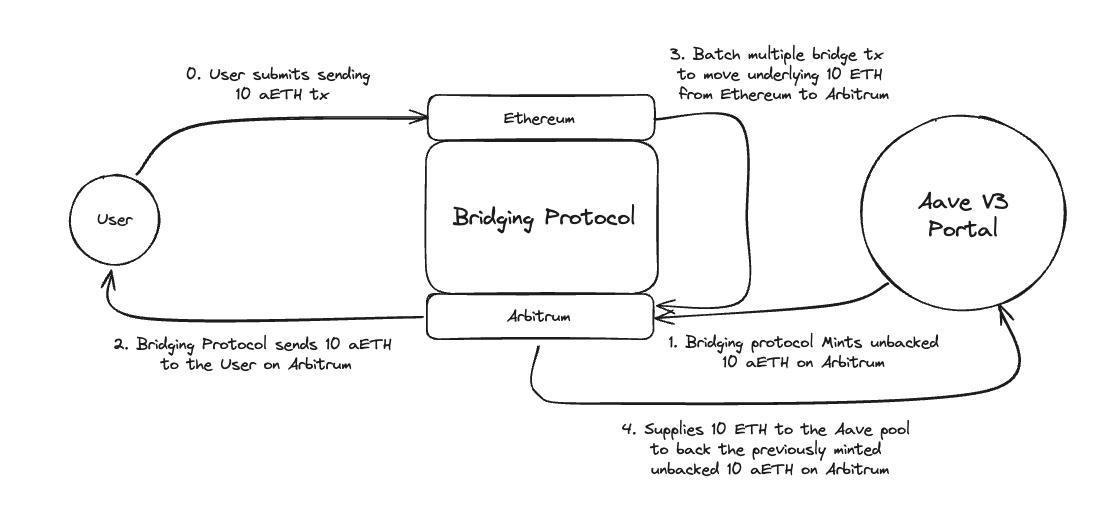

3/ Let’s say Alice has 10 aETH on Ethereum and wants to move her 10 aETH to the Arbitrum network. Once Alice submits a transaction to the whitelisted bridging protocol, the bridging protocol goes through the following steps:

1. Mints unbacked 10 aETH on the destination network (in this case Arbitrum) to the intermediate contract.

2. The intermediate contract then transfers the 10 aETH to Alice on Arbitrum.

3. Batches multiple bridge transactions and actually moves the underlying 10 ETH to Arbitrum.

2. The intermediate contract then transfers the 10 aETH to Alice on Arbitrum.

3. Batches multiple bridge transactions and actually moves the underlying 10 ETH to Arbitrum.

4. Once the funds are available on Arbitrum, the whitelisted bridge contract on Arbitrum supplies the 10 ETH to the Aave pool to back the previously minted unbacked 10 aETH.

4/ In the above example, it moves Alice’s 10 aETH from Ethereum to Arbitrum, but in the real world, it can handle various cases. For instance, Alice can receive 10 ETH on the Arbitrum network instead of 10 aETH, or it can simply be used for the general purpose of moving funds.

5/ This feature makes life easier for users who seek higher interest rates across different networks. For example, Optimism has a relatively small pool size, so even with a smaller borrow volume, the deposit interest on Optimism is higher than that of Ethereum.

6/ Users can simply move their deposit position from Ethereum to Optimism with one click using the Portal and enjoy higher deposit interest rates.

7/ Although the Portal makes Aave V3 a chain-agnostic, borderless liquidity protocol, it initially requires significant trust assumptions to function effectively.

8/ Users should submit a bridge transaction to a whitelisted bridging protocol like Connext, not the Aave V3 core protocol. Again, there are no core protocol methods for end-users to use the Portals.

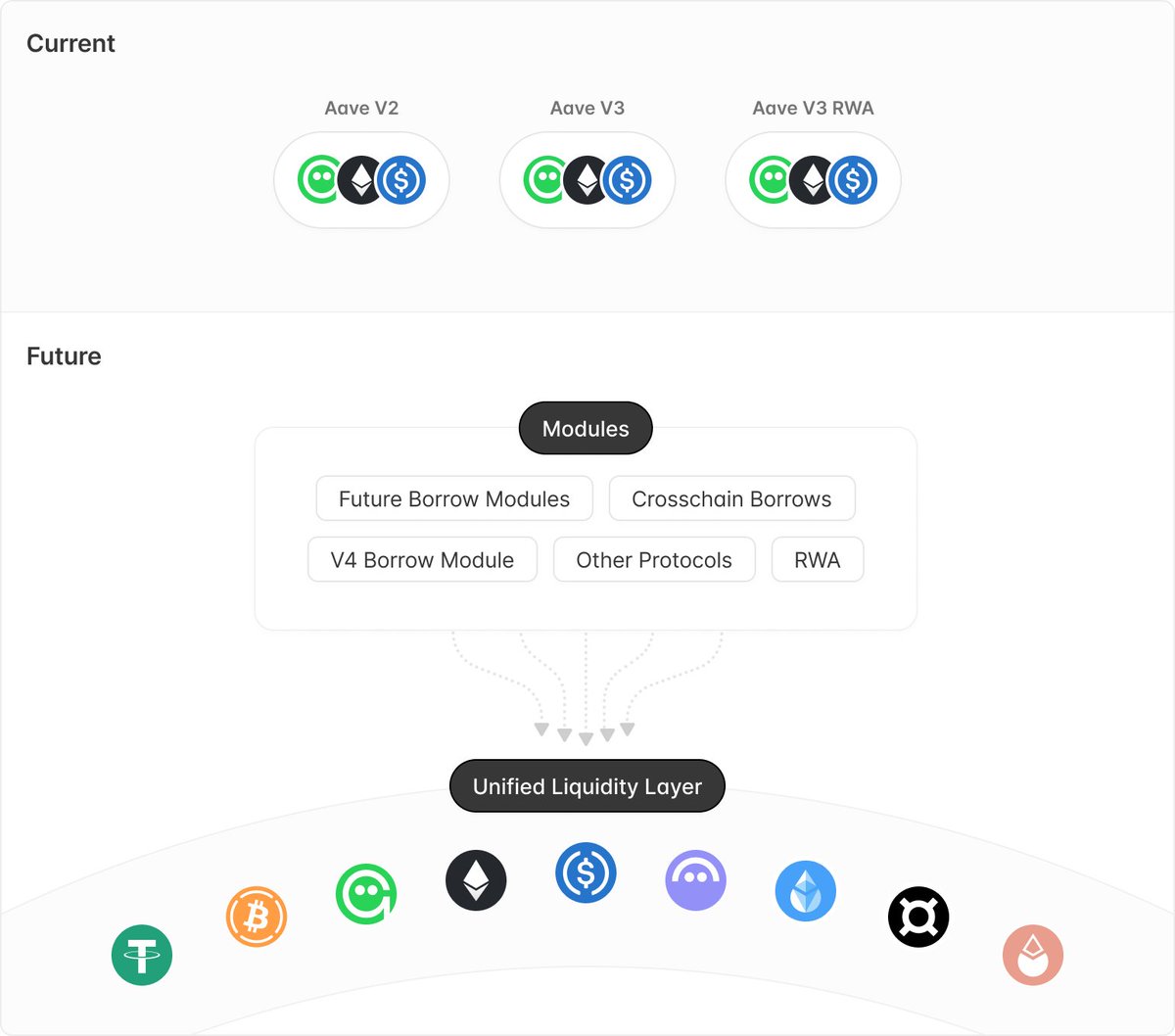

9/ Unified Liquidity Layer (ULL): The most important architectural change from Aave V3 to V4 is the ULL. This layer manages supply/borrow caps, interest rates, assets, and incentives, allowing modules to draw liquidity from it.

10/ By consolidating the management of liquidity, the ULL allows for more efficient use of available assets. Liquidity can be dynamically allocated where it is most needed, improving overall efficiency.

11/ The ULL’s modular design means that new borrow modules or features (such as isolation pools, RWA modules, and CDPs) can be added without disrupting the entire system.

12/ For example, the liquidation module remains unchanged while the borrow modules are updated. Additionally, it enables the Aave DAO to easily onboard new modules or offboard old ones without needing to migrate liquidity.

13/ In Aave V3, the Portal allowed assets to move between different instances of the protocol, facilitating cross-chain liquidity. The ULL generalizes this idea by creating a more flexible and abstracted infrastructure that can support a variety of liquidity provisioning needs.

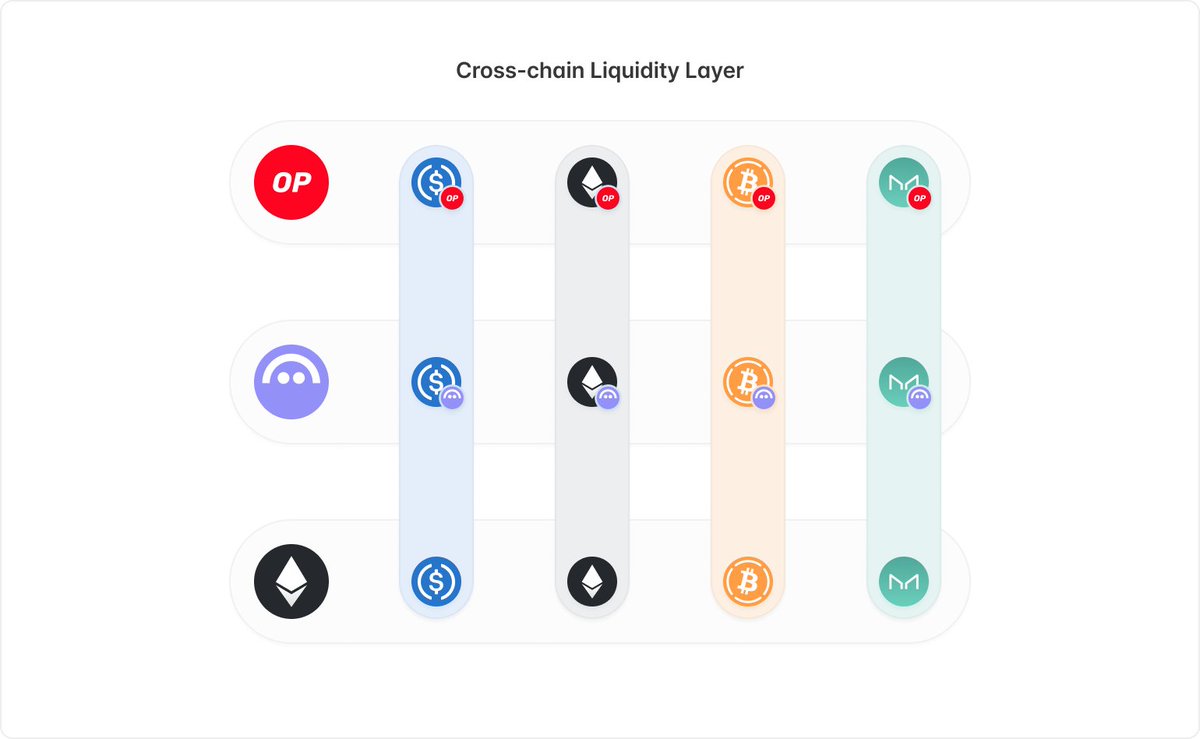

14/ Cross-Chain Liquidity Layer (CCLL): With the adoption of Chainlink’s CCIP and V4’s Unified Liquidity Layer feature, CCLL will allow borrowers to access instant liquidity across all supported networks.

15/ These improvements have the potential to evolve the Portal into a fully cross-chain liquidity protocol. Looking forward to seeing how Aave V4 will leverage this new infrastructure as a potential revenue source for the protocol.

Tagging for visibility!

- @StaniKulechov

- @lemiscate

- @The3D_

- @StaniKulechov

- @lemiscate

- @The3D_

• • •

Missing some Tweet in this thread? You can try to

force a refresh