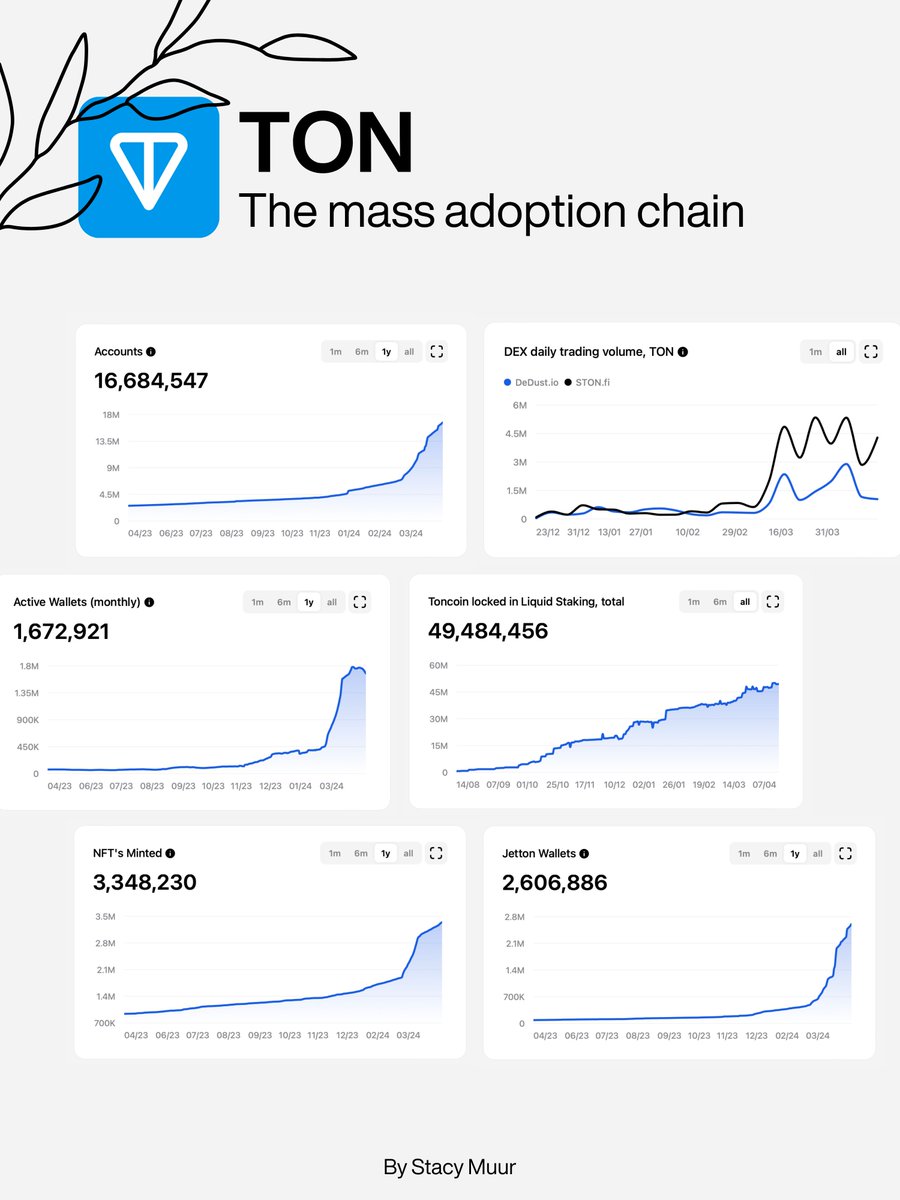

The @ton_blockchain ecosystem continues to impress.

$NOT @thenotcoin has been one of the largest airdrops in 2024, with almost half a billion USD equivalent airdropped to 13M users.

Ecosystem metrics keep heading up right off the chart, with ~10x growth this year alone.

$NOT @thenotcoin has been one of the largest airdrops in 2024, with almost half a billion USD equivalent airdropped to 13M users.

Ecosystem metrics keep heading up right off the chart, with ~10x growth this year alone.

Since the start of The Open League, TON has:

• Daily active wallets (DAW): 311,900 (+725%)

• Weekly Active Wallets: 999,600 (+540%)

• DeFi TVL: $206M (+800%)

• Liquidity Providers: 37,462 (+765%)

• Daily Trading Volume: $29.2M (+1,038%)

• Daily Traders: 28,698 (+498%)

• Daily active wallets (DAW): 311,900 (+725%)

• Weekly Active Wallets: 999,600 (+540%)

• DeFi TVL: $206M (+800%)

• Liquidity Providers: 37,462 (+765%)

• Daily Trading Volume: $29.2M (+1,038%)

• Daily Traders: 28,698 (+498%)

The Foundation is eagerly deploying incentives to support this trend.

So what are the best things to do on TON now?

First, passive yields.

So what are the best things to do on TON now?

First, passive yields.

Right now, there are two juicy campaigns ongoing to attract more liquidity to the TON ecosystem.

• On @ston_fi, users can provide TON/USDT liquidity to earn 87% APY.

• On @dedust_io, the same pair yields 105% APY.

Providing liquidity on TON is now much better than staking ;)

• On @ston_fi, users can provide TON/USDT liquidity to earn 87% APY.

• On @dedust_io, the same pair yields 105% APY.

Providing liquidity on TON is now much better than staking ;)

Furthermore, until the end of May, users of on Telegram can activate a 25% APY for their USDT with Wallet Earn. Please note that the deposit needs to be below $3K per wallet.

$NOT earnings are another thing that can be farmed. t.me/wallet

$NOT earnings are another thing that can be farmed. t.me/wallet

TON's Open League Season 3 focuses on Liquidity Providers, so there are much more pools you can participate in.

Here, the APY can be as high as 900%, but please DYOR as higher APY always comes with higher risks.

Here, the APY can be as high as 900%, but please DYOR as higher APY always comes with higher risks.

TON is now one of the most actively developing and heavily incentivized ecosystems in Web3.

In their blockchain letter, @PanteraCapital's founder Dan Morehead called $TON their largest investment.

What makes the $TON ecosystem so special?

In their blockchain letter, @PanteraCapital's founder Dan Morehead called $TON their largest investment.

What makes the $TON ecosystem so special?

https://twitter.com/dan_pantera/status/1788641145230356488

$TON already benefits from access to Telegram's vast community, unlike other protocols that need to build their user base from the ground up.

They have money and actively incentivize the community; just the @thenotcoin airdrop was valued at $500 million when distributed.

They have money and actively incentivize the community; just the @thenotcoin airdrop was valued at $500 million when distributed.

For many people, @ton_blockchain's incentives are a life-changing opportunity, akin to @AxieInfinity or @Stepnofficial of their early days, but with a larger audience and better tokenomics.

I am optimistic about the future of $TON.

Explore its ecosystem, frens!

I am optimistic about the future of $TON.

Explore its ecosystem, frens!

• • •

Missing some Tweet in this thread? You can try to

force a refresh