#1 @blackwing_fi

Posted about this earlier this week but think it's pretty underfarmed.

Best strategy is definitely depositing your PT assets from @pendle_fi to really rehypothecate that yield.

Calculator & invite code below. Return does not display PT yields.

Posted about this earlier this week but think it's pretty underfarmed.

Best strategy is definitely depositing your PT assets from @pendle_fi to really rehypothecate that yield.

Calculator & invite code below. Return does not display PT yields.

#2 @ethena_labs

The sUSDe market on @pendle_fi has just been increased from $250m to $350m.

YT-sUSDe not only leverages points but also the large yield generated by Ethena.

Even with a 25% average sUSDe yield till Sep 2nd, the return is quite significant.

The sUSDe market on @pendle_fi has just been increased from $250m to $350m.

YT-sUSDe not only leverages points but also the large yield generated by Ethena.

Even with a 25% average sUSDe yield till Sep 2nd, the return is quite significant.

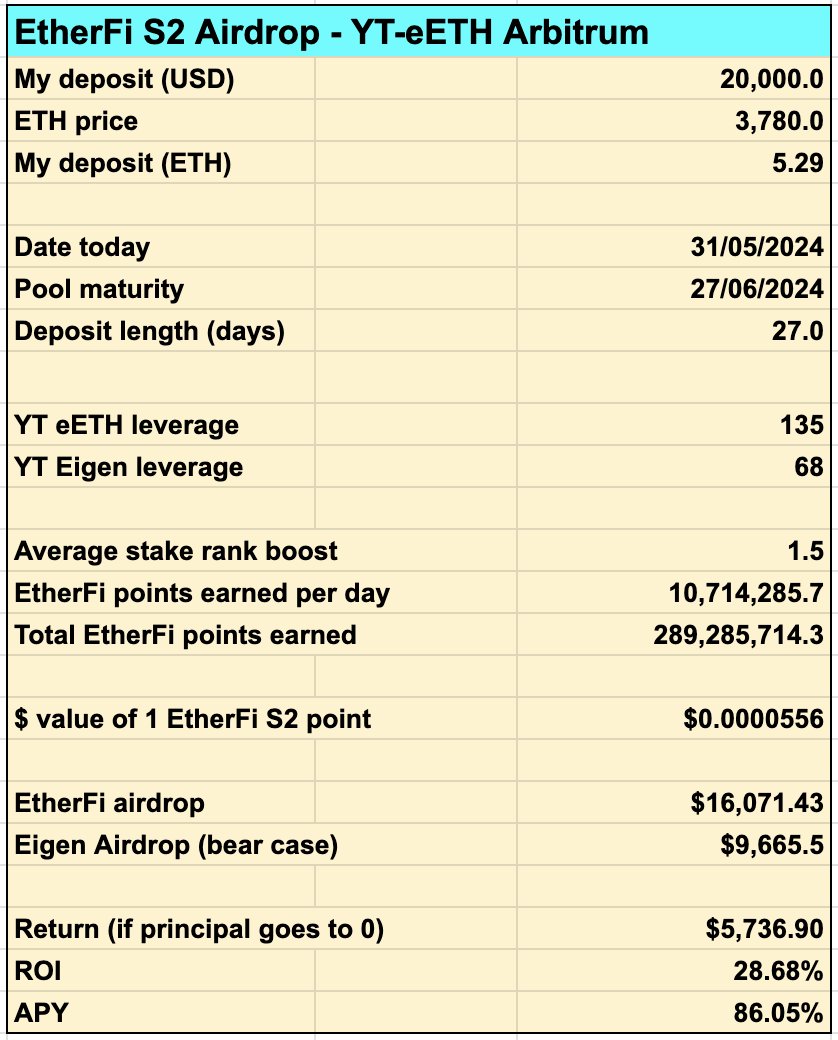

#3 @ether_fi

Etherfi S2 ends at the end of June but last-minute YT-eETH purchasers might be eating good.

There is slightly more risk associated here due to the uncertainty of EigenLayer S2

If you are at stakerank level 8, it's a very good strategy imo.

Etherfi S2 ends at the end of June but last-minute YT-eETH purchasers might be eating good.

There is slightly more risk associated here due to the uncertainty of EigenLayer S2

If you are at stakerank level 8, it's a very good strategy imo.

#4 @Karak_Network

Many ways to play this, either by depositing LRTs/PT assets from Pendle into Karak directly.

Or alternatively buying into one of the new Pendle Karak markets that just went live.

@PendleIntern did a great breakdown of this strategy on their profile.

Many ways to play this, either by depositing LRTs/PT assets from Pendle into Karak directly.

Or alternatively buying into one of the new Pendle Karak markets that just went live.

@PendleIntern did a great breakdown of this strategy on their profile.

I did a complete breakdown of these over at On Chain Times where you can also find the Google sheet containing everything.

Do subscribe if you haven't already.

Post👇

onchaintimes.com/p/yieldfarms-a…

Do subscribe if you haven't already.

Post👇

onchaintimes.com/p/yieldfarms-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh