Japanese exchange DMM Bitcoin recently lost 4503 BTC, worth over $300m.

So what happened? Did North Korea hack their mainframe? Perhaps a team of elite thieves executed a series of elaborate heists to exfiltrate multisig keys from DMM's vaults?

Let's investigate... 🧵

So what happened? Did North Korea hack their mainframe? Perhaps a team of elite thieves executed a series of elaborate heists to exfiltrate multisig keys from DMM's vaults?

Let's investigate... 🧵

https://twitter.com/nobsbitcoin/status/1796845620809887978

Here's the "theft" transaction. Note the output address, and the absurdly high fee of 0.1 BTC.

mempool.space/tx/975ec405ac9…

mempool.space/tx/975ec405ac9…

Here's a legitimate withdrawal to one of DMM's own addresses from earlier this month.

mempool.space/tx/a673525b3c8…

mempool.space/tx/a673525b3c8…

And here's a random unconfirmed dust transaction to DMM's multisig address, that's been floating in the mempool for months.

mempool.space/tx/e40ef6bc0eb…

mempool.space/tx/e40ef6bc0eb…

Did you spot it?

Yep, the stolen funds were sent to an address that matches the first 5 and last 2 characters of the address DMM routinely uses to handle withdrawals from this wallet.

Classic address poisoning* attack, right?

Yep, the stolen funds were sent to an address that matches the first 5 and last 2 characters of the address DMM routinely uses to handle withdrawals from this wallet.

Classic address poisoning* attack, right?

Well, maybe not.

Remember the crazy fee? DMM has never overpaid like that before from this wallet.

And what are the odds that a poisoned withdrawal just so happened to be sweeping an unprecedented 90% of the total balance in a single transaction?

Remember the crazy fee? DMM has never overpaid like that before from this wallet.

And what are the odds that a poisoned withdrawal just so happened to be sweeping an unprecedented 90% of the total balance in a single transaction?

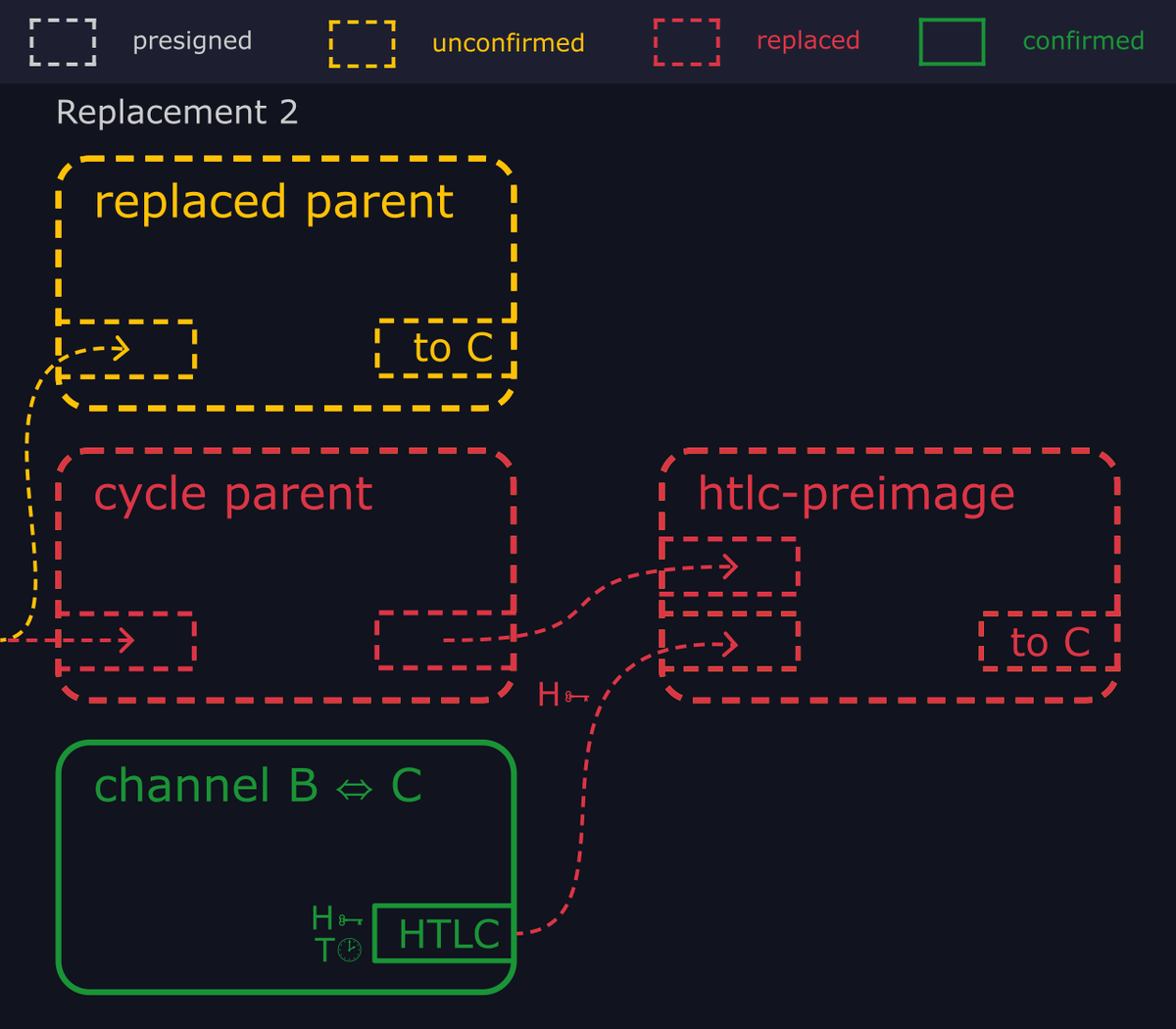

This was a 2-of-3 multisig holding hundreds of millions of dollars of Bitcoin.

Unless DMM is completely insane, each of those keys will be controlled by a separate person.

So imagine you gain access to just one of those keys, but want to steal all of the money.

What do you do?

Unless DMM is completely insane, each of those keys will be controlled by a separate person.

So imagine you gain access to just one of those keys, but want to steal all of the money.

What do you do?

Perhaps you craft a consolidation to a confusingly similar address, and send it off to another keyholder for approval.

And then hope they don't compare the actual destination with their whitelist of safe addresses too carefully before signing the transaction.

And then hope they don't compare the actual destination with their whitelist of safe addresses too carefully before signing the transaction.

Which leaves some obvious questions:

How did the attacker get access to even one key?

And how did they know who and how to contact to secure that crucial second signature?

I suspect we'll never know...

How did the attacker get access to even one key?

And how did they know who and how to contact to secure that crucial second signature?

I suspect we'll never know...

h/t to my eagle-eyed anonymous source for spotting the address similarities!

*("address poisoning" is when an attacker sends funds from an address they control, which has been "mined" to look confusing similar to one of the victim's own, in the hope that they'll accidentally copy and paste the wrong address from their transaction history)

• • •

Missing some Tweet in this thread? You can try to

force a refresh