WTF Are Fraud Proofs?

.@Optimism just broke the news that their fraud proofs are live, but wtf does that mean and how does it help you?

Here are some pictures to explain the changes and why they matter.

FRAUD PROOF UNLOCK TLDR

🔴 Bridged assets (ETH, ERC-20s, etc) on OP Mainnet can be withdrawn back to Ethereum without Optimism's input

🔴 Anyone can review the OP Mainnet transactions and challenge them if they're invalid

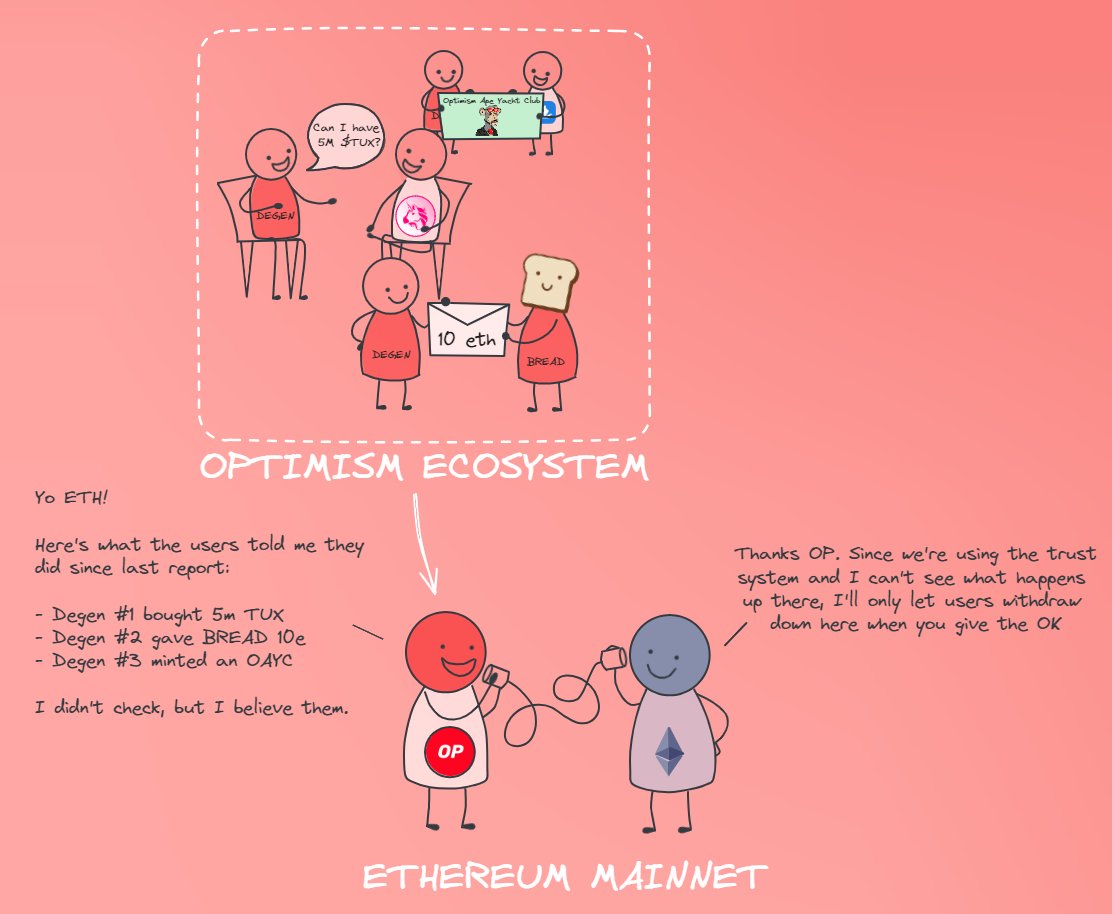

WITHOUT FRAUD PROOFS

This is the relationship with OP's L2 that you were used to, and it's relationship to Ethereum, whether you knew it or not.

In this paradigm, you would bridge in your assets (typically ETH) and play around on the chain with those assets. Owned amounts would be updated, new owners would be assigned and net-new assets would be created just like they would any other blockchain.

Recall though; the reason we use L2's in the first place is in an effort to scale Ethereum while preserving key properties like permissionless execution and asset sovereignty. In order to maintain those properties for their users Optimism must record what's happening locally and not only inform Ethereum of asset changes but be able to prove that it's telling the truth - this is what has been missing all this time, and what fraud proofs allow.

Up until now Ethereum had no way of knowing the truth about ownership, which means it relied on Optimism to tell it when and who could take their ETH back out of Optimism.

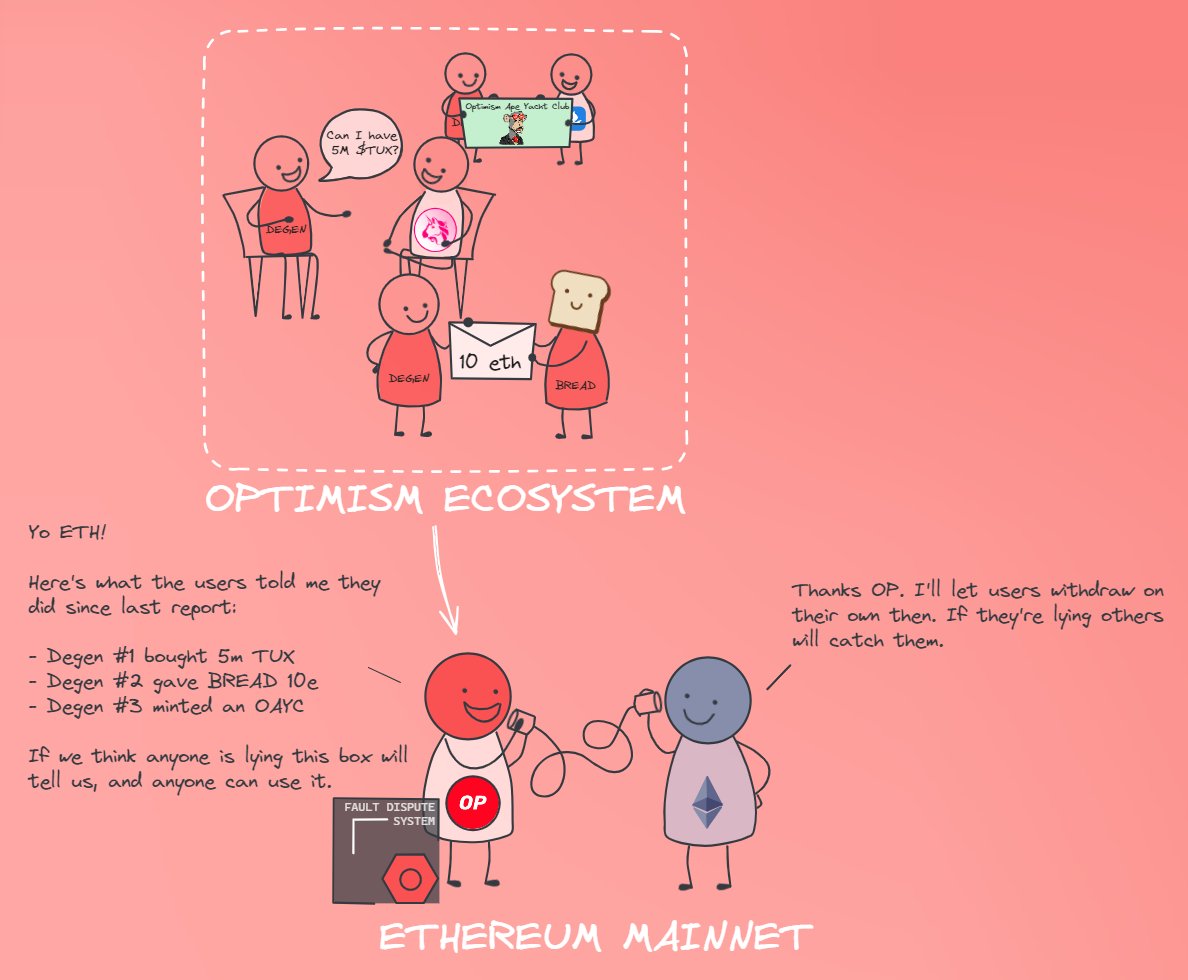

Enter: Fault Dispute System

WITH FRAUD PROOFS

Going forward, here's how things will look: mostly the same, with the addition of an onchain dispute system on mainnet:

What will users dispute? When others are claiming to own assets that they actually don't.

That's it: Optimism has armed users with the ability to prove when someone else is lying about what they own (and are attempting to move/withdraw). Given this ecosystem primitive, it means we can grant anyone withdrawal powers because others are incentivized to catch them and keep the system honest.

LOOKING FORWARD

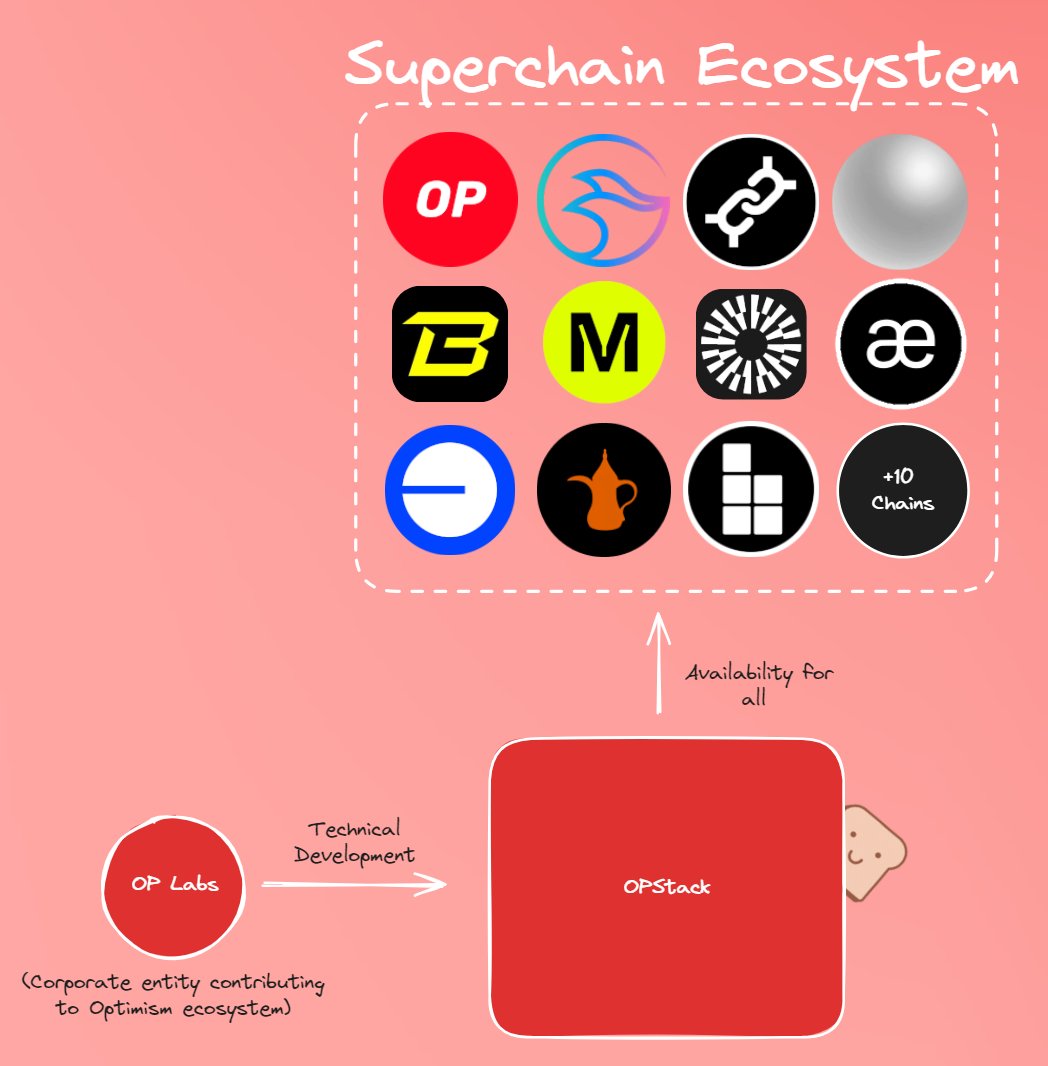

With these changes, OP Mainnet will become the second chain in the top 10 by TVL to achieve Stage 1 decentralization (per @l2beat), but we could see others like Base and Mantle implement the new system in shoter(er) order as they benefit from all changes to the OPStack (i.e. OP Mainnet and those chains share code so they can all contribute and borrow developments).

Here's a quick image I whipped up to demonstrate how these changes are implemented and adopted amongst these chain clusters:

That should do it.

If you'd like to learn more about Optimism, the OP Superchain, or the L2 ecosystem writ large @binji_x is a great follow.

.@Optimism just broke the news that their fraud proofs are live, but wtf does that mean and how does it help you?

Here are some pictures to explain the changes and why they matter.

FRAUD PROOF UNLOCK TLDR

🔴 Bridged assets (ETH, ERC-20s, etc) on OP Mainnet can be withdrawn back to Ethereum without Optimism's input

🔴 Anyone can review the OP Mainnet transactions and challenge them if they're invalid

WITHOUT FRAUD PROOFS

This is the relationship with OP's L2 that you were used to, and it's relationship to Ethereum, whether you knew it or not.

In this paradigm, you would bridge in your assets (typically ETH) and play around on the chain with those assets. Owned amounts would be updated, new owners would be assigned and net-new assets would be created just like they would any other blockchain.

Recall though; the reason we use L2's in the first place is in an effort to scale Ethereum while preserving key properties like permissionless execution and asset sovereignty. In order to maintain those properties for their users Optimism must record what's happening locally and not only inform Ethereum of asset changes but be able to prove that it's telling the truth - this is what has been missing all this time, and what fraud proofs allow.

Up until now Ethereum had no way of knowing the truth about ownership, which means it relied on Optimism to tell it when and who could take their ETH back out of Optimism.

Enter: Fault Dispute System

WITH FRAUD PROOFS

Going forward, here's how things will look: mostly the same, with the addition of an onchain dispute system on mainnet:

What will users dispute? When others are claiming to own assets that they actually don't.

That's it: Optimism has armed users with the ability to prove when someone else is lying about what they own (and are attempting to move/withdraw). Given this ecosystem primitive, it means we can grant anyone withdrawal powers because others are incentivized to catch them and keep the system honest.

LOOKING FORWARD

With these changes, OP Mainnet will become the second chain in the top 10 by TVL to achieve Stage 1 decentralization (per @l2beat), but we could see others like Base and Mantle implement the new system in shoter(er) order as they benefit from all changes to the OPStack (i.e. OP Mainnet and those chains share code so they can all contribute and borrow developments).

Here's a quick image I whipped up to demonstrate how these changes are implemented and adopted amongst these chain clusters:

That should do it.

If you'd like to learn more about Optimism, the OP Superchain, or the L2 ecosystem writ large @binji_x is a great follow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh