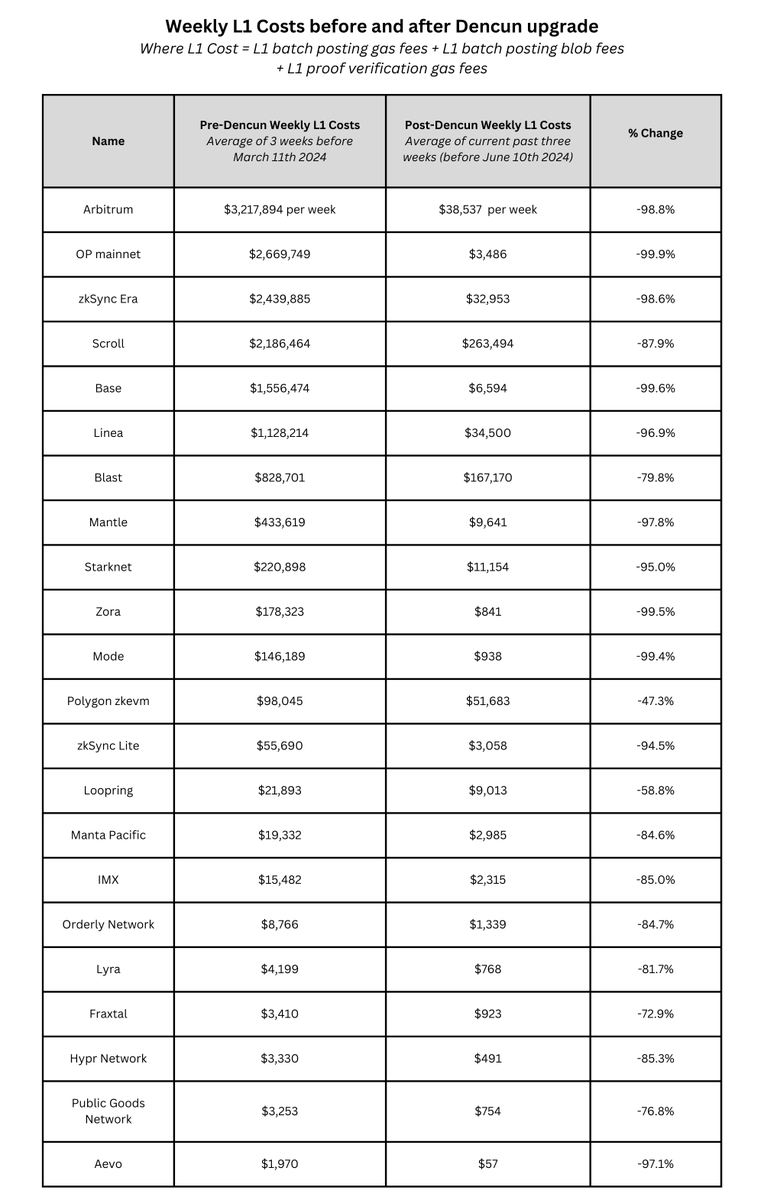

How has EIP-4844 impacted L2 costs?

1/ As the table below shows, most L2s experienced a 90%+ reduction in their L1 costs after adopting EIP-4844 blobs

L1 costs = Gas and Blob Fees for batch posting transactions + Gas Fees for proof verification transactions

1/ As the table below shows, most L2s experienced a 90%+ reduction in their L1 costs after adopting EIP-4844 blobs

L1 costs = Gas and Blob Fees for batch posting transactions + Gas Fees for proof verification transactions

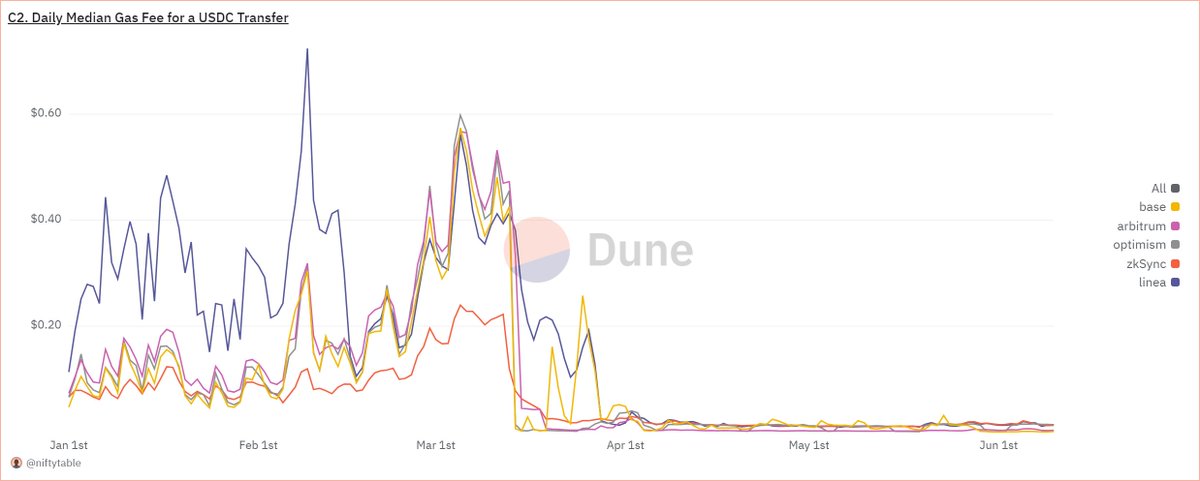

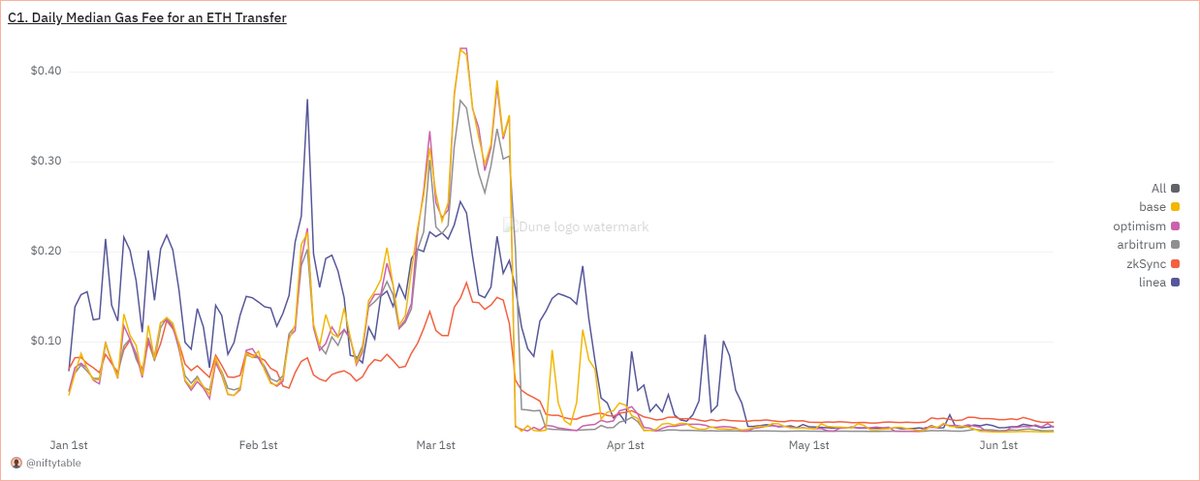

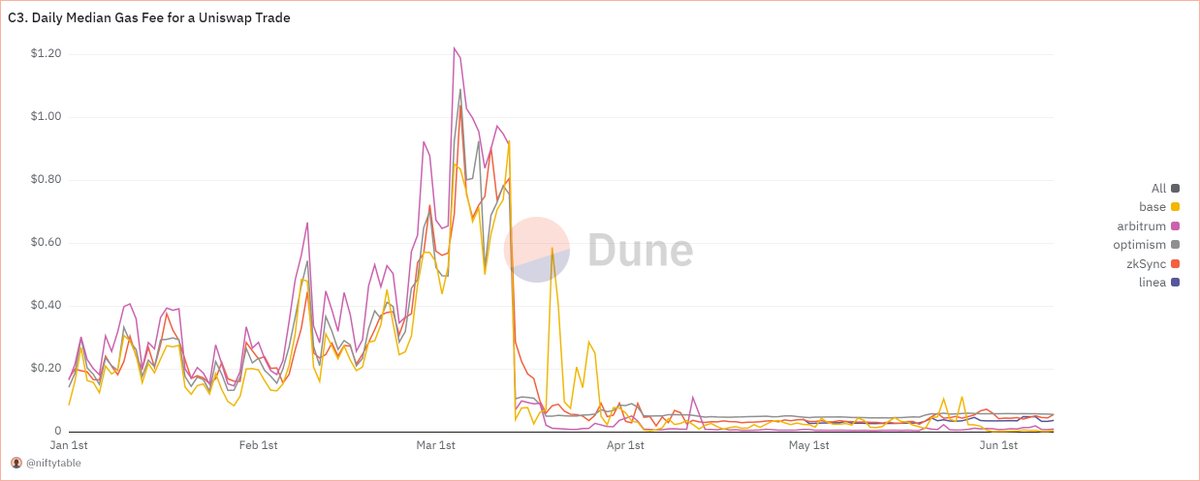

2/ Since their costs dropped by an order of magnitude, L2s could afford to reduce the gas fees they charged users.

As shown in the charts below, the cost of making common transactions like ETH transfers or Uniswap trades has dropped 90%+ on most L2s.

As shown in the charts below, the cost of making common transactions like ETH transfers or Uniswap trades has dropped 90%+ on most L2s.

3/ I look forward to seeing all the new use cases that this low-fee environment enables!

For more insights into how EIP-4844 has transformed the L2 business model, and links to the code for all these charts, check out my blog post 👇

0xkofi.substack.com/p/impact-of-ei…

For more insights into how EIP-4844 has transformed the L2 business model, and links to the code for all these charts, check out my blog post 👇

0xkofi.substack.com/p/impact-of-ei…

CORRECTION: Manta, Orderly, Lyra, Hypr and Aevo post their batches on Celestia instead of using EIP-4844 blobs. Credit to @emilianobonassi for the callout!

• • •

Missing some Tweet in this thread? You can try to

force a refresh