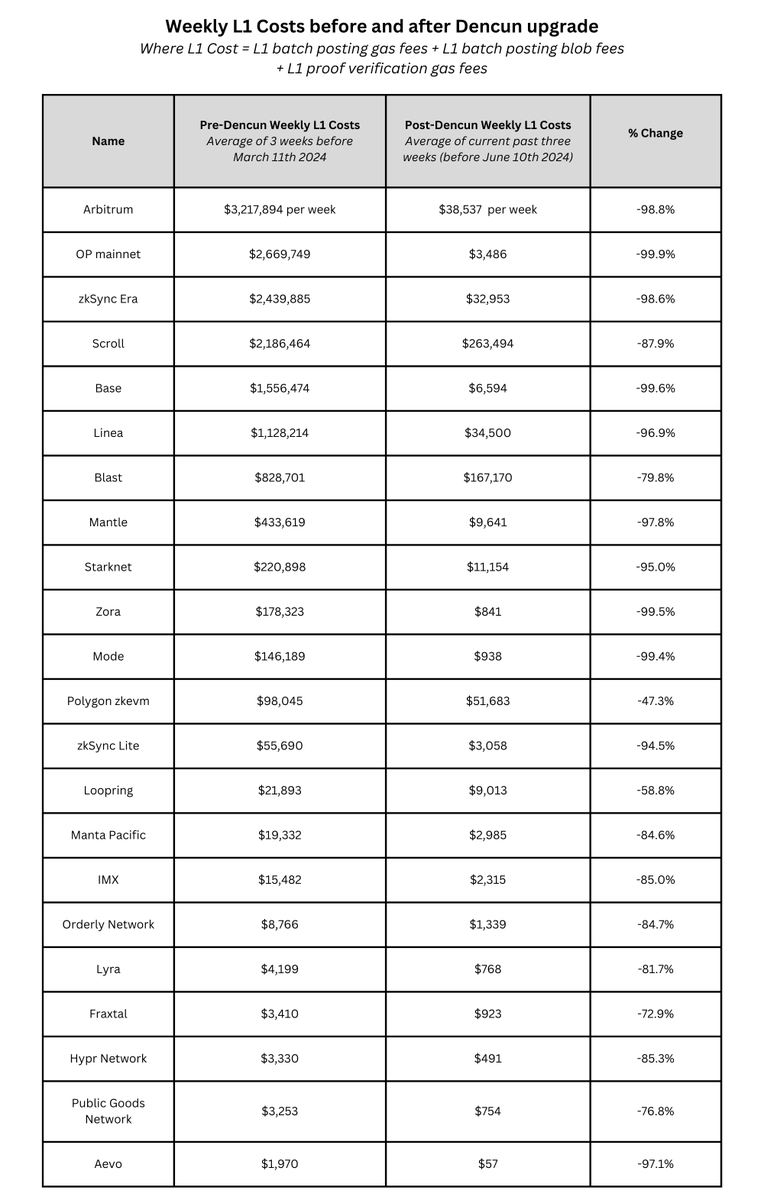

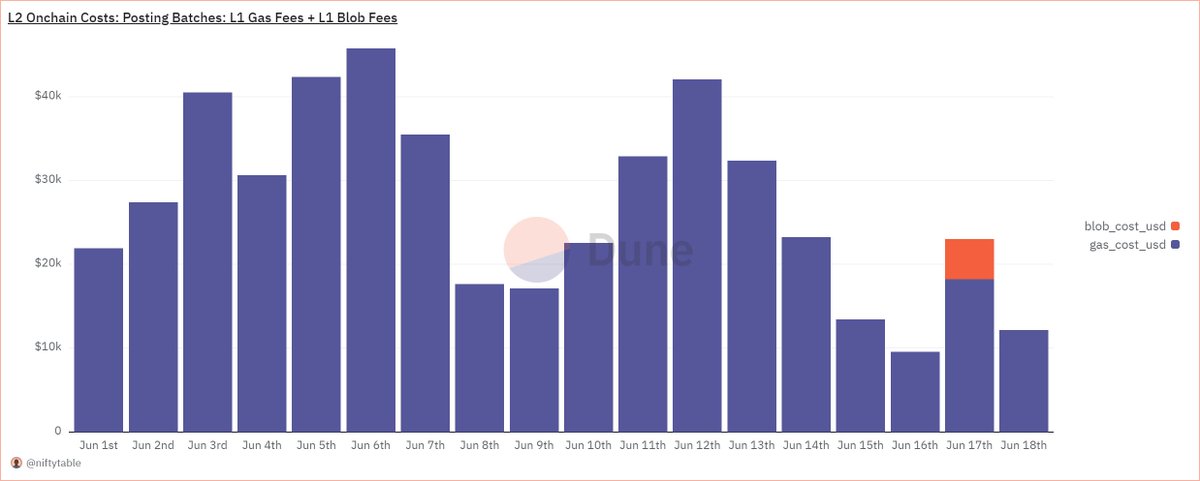

L2s pay both a gas fee and a blob fee for posting their batched transaction data to Ethereum.

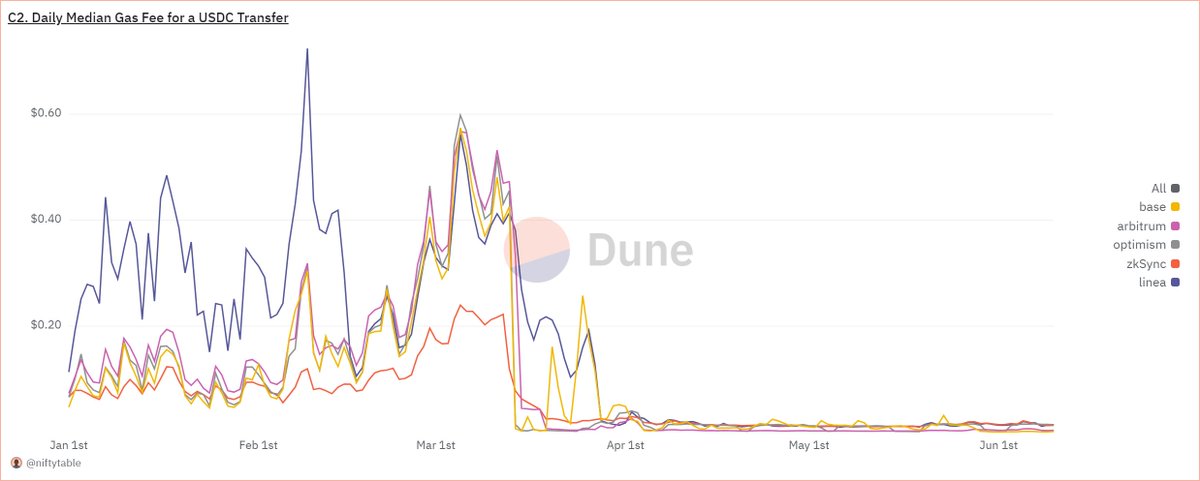

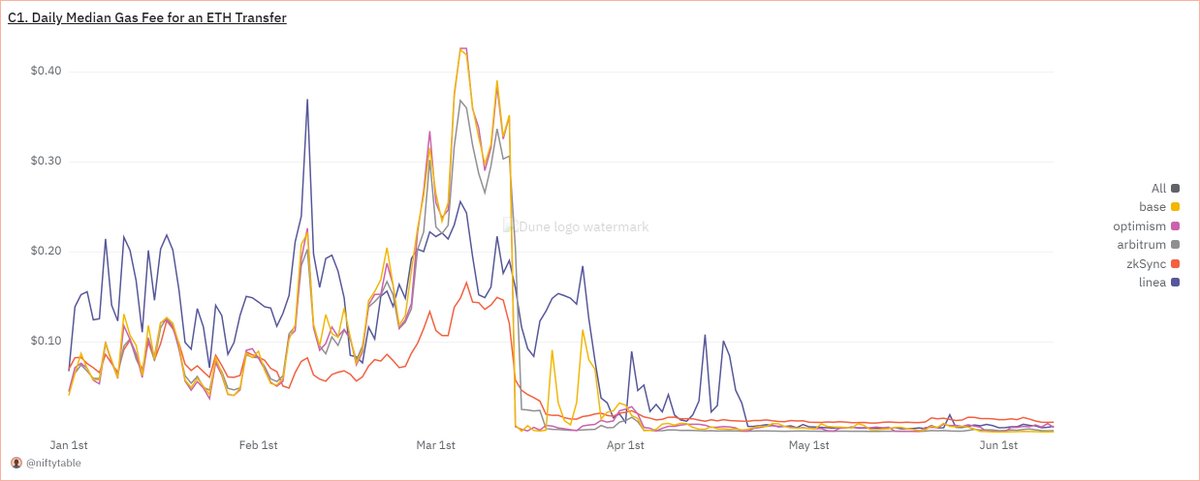

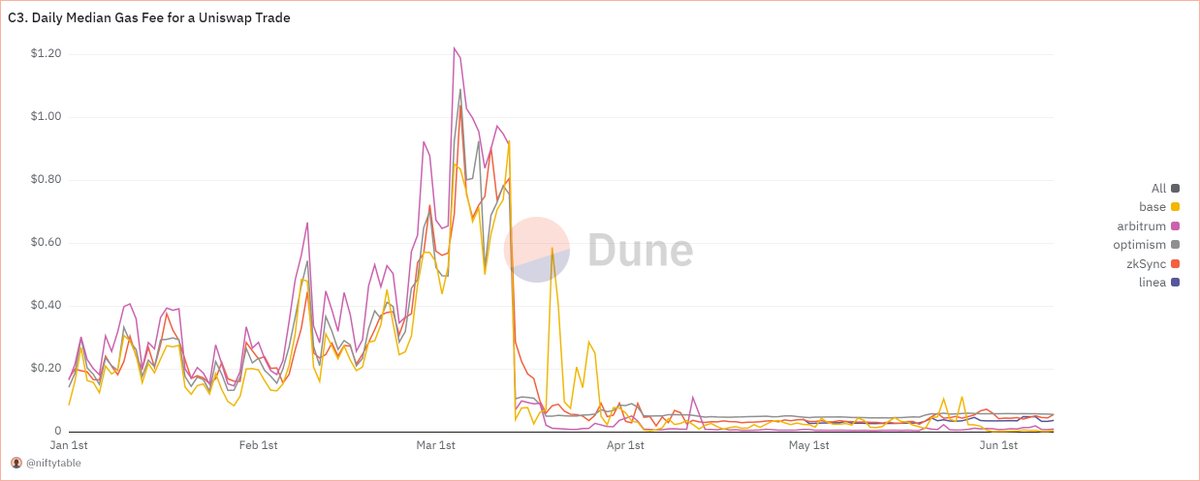

Usually, blob fees are tiny, and gas is the majority of the cost. Yesterday, however, blob fees skyrocketed and made up 21% of L2 batch posting costs that day.

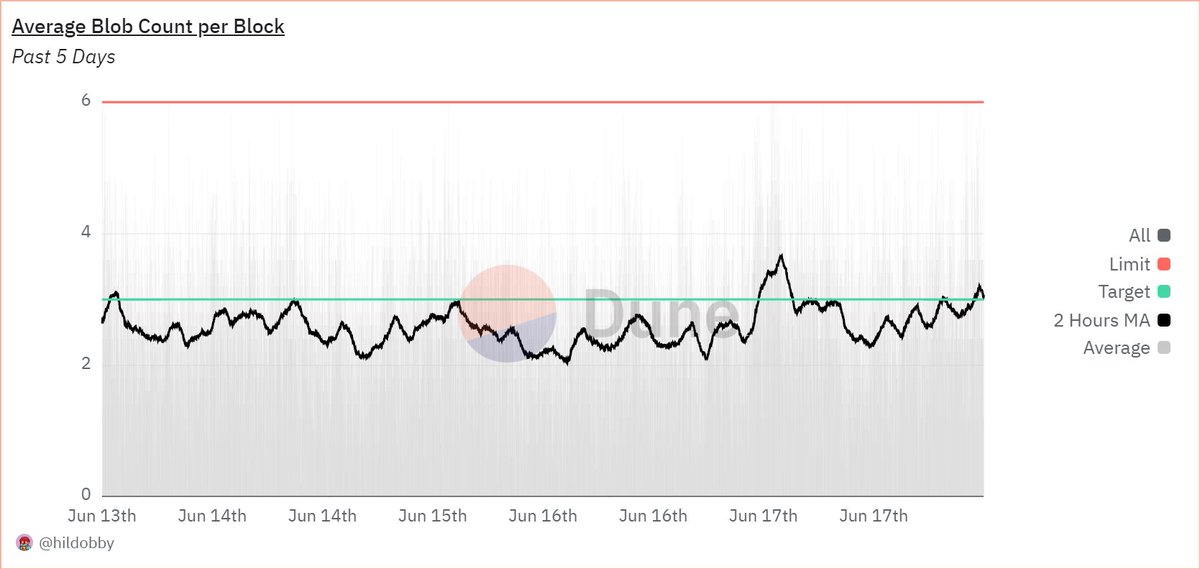

This is because the number of blobs submitted per block briefly passed the blob "target".

(Chart by genius @hildobby_ )

When the 'blobs per block' is below the "target", blobs cost a fraction of a fraction of a cent. When blob activity picks up and the target is passed, the blob fee market activates and each blob costs a lot more based on demand.

Yesterday's spike was probably caused by zkSync airdrop activity -> driving zkSync to post more blobs -> pushing the blob per block past target

But, even though the zkSync airdrop has passed, we can see that blob activity is still hugging close to the target and will likely cross that boundary again soon.

This won't affect users that much at first. L2 gas will remain low because, even when the blob fee market is active, posting batches is still 10X cheaper now than it was before blobs were live.

But if you're working on an L2, you should be paying attention to the blob fee dynamics. They're gonna affect any cost/revenue/profit projections you might have for the future.

Usually, blob fees are tiny, and gas is the majority of the cost. Yesterday, however, blob fees skyrocketed and made up 21% of L2 batch posting costs that day.

This is because the number of blobs submitted per block briefly passed the blob "target".

(Chart by genius @hildobby_ )

When the 'blobs per block' is below the "target", blobs cost a fraction of a fraction of a cent. When blob activity picks up and the target is passed, the blob fee market activates and each blob costs a lot more based on demand.

Yesterday's spike was probably caused by zkSync airdrop activity -> driving zkSync to post more blobs -> pushing the blob per block past target

But, even though the zkSync airdrop has passed, we can see that blob activity is still hugging close to the target and will likely cross that boundary again soon.

This won't affect users that much at first. L2 gas will remain low because, even when the blob fee market is active, posting batches is still 10X cheaper now than it was before blobs were live.

But if you're working on an L2, you should be paying attention to the blob fee dynamics. They're gonna affect any cost/revenue/profit projections you might have for the future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh