🔸Why do some narratives outperform?

I've been asking myself this question for a while.

Ignoring memecoins, AI and RWA have probably been the best performing narratives in the last month.

Why is that?

The short answer is because the markets are forward-looking.

Let me share some examples and expand.

We all use DEXs every day and innovation continues in the AMM space. Why are (Perp) DEX tokens not outperforming?

Same question for other narratives like NFTs, and others.

My 'History of narratives' query could provide some answers. Let's consider the DEX narrative for example. When was it the best or the 2nd best performing narrative of a month?

As we can see below, it only happened twice. Both relatively close to the start of DeFi summer and the 2021 bull market.

Why is that?

Because it was probably the 1st time we started to see many tokens across many blockchains and having a decentralized permissionless AMM could answer that increasing need. It was huge at the time. This potential had to get priced in. Which led to DEXs being the best performing narrative in Nov. 2020.

But since then, we've had Uniswap V2, V3, V4, concentrated liquidity, hooks, hyper-optimized liquid pools, v3(3,3) tokenomics, orderbook DEXs, limit orders, revenue sharing etc. etc. Why has the DEX narrative never outperformed again in the last 3 years.

Simply because these features were no longer considered

revolutionary new information compared to what other stronger narratives had to offer.

Same holds true for NFTs. Using the history of narratives query, we can see they were the best performing narrative from June 2021 to June 2022.

When they launched, they performed extremely well because of the unpriced new information. It wasn't about the monkey pictures or other cool cat pfp pics. That was just the manifestation of that potential. The reason was people realized this is an entire new asset class that could entire revolutionize many Web2 industries. From brands, concerts, certificates, real estate, etc. It took almost 1 year for this to get priced in. Since then, NFTs are consistently the worst performing narrative. Because there is no new unpriced new information.

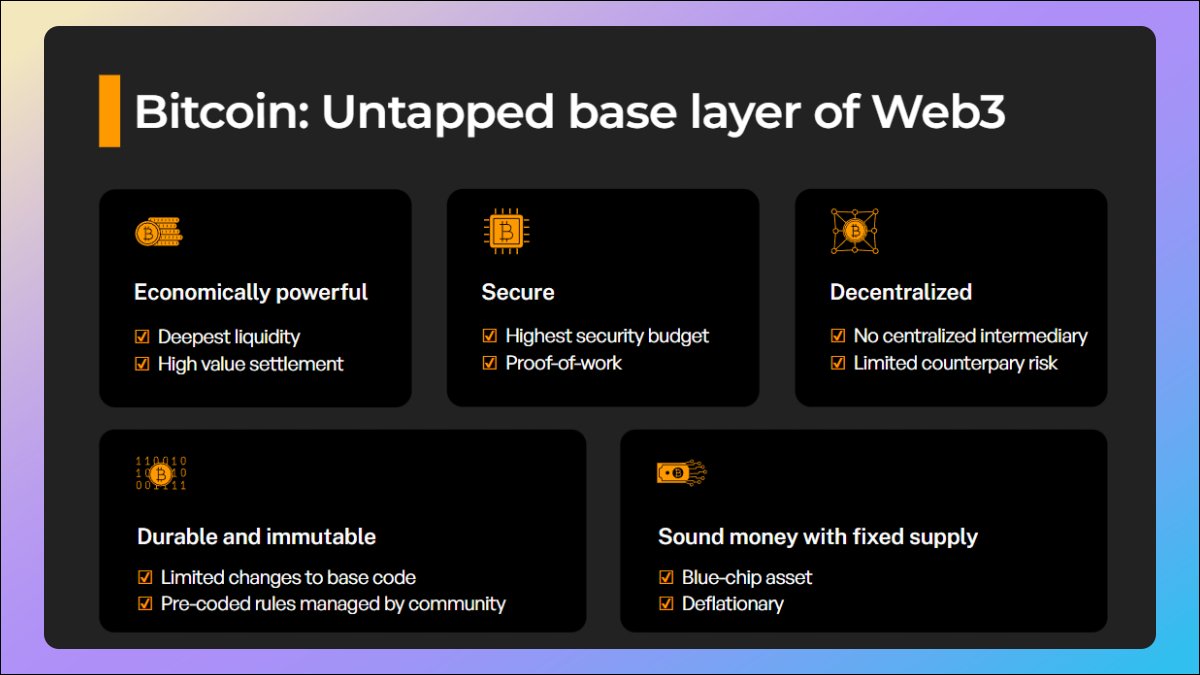

Now, let's talk about L2s. As we can see below $STX is by far the best performing L2 YTD and the only one with a positive performance.

Why is that? Simply because people realized in Q4 2023 that Bitcoin DeFi could be a real thing. And that Bitcoin alone could certainly not scale and Bitcoin L2s would be needed. Although Stacks $STX is not really a Bitcoin L2, it was the closest thing with a ticker that could be associated to it and this unpriced new information got priced in on $STX which is why it vastly outperformed ETH L2s (that are all very similar to each other).

Now let's get back to AI, RWA. Why have these been consistently the best performing narrative this year?

Well, the answer is obvious.

After chatgpt, the AI potential was revealed to the world. Since it's life-changing developments are still continuing at a fast pace, it still isn't fully priced in after a year.

Same for RWA, potentially a multi trillion dollar industry, the potential and inflows that tokenizations could bring to crypto markets, was unpriced new information. Blackrock understands it.

Note that this "unpriced new information" element is so powerful and brings so much demand that it outweighs any other element on the supply/demand equation, such as high inflation, high fdv low float, vc backed or not, bad market conditions, or anything else you could think of.

This is the main reason why Ondo, despite being a VC backed project, and despite a launch in 2024, has outperformed all other 2024 launches by far. VC funded or not. Among all narrative.

I'll conclude with one last example.

L1s had a great run in both 20/21 as they are the foundation level for all defi activity. But since then, L1 coins rarely outperformed the tokens of the best performing narratives.

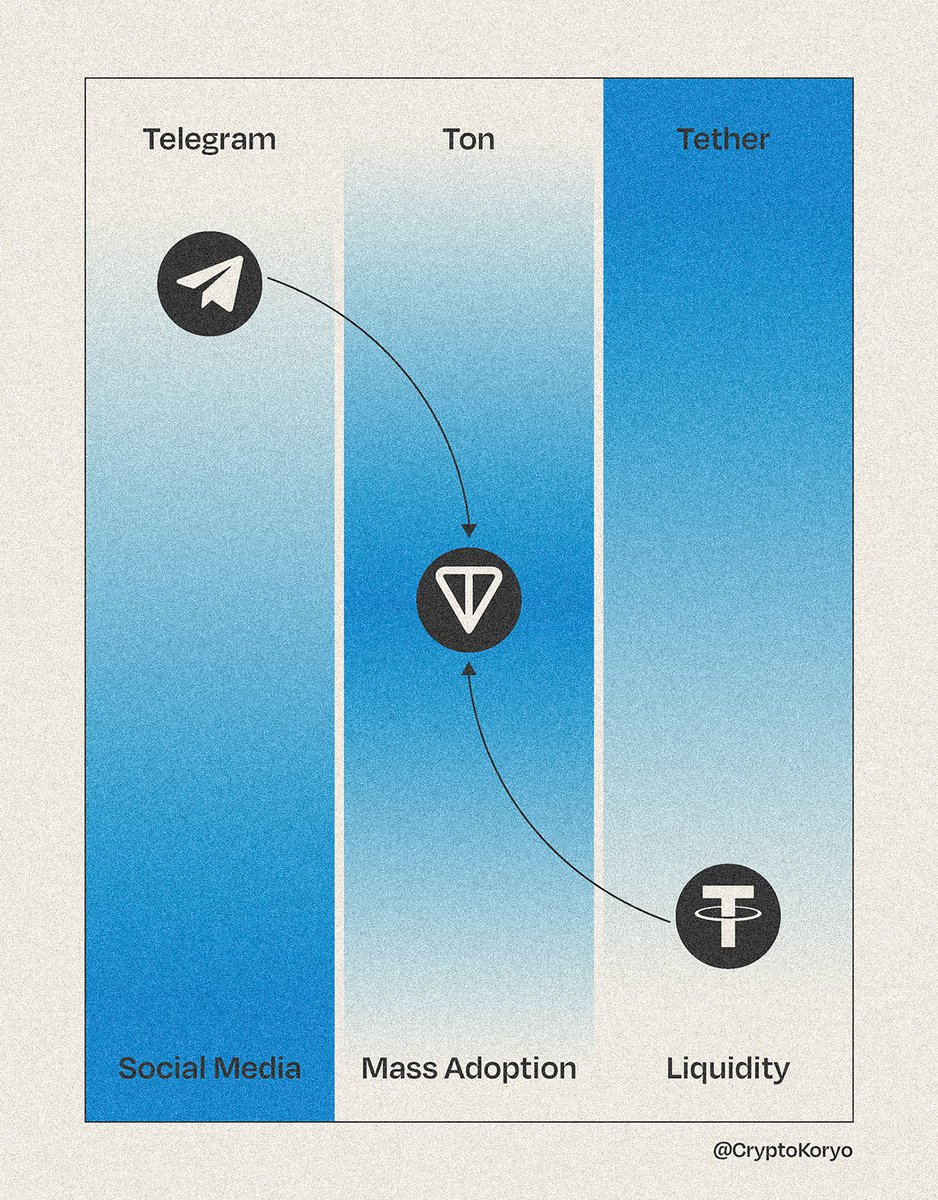

There are mainly twos exceptions in 2024: $SOL and $TON

$SOL somehow started become the home for retail and memecoins.

$TON is probably just another chain in terms of the tech, but it's associated with Telegram and it's 1b active users. Something no other L1 has.

In both cases, there was unpriced new information.

🔸Conclusion

Every week, you will see dozens of new announcement from different protocols and chains and see content creators writing about the next big trends.

A new DEX that is 10% more capital-efficient than its competitor.

A new Ethereum L2 with more decentralized sequencers.

A new LRT protocol with more integrations and more gas efficient.

And so on.

Every time, you have to ask yourself how much unpriced new information is there? What is the entropy?

Answering correctly these questions are were the 100x opportunities are.

I've been asking myself this question for a while.

Ignoring memecoins, AI and RWA have probably been the best performing narratives in the last month.

Why is that?

The short answer is because the markets are forward-looking.

Let me share some examples and expand.

We all use DEXs every day and innovation continues in the AMM space. Why are (Perp) DEX tokens not outperforming?

Same question for other narratives like NFTs, and others.

My 'History of narratives' query could provide some answers. Let's consider the DEX narrative for example. When was it the best or the 2nd best performing narrative of a month?

As we can see below, it only happened twice. Both relatively close to the start of DeFi summer and the 2021 bull market.

Why is that?

Because it was probably the 1st time we started to see many tokens across many blockchains and having a decentralized permissionless AMM could answer that increasing need. It was huge at the time. This potential had to get priced in. Which led to DEXs being the best performing narrative in Nov. 2020.

But since then, we've had Uniswap V2, V3, V4, concentrated liquidity, hooks, hyper-optimized liquid pools, v3(3,3) tokenomics, orderbook DEXs, limit orders, revenue sharing etc. etc. Why has the DEX narrative never outperformed again in the last 3 years.

Simply because these features were no longer considered

revolutionary new information compared to what other stronger narratives had to offer.

Same holds true for NFTs. Using the history of narratives query, we can see they were the best performing narrative from June 2021 to June 2022.

When they launched, they performed extremely well because of the unpriced new information. It wasn't about the monkey pictures or other cool cat pfp pics. That was just the manifestation of that potential. The reason was people realized this is an entire new asset class that could entire revolutionize many Web2 industries. From brands, concerts, certificates, real estate, etc. It took almost 1 year for this to get priced in. Since then, NFTs are consistently the worst performing narrative. Because there is no new unpriced new information.

Now, let's talk about L2s. As we can see below $STX is by far the best performing L2 YTD and the only one with a positive performance.

Why is that? Simply because people realized in Q4 2023 that Bitcoin DeFi could be a real thing. And that Bitcoin alone could certainly not scale and Bitcoin L2s would be needed. Although Stacks $STX is not really a Bitcoin L2, it was the closest thing with a ticker that could be associated to it and this unpriced new information got priced in on $STX which is why it vastly outperformed ETH L2s (that are all very similar to each other).

Now let's get back to AI, RWA. Why have these been consistently the best performing narrative this year?

Well, the answer is obvious.

After chatgpt, the AI potential was revealed to the world. Since it's life-changing developments are still continuing at a fast pace, it still isn't fully priced in after a year.

Same for RWA, potentially a multi trillion dollar industry, the potential and inflows that tokenizations could bring to crypto markets, was unpriced new information. Blackrock understands it.

Note that this "unpriced new information" element is so powerful and brings so much demand that it outweighs any other element on the supply/demand equation, such as high inflation, high fdv low float, vc backed or not, bad market conditions, or anything else you could think of.

This is the main reason why Ondo, despite being a VC backed project, and despite a launch in 2024, has outperformed all other 2024 launches by far. VC funded or not. Among all narrative.

I'll conclude with one last example.

L1s had a great run in both 20/21 as they are the foundation level for all defi activity. But since then, L1 coins rarely outperformed the tokens of the best performing narratives.

There are mainly twos exceptions in 2024: $SOL and $TON

$SOL somehow started become the home for retail and memecoins.

$TON is probably just another chain in terms of the tech, but it's associated with Telegram and it's 1b active users. Something no other L1 has.

In both cases, there was unpriced new information.

🔸Conclusion

Every week, you will see dozens of new announcement from different protocols and chains and see content creators writing about the next big trends.

A new DEX that is 10% more capital-efficient than its competitor.

A new Ethereum L2 with more decentralized sequencers.

A new LRT protocol with more integrations and more gas efficient.

And so on.

Every time, you have to ask yourself how much unpriced new information is there? What is the entropy?

Answering correctly these questions are were the 100x opportunities are.

• • •

Missing some Tweet in this thread? You can try to

force a refresh