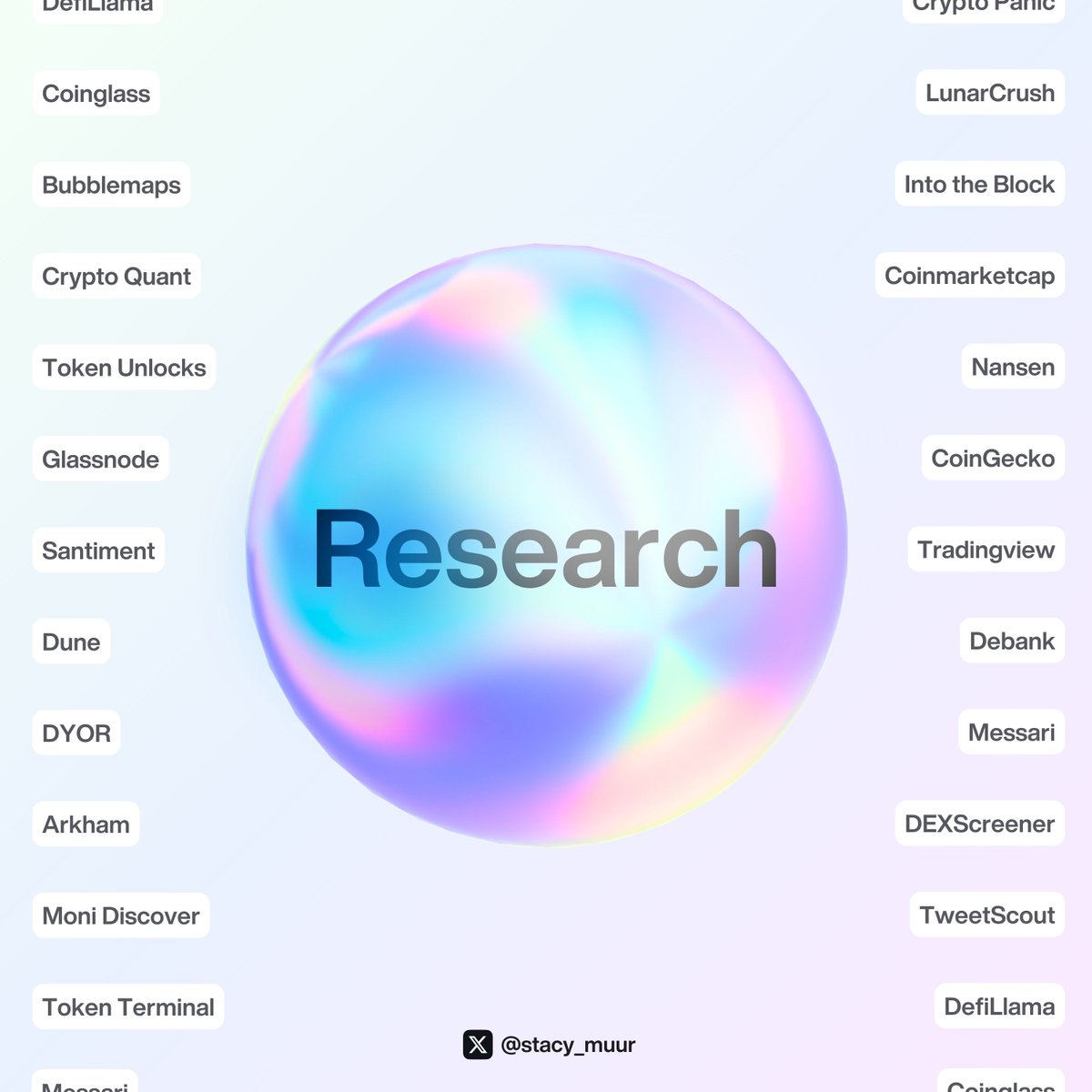

The flywheel of Web3 research consists of two key steps:

1. Identifying promising protocols within a vast array of opportunities.

2. Researching these protocols to inform investment decisions.

1. Identifying promising protocols within a vast array of opportunities.

2. Researching these protocols to inform investment decisions.

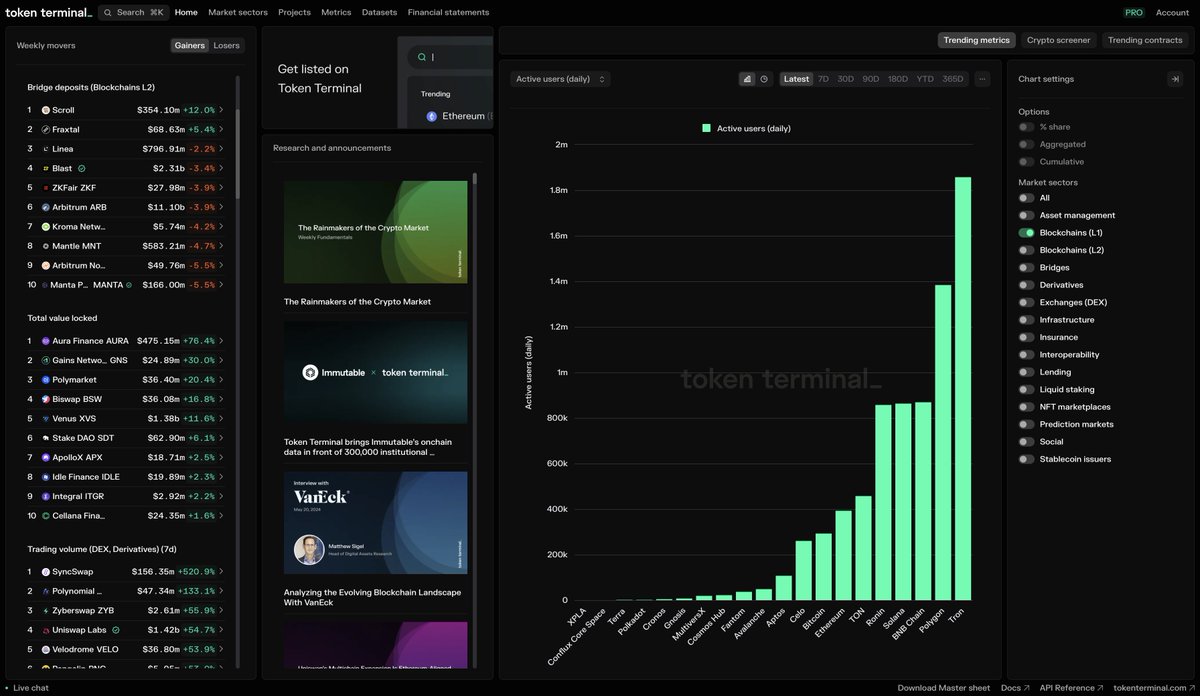

#1: @tokenterminal – best for fundamentals

Identify gainers and losers by:

• TVL (for DeFi)

• Bridge deposits (chains)

• Trading volume (DEXes)

• Active loans (Lending)

• Assets staked (LST)

• Fees and revenue

• DAU & MAU trends

+ Deeper fundamentals research

Identify gainers and losers by:

• TVL (for DeFi)

• Bridge deposits (chains)

• Trading volume (DEXes)

• Active loans (Lending)

• Assets staked (LST)

• Fees and revenue

• DAU & MAU trends

+ Deeper fundamentals research

#2: @dyorcryptoapp by @hmalviya9 – best for identifying top gainers

Discover the highlights of on-chain growth:

• TVL

• Fees

• Supply emission

• Price

• Trading volume

• Token holders

• DAU

Invite code: P4gKTxNQIE

Discover the highlights of on-chain growth:

• TVL

• Fees

• Supply emission

• Price

• Trading volume

• Token holders

• DAU

Invite code: P4gKTxNQIE

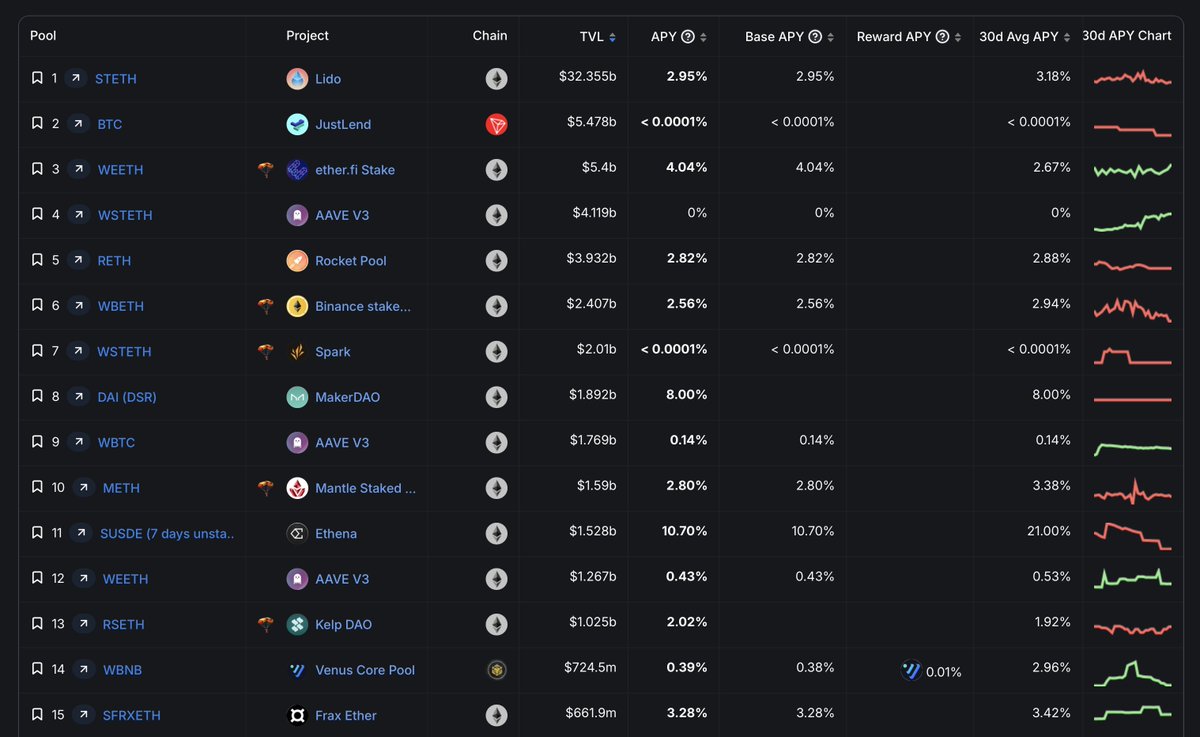

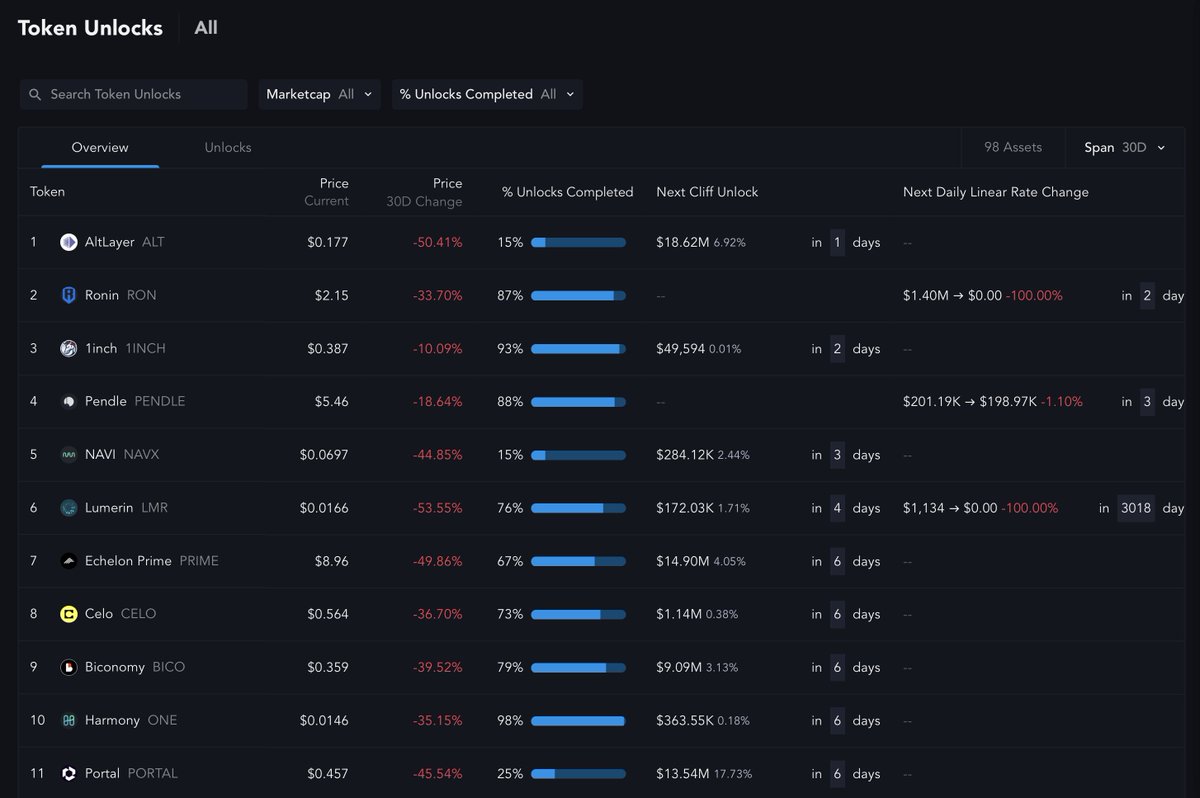

#3: @DefiLlama – the most diversified on-chain data aggregator

Here, you can do on-chain research by:

• Chains

• Categories

• Parameters (i.e. fees or trading volume)

• Funding rounds

• Token unlocks

• Yields

Here, you can do on-chain research by:

• Chains

• Categories

• Parameters (i.e. fees or trading volume)

• Funding rounds

• Token unlocks

• Yields

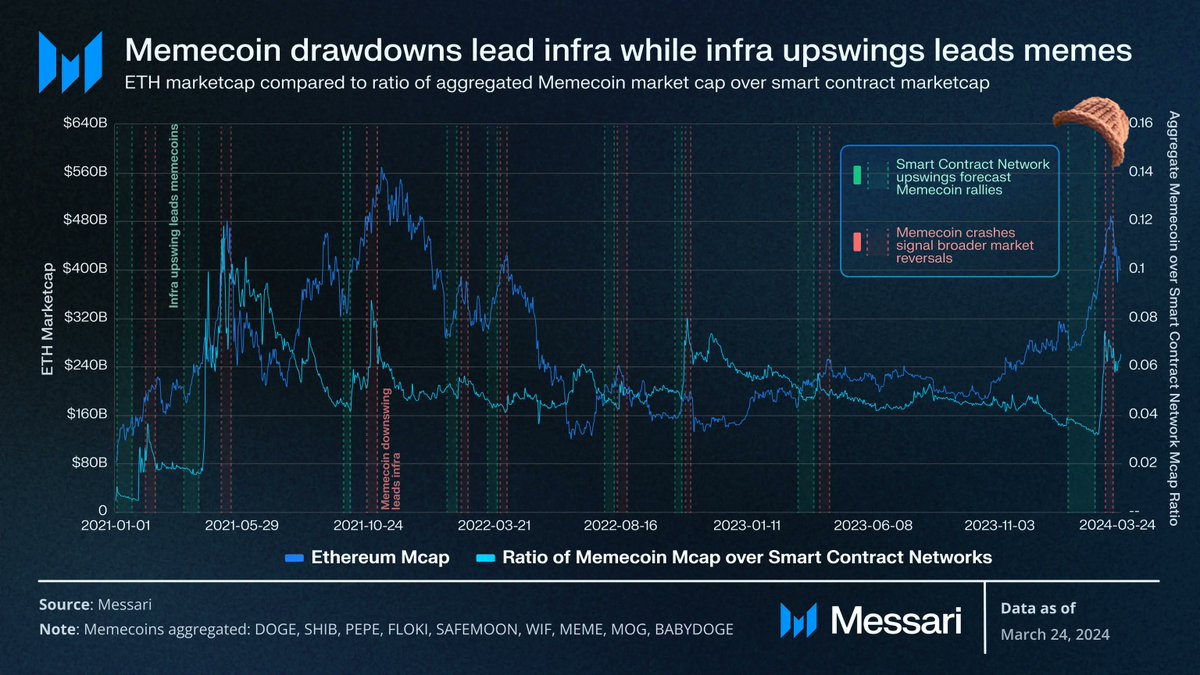

#4: @MessariCrypto – the powerhouse of on-chain data and news

Messari offers the same depth of on-chain data and combines it with news and research stream:

• Daily AI news insights

• Regular research reports

• Token unlocks

• Watchlists

Messari offers the same depth of on-chain data and combines it with news and research stream:

• Daily AI news insights

• Regular research reports

• Token unlocks

• Watchlists

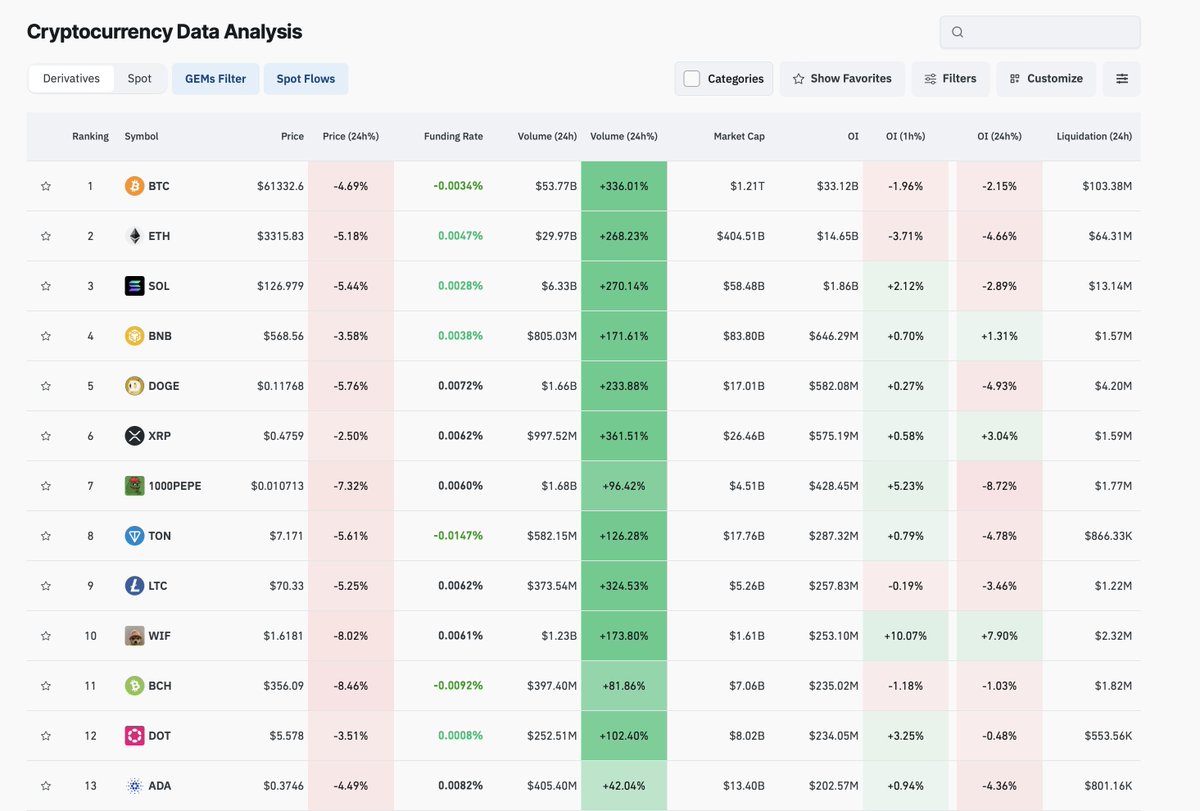

#5: @coinglass_com – market essentials for traders

• Filter assets by market cap, price change, and CEXes

• Analyze spot and futures net flow

• Track volumes, open interest, funding rates, and liquidations and filter by categories and other parameters

• Filter assets by market cap, price change, and CEXes

• Analyze spot and futures net flow

• Track volumes, open interest, funding rates, and liquidations and filter by categories and other parameters

#6: @intotheblock – deep market intel and risk assessment

Essential for analyzing:

• Sentiment

• Large transactions

• Ownership distribution

• Depeg risks

• Health factor & high-risk loans

Essential for analyzing:

• Sentiment

• Large transactions

• Ownership distribution

• Depeg risks

• Health factor & high-risk loans

#7: @glassnode – another essential tool for traders

Glassnode probably has the largest set of on-chain insights for traders featuring the most popular assets.

Some highlights:

• Profit / loss analysis

• Wealth distribution

• MVRV

• Investor cap

• Realized volatility

Glassnode probably has the largest set of on-chain insights for traders featuring the most popular assets.

Some highlights:

• Profit / loss analysis

• Wealth distribution

• MVRV

• Investor cap

• Realized volatility

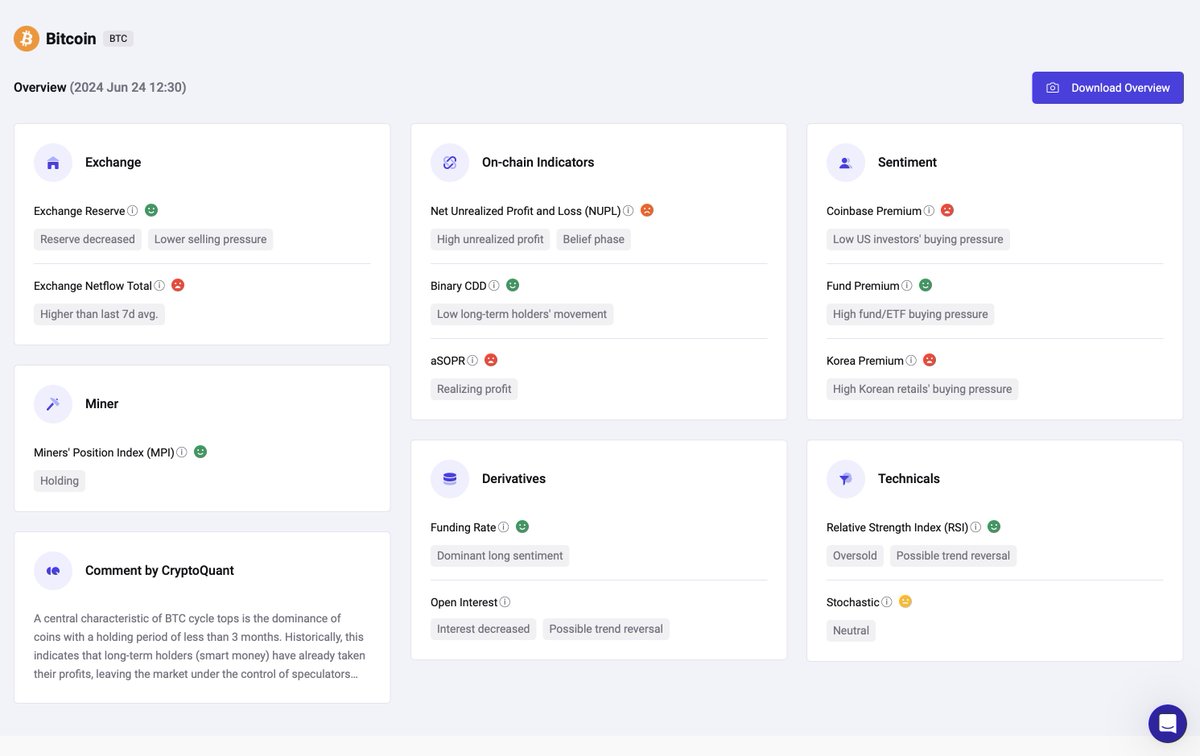

#8: @cryptoquant_com – deep data insights

• Community-generated data sets

• Asset summary (sentiment, RSI, OI, on-chain indicators, etc.)

• Additional indicators: network stats, exchange flows, miner flows, derivatives, bank flows, etc.

• Community-generated data sets

• Asset summary (sentiment, RSI, OI, on-chain indicators, etc.)

• Additional indicators: network stats, exchange flows, miner flows, derivatives, bank flows, etc.

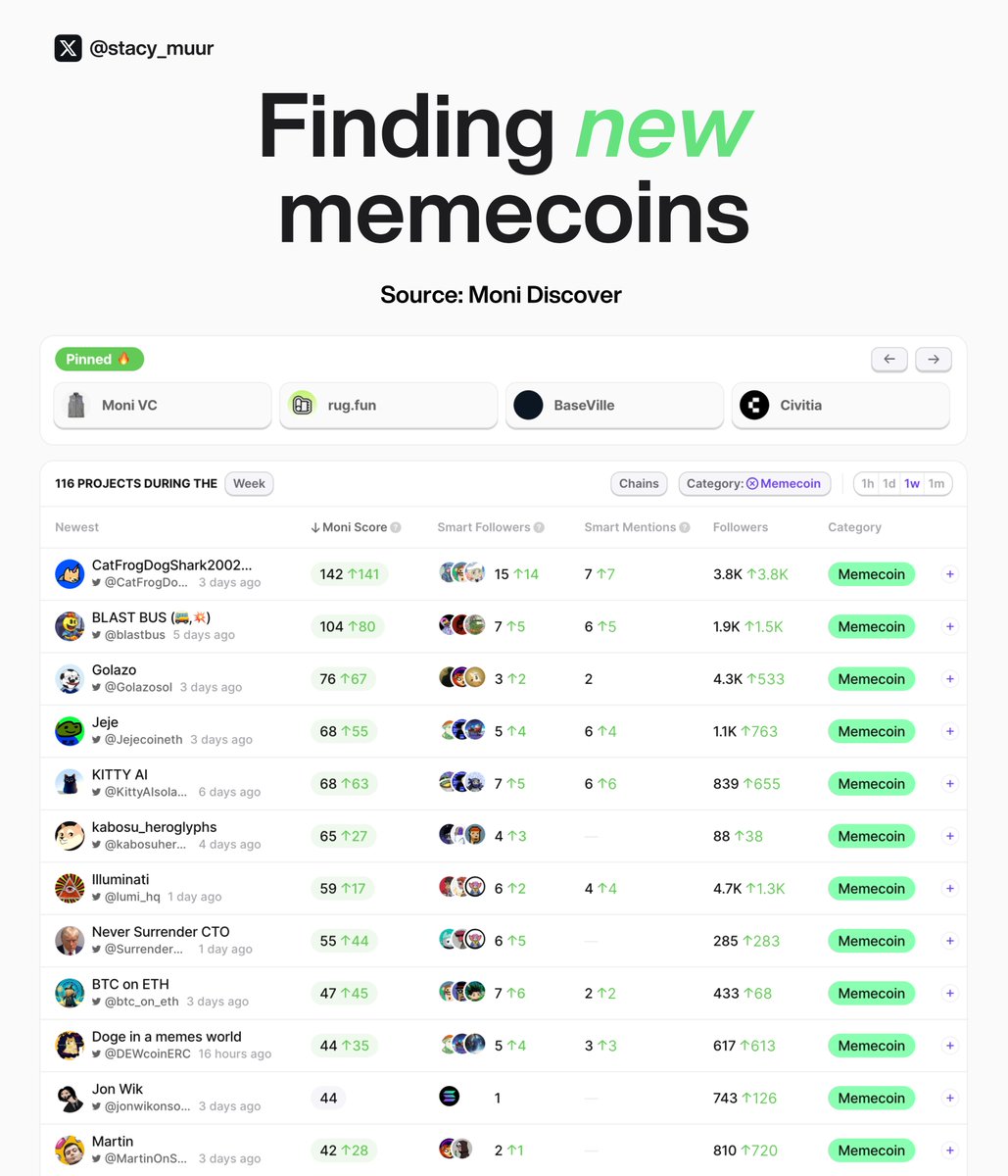

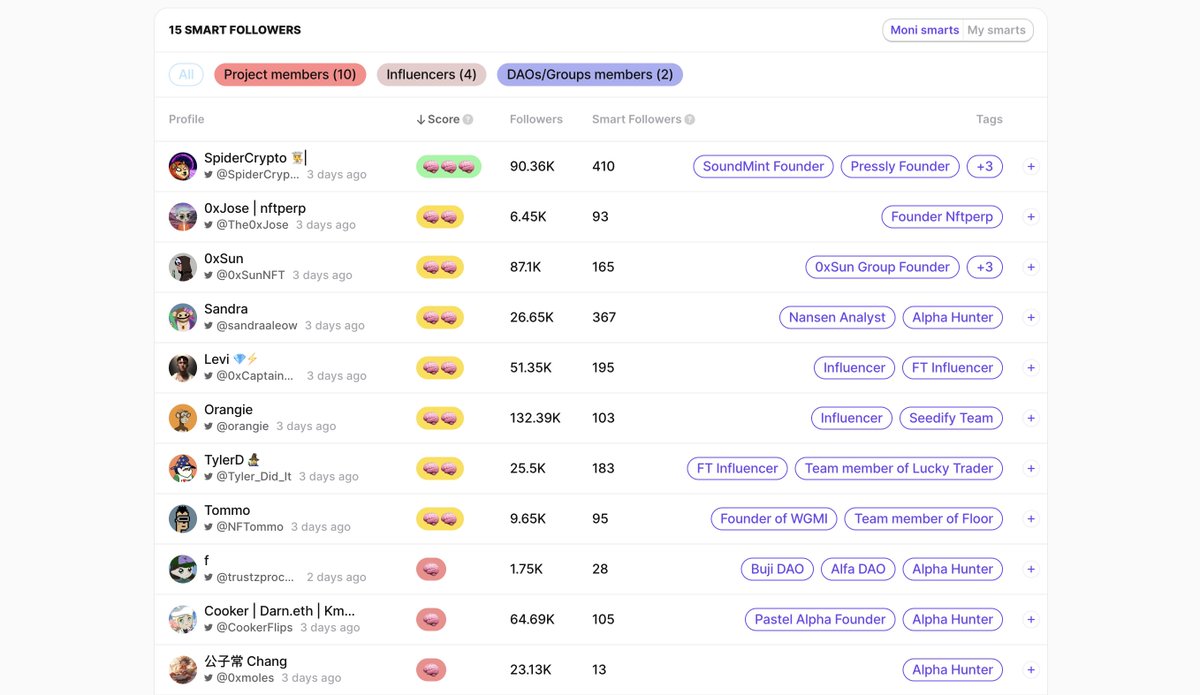

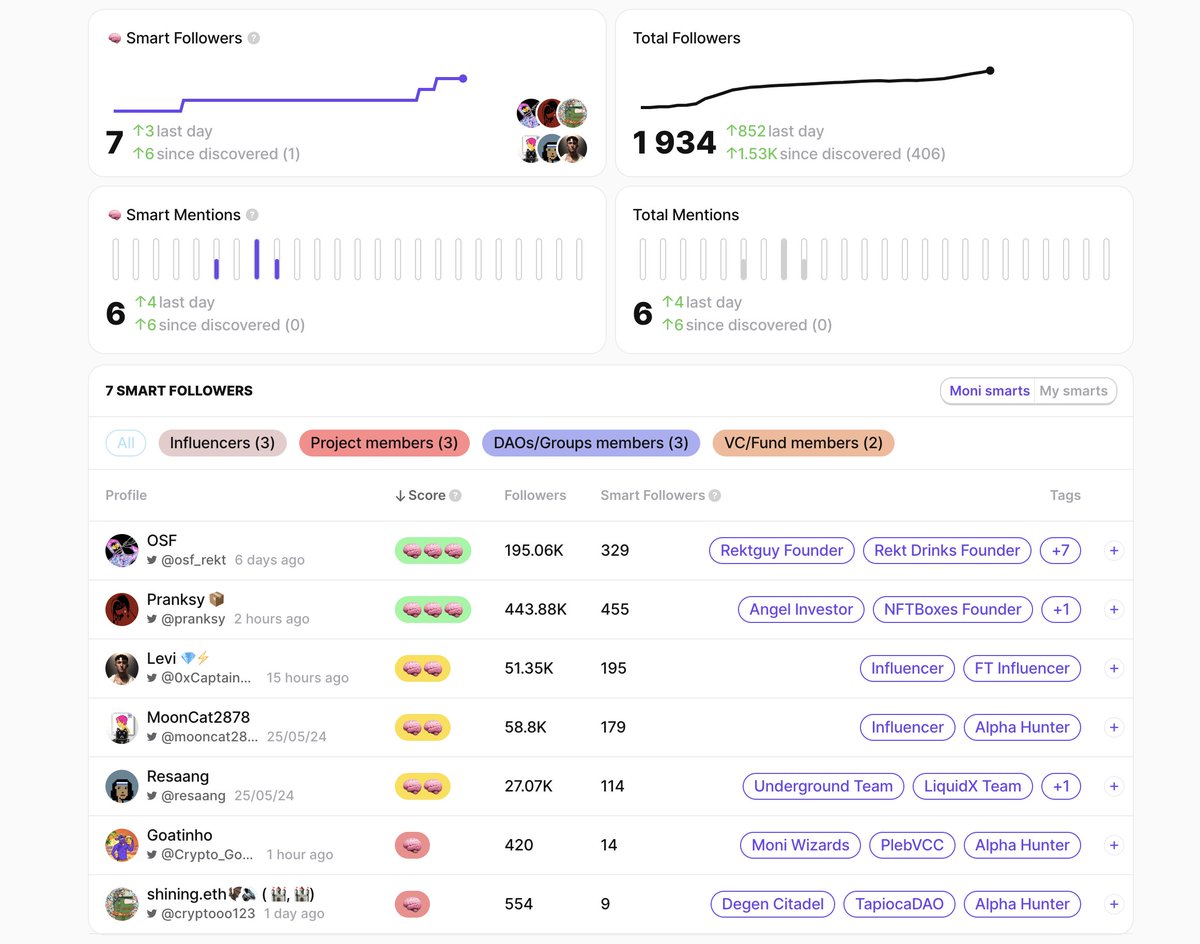

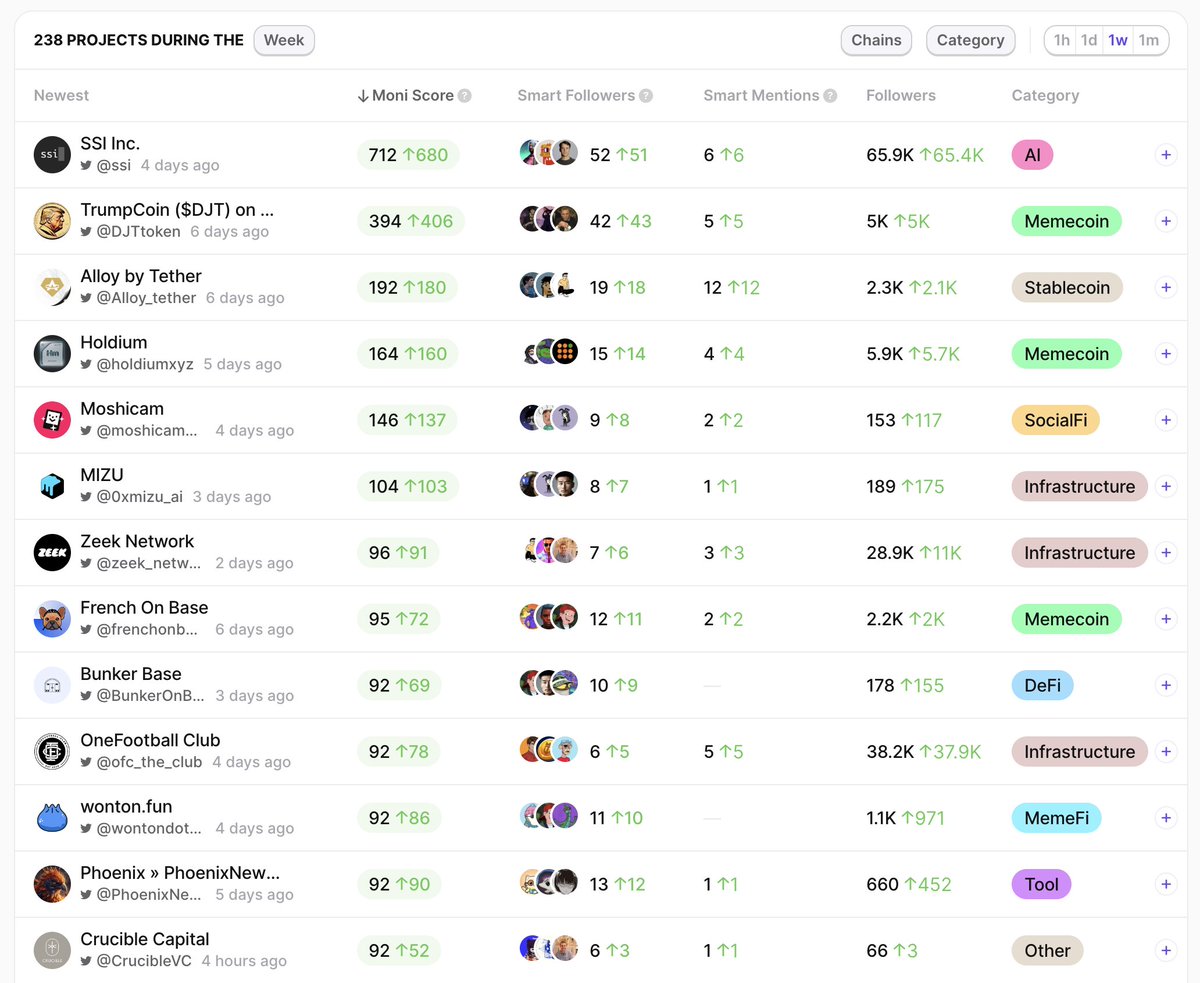

#9: @getmoni_io – perfect for spotting early-stage projects

Moni analyzes accounts experiencing a spike in user interest from opinion leaders, VCs, DAO members, and more. It's like a social hype tracker for new projects.

10% discount code: discover.getmoni.io/?ref=WWMFDS

Moni analyzes accounts experiencing a spike in user interest from opinion leaders, VCs, DAO members, and more. It's like a social hype tracker for new projects.

10% discount code: discover.getmoni.io/?ref=WWMFDS

More tools for in-depth research:

• @DuneAnalytics – data aggregators for DeFi protocols & airdrops

• @Footprint_Data – similar to Dune, more dashboards

• @LunarCrush – social sentiment analysis

• @santimentfeed – data highlights, visualized

• @DuneAnalytics – data aggregators for DeFi protocols & airdrops

• @Footprint_Data – similar to Dune, more dashboards

• @LunarCrush – social sentiment analysis

• @santimentfeed – data highlights, visualized

• @CryptoPanicCom – news aggregator showing news price impact

• @CryptoRank_io – great for tracking fundraising

• @Token_Unlocks – token unlocks & tokenomics tracker

• @ArkhamIntel – wallet tracker

• @bubblemaps – visualized on-chain interactions

• @CryptoRank_io – great for tracking fundraising

• @Token_Unlocks – token unlocks & tokenomics tracker

• @ArkhamIntel – wallet tracker

• @bubblemaps – visualized on-chain interactions

What other tools do you use on a daily basis?

Feel free to share in the commentaries below <3

Feel free to share in the commentaries below <3

• • •

Missing some Tweet in this thread? You can try to

force a refresh