It's been almost 3 months since Wormhole's airdrop

Will airdrops continue? How will they change?

It's worth highlighting the effort it takes to launch one at scale & share learnings from Wormhole's first round

- 1M+ wallets

- 70+ eco teams

- 26 chains

- 5 onchain communities

Will airdrops continue? How will they change?

It's worth highlighting the effort it takes to launch one at scale & share learnings from Wormhole's first round

- 1M+ wallets

- 70+ eco teams

- 26 chains

- 5 onchain communities

2/ What went well?..

- Vested airdrops are gud. We need more of these and are already starting to see this more with teams like the @FantomFDN's recently announced Sonic chain

-Separating the checker and claim should be a standard. People will always be mad about not getting free money. So if you combine the disappointment of those people with the protocol's claim/TGE, you almost guarantee an outcome of negative sentiment (I'm sure there are examples on both sides of this)

- Goes without saying, but prioritize the users of the product over everything else, no matter what new ideas you have

- Anti-sybil work over 5 months with @AlliumLabs was a success

- Meticulously prioritizing claim experience. Make it as cheap and fast as possible, simple as that. Thanks to @triton_one and @heliuslabs for the support here

- Vested airdrops are gud. We need more of these and are already starting to see this more with teams like the @FantomFDN's recently announced Sonic chain

-Separating the checker and claim should be a standard. People will always be mad about not getting free money. So if you combine the disappointment of those people with the protocol's claim/TGE, you almost guarantee an outcome of negative sentiment (I'm sure there are examples on both sides of this)

- Goes without saying, but prioritize the users of the product over everything else, no matter what new ideas you have

- Anti-sybil work over 5 months with @AlliumLabs was a success

- Meticulously prioritizing claim experience. Make it as cheap and fast as possible, simple as that. Thanks to @triton_one and @heliuslabs for the support here

3/ Could've gone better

- People absolutely care about the tokenomics but the loudest people care more about what they are individually receiving. Prioritization should be on both but I'd think about the individual more next time.

- Given this was across a number of chains, there were a lot of different wallets eligible for a given individual. A lot of frustration boiled down to not checking all of an individual's eligible wallets. Displaying all eligible wallets linked to your ownership cluster would've been a great feature.

- Wallet loyalty is real. Particularly for multichain airdrops, making sure you have as much wallet support as possible is important.

- People absolutely care about the tokenomics but the loudest people care more about what they are individually receiving. Prioritization should be on both but I'd think about the individual more next time.

- Given this was across a number of chains, there were a lot of different wallets eligible for a given individual. A lot of frustration boiled down to not checking all of an individual's eligible wallets. Displaying all eligible wallets linked to your ownership cluster would've been a great feature.

- Wallet loyalty is real. Particularly for multichain airdrops, making sure you have as much wallet support as possible is important.

4/ After combing through addresses to prevent Sybil attacks, 400,000~ wallets from 26 different ecosystems were eligible.

With Wormhole being live for 3+ years, it was a lot of data to process. It took 4~ months with a part-time focus.

With Wormhole being live for 3+ years, it was a lot of data to process. It took 4~ months with a part-time focus.

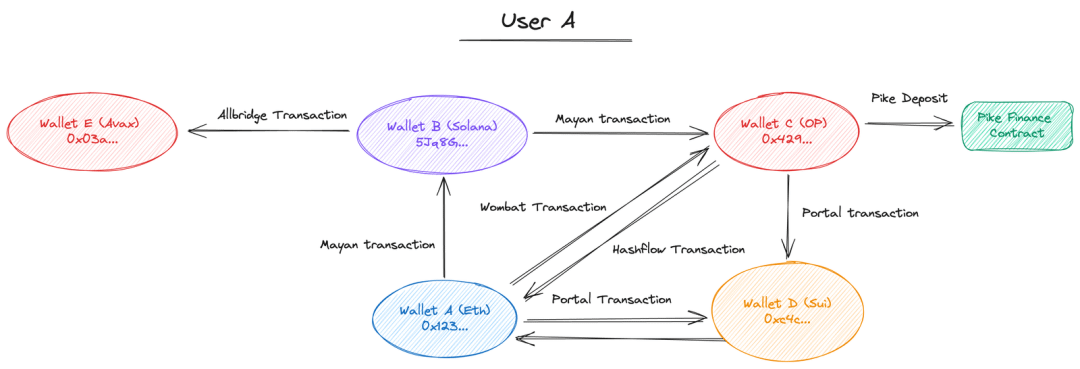

5/ We started with an ownership graph to maximize each user’s chance of qualifying for the airdrop. Wormhole contributors constructed this graph so that a unique user ID gets assigned to a cluster of wallets that belong to the user.

Ownership Graph

Ownership Graph

6/ We used a number of sybil analysis techniques the main ones here...

Skip this if you are tired of hearing about sybils

1. Source of Funds Analysis

Sybils often aim to fund numerous or – in several identified instances with Wormhole – hundreds to thousands of wallet clusters from a single funding source. Each of these wallets then go on to perform its own set of transactions within the protocol. Wormhole contributors used historical data from archival nodes and extensively labeled exchange wallets and contracts across every connected chain to determine whether the source funding behavior of each wallet exhibited clear sybil characteristics.

2. Behavioral Clustering Analysis

While source funding sybil detection is effective, sybil strategies have advanced significantly over time. More sophisticated actors may fund large swaths of wallets individually directly from exchange(s) in an attempt to circumvent source funding detection algorithms. However, performing this activity at scale requires automation and often exhibits behavioral patterns that set these actors apart from legitimate users. By applying the Louvain Community Detection Algorithm on a similarity matrix of transactions over all ownership clusters, Wormhole contributors were able to identify sybils based on repetitive actions performed over time and at similar intervals of other wallet.

3. Transaction Spam Analysis

Another common large scale action involved rapid sequential transactions of identical token amounts, either between two chains or across multiple chains. Wallets with transactions that both matched this activity at abnormally high frequencies and coincided with the large influx of sybil activity starting in December 2023 may have been tagged as indicative of spam-like behavior and subsequently removed from the airdrop eligibility dataset.

Learn more:

wormhole.com/blog/from-elig…

Skip this if you are tired of hearing about sybils

1. Source of Funds Analysis

Sybils often aim to fund numerous or – in several identified instances with Wormhole – hundreds to thousands of wallet clusters from a single funding source. Each of these wallets then go on to perform its own set of transactions within the protocol. Wormhole contributors used historical data from archival nodes and extensively labeled exchange wallets and contracts across every connected chain to determine whether the source funding behavior of each wallet exhibited clear sybil characteristics.

2. Behavioral Clustering Analysis

While source funding sybil detection is effective, sybil strategies have advanced significantly over time. More sophisticated actors may fund large swaths of wallets individually directly from exchange(s) in an attempt to circumvent source funding detection algorithms. However, performing this activity at scale requires automation and often exhibits behavioral patterns that set these actors apart from legitimate users. By applying the Louvain Community Detection Algorithm on a similarity matrix of transactions over all ownership clusters, Wormhole contributors were able to identify sybils based on repetitive actions performed over time and at similar intervals of other wallet.

3. Transaction Spam Analysis

Another common large scale action involved rapid sequential transactions of identical token amounts, either between two chains or across multiple chains. Wallets with transactions that both matched this activity at abnormally high frequencies and coincided with the large influx of sybil activity starting in December 2023 may have been tagged as indicative of spam-like behavior and subsequently removed from the airdrop eligibility dataset.

Learn more:

wormhole.com/blog/from-elig…

7/ Once we had the list..we decided to go with a design where the user needs to trigger the claim from a smart contract instead of receiving the tokens passively. This is useful because otherwise you might send tokens to inactive addresses. You can also ensure proper geo-fencing.

8/ The user signs 2 messages. They first sign a message with the wallet that's eligible to claim to prove ownership over that wallet. Then, they sign another message with the Solana wallet that they'd like to receive the allocation in. This second message encodes the Solana transaction to actually execute the claim.

9/ Then, you send that message to the token dispenser (Solana program for the airdrop). The smart contract checks the signature, reads the Solana address you submitted, checks if you’re eligible and sends your tokens to the Solana address.

10/ Getting the whole experience right was hard, but we managed to provide something we were proud of. We have processed 265,476 claims so far.

11/ I'll end by saying that I think the best airdrops are the ones that users don't think are coming. However, I'm not convinced we can go back to that time of purity. Enter Points Programs and Sybil Wars.

Points programs are almost like unspoken agreements between protocols and "new users" that airdrop farming is acceptable.

The question becomes, can the protocol properly farm the farmer.

I am a fan of points programs because they can reduce the burden of work on the protocol team (i.e. reduction in time related to anti-sybil work)

Points programs are almost like unspoken agreements between protocols and "new users" that airdrop farming is acceptable.

The question becomes, can the protocol properly farm the farmer.

I am a fan of points programs because they can reduce the burden of work on the protocol team (i.e. reduction in time related to anti-sybil work)

Huge shoutout to an incredible team and one of our closest partners, @pythnetwork. They contributed a ton to this airdrop by open sourcing their process.

Additional shoutout to @AlliumLabs and the legends at the @WormholeFdn, particularly @nsuri_ and @maherlatif_ !

Additional shoutout to @AlliumLabs and the legends at the @WormholeFdn, particularly @nsuri_ and @maherlatif_ !

Check out @guibescos_ thread for more info on the Pyth Airdrop as well!

https://x.com/guibescos_/status/1729520445789991214

Huge shoutout to @xLabsxyz and @ComeBuidlwithUs as well, it took a village 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh