Solana stablecoin volumes - a small thread 🧵

https://twitter.com/869659857590288384/status/1805731528023957778

As mentioned in @WazzCrypto's thread, much of overall volume is driven by 2 sources: MEV Bot 7rhxnL and Phoenix DEX, accounting for ~$1tn of total transfer volume over the last month

solscan.io/account/7rhxnL…

solscan.io/account/7rhxnL…

On more recent time horizons in the Artemis stablecoin breakdown view, MEV Bot 7rhxnL has significantly less transfer volume - what happened?

On June 10, the Solana Foundation removed delegations for several validators engaged in sandwiching.

https://twitter.com/1435897632581357572/status/1800146153125691671

This action follows @jito_labs's decision to spin down its mempool offering in March, citing adverse behavior towards retail traders.

https://twitter.com/1411116427776610307/status/1766228889888514501

The June 10 date corresponds directly with the day MEV Bot 7rhxnL drastically reduced its stablecoin activity

It is reasonable to assume that MEV Bot 7rhxnL operated via one of these sandwiching validators and that the bot's strategy is no longer viable given the undelegation.

In the next week, we'll be rolling out 2 new stablecoin metrics to make it easier to adjust for automated actors:

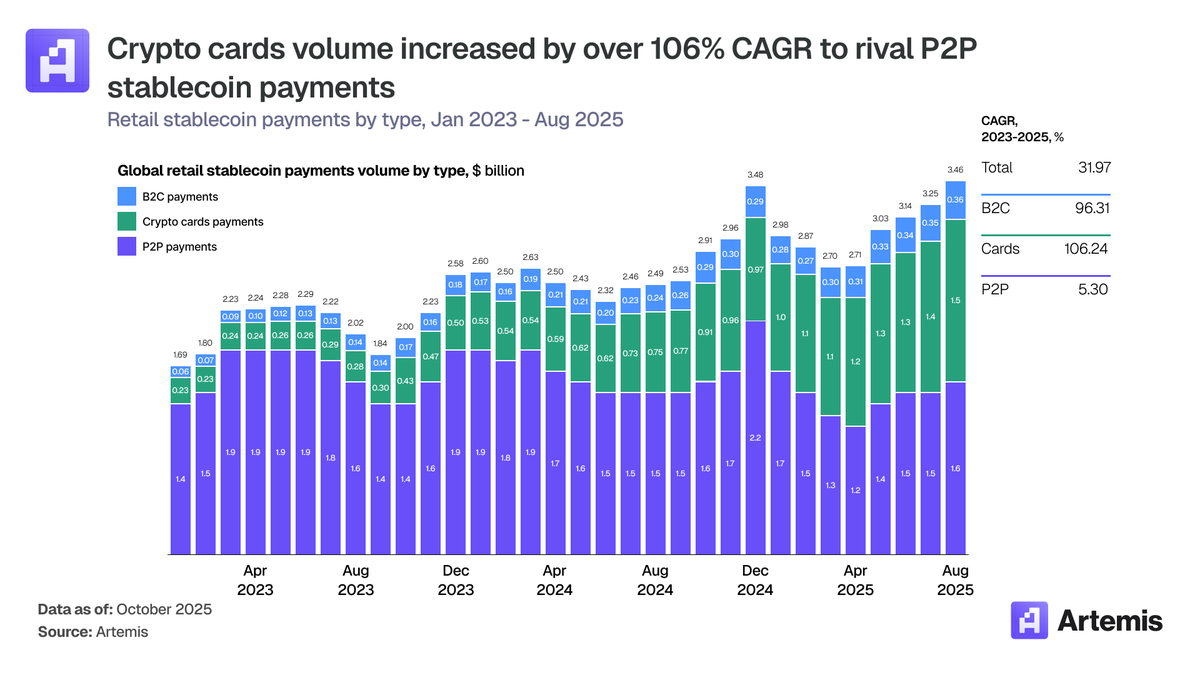

1️⃣ P2P Stablecoin Transfer Volume (from one non-contract address to another)

sneak preview: app.artemis.xyz/chart-builder/…

1️⃣ P2P Stablecoin Transfer Volume (from one non-contract address to another)

sneak preview: app.artemis.xyz/chart-builder/…

2️⃣ Adjusted Stablecoin Transfer Volume, which seeks to remove large transacting entities via simple heuristics (more on this methodology soon!)

Along with these two new metrics, stay tuned for a stablecoin dashboard UI overhaul!

• • •

Missing some Tweet in this thread? You can try to

force a refresh