Good tokenomics: 100x in a year.

Bad tokenomics: -90% in a year.

Understanding of tokenomics is the most important skill in crypto.

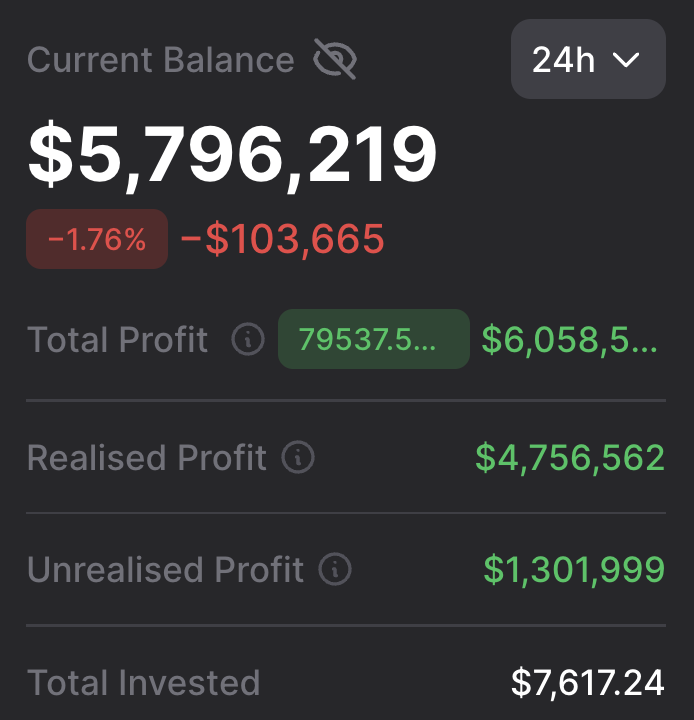

I am an angel investor with $3.5M in capital, analyzing different tokenomics daily.

🧵: My master guide on tokenomics 👇

Bad tokenomics: -90% in a year.

Understanding of tokenomics is the most important skill in crypto.

I am an angel investor with $3.5M in capital, analyzing different tokenomics daily.

🧵: My master guide on tokenomics 👇

Before I begin...

I'll likely make my X and TG private soon, so make sure to follow me here and join my tg (link in bio), so u won't miss this and my future content.

And if you appreciate my work, retweet and like the first post to support me 🤍

I'll likely make my X and TG private soon, so make sure to follow me here and join my tg (link in bio), so u won't miss this and my future content.

And if you appreciate my work, retweet and like the first post to support me 🤍

1/➮ For successful investing, learning is crucial

✧ If you don't understand the tokenomics, all purchases are simply hoping that the price will move in the direction you need

Don't engage in blind trading, or you might end up getting rekt

Here is a full guide on Tokenomics:

✧ If you don't understand the tokenomics, all purchases are simply hoping that the price will move in the direction you need

Don't engage in blind trading, or you might end up getting rekt

Here is a full guide on Tokenomics:

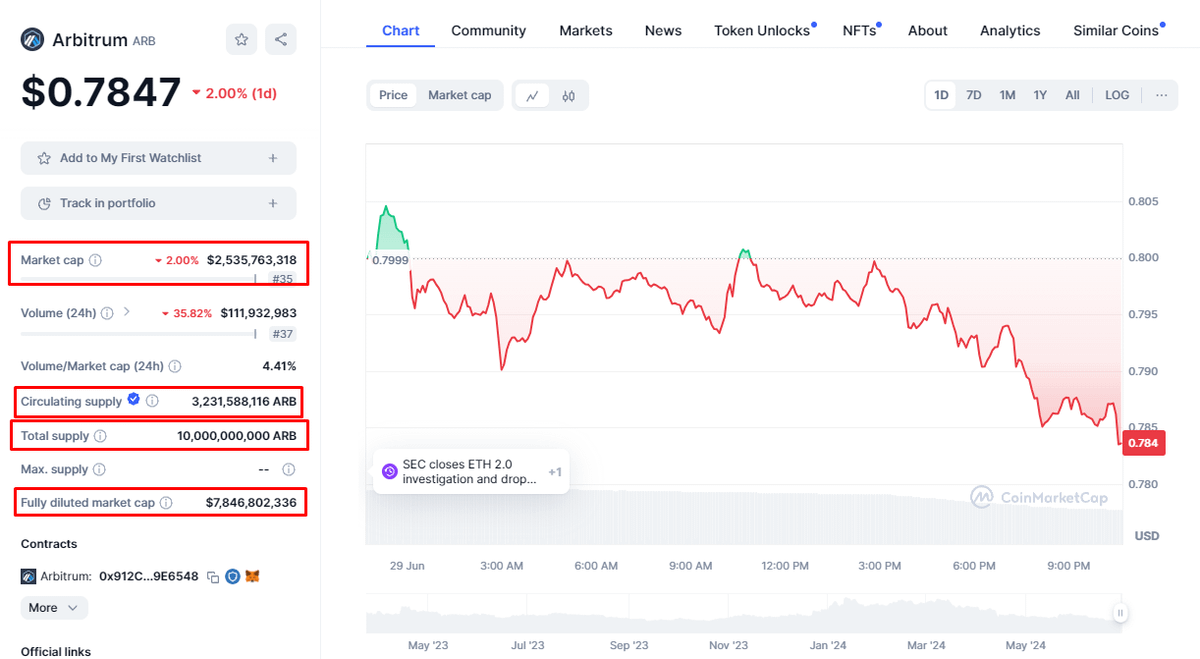

2/➮ Initially, when you find a potential coin to invest in, for example on CMC, you see the following:

- Market cap (mc)

- Total supply

- Circulating supply

- Fully Diluted Value (FDV)

Let's figure out what this means👇

- Market cap (mc)

- Total supply

- Circulating supply

- Fully Diluted Value (FDV)

Let's figure out what this means👇

3/➮ Basic supply metrics:

✧ Circulating Supply: tokens that are currently in circulation

✧ Total Supply: total tokens that can exist

✧ MC: total value in $ of circulating supply

✧ FDV: total value in $ of total supply

But why u need these metrics?

Let me explain👇

✧ Circulating Supply: tokens that are currently in circulation

✧ Total Supply: total tokens that can exist

✧ MC: total value in $ of circulating supply

✧ FDV: total value in $ of total supply

But why u need these metrics?

Let me explain👇

4/➮ So, understanding these metrics allows you to assess the token's potential

✧ But to do this, you need to know more about them than just their labels

✧ You need to understand how each of them operates and how they can impact the price

✧ But to do this, you need to know more about them than just their labels

✧ You need to understand how each of them operates and how they can impact the price

5/➮ Let's start with Supply. There are two paths a token can take:

- Inflationary

- Deflationary

Now about each one separately👇

- Inflationary

- Deflationary

Now about each one separately👇

6/➮ Inflationary token

✧ The token's supply can increase, and this is called emissions

Emission is not good cause it usually leads to a decrease in value

However, if the emission rate is slow and the total supply is still far away, it does not significantly impact the value

✧ The token's supply can increase, and this is called emissions

Emission is not good cause it usually leads to a decrease in value

However, if the emission rate is slow and the total supply is still far away, it does not significantly impact the value

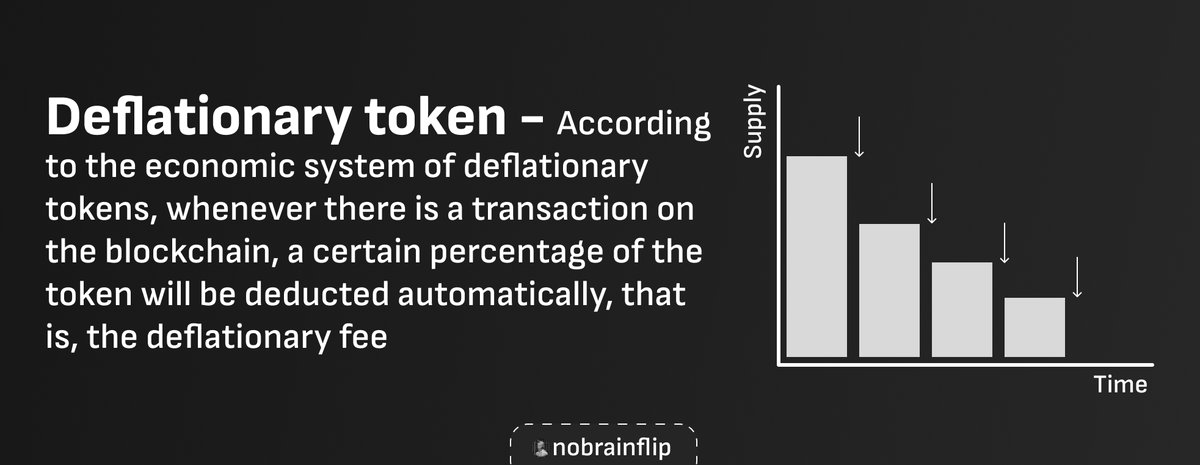

7/➮ Deflationary token

✧ It can also happen that the token supply decreases over time

✧ This occurs when a project buys back tokens and burns them

✧ In theory, reducing the supply should increase the value, but this is only in theory

✧ It can also happen that the token supply decreases over time

✧ This occurs when a project buys back tokens and burns them

✧ In theory, reducing the supply should increase the value, but this is only in theory

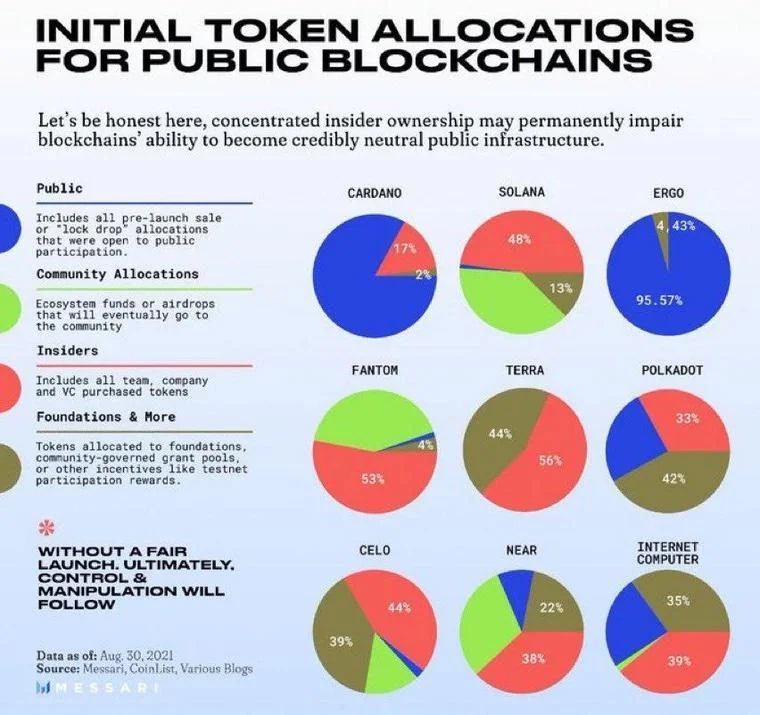

8/➮ Now let's discuss the main factor that determines the launch and life of a token: Allocation & Distribution

There are 2 ways:

- Pre Mined (distribution between early investors, team, advisors, etc. )

- Fair Launch (everyone has equal position to buy)

Mostly Pre-mind used

There are 2 ways:

- Pre Mined (distribution between early investors, team, advisors, etc. )

- Fair Launch (everyone has equal position to buy)

Mostly Pre-mind used

9/➮ Why it's important?

✧ Cause if 50% is allocated for investors and there is TGE 100%, investors can dump the token and u become exit liquidity

✧ That's why you need to understand what are:

- TGE allocation

- Vesting

- Cliff

Let me explain👇

✧ Cause if 50% is allocated for investors and there is TGE 100%, investors can dump the token and u become exit liquidity

✧ That's why you need to understand what are:

- TGE allocation

- Vesting

- Cliff

Let me explain👇

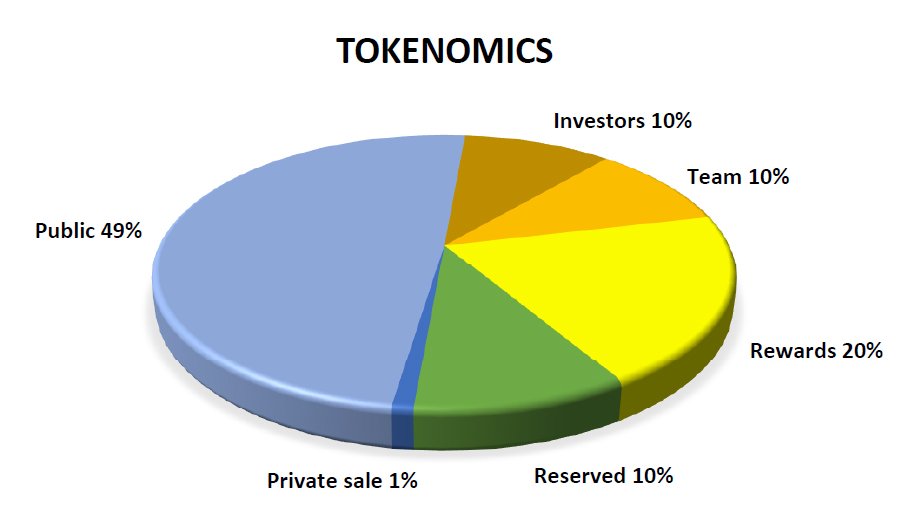

10/➮ There are often the following Distribution receivers:

- Private Sale (investors, KOLs, etc)

- Public sale (retail investors)

- Marketing

- Ecosystem (staking, rewards, etc)

- Airdrop

So we've discussed who receives the tokens, now let's talk about how they sell them

- Private Sale (investors, KOLs, etc)

- Public sale (retail investors)

- Marketing

- Ecosystem (staking, rewards, etc)

- Airdrop

So we've discussed who receives the tokens, now let's talk about how they sell them

11/➮ The day of the token launch is called TGE

✧TGE allocation is the percentage of tokens allocated to all the aforementioned individuals (10-20%)

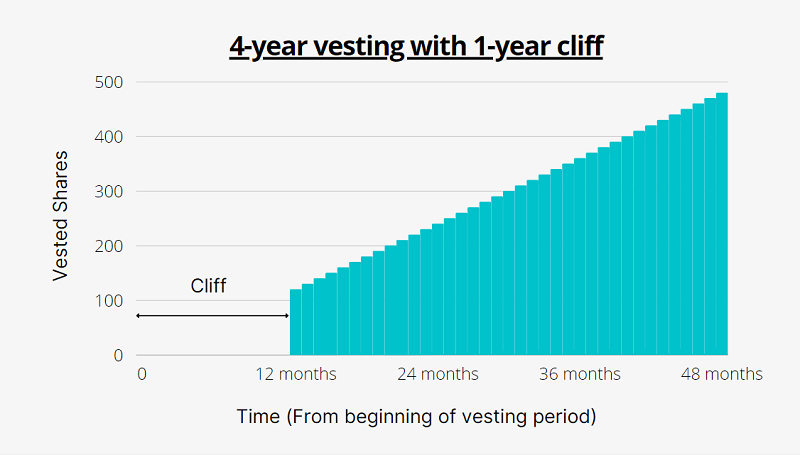

✧ Cliff is the period after TGE and before the next vesting

✧ Vesting is the gradual release of token percentages each month

✧TGE allocation is the percentage of tokens allocated to all the aforementioned individuals (10-20%)

✧ Cliff is the period after TGE and before the next vesting

✧ Vesting is the gradual release of token percentages each month

12/➮ Recently, projects have been adopting a method with a small % TGE (up to 20%), followed by several months of cliff and 12+ months of vesting

✧ This approach is better suited for long-term project success, so it's important to verify all these details before investing

✧ This approach is better suited for long-term project success, so it's important to verify all these details before investing

13/➮ Now, the other side of the coin for the success of any token is demand

✧ This is what motivates people to buy that particular token

✧ For example, the $, despite significant inflation, people still buy it cause they need it to live

✧ This is what motivates people to buy that particular token

✧ For example, the $, despite significant inflation, people still buy it cause they need it to live

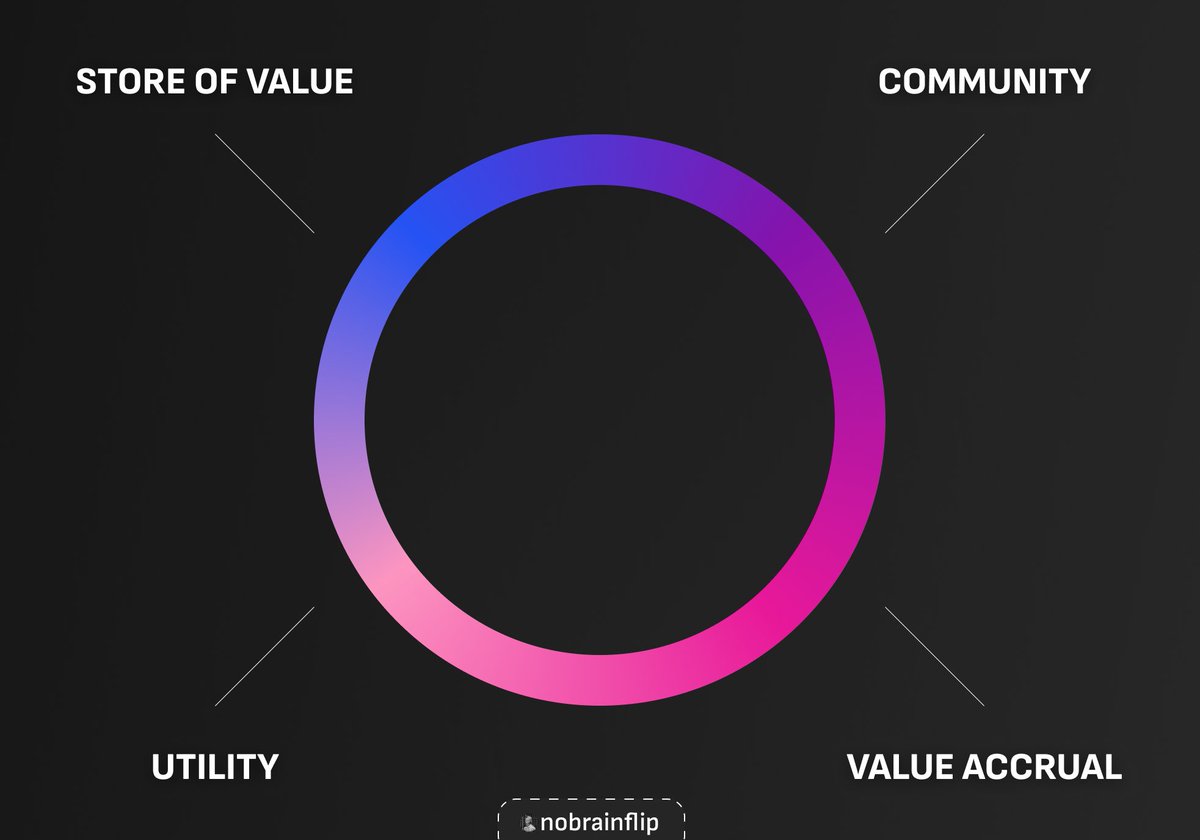

14/➮ In general, 4 things drive demand for tokens:

• Store of value

• Community

• Utility

• Value Accrual

Now about each one separately 👇

• Store of value

• Community

• Utility

• Value Accrual

Now about each one separately 👇

15/➮ Store of value

✧ The next demand factor is that crypto can serve as a store of value

✧ Many people buy crypto simply to store their money in it, such as in $BTC, which is often compared to gold

✧ The next demand factor is that crypto can serve as a store of value

✧ Many people buy crypto simply to store their money in it, such as in $BTC, which is often compared to gold

16/➮ Community

✧ As this cycle has already shown us, a community can strongly drive demand

✧ Memecoins pumped solely because of community

✧ People buy what they think will make them money

✧ As this cycle has already shown us, a community can strongly drive demand

✧ Memecoins pumped solely because of community

✧ People buy what they think will make them money

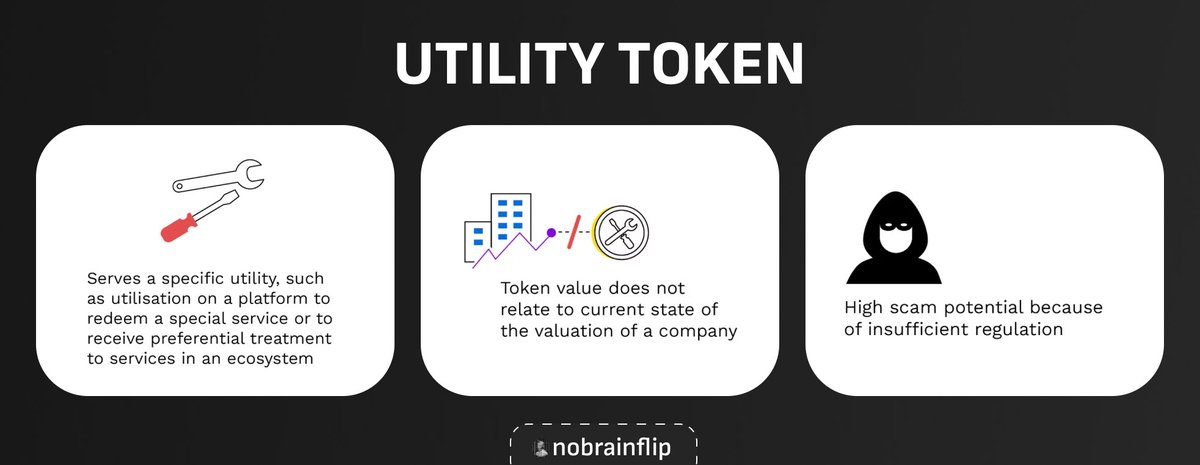

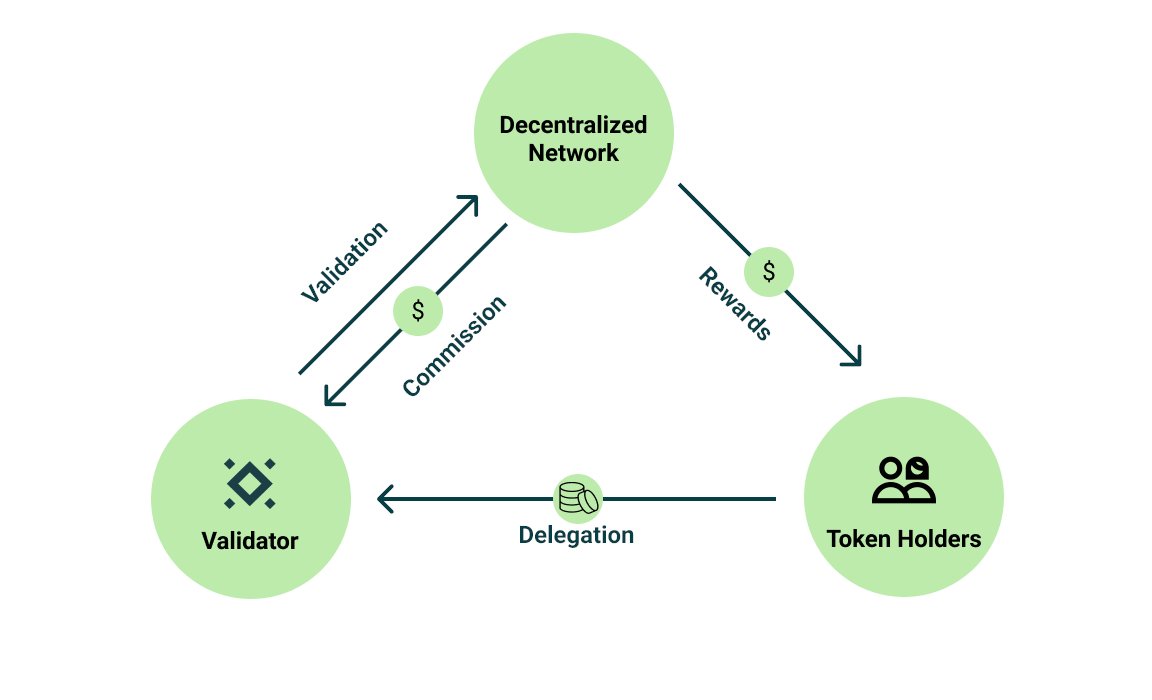

17/➮ Utility

✧ It's when holding the token provides some sort of utility

✧ For example, to stake a token, you need the token of that network, etc

✧ It's when holding the token provides some sort of utility

✧ For example, to stake a token, you need the token of that network, etc

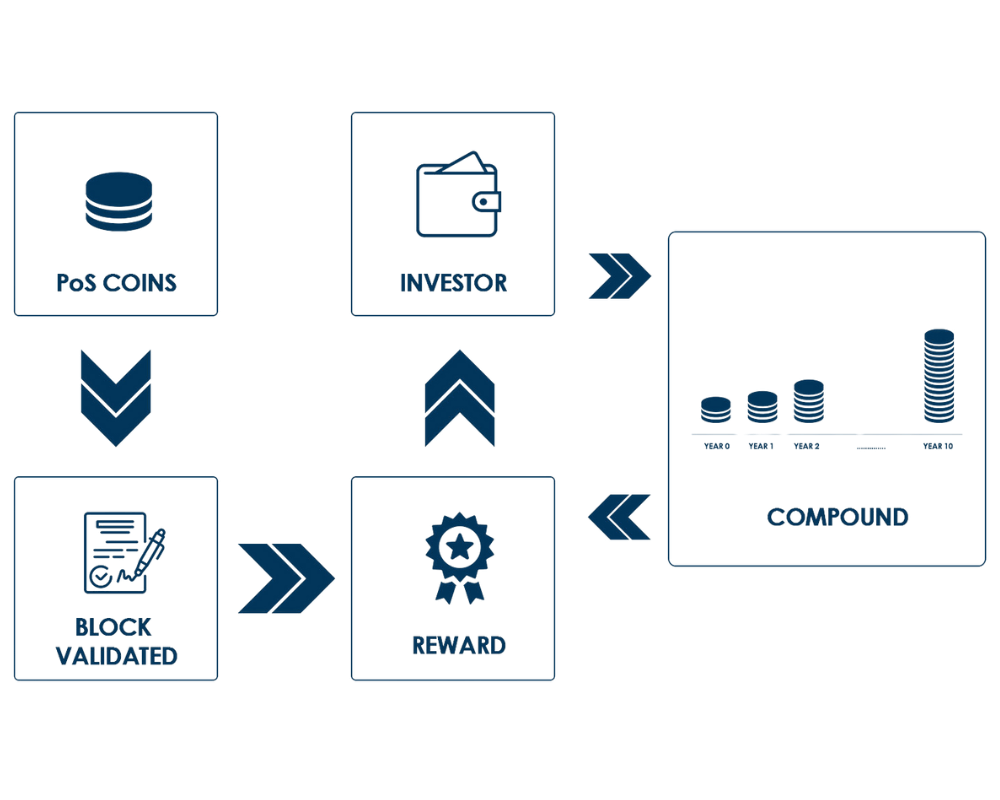

18/➮ Value Accrual - Incentivizing for Stakers

✧ People also want tokens to provide some value

✧ So here is Staking, where you lock your tokens to earn rewards at regular intervals

✧ This is also beneficial for everyone and carries a relatively low risk

✧ People also want tokens to provide some value

✧ So here is Staking, where you lock your tokens to earn rewards at regular intervals

✧ This is also beneficial for everyone and carries a relatively low risk

19/➮ Value Accrual - Incentivizing for Holders

✧ Another option is Holding

✧ So, projects often give rewards/airdrops, etc., to their holders, and this is often beneficial for everyone

✧ But there are even more ways to lower the selling pressure through holding:

✧ Another option is Holding

✧ So, projects often give rewards/airdrops, etc., to their holders, and this is often beneficial for everyone

✧ But there are even more ways to lower the selling pressure through holding:

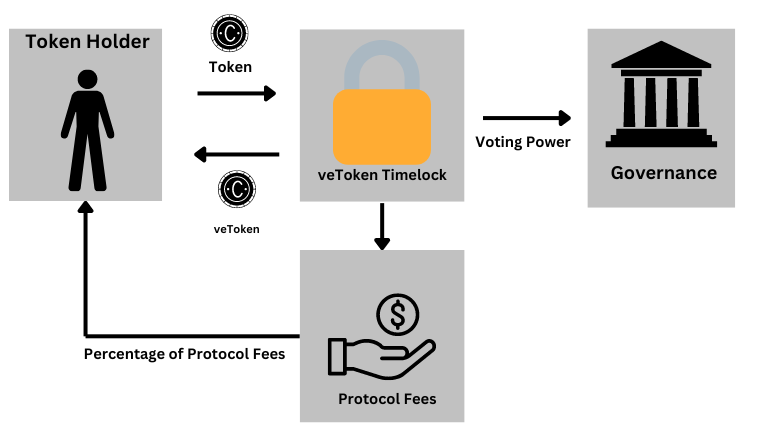

20/➮ Holding 1 VeTokens

✧ You can also receive VeTokens for holding tokens

✧ "Ve" stands for Vote Escrow, meaning by locking your tokens, you gain voting power

✧ The longer you hold, the more voting power you accumulate

✧ You can also receive VeTokens for holding tokens

✧ "Ve" stands for Vote Escrow, meaning by locking your tokens, you gain voting power

✧ The longer you hold, the more voting power you accumulate

21/➮ Holding 2 Farm Boosting

✧ Holding can also boost your farming token percentage

✧ The more you hold, the higher your percentage will grow

✧ Holding can also boost your farming token percentage

✧ The more you hold, the higher your percentage will grow

22/➮ Also, understand that no matter how high the demand may be, it's important to understand Who's Holding.

✧ Strong community or dumpers

✧ This is more challenging to figure out; you need to get involved in the project's community and analyze it

✧ Strong community or dumpers

✧ This is more challenging to figure out; you need to get involved in the project's community and analyze it

23/➮ Also, remember an important thing: despite poor tokenomics, a token can rise, and vice versa

✧ Always consider this possibility

✧ Below, I've made a list of what you need to check before investing:

✧ Always consider this possibility

✧ Below, I've made a list of what you need to check before investing:

24/➮ NO BLIND INVESTMENT:

- Total Supply and Circulating Supply

- Allocation and Distribution

- Vesting period/Unlocking dates

- % Emission

- Demand

✧ After such analysis, you'll be able to determine whether it's worth investing in the project or not

- Total Supply and Circulating Supply

- Allocation and Distribution

- Vesting period/Unlocking dates

- % Emission

- Demand

✧ After such analysis, you'll be able to determine whether it's worth investing in the project or not

➮ I've created a Free Discord Server where u can find everything u've been missing in crypto:

✧ Community & mentorship

✧ Free airdrop software

✧ Shitcoin & NFT calls

✧ Daily news and airdrop to-do list

✧ Giveaways & WL raffles

Join for free:

✧ Community & mentorship

✧ Free airdrop software

✧ Shitcoin & NFT calls

✧ Daily news and airdrop to-do list

✧ Giveaways & WL raffles

Join for free:

https://twitter.com/nobrainflip/status/1734902982880252261

➮ My TG channel has become too large to drop low caps and other moves with a small number of users, so I'll make it private very soon. Now is likely ur last chance to join:

t.me/+uh1Ubbla3Us2M…

t.me/+uh1Ubbla3Us2M…

➮ Liked this thread? I write educational threads daily, so don't forget to:

✧ Follow me @nobrainflip

✧ Like, RT, bookmark and leave a comment on the first tweet 👇

✧ Follow me @nobrainflip

✧ Like, RT, bookmark and leave a comment on the first tweet 👇

https://x.com/nobrainflip/status/1807356136980419051

• • •

Missing some Tweet in this thread? You can try to

force a refresh