Liquid Staking is Booming on Solana ☀️

- Liquid Staking Ratio increased by 1.76% QoQ

- The Number of LSTs has doubled

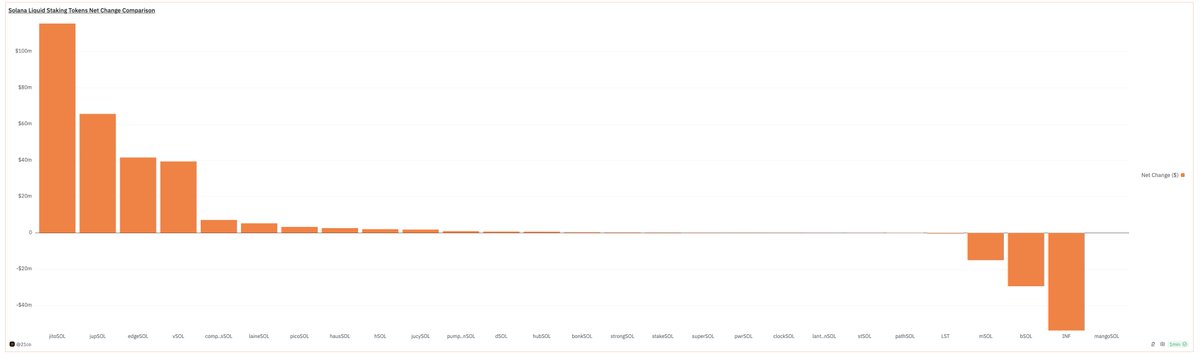

- Market Landscape is more diversified: The dominance of the top 3 providers dropped from 93% -> 68.7%

Deeper Insights below 👇 (/4)

- Liquid Staking Ratio increased by 1.76% QoQ

- The Number of LSTs has doubled

- Market Landscape is more diversified: The dominance of the top 3 providers dropped from 93% -> 68.7%

Deeper Insights below 👇 (/4)

1/ The Key Catalyst: @sanctumso

The airdrop from @jito_labs has brought the spotlight to liquid staking on Solana. The liquid staking ratio has increased by 2% from Q4 2023 - Q1 2024

Sanctum is able to take the torch. The launch of INF, Sanctum Router, and Sanctum Reserve, has lowered the barrier to entry, building the foundation of a Cambrian explosion of the Liquid Staking sector on Solana

The airdrop from @jito_labs has brought the spotlight to liquid staking on Solana. The liquid staking ratio has increased by 2% from Q4 2023 - Q1 2024

Sanctum is able to take the torch. The launch of INF, Sanctum Router, and Sanctum Reserve, has lowered the barrier to entry, building the foundation of a Cambrian explosion of the Liquid Staking sector on Solana

2/ The Number of LSTs on Solana has reached 53, almost doubled compared to last quarter

While this is still far from @soleconomist's vision of having thousands of LSTs, we are seeing the early innings of the new era on Solana.

With Sanctum Router and Reserve, users can try out a new LST easily with sufficient liquidity. As a result, newer LSTs like vSOL, edgeSOL, and jupSOL can also grow as rapidly as the existing LSTs

While this is still far from @soleconomist's vision of having thousands of LSTs, we are seeing the early innings of the new era on Solana.

With Sanctum Router and Reserve, users can try out a new LST easily with sufficient liquidity. As a result, newer LSTs like vSOL, edgeSOL, and jupSOL can also grow as rapidly as the existing LSTs

3/ A more Diversified Market Landscape

Lido has been dominating the Liquid Staking Sector on Ethereum with 70% market share. Before Sanctum, the market landscape on Solana is moving to a similar dynamics, with top LSTs (jitoSOL, mSOL, bSOL) accounting for 93% of the market share

With the help of Sanctum, high-quality projects can build their own LSTs to challenge the status quo and scale efficiently, such as @heliuslabs, @SolanaCompass , @JupiterExchange, @DriftProtocol. Currently, the top 3 LSTs only hold 68% of the market share (Top 5 holds 84%), which has shown a more healthy and diversified market

Lido has been dominating the Liquid Staking Sector on Ethereum with 70% market share. Before Sanctum, the market landscape on Solana is moving to a similar dynamics, with top LSTs (jitoSOL, mSOL, bSOL) accounting for 93% of the market share

With the help of Sanctum, high-quality projects can build their own LSTs to challenge the status quo and scale efficiently, such as @heliuslabs, @SolanaCompass , @JupiterExchange, @DriftProtocol. Currently, the top 3 LSTs only hold 68% of the market share (Top 5 holds 84%), which has shown a more healthy and diversified market

4/ @JupiterExchange's jupSOL enters the Top 3 LSTs

jupSOL has surpassed bSOL in market cap, with $329M TVL. It has grown 22% in the past 30 Days thanks to the integration with @KaminoFinance .

jupSOL is already the most deposited LST on Kamino, with $220M (59%). They are also the most popular option on the Multiply product as they have the highest APY (21%)

jupSOL has surpassed bSOL in market cap, with $329M TVL. It has grown 22% in the past 30 Days thanks to the integration with @KaminoFinance .

jupSOL is already the most deposited LST on Kamino, with $220M (59%). They are also the most popular option on the Multiply product as they have the highest APY (21%)

For more details about the data, feel free to check out our @DuneAnalytics dashboard

dune.com/21co/solana-li…

dune.com/21co/solana-li…

Let me know if you have any questions or feedback!

https://x.com/tomwanhh/status/1807776167807607020

Tagging chads who would be interested:

@aeyakovenko

@rajgokal

@cburniske

@sssionggg

@crypthoem

@0xmiir

@SolanaLegend

@KyleSamani

@0xMert_

@kashdhanda

@bennybitcoins

@SolanaFloor

@rektdiomedes

@cryptoian

@anduri

@Austin_Federa

@aeyakovenko

@rajgokal

@cburniske

@sssionggg

@crypthoem

@0xmiir

@SolanaLegend

@KyleSamani

@0xMert_

@kashdhanda

@bennybitcoins

@SolanaFloor

@rektdiomedes

@cryptoian

@anduri

@Austin_Federa

• • •

Missing some Tweet in this thread? You can try to

force a refresh