MEV resistant dynamic pricing auction of execution proposal rights

This post presents an alternative auction mechanism for selling execution proposal rights in advance, relevant to current research on ET/EA. It induces little new MEV, producing a high aggregate MEV burn.

Link👇

This post presents an alternative auction mechanism for selling execution proposal rights in advance, relevant to current research on ET/EA. It induces little new MEV, producing a high aggregate MEV burn.

Link👇

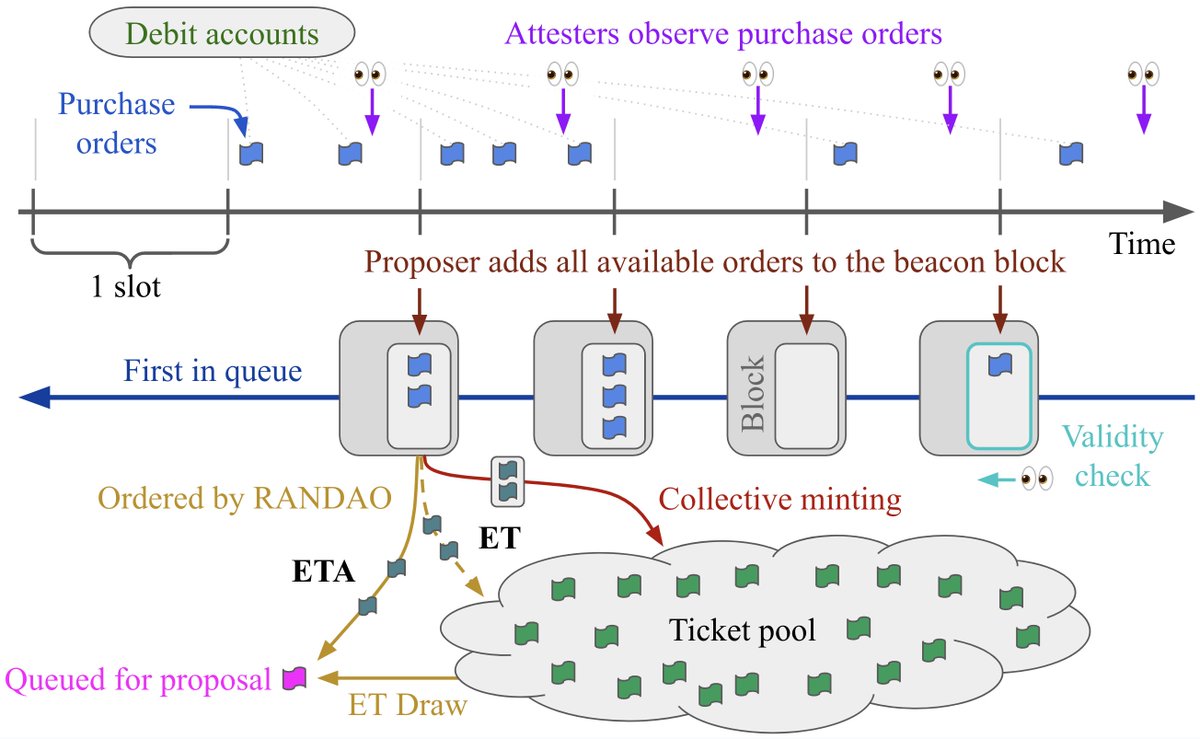

Builders place binding purchase order for a ticket or an execution proposal slot. The final price adapts dynamically based on the total outstanding as well as currently incoming orders/tickets, with some similarities to EIP-1559. The payment is burned. ethresear.ch/t/mev-resistan…

Attesters observe to ensure that the beacon proposer adds all orders to the block, and otherwise rejects it. Orders are priced and collectively added to the ticket pool, or in the "execution ticket auction" (ETA) design directly queued for proposal, using RANDAO for sequencing.

The ticket price adapts to the quantity of orders, like EIP-1559, but with these differences: (1) the price is affected by orders in the current slot; (2) the block is never "full", lest the price rises sharply; (3) the mechanism accounts for both outstanding and current orders.

An exemplified price change w is shown when windowing orders across 32 slots and seeking 4096 tickets in a pool. Neutral ticket delta (horizontal line) is one incoming order per slot (32 in total) and neutral saturation (vertical line) is 4096. Yellow stipulates no price change.

Orders can also be priced only based on quantity of a single slot. Neutral ticket delta is then one order. The price could in this case increase rather sharply if there are many incoming incoming orders for the specific slot. The exact setting would require careful consideration.

I hope the proposed auction mechanism can inspire further discussion as work on ePBS proceeds. Special thanks to @barnabemonnot for helping me improve the clarity of this post. Thanks also for valuable feedback to @soispoke, @_julianma and @fradamt.

• • •

Missing some Tweet in this thread? You can try to

force a refresh