There is no broader evidence that the low reads of measured inflation in May marked a significant turning point.

Looking across a range of other measures, inflation looks pretty stable for the last year and elevated compared to pre-covid levels and the Fed's mandate.

Thread.

Looking across a range of other measures, inflation looks pretty stable for the last year and elevated compared to pre-covid levels and the Fed's mandate.

Thread.

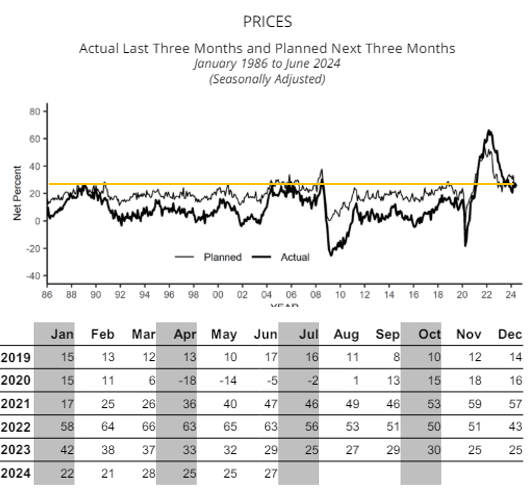

Small biz are a big part of the economy and the NFIB *actual* price changes in recent months is a good indication small biz pricing. Net price increases have come down, but still are clearly higher than pre-covid and nearly all of the pre-covid period.

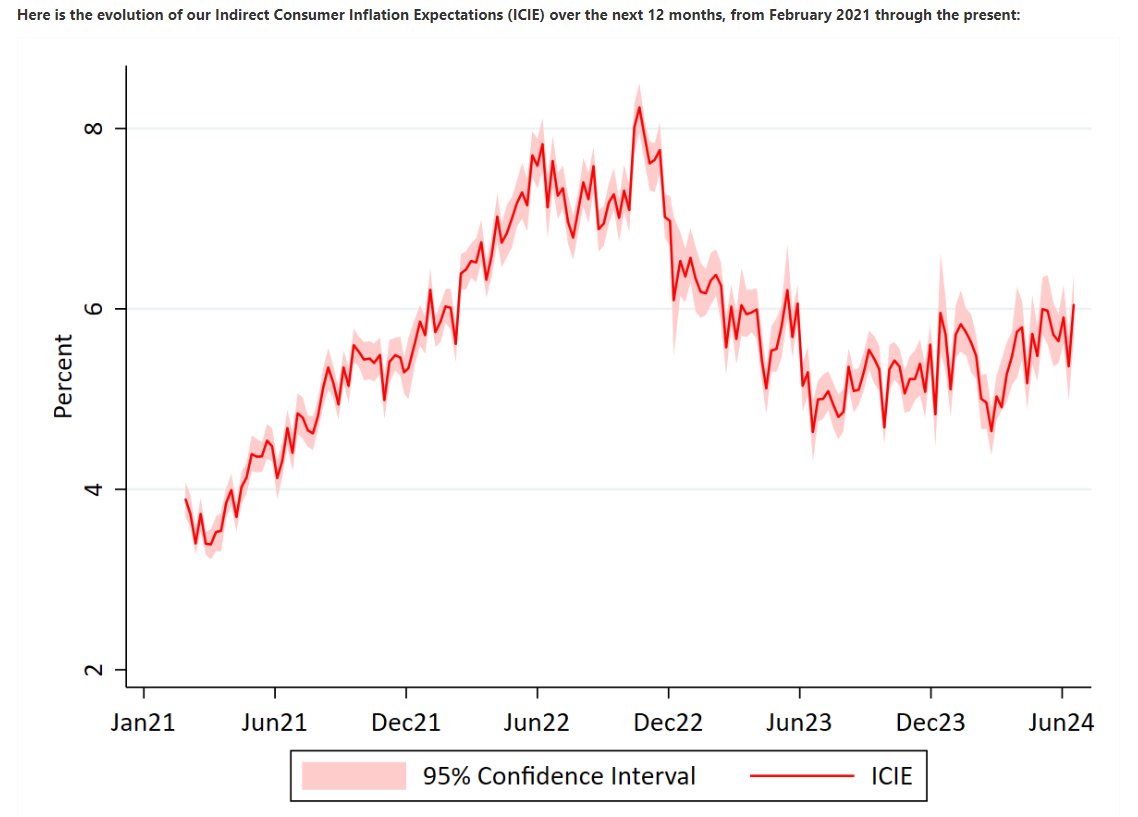

If there was a significant inflection in inflation downward, you'd expect to see it in timely consumer expectations. CEBRA inferred inflation expectations look pretty stable and well above the levels seen before the inflation shock in '22.

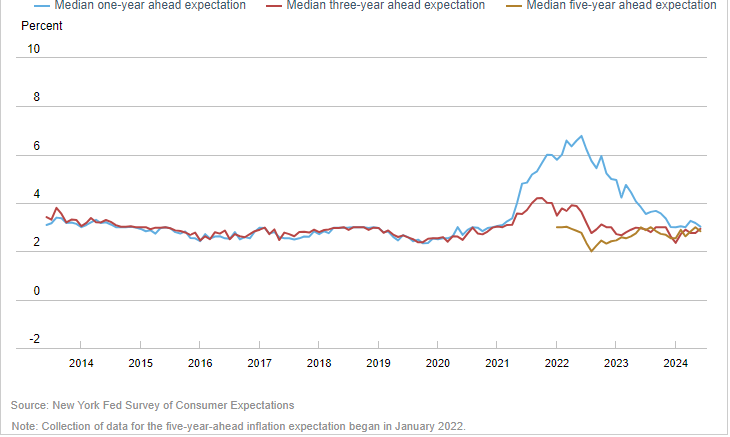

Fed consumer inflation expectations have also remained stable in recent months, a touch above pre-covid levels and around 3%.

Michigan 1yr inflation expectations have also been pretty stable around 3% this year. No signs of a material transition lower.

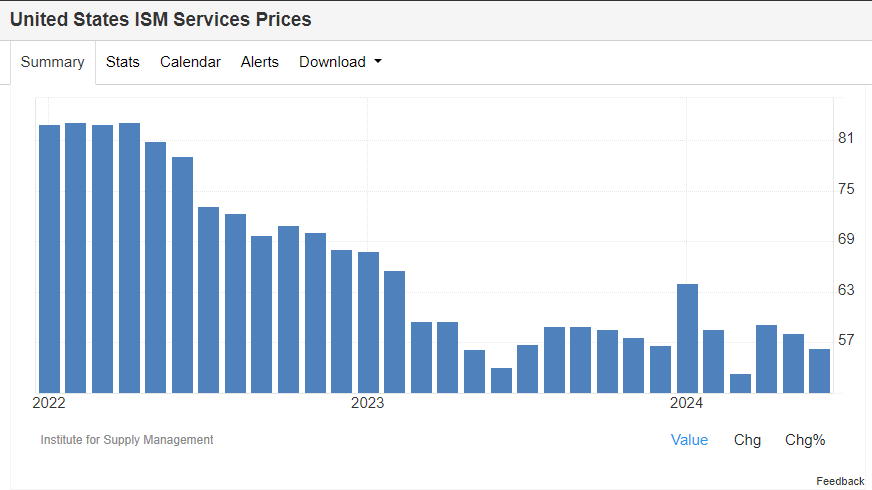

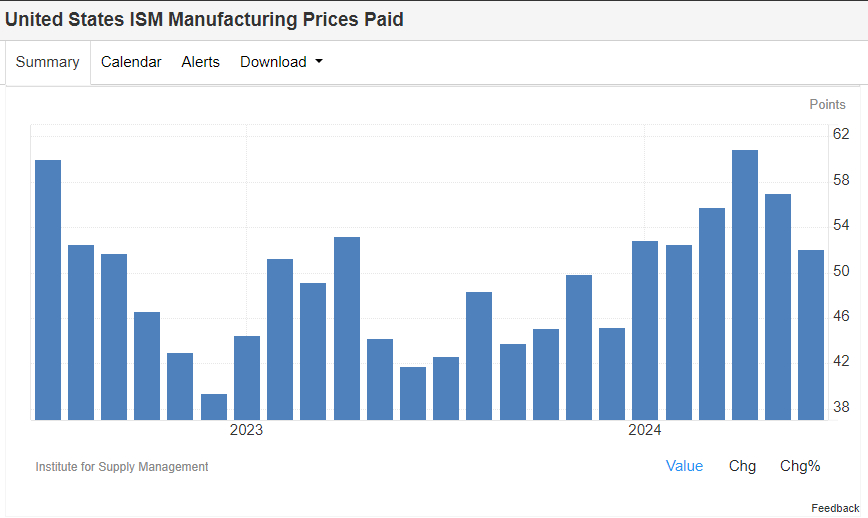

ISM has issues, but is another triangulation on the read on how prices are evolving that generally captured the up and down of the recent inflation spike. Pretty stable over the last year or so.

Manufactured goods has been a big source of disinflation lately, though not seeing a meaningful shift to a lower level in the ISM prices paid. Choppy and recent numbers have ticked down, but still higher than all of '23.

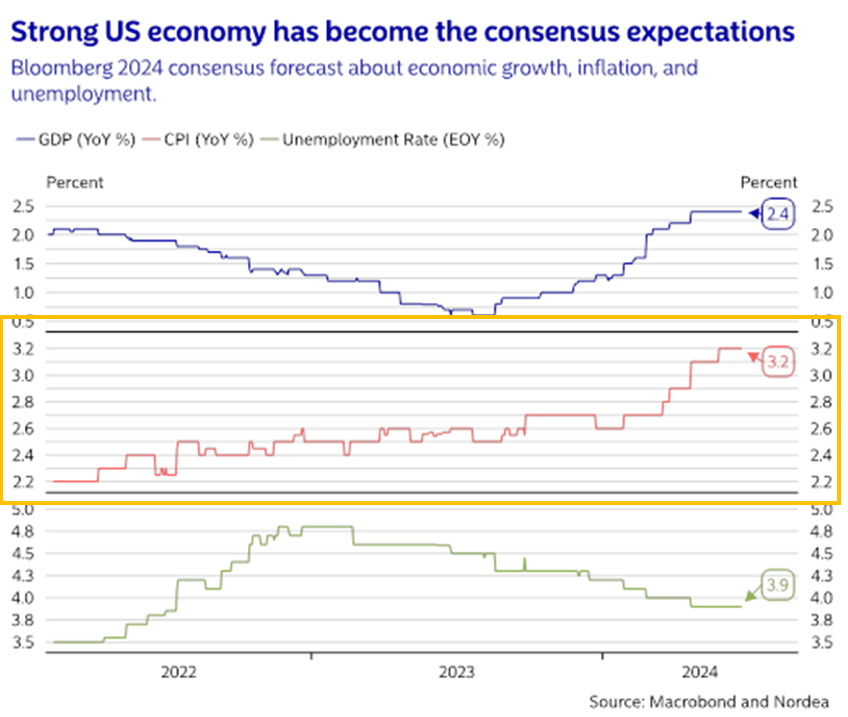

Notable that despite the relatively soft print, we haven't seen much in the way of shifts in analysts expectations for '24 inflation (CPI), which continue to hold steady at highs and above 3%.

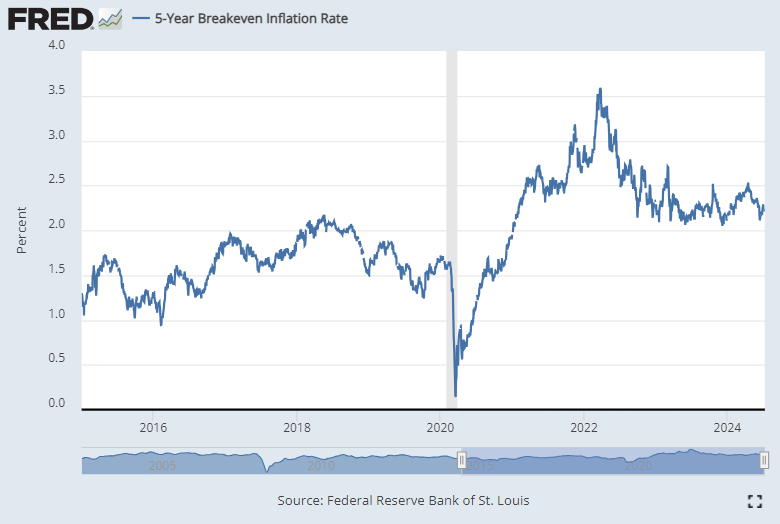

Market based measures of inflation have also remained relatively stable. 5yr break-evens have continued to trade in a narrow range and above pre-covid levels.

Also worth noting that some of the disinflationary pressure seen in oil prices in May has largely reverted and is running now in line with the average of the last year or so. So that input possibly dragging down traded inflation measures no longer in place.

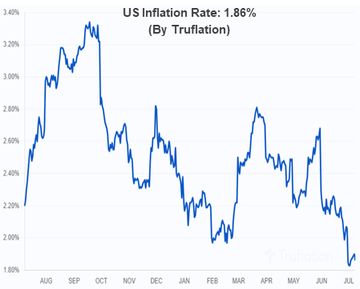

@truflation is main outlier among the broader set of data. Its vacillated wildly from well above 3% to a recent low of 1.8% - though May was kinda flat. Seems unreliable.

Lots of people will post this saying inflation is dead, but I'd suggest taking a broader perspective above.

Lots of people will post this saying inflation is dead, but I'd suggest taking a broader perspective above.

While measured inflation is important for policymakers, it has all sorts of randomness to any one month's measure so its important to look holistically at all of the available data to triangulate whether the low reading in May is likely part of a broader shift lower.

So far there are few indications of such a shift scanning across a wide range of measures. Underlying inflation looks to be pretty stable and above levels seen in the pre-covid period. And largely has been flat for roughly a year now.

Anyone thinking they have an edge in predicting the 1 month core CPI data is fooling themselves - there is just too much noise in the measurement. And as a result no one (including the Fed!) should read too much into that datapoint either.

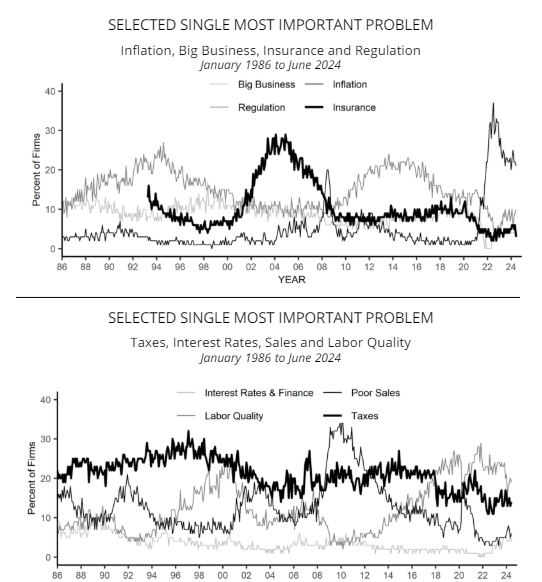

As NFIB shows, the biggest problems today remain inflation and labor quality.

Regardless of measured inflation or UE, main street doesn't think inflation is beat or that labor markets have loosened materially lately. That should give the Fed real concerns about easing now.

Regardless of measured inflation or UE, main street doesn't think inflation is beat or that labor markets have loosened materially lately. That should give the Fed real concerns about easing now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh