This is not a joke.

Pendle will be the largest project in this space.

Pendle's TVL will flip Eigenlayer & Lido.

And nobody is ready for this.

▪️▪️▪️

This thread will explore the future of Pendle including:

- Pendle V3

- BTC Restaking;

- and Permissionless Listing

🧵/1

Pendle will be the largest project in this space.

Pendle's TVL will flip Eigenlayer & Lido.

And nobody is ready for this.

▪️▪️▪️

This thread will explore the future of Pendle including:

- Pendle V3

- BTC Restaking;

- and Permissionless Listing

🧵/1

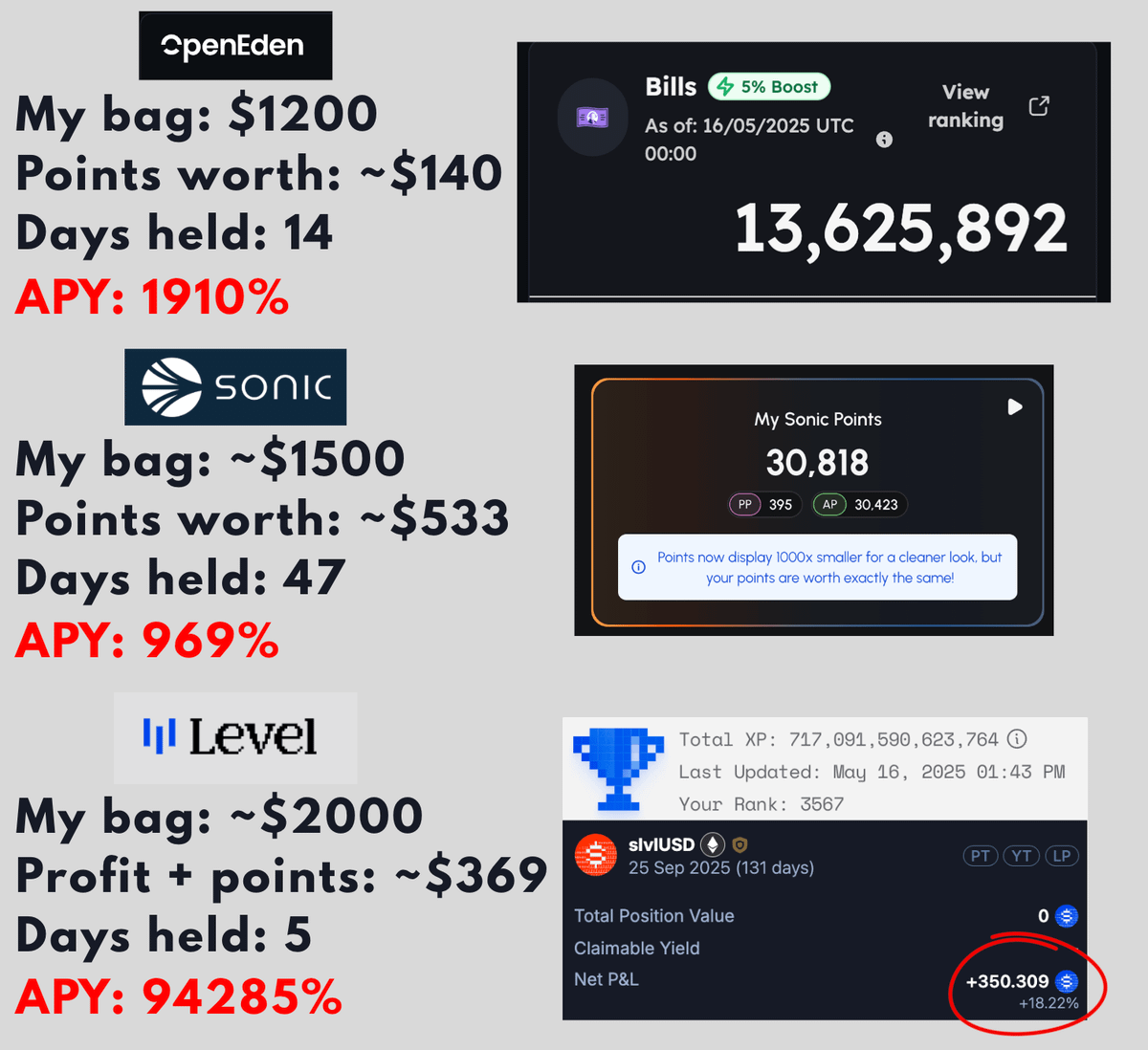

@pendle_fi History does not repeat itself, but it rhymes.

@pendle_fi V1 achieved US$40M TVL back in 2021.

- Then it's TVL dropped by 90%.

Pendle V2 achieved US$6.7B TVL in 2024.

- Then it's TVL dropped by 50%.

Naturally, Pendle V3 TVL will at least do another tenfold.

But why?

/2

@pendle_fi V1 achieved US$40M TVL back in 2021.

- Then it's TVL dropped by 90%.

Pendle V2 achieved US$6.7B TVL in 2024.

- Then it's TVL dropped by 50%.

Naturally, Pendle V3 TVL will at least do another tenfold.

But why?

/2

@ViNc2453 WHAT IS PENDLE "V3"?

It was mentioned by the team, but never did they specifically told us what it is.

Except @crypto_linn.

Remember what she said? ⬇️

"OH SHIT OH SHIT OH SHIT"

That's right.

I'm about to tell you my speculation that will make you go "OH SHIT" as well.

/3

It was mentioned by the team, but never did they specifically told us what it is.

Except @crypto_linn.

Remember what she said? ⬇️

"OH SHIT OH SHIT OH SHIT"

That's right.

I'm about to tell you my speculation that will make you go "OH SHIT" as well.

/3

https://twitter.com/1139174563802226688/status/1811039526271471676

PENDLE'S BLUE OCEAN STRATEGY:

The devs have always been seeking for innovation.

V1: Provide the "missing piece" in DeFi = Fixed yield product

V2: Renovating AMM to accomodate deeper liquidity + Complete adaptation for LSD&LRT narrative.

So what about V3?

/4

The devs have always been seeking for innovation.

V1: Provide the "missing piece" in DeFi = Fixed yield product

V2: Renovating AMM to accomodate deeper liquidity + Complete adaptation for LSD&LRT narrative.

So what about V3?

/4

@tn_pendle @PendleIntern It was previously hinted that Pendle is aiming to become the next Binance.

Does that mean Pendle will:

- Create its own chain?

- Provide deeper liquidity for its products?

- Further minimize transaction fee?

- Offer transaction discounts to users who pay in $PENDLE?

/5

Does that mean Pendle will:

- Create its own chain?

- Provide deeper liquidity for its products?

- Further minimize transaction fee?

- Offer transaction discounts to users who pay in $PENDLE?

/5

Ok. Hear me out.

What if I told you that

Pendle

might become

the Centralized

Exchange

of

Interest Rate Derivatives.

▪️▪️▪️

That's right.

A CEX for Interest Rate Swaps ('IRS')

▪️▪️▪️

If this is true, then no wonder @crypto_linn went absolute bonkers.

/6

What if I told you that

Pendle

might become

the Centralized

Exchange

of

Interest Rate Derivatives.

▪️▪️▪️

That's right.

A CEX for Interest Rate Swaps ('IRS')

▪️▪️▪️

If this is true, then no wonder @crypto_linn went absolute bonkers.

/6

"OK, SO WHAT ABOUT IT?"

Some of you might not understand the implications of this.

If this is true, then Pendle V3 will become the first IRS CEX across DeFi AND TradFi.

Yes, you read that right.

Not even traditional finance has centralized exchange for IRS.

Why is that?

/7

Some of you might not understand the implications of this.

If this is true, then Pendle V3 will become the first IRS CEX across DeFi AND TradFi.

Yes, you read that right.

Not even traditional finance has centralized exchange for IRS.

Why is that?

/7

IRS CEX isn't feasible in TradFi because:

- Risk of parties defaulting is too high;

- Depending on the structure, significant costs may arise with entering and managing the swap agreement, and;

- IRS may have limited liquidity = parties may not enter/exit at favourable rate.

/8

- Risk of parties defaulting is too high;

- Depending on the structure, significant costs may arise with entering and managing the swap agreement, and;

- IRS may have limited liquidity = parties may not enter/exit at favourable rate.

/8

IRS is feasible on Pendle/blockchain because:

- Pendle's pseudo-AMM (w/ flash swaps) enables users to enjoy much lower slippage fees with deeper liquidity;

- No "default" per se;

- Streamlined structure that reduces costs with entering/managing swap agreement

/9

- Pendle's pseudo-AMM (w/ flash swaps) enables users to enjoy much lower slippage fees with deeper liquidity;

- No "default" per se;

- Streamlined structure that reduces costs with entering/managing swap agreement

/9

Here's the exciting part.

▶️The market for IRS in TradFi is approx. $500 TRILLION USD.

▶️Pendle has proven to be capable of handling large liquidity on 6/27 (i.e. battle-tested $2.7 bil in redemption).

▶️IF INSTITUTIONS ARE WILLING TO PERFORM IRS ON BLOCKCHAIN:

Cont.

/10

▶️The market for IRS in TradFi is approx. $500 TRILLION USD.

▶️Pendle has proven to be capable of handling large liquidity on 6/27 (i.e. battle-tested $2.7 bil in redemption).

▶️IF INSTITUTIONS ARE WILLING TO PERFORM IRS ON BLOCKCHAIN:

Cont.

/10

▶️TradFi IRS market (~$500T) siphoned to DeFi market.

▶️Huge transaction fee accrued by Pendle.

▶️Supernova TVL.

▶️$PENDLE Price = ?

You see where I'm going at?

For those who's still fudding the TVL or scared to buying the dip

They are NGMI.

/11

▶️Huge transaction fee accrued by Pendle.

▶️Supernova TVL.

▶️$PENDLE Price = ?

You see where I'm going at?

For those who's still fudding the TVL or scared to buying the dip

They are NGMI.

/11

Since Pendle V3 will probably launch at a later date, lets focus on something "soon"er.

BTC RESTAKING:

Built upon @babylon_chain, multiple protocols have launched LIQUID RESTAKING for BTC.

This allows users to stake wBTC for (____)BTC on Ethereum.

/12

BTC RESTAKING:

Built upon @babylon_chain, multiple protocols have launched LIQUID RESTAKING for BTC.

This allows users to stake wBTC for (____)BTC on Ethereum.

/12

This means BTC holders can now participate in PoS consensus mech without sacrificing:

- Liquidity, nor;

- Security of their holdings.

TLDR: LRT holders now receive staking reward & protocol's yield.

/13

- Liquidity, nor;

- Security of their holdings.

TLDR: LRT holders now receive staking reward & protocol's yield.

/13

MOST IMPORTANTLY

PENDLE WILL BE INTERESTED

TO SPLIT THIS YIELD BEARING ASSET

MEANING ALL YOU DEGENS CAN USE YT TO LEVERAGE

AND MULTIPLY DEM BLING 💎 INTO BLING BLINGS 💎💎💎

/14

PENDLE WILL BE INTERESTED

TO SPLIT THIS YIELD BEARING ASSET

MEANING ALL YOU DEGENS CAN USE YT TO LEVERAGE

AND MULTIPLY DEM BLING 💎 INTO BLING BLINGS 💎💎💎

/14

Babylon X BTC-LRT is on track to become the next narrative.

ALPHA INFO: As @ViNc2453 had mentioned in his AMA on June 11, this narrative might evolve into:

Babylon

X BTC LRT

X BTC L2

👁️👄👁️

I urge everyone to WATCH. THIS. SPACE.

/15

ALPHA INFO: As @ViNc2453 had mentioned in his AMA on June 11, this narrative might evolve into:

Babylon

X BTC LRT

X BTC L2

👁️👄👁️

I urge everyone to WATCH. THIS. SPACE.

/15

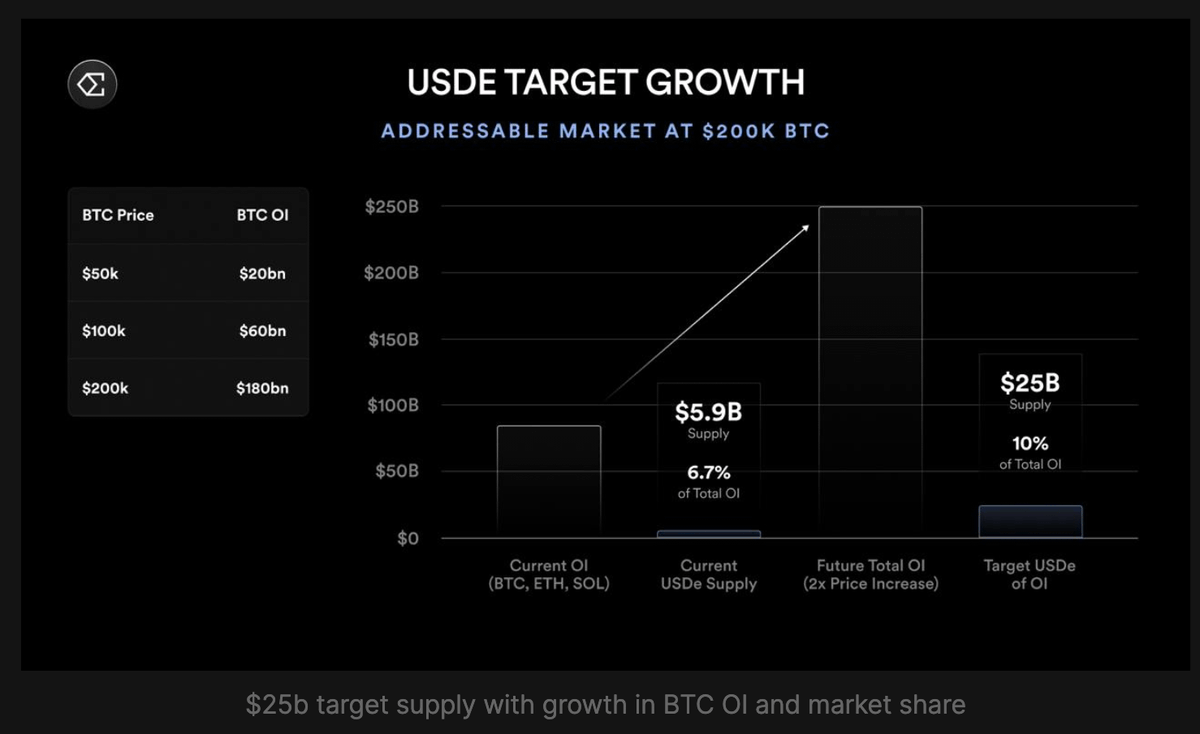

Why is this important?

WBTC TVL is US$8.87 Billion.

WBTC has minimal yield opportunities as for its status quo.

It would be an absolute pleasure if Pendle is able to tap into the BTC ecosystem.

WBTC ➡️ BABYLON ➡️ LRT + L2 ➡️ PENDLE = YUM YUM 😋

/16

WBTC TVL is US$8.87 Billion.

WBTC has minimal yield opportunities as for its status quo.

It would be an absolute pleasure if Pendle is able to tap into the BTC ecosystem.

WBTC ➡️ BABYLON ➡️ LRT + L2 ➡️ PENDLE = YUM YUM 😋

/16

PERMISSIONLESS LISTING:

Pendle at it's core is a permissionless yield-trading protocol.

Its contract is permissionless = ANYONE can deploy a new market with ANY duration.

However, the current UI is PERMISSIONED = the team will still need to whitelist it before listing.

/17

Pendle at it's core is a permissionless yield-trading protocol.

Its contract is permissionless = ANYONE can deploy a new market with ANY duration.

However, the current UI is PERMISSIONED = the team will still need to whitelist it before listing.

/17

If permissionless listing is enabled, it will be similar to Uniswap.

Automated liquidty protocol (Customizable AMM)? Check ✅

Liquidity provision? Check ✅

Constant product formula? Check ✅

All we need is for the team to say the word...

/18

Automated liquidty protocol (Customizable AMM)? Check ✅

Liquidity provision? Check ✅

Constant product formula? Check ✅

All we need is for the team to say the word...

/18

Implications of Permissionless Listing:

By enabling projects to list their products on Pendle, it opens up their revenue streams.

Whenever users transacts with one of Pendle's liquidity pool, they now pay a transaction fee of X percent.

More fees = vePENDLE/PNP/EQB 🔺🔺🔺

/19

By enabling projects to list their products on Pendle, it opens up their revenue streams.

Whenever users transacts with one of Pendle's liquidity pool, they now pay a transaction fee of X percent.

More fees = vePENDLE/PNP/EQB 🔺🔺🔺

/19

As a wrap up, I heard from a little bird that "Pendle is in discussion with several NEW high profile L1 protocols.

Pendle is truly a ditto at this point.

Able to adapt and evolve into different shapes and forms.

Bullish AF.

/20

Pendle is truly a ditto at this point.

Able to adapt and evolve into different shapes and forms.

Bullish AF.

/20

This thread will not be possible if not for @ViNc2453's guidance and referencing answers on Pendle DC (mostly from Botanic the Chad @BTC_CRO , please drop a follow for him)

Lovely pendlers:

@PendleIntern

@Rightsideonly

@kevin0x0

@quant_sheep

@Neoo_Nav

@2lambro

@packformoon

Lovely pendlers:

@PendleIntern

@Rightsideonly

@kevin0x0

@quant_sheep

@Neoo_Nav

@2lambro

@packformoon

It would mean the world to me if you can drop a like and retweet <3

https://twitter.com/1139577989794893825/status/1811621495439081825

• • •

Missing some Tweet in this thread? You can try to

force a refresh