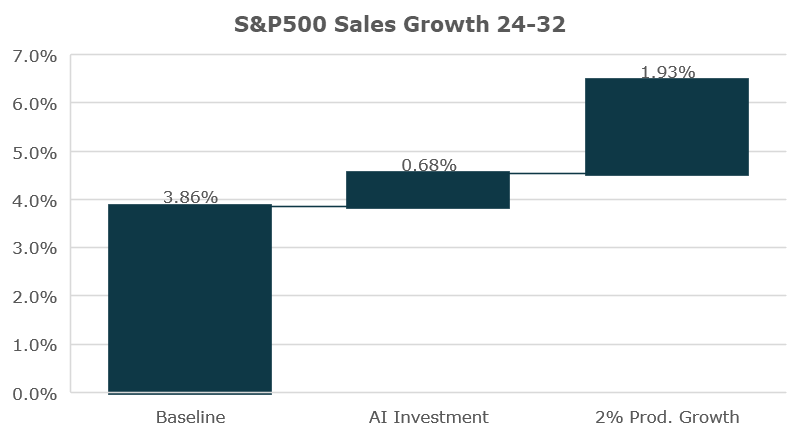

The benefits to S&P500 companies from rising AI-related spending and increased economy-wide productivity are modest even in an extremely optimistic case.

Thread.

Thread.

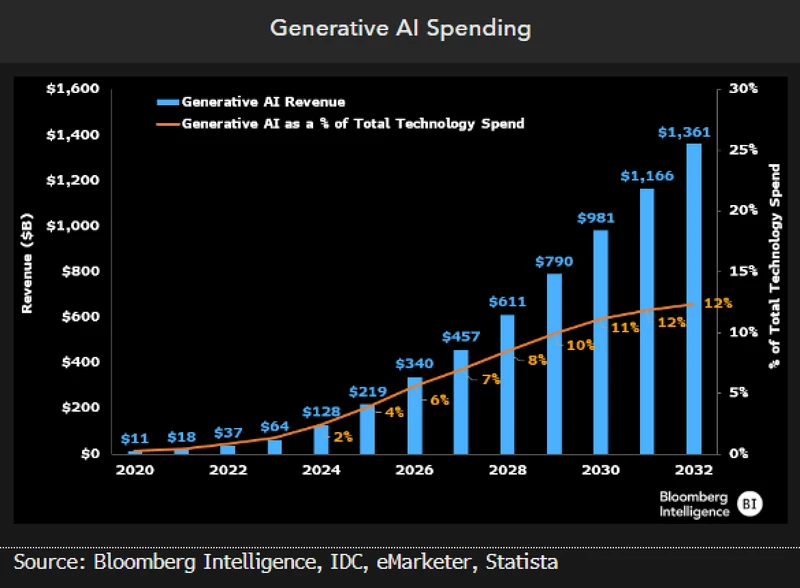

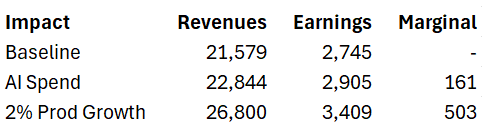

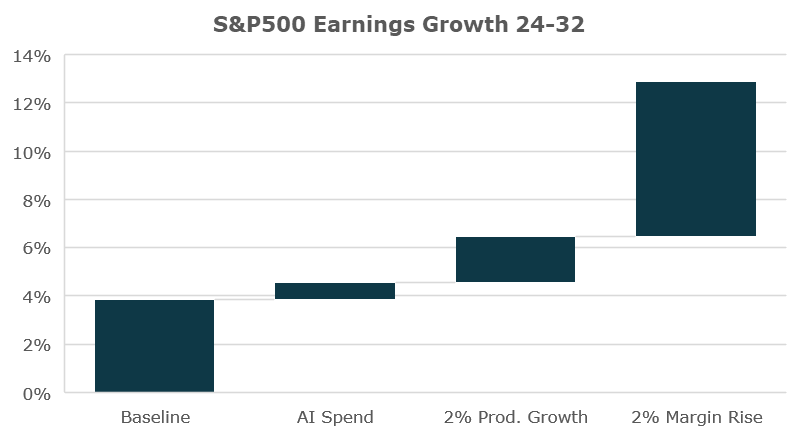

To get some perspective, lets work through the impacts inputting optimistic assumptions. First that AI spending rises to 1.3tln by '32 before it plateaus with other tech spend. And lets assume 100% of that to S&P companies.

bloomberg.com/professional/i…

bloomberg.com/professional/i…

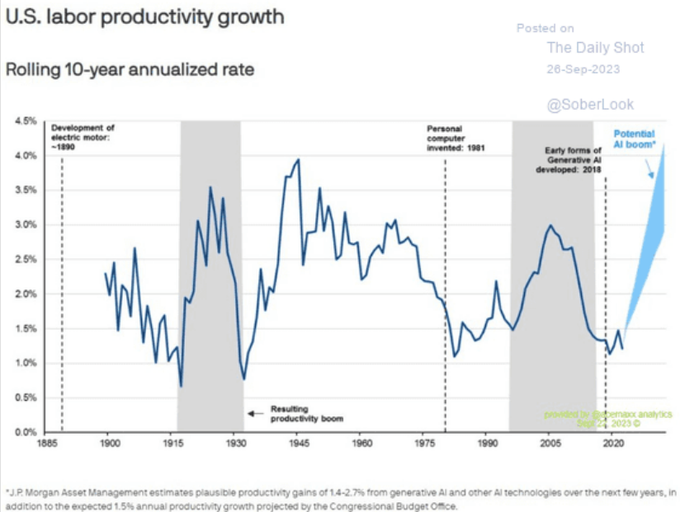

Then let's put in an extremely optimistic assumption that AI specifically would enhance economy wide productivity relative to the baseline, say 2% annually, which would significantly outpace the impact of personal computing.

Taking those pieces together would lead to S&P500 companies revenue growth going from about 4% to about 6.5%. Certainly impactful over a near decade long timeframe, but not game changing.

Putting that together, it suggests a roughly 650bln increase in S&P500 earnings for the 2032 year relative to today, or about 25% higher than they would have been without the above benefits in nominal terms.

What is 650bln of extra earnings worth nearly a decade from now in today's prices?

Even with a 20x on it today, that's 10tln in market cap, or about a 25% increase at today's market cap. And of course, that's not giving any discount to uncertainty of earnings 8yrs from now.

Even with a 20x on it today, that's 10tln in market cap, or about a 25% increase at today's market cap. And of course, that's not giving any discount to uncertainty of earnings 8yrs from now.

Taken together even under a boom in AI-related spend and a surge in productivity, its a pretty marginal impact, not one that is game changing.

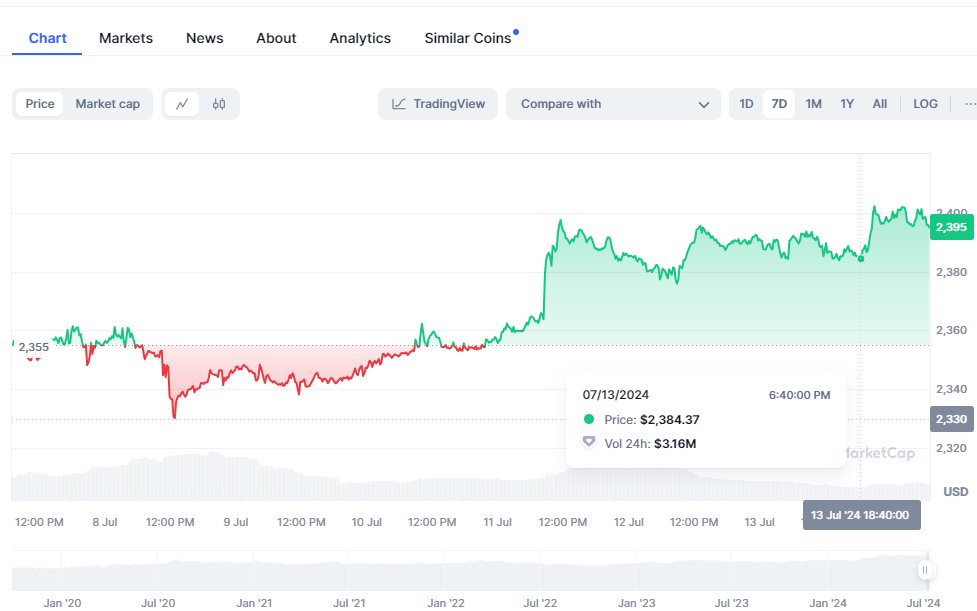

That magnitude of this is already likely priced in. Probably was fully priced last year during the summer of the AI "boom".

That magnitude of this is already likely priced in. Probably was fully priced last year during the summer of the AI "boom".

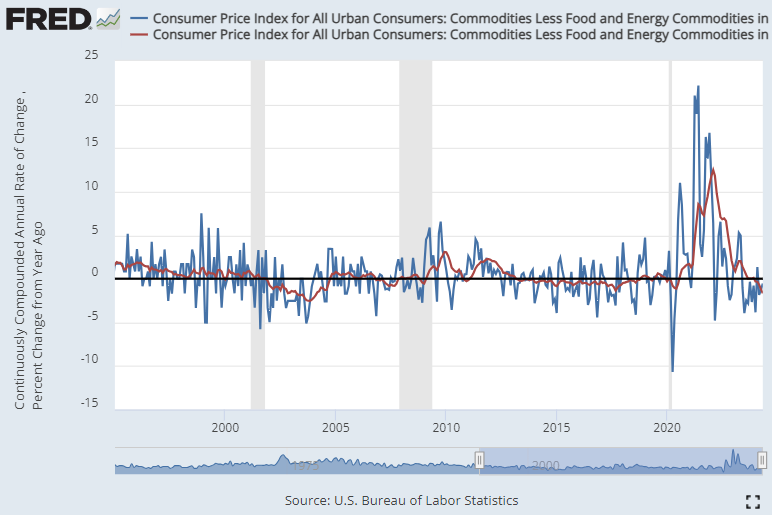

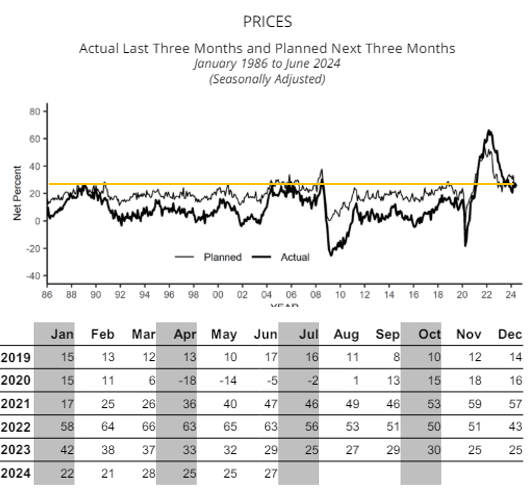

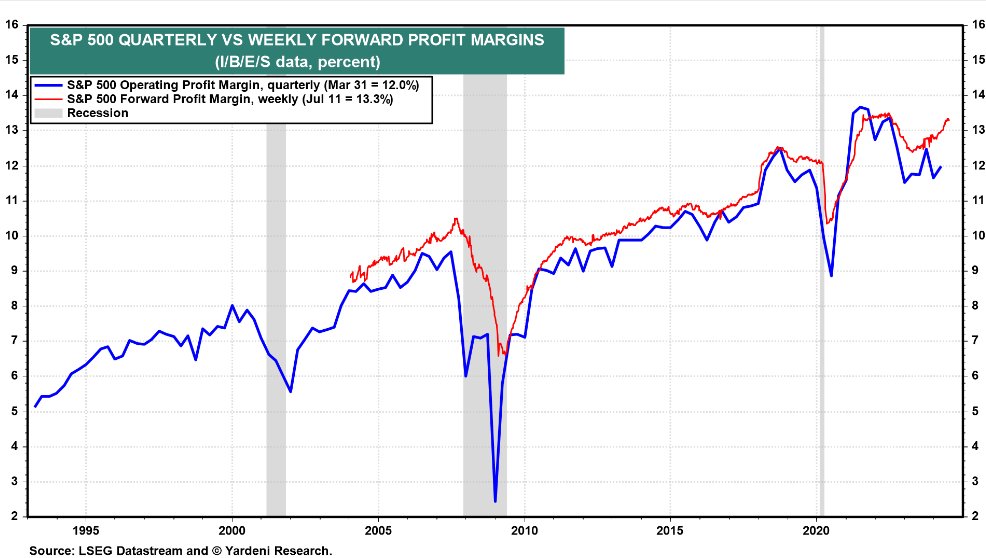

To get something that is at all in the ballpark of what the true techno-optimists claim, its going to have to come through a surge in margins that pairs with the other pieces. And of course margins are already at secular highs and expected to rise further.

The tricky thing with rising margins is that it doesn't come from thin air. Since one sectors income is another's spending to get margin expansion (which is largely just labor paid less relative to revenue) you are gonna need a different sector to dissave on an ongoing basis.

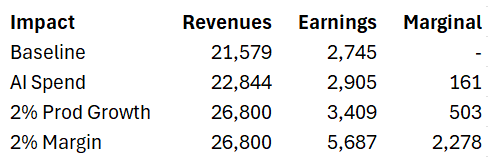

Let's say we add a 1% margin increase into the mix *per year* in addition to the other impacts mentioned above. Then you start to get to something that looks closer akin to the mid-double digit earnings growth ahead proposed by the techno-optimist set.

And that would add an incremental 2.3tln in earnings, bringing the total to roughly 3tln more earnings in 2032 relative to the baseline expectation.

Even under those extraordinary assumptions, at 20x multiples, you are only talking about a doubling of stock market if fully priced in today assuming no discounting of any kind, a big chunk of which has been priced in over the last 12-18m already.

From a macro fundamentals perspective, achieving this level of margin expansion would not only elevated in comparison to history, but would require a different sector of the economy to dissave at an ongoing rate 5% of GDP pace below its current level.

Meaning some combination of households, a share of businesses, or the government deficit would have to combine to offset the extraordinary margins of the corporate sector.

It could happen, but it would require an extraordinary further secular shift to corporations from labor.

It could happen, but it would require an extraordinary further secular shift to corporations from labor.

Believing that a surge in stock prices is justified as a result of AI impact on the economy and businesses requires pretty extraordinary assumptions around investment, productivity growth, and margin expansion, and shift from labor to corporations.

At this point current valuations and expectations are already reflecting a very high probability of this extraordinary combination of future outcomes comes together.

Most likely investors at these prices will be disappointed over the long-term as they don't come to fruition.

Most likely investors at these prices will be disappointed over the long-term as they don't come to fruition.

• • •

Missing some Tweet in this thread? You can try to

force a refresh