I conducted a 10-minute experiment to evaluate the crypto onramp experience for new users. The results suggest that we're not yet prepared for full-scale consumer crypto app onboarding.

I chose Phantom as the default wallet due to its recent ranking as the third most popular utility app in the App Store (May) and its reported 7 million monthly active users. However, other wallets like Solflare show similar growth trends.

As a retail user, I simulated the process of buying SOL using a credit/debit card or bank account. The experiment involved the following steps:

1. Download Phantom wallet

2. Create a new wallet

3. Store seed phrase

4. Set password

5. Enable biometrics

6. Confirm recovery

Wallet setup totaled 6 steps, including the initial download.

Onramp Options: Upon clicking "Buy," three options were presented: Meso, Moonpay, and Coinbase.

Notably, none offered credit card onramps, only debit cards. This limitation likely stems from fraud and chargeback concerns but represents a significant barrier for retail onboarding.

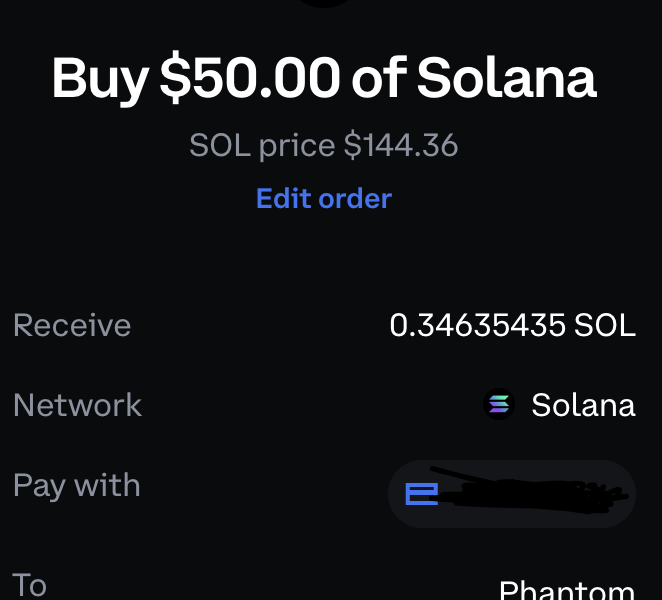

I attempted to purchase $50 worth of SOL through each provider. Here are the outcomes:

1. Coinbase:

- Time: 2:18 minutes

- Steps: 6

- Amount received: $48.48

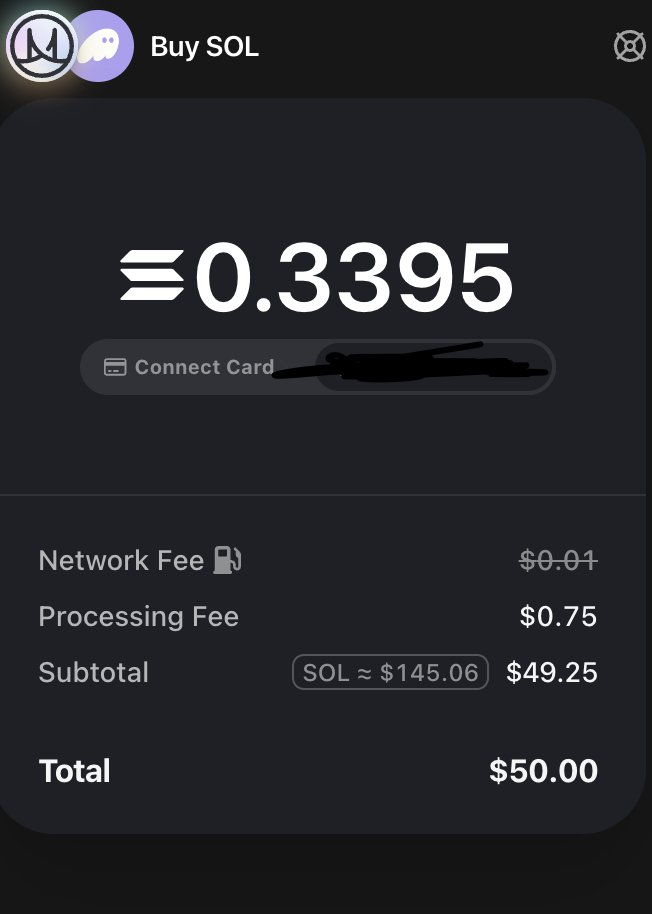

2. Meso:

- Time: 3:05 minutes

- Steps: 7

- Amount received: $47.54

3. Moonpay:

- Time: 5:45 minutes

- Steps: 13

- Outcome: Unable to add card

1. Wallet Creation and Management: This aspect is improving, with solutions like @privy_io and @0xpass_io emerging for consumer apps.

2. Fiat-to-Crypto Onboarding: This remains a significant challenge, with current processes being too complex and time-consuming for adoption. And the only option users have are debit cards because credits card are expensive + filled with chargebacks/fraud. And Sardine is expensive to use at scale.

The best example of streamlined crypto onboarding is Cash App. They own the KYC process so the user will not have to be redirected to another widget which could cause churn. And its simple/easy to follow.

For crypto apps to achieve adoption, they need to unify the onramping experience with the app and make it as simple as possible. Funny enough, Cashapp also has a tutorial on Youtube with 300K views on how to purchase bitcoin using Cashapp. So even the above isnt easy for the average retail user.

While progress has been made in wallet management, fiat-to-crypto onboarding remains a hurdle. To achieve millions of downloads, crypto apps must find ways to abstract and simplify the entire onramping experience. Otherwise, exchanges will continue to dominate the onboarding process.

The current state of onramps suggests that we're still far from solving the challenges of pure fiat-to-crypto onboarding for mainstream users. To win in this space, it should be as simple as Apple/Google Pay.

I chose Phantom as the default wallet due to its recent ranking as the third most popular utility app in the App Store (May) and its reported 7 million monthly active users. However, other wallets like Solflare show similar growth trends.

As a retail user, I simulated the process of buying SOL using a credit/debit card or bank account. The experiment involved the following steps:

1. Download Phantom wallet

2. Create a new wallet

3. Store seed phrase

4. Set password

5. Enable biometrics

6. Confirm recovery

Wallet setup totaled 6 steps, including the initial download.

Onramp Options: Upon clicking "Buy," three options were presented: Meso, Moonpay, and Coinbase.

Notably, none offered credit card onramps, only debit cards. This limitation likely stems from fraud and chargeback concerns but represents a significant barrier for retail onboarding.

I attempted to purchase $50 worth of SOL through each provider. Here are the outcomes:

1. Coinbase:

- Time: 2:18 minutes

- Steps: 6

- Amount received: $48.48

2. Meso:

- Time: 3:05 minutes

- Steps: 7

- Amount received: $47.54

3. Moonpay:

- Time: 5:45 minutes

- Steps: 13

- Outcome: Unable to add card

1. Wallet Creation and Management: This aspect is improving, with solutions like @privy_io and @0xpass_io emerging for consumer apps.

2. Fiat-to-Crypto Onboarding: This remains a significant challenge, with current processes being too complex and time-consuming for adoption. And the only option users have are debit cards because credits card are expensive + filled with chargebacks/fraud. And Sardine is expensive to use at scale.

The best example of streamlined crypto onboarding is Cash App. They own the KYC process so the user will not have to be redirected to another widget which could cause churn. And its simple/easy to follow.

For crypto apps to achieve adoption, they need to unify the onramping experience with the app and make it as simple as possible. Funny enough, Cashapp also has a tutorial on Youtube with 300K views on how to purchase bitcoin using Cashapp. So even the above isnt easy for the average retail user.

While progress has been made in wallet management, fiat-to-crypto onboarding remains a hurdle. To achieve millions of downloads, crypto apps must find ways to abstract and simplify the entire onramping experience. Otherwise, exchanges will continue to dominate the onboarding process.

The current state of onramps suggests that we're still far from solving the challenges of pure fiat-to-crypto onboarding for mainstream users. To win in this space, it should be as simple as Apple/Google Pay.

• • •

Missing some Tweet in this thread? You can try to

force a refresh