1/15 How many web3 users are **real**?

Spoiler: Not nearly as many as we'd like to believe.

**note**: The analysis and graphics presented in this thread are on protocols that are **not** @chaos_labs partners

Spoiler: Not nearly as many as we'd like to believe.

**note**: The analysis and graphics presented in this thread are on protocols that are **not** @chaos_labs partners

2/15 With the rise of onchain agents and Sybils increasing, we're facing a crucial question:

What constitutes a real Web3 user? The answer is more nuanced than ever.

What constitutes a real Web3 user? The answer is more nuanced than ever.

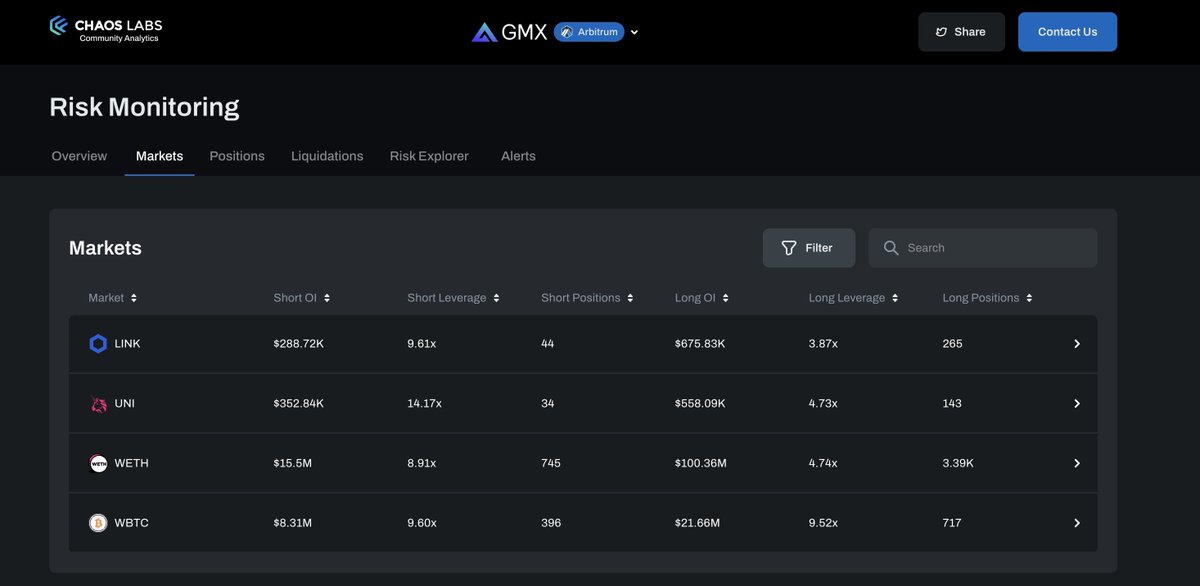

3/15 At @chaos_labs, we initially developed a Sybil Detection Platform to enhance our risk models by identifying wallet and whale concentration across applications. Concentration risk is real and heavily skews VaR (value at risk) and downstream parameter recommendations.

4/15 As we refined our model, we realized its potential extended beyond DeFi and that our clustering and labeling heuristics could be used across various verticals, such as social applications.

5/15 Models support two types of heuristics:

1) general heuristics to classify sybil clusters by identical attributes (e.g., funding sources)

2) application-specific rules customized per application.

1) general heuristics to classify sybil clusters by identical attributes (e.g., funding sources)

2) application-specific rules customized per application.

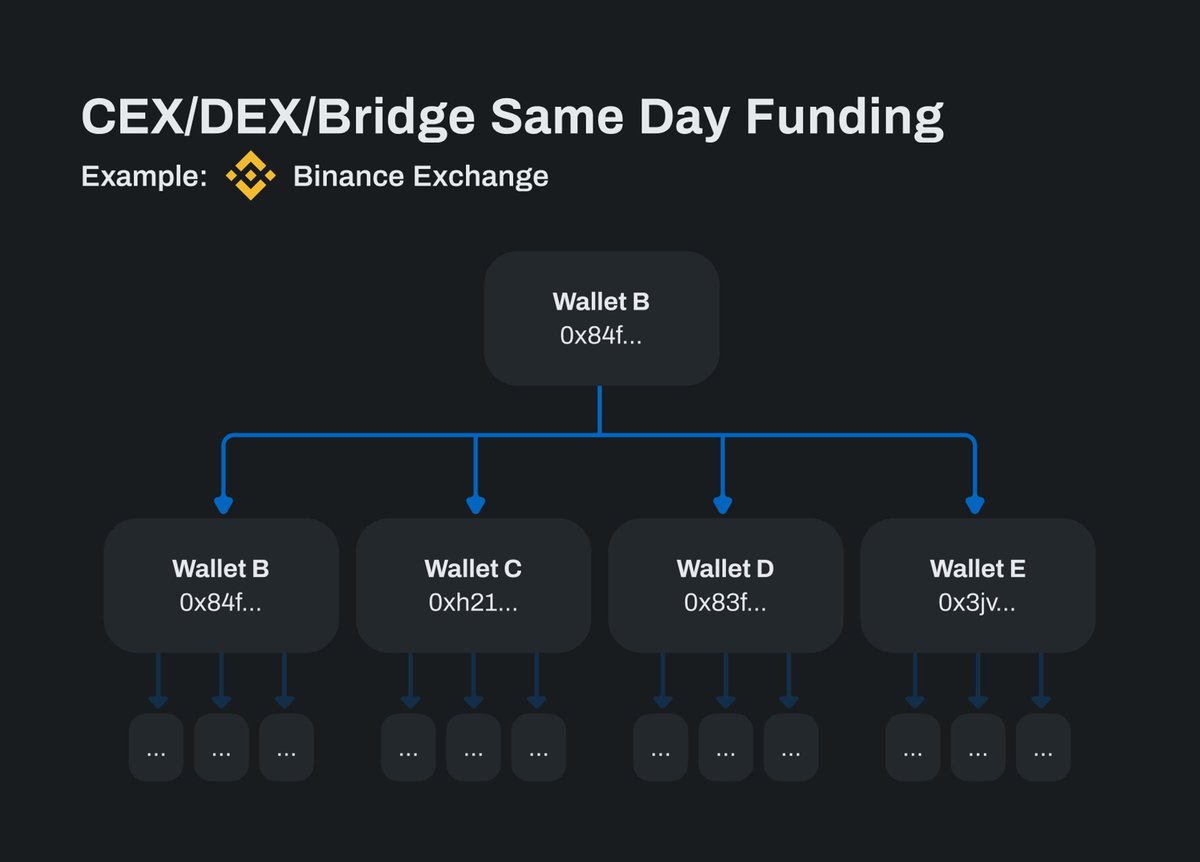

6/15 This image showcases a simple fund dispersion tracer in action.

Within the same hour, we've identified wallets funded by the same CEX cluster, such as Binance. This is a single heuristic in a model that can support hundreds, if not thousands, of rules.

Within the same hour, we've identified wallets funded by the same CEX cluster, such as Binance. This is a single heuristic in a model that can support hundreds, if not thousands, of rules.

7/15 We've since adapted our clustering algorithms to assist teams like @LayerZero_Labs and @ether_fi optimize their incentive strategies and explore non-DeFi use cases like social.

Example: How many @farcaster_xyz / @LensProtocol users are **real**?

Example: How many @farcaster_xyz / @LensProtocol users are **real**?

8/15, the numbers speak for themselves. In some cases, we've flagged application user bases as over 98% Sybil.

But do well-connected clusters necessarily mean Sybil / farmers / bots?

But do well-connected clusters necessarily mean Sybil / farmers / bots?

9/15 As AI agent deployment grows, the distinction between Sybils and legitimate user-authorized/intent agents becomes less clear-cut.

10/15 This shift presents new challenges in defining authentic or "intended" usage.

It's evolving into a spectrum that requires context.

It's evolving into a spectrum that requires context.

11/15 These changes have significant implications for UX design and incentive structures. Teams are now grappling with questions like: How do we encourage valuable user behaviors while accounting for AI-driven interactions?

12/15 There's no universal classifier, and context, i.e., intended or encouraged UX patterns or usage matter.

13/15 We believe every crypto team could benefit from this type of analysis to:

a) Gain deeper insights into their user base

b) Optimize their incentive strategies

c) Adapt to the changing landscape of human and AI interactions

a) Gain deeper insights into their user base

b) Optimize their incentive strategies

c) Adapt to the changing landscape of human and AI interactions

14/15 Encouragingly, while Sybil's sophistication is advancing, we're also seeing growth in organic wallet activity. The key is in thoughtfully interpreting and applying these insights.

15/15 We'll publish reports we've run on various protocols very soon.

If your team wants to better understand users, identify sybil clusters, or optimize incentive spending, we'd love to chat!

If your team wants to better understand users, identify sybil clusters, or optimize incentive spending, we'd love to chat!

• • •

Missing some Tweet in this thread? You can try to

force a refresh