Fun fact: 🇨🇦 issues student visas to anyone with a few bucks.

Here’s a quick thread on the hundreds of criminals that organized crime groups set up in 🇨🇦 using student visas.

<thread> 🧵👇

Here’s a quick thread on the hundreds of criminals that organized crime groups set up in 🇨🇦 using student visas.

<thread> 🧵👇

2/ 🇺🇸’s DEA claims El Chapo made $3m/day in 🇨🇦 prior to his arrest, and they were surprised by how “deep infiltration” was.

His point man in 🇨🇦? Jesus Herrera Esperanza, aka Hondo—a “student” in 🇨🇦. No one knows where Hondo is these days.

His point man in 🇨🇦? Jesus Herrera Esperanza, aka Hondo—a “student” in 🇨🇦. No one knows where Hondo is these days.

3/ One of the world’s most powerful gangsters is former TO resident Lawrence Bishnoi—a 31 y/o that runs a global assassin & extortion network… from prison for the past 10 years.

His empire is allegedly run by his #2—Satinderjeet Singh, aka Goldy Brar. I wonder what he studied.

His empire is allegedly run by his #2—Satinderjeet Singh, aka Goldy Brar. I wonder what he studied.

4/ speaking of Goldy Brar, two of his alleged associates arrived on student visas. They’re accused of participating in the murder that caused a diplomatic row with India.

One got a visa faster than someone in 🇨🇦 can get a license.

One got a visa faster than someone in 🇨🇦 can get a license.

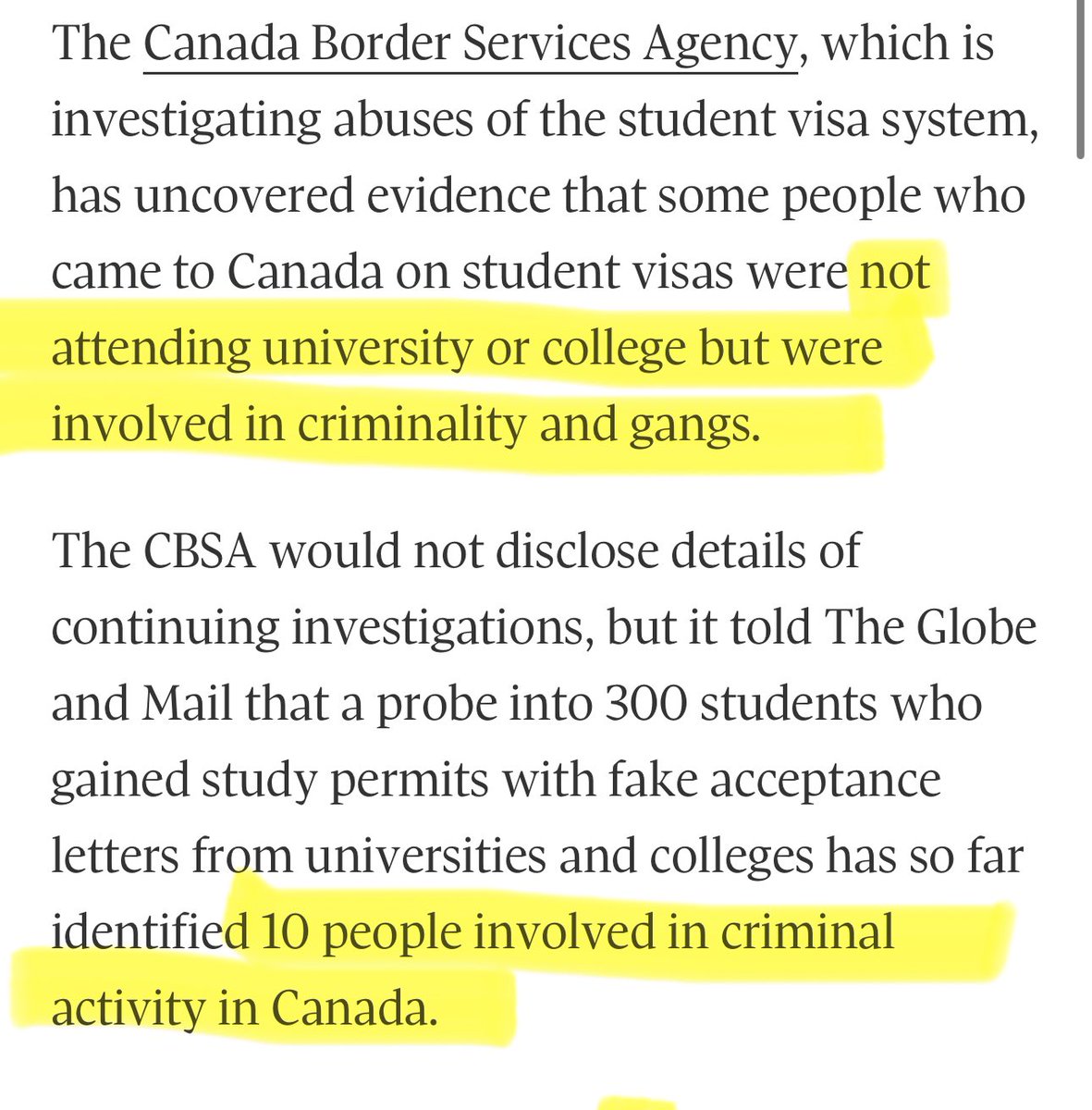

5/ it’s not a secret. 🇨🇦’s border agency audited 300 students & found 10 were organized crime.

Considering the CBSA fails to identify notorious mobsters & war criminals, these 10 must have wrote “gang stuff” under purpose of visit to be identified.

Considering the CBSA fails to identify notorious mobsters & war criminals, these 10 must have wrote “gang stuff” under purpose of visit to be identified.

6/ You know how 🇨🇦 is considering pulling back on student visas because of the pressure on housing?

LOL. Nope! It’s because the CBSA testified that they realized back in 2018 that gangs were using student visas to send their members.

LOL. Nope! It’s because the CBSA testified that they realized back in 2018 that gangs were using student visas to send their members.

7/ to be fair, it’s a general problem in 🇨🇦.

Back in the day, 🇨🇦 used to be where organized crime heads would hide when they got in trouble to avoid scrutiny.

Word must have got out, because 🇨🇦’s now trying to catch 29k fugitives—300 considered immediate public danger.

Back in the day, 🇨🇦 used to be where organized crime heads would hide when they got in trouble to avoid scrutiny.

Word must have got out, because 🇨🇦’s now trying to catch 29k fugitives—300 considered immediate public danger.

8/ let’s quickly circle back to the CBSA finding this out in 2018.

That’s a lie. I know this because this is the index from a leaked CSIS report from 1996 on how the Triads are setting up in 🇨🇦.

Been bothering me for 10+ years now–even the leaks are missing this one section.

That’s a lie. I know this because this is the index from a leaked CSIS report from 1996 on how the Triads are setting up in 🇨🇦.

Been bothering me for 10+ years now–even the leaks are missing this one section.

9/ anyway, thanks for reading!

https://twitter.com/stephenpunwasi/status/1549583521848737792

• • •

Missing some Tweet in this thread? You can try to

force a refresh