THREAD: Digging through the documents showing how Xiao Jianhua, a jailed billionaire and former concierge to China's Communist Party princelings, was secretly invested in Alibaba, Ant Financial and other companies linked to Jack Ma, China's most famous businessman. (1/x)

Please read our story, published by the both the NYT and @thewirechina . We worked for more than a year to put this together and it was a joy to write this with two brilliant young journalists, @NorthropKatrina and @eliotcxchen - plus @DavidBarboza2 (2/x)

nytimes.com/2024/07/21/wor…

nytimes.com/2024/07/21/wor…

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 The documents we used are from internal company files of Xiao Jianhua's business empire, which people (us included) call "The Tomorrow Group," although that refers more to the now-dismantled internal Chinese network of companies. These records focus on his offshore network (3/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 The source of the docs is a former employee who wanted to expose how Xiao could secretly control companies behind the scenes. The source also wanted to shine a light on shoddy enforcement and oversight, particularly in Hong Kong, that allowed Xiao to get away with this. (4/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 In more than 24 years as a reporter, I've never seen a cache of documents this amazing. There are more than 2000 of them, in Chinese and English, mostly contracts, spreadsheets, brokerage/bank statements, plus a lot of company docs from the British Virgin Islands. (5/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 Why are they amazing? Because they are the internal docs of a deeply politically connected, criminal, brilliant billionaire and they tell a story SHARPLY at odds with what the public is told, and they give unique insight into how business is done at elite levels in China (6/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 This isn't the first article we've done from the Xiao docs. Last year @QianIsabelle @muyixiao @vwang3 and I wrote about a van Gogh painting that the world thought was purchased at Sotheby's by a Chinese movie director. The real buyer, a Xiao proxy. (7/x) nytimes.com/2023/05/29/wor…

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 Who is Xiao Jianhua? Until his detention in Jan 2017, he was a billionaire who controlled or held large stakes brokerages, insurers and banks. He also acted as a banker to the princelings including, in one instance, to one of Xi Jinping's sisters. (8/x) nytimes.com/2014/06/04/wor…

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 But that all ended 7 years ago when he was abducted from his apartment at the Four Seasons in Hong Kong and whisked into China. He was eventually sentenced to 13 years in prison in 2022 for crimes including bribery. (9/x) nytimes.com/2017/02/10/wor…

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 Xiao controlled his empire via proxies - often employees or their relatives - so his fingerprints were not on the deals. But the docs include a spreadsheet listing all of the offshore companies he controlled. (10/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 Armed w that info, the deal history of some big transactions that happened in Hong Kong during the peak era of Jack Ma's influence look completely different from the public record. One example: the 2015 purchase of a HK brokerage by Ma and his longtime biz partner David Yu (11/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 The brokerage was called Reorient, and its chairman was Johnson Ko, who partnered with Erik Prince, the US security contractor. Yu and Ma led a consortium of investors, taking control of the company and renaming it Yunfeng Financial, after their PE firm Yunfeng Capital (12/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 It was a uniquely Hong Kong deal. Ko sold 1.94 billion new shares to Yu and Ma's consortium at a price WAY lower than what Reorient was trading at. For anyone in the deal, it was a license to print money b/c once word got out that Ma was behind the deal, shares soared. (13/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 Hong Kong financial journalists and the investing public are inundated with these legalese-infested announcements all the time. Not sure how this is legal, given the obvious temptation to abuse it. (14/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 Sure enough, once public, Reorient's share price took off! This was the latest in a string of deals Jack Ma had been involved with over the previous 18 months. As a former senior Xiao exec said of Ma and Alibaba: "They could turn stone into gold." (15/x) bloomberg.com/news/articles/…

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 So you'd think that ANYONE invited to be part of the Yu/Ma consortium would have to be super-connected and well known. You don't let just anyone get a super-discounted slice of a company whose share price is near certain to take off, right? Right? (16/x)

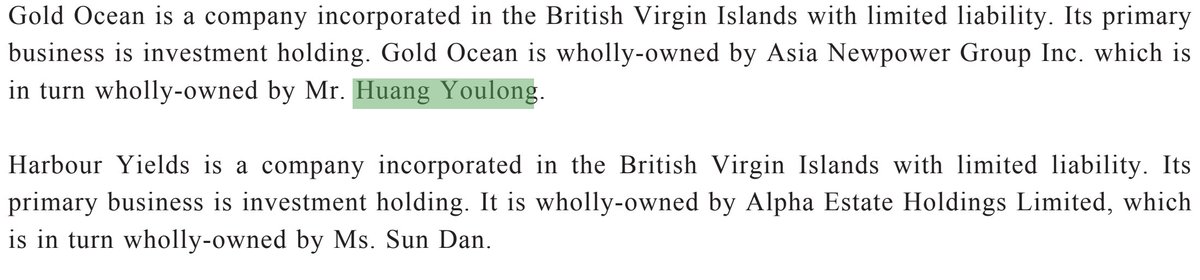

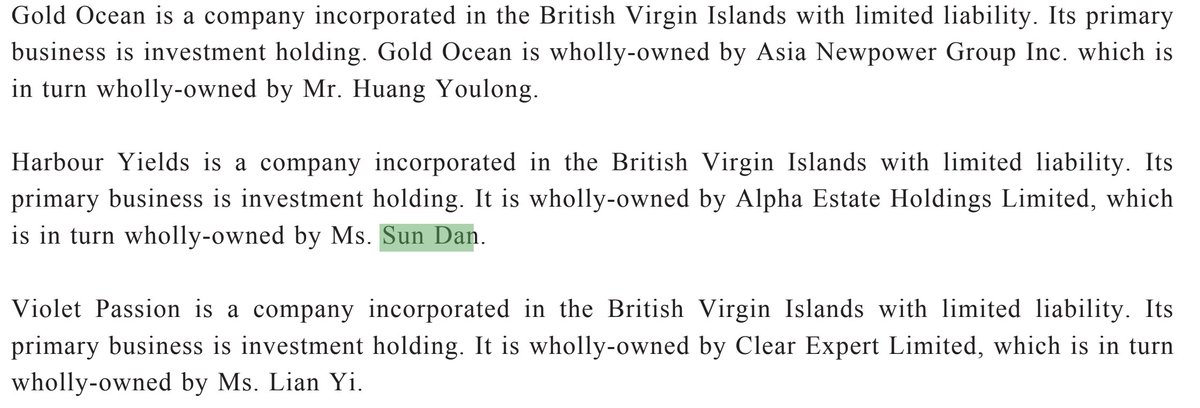

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 Sure enough, there were some well known people. Ma and Yu, as well as Huang Youlong, friend of Jack and husband to one of China's most famous movie stars, Zhao Wei (Vicki Zhao). Much more on him later. But most of the co-investors were TOTAL unknowns. (17/x)

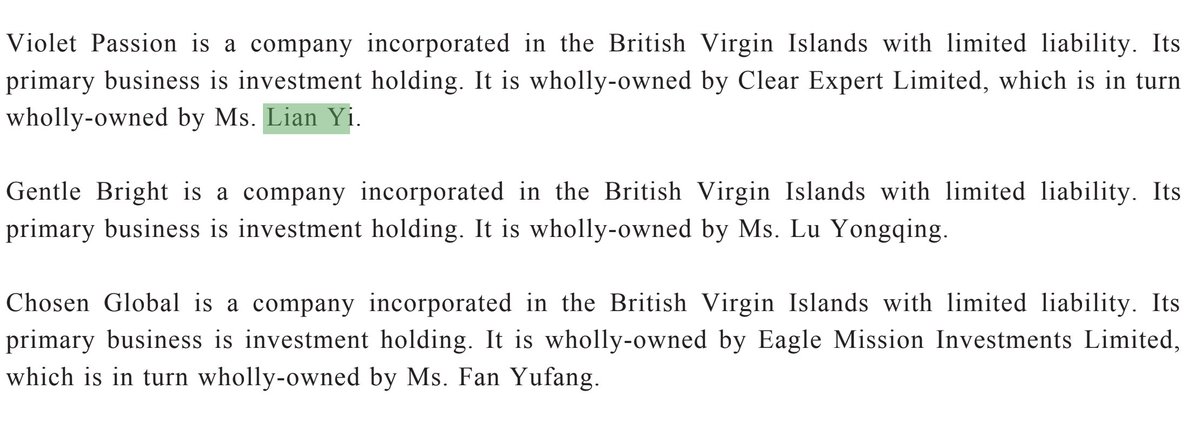

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 For example, there was Lian Yi, who, when the deal closed that Nov., would own 7% of Reorient/Yunfeng Financial via BVI Violet Passion. There was Fan Yufang, owner of BVI Chosen Global, with 4.5%. Total, complet unknowns. Lu Yongqing of Gentle Bright we'll get to later. (18/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 I was in Hong Kong in 2015, and very much writing about Jack Ma and Alibaba. But I totally missed this. Shouldn't this have raised alarm bells? The last few screenshots have not been from the docs but from a public exchange announcement. Who are these people? (19/x)

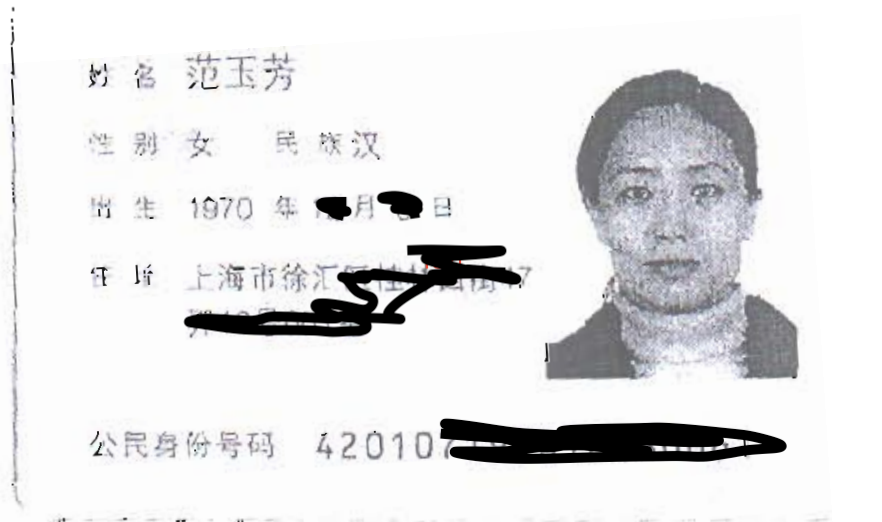

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 Lian Yi was a 27-year old woman whose hometown was Baotou, a base area for Xiao's tomorrow group and hometown of his wife. Fan Yufang lived in Shanghai. How do I know this? Their ID information, passport photo pages, BVI company ownership info, is all in the docs. (20/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 They are cutouts for Xiao. Here they are on the spreadsheet. Lian Yi is 连轶,and Fan Yufang is 范玉芳

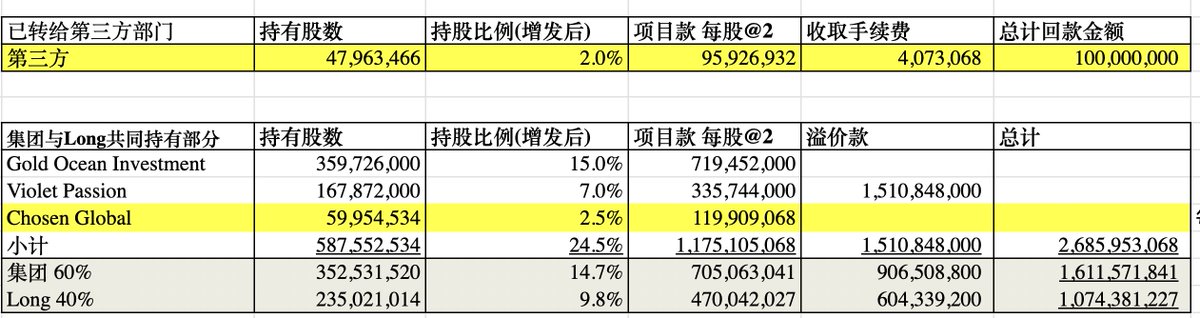

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 So right off the bat Xiao is controlling 11.5% of Reorient via those 2 shell companies, but he also controls a large chunk of Huang Youlong's stake. Why? Because he fronted Huang the money for his own stake. (22/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 Read the story for more details on how Huang and his glamorous wife weaved their way into Jack Ma's world. But here's a Chinese spreadsheet showing Xiao's actual control over Huang's shares. And this was also spelled out in a contract. (23/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 In that spreadsheet, Gold Ocean is Huang's company, and a contract in the docs says that in effect, Huang is a NOMINEE SHAREHOLDER and the Xiao company is the true owner of much of Gold Ocean's stake. But see what HK investors are being told: (24/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 That's false. Huang isn't the sole owner of Gold Ocean's Reorient stake. And Chinese readers will also notice in the spreadsheet that Huang/Xiao bought a 2% stake in Reorient for a mystery "3rd Party" (第三方) and paid a huge premium for their shares to parties unknown. (25/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 At this point, as you see from the spreadsheet, Xiao/Huang control 24.5% of Reorient. But at the end of 2015 Xiao buys up the 7% stake owned via BVI Gentle Bright, which is owned by Lu Yongqing (scroll back if you forgot). That brings their stake up to 31.5%. (26/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 At the end of 2015, Xiao, via 3 BVIs and his control of much of a 4th, is the single largest shareholder (by far) in Reorient/Yunfeng Financial. This is a company that the world thinks is run by David Yu and Jack Ma and "Yunfeng" is Ma/Yu's first names in Chinese. (27/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 And who is Lu Yongqing? She is the ex-wife of David Yu. THIS IS NOT DISCLOSED IN THE EXCHANGE ANNOUNCEMENT! And Xiao buys out her stake not at the discounted pre-deal price but at the post deal price, netting her an enormous profit. Just how big? See..(28/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 At this point, it is important to note that all the parties in this transaction profess ignorance that Xiao was behind these deals, even though he and Huang by end-2015 controlled nearly 1/3 of Yunfeng Financial. Here is what they said. (29/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 And, it is important to note, that Jack Ma and Alibaba say they were unaware of Xiao's investments into Alibaba, Alibaba Pictures and other entities. This is what they said. (30/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 There is SO MUCH MORE in the story. That was just 1 example Please have a read. I want to thank Dean Murphy and @rory_tolan_ for editing. I really could go on forever. Tomorrow I will try to do a thread about the 3 Swiss Banks involved in these deals. ONE LAST THING.. (31/x)

@thewirechina @NorthropKatrina @eliotcxchen @DavidBarboza2 @QianIsabelle @muyixiao @vwang3 @rory_tolan_ If you have ANY information on the identity of Ms. Sun Dan, owner of BVI "Harbour Yields" which owned 6.5% of Reorient Shares, please consider reaching out to us. You can always use (32/32) END nytimes.com/tips

• • •

Missing some Tweet in this thread? You can try to

force a refresh