An order flow shift is simply

price changing from bullish → bearish or bearish → bullish.

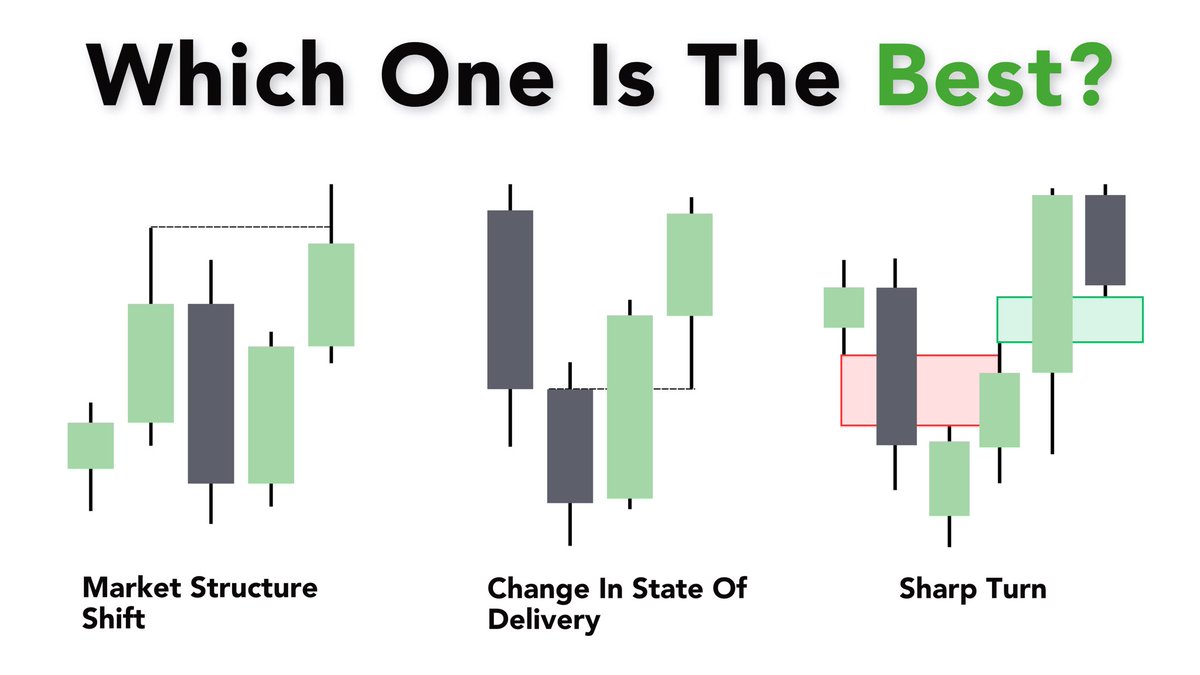

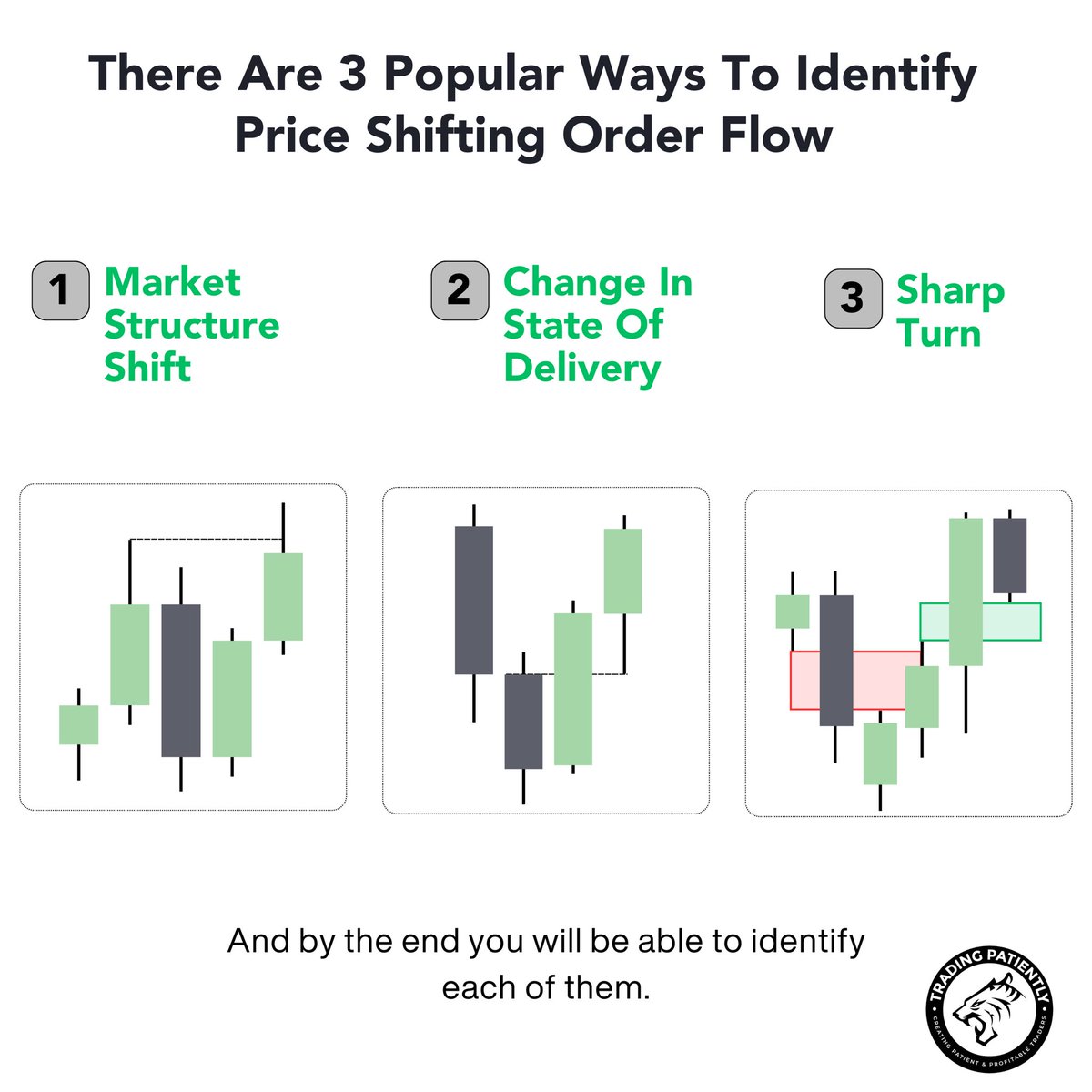

There are 3 popular ways to identify price shifting order flow: MSS, CISD, & ST.

𝗔𝗹𝗹 𝟯 𝗼𝗳 𝘁𝗵𝗲𝗺 𝗺𝘂𝘀𝘁 𝗼𝗰𝗰𝘂𝗿 @ 𝗮 𝗛𝗧𝗙 𝗣𝗗𝗔.

price changing from bullish → bearish or bearish → bullish.

There are 3 popular ways to identify price shifting order flow: MSS, CISD, & ST.

𝗔𝗹𝗹 𝟯 𝗼𝗳 𝘁𝗵𝗲𝗺 𝗺𝘂𝘀𝘁 𝗼𝗰𝗰𝘂𝗿 @ 𝗮 𝗛𝗧𝗙 𝗣𝗗𝗔.

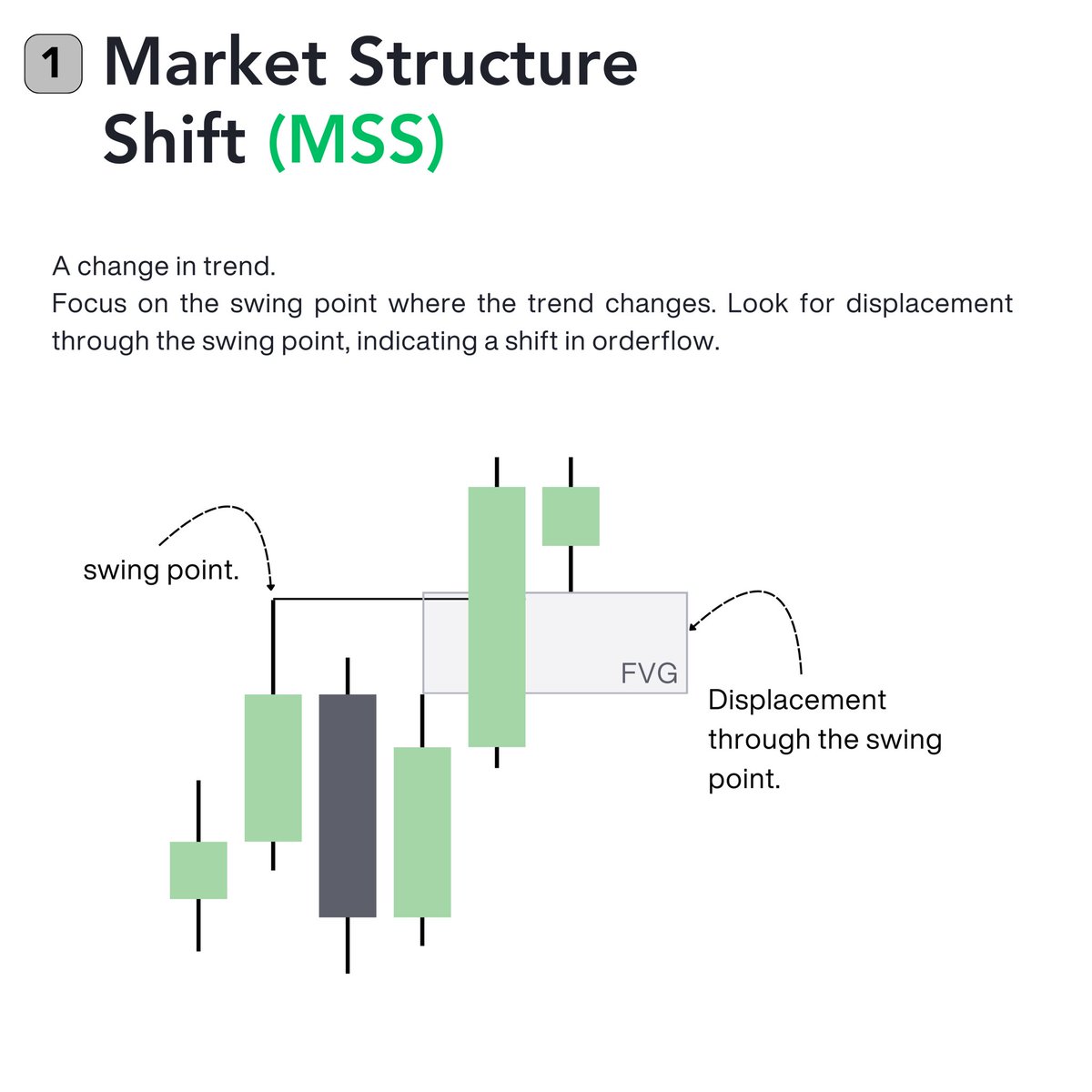

𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗲 𝗦𝗵𝗶𝗳𝘁𝘀 (𝗠𝗦𝗦)

A change in trend.

MSS focuses on the swing point where the trend changes.

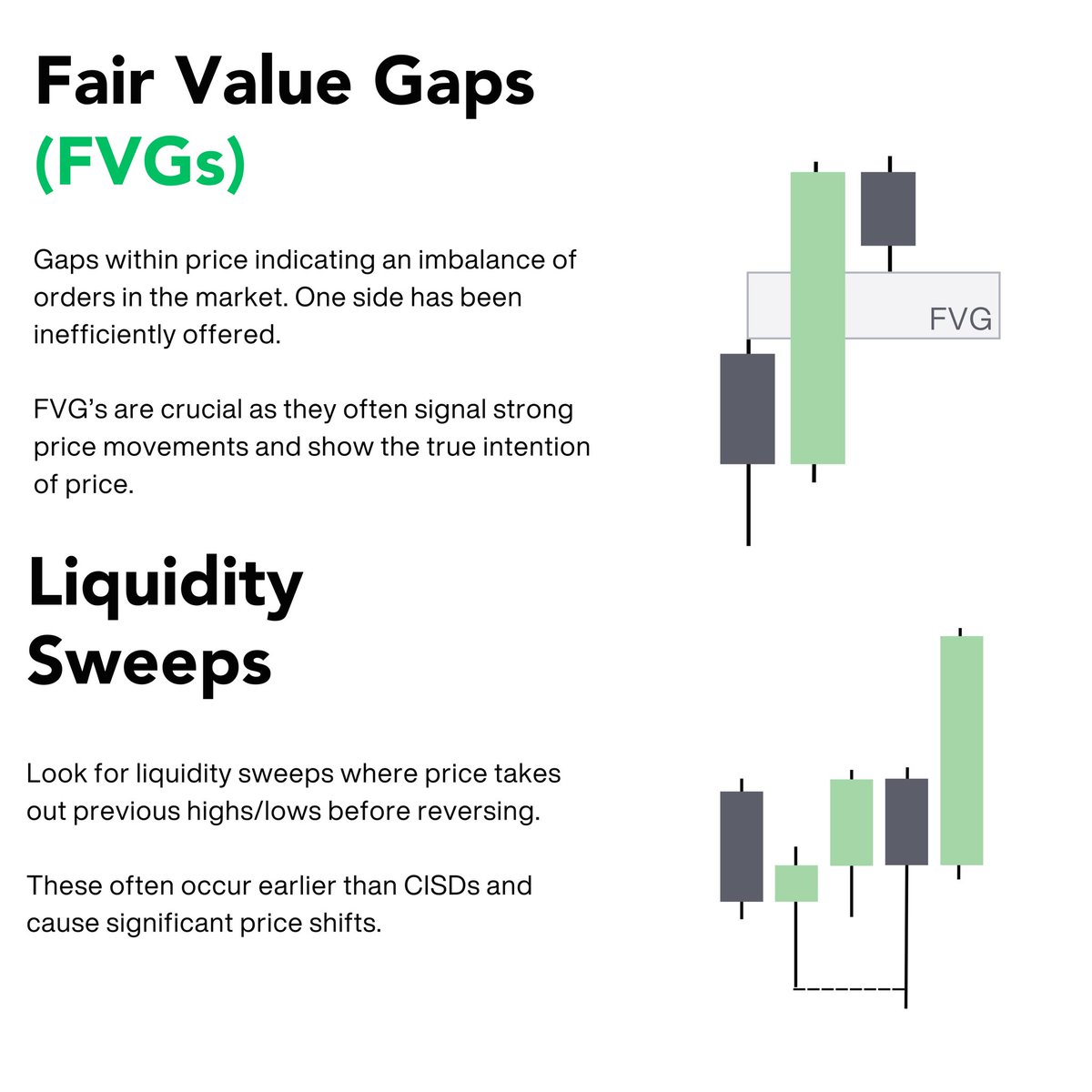

We want to see displacement (FVG) through the swing point, confirming the shift in trend.

High probability MSS create FVG through the swing point.

A change in trend.

MSS focuses on the swing point where the trend changes.

We want to see displacement (FVG) through the swing point, confirming the shift in trend.

High probability MSS create FVG through the swing point.

𝗖𝗵𝗮𝗻𝗴𝗲 𝗜𝗻 𝗦𝘁𝗮𝘁𝗲 𝗢𝗳 𝗗𝗲𝗹𝗶𝘃𝗲𝗿𝘆 (𝗖𝗜𝗦𝗗)

An order block.

CISD focuses on the order block that gets created when price shifts order flow.

Once the body closes past the opening price of the order block, the CISD is confirmed and should act as fair value.

An order block.

CISD focuses on the order block that gets created when price shifts order flow.

Once the body closes past the opening price of the order block, the CISD is confirmed and should act as fair value.

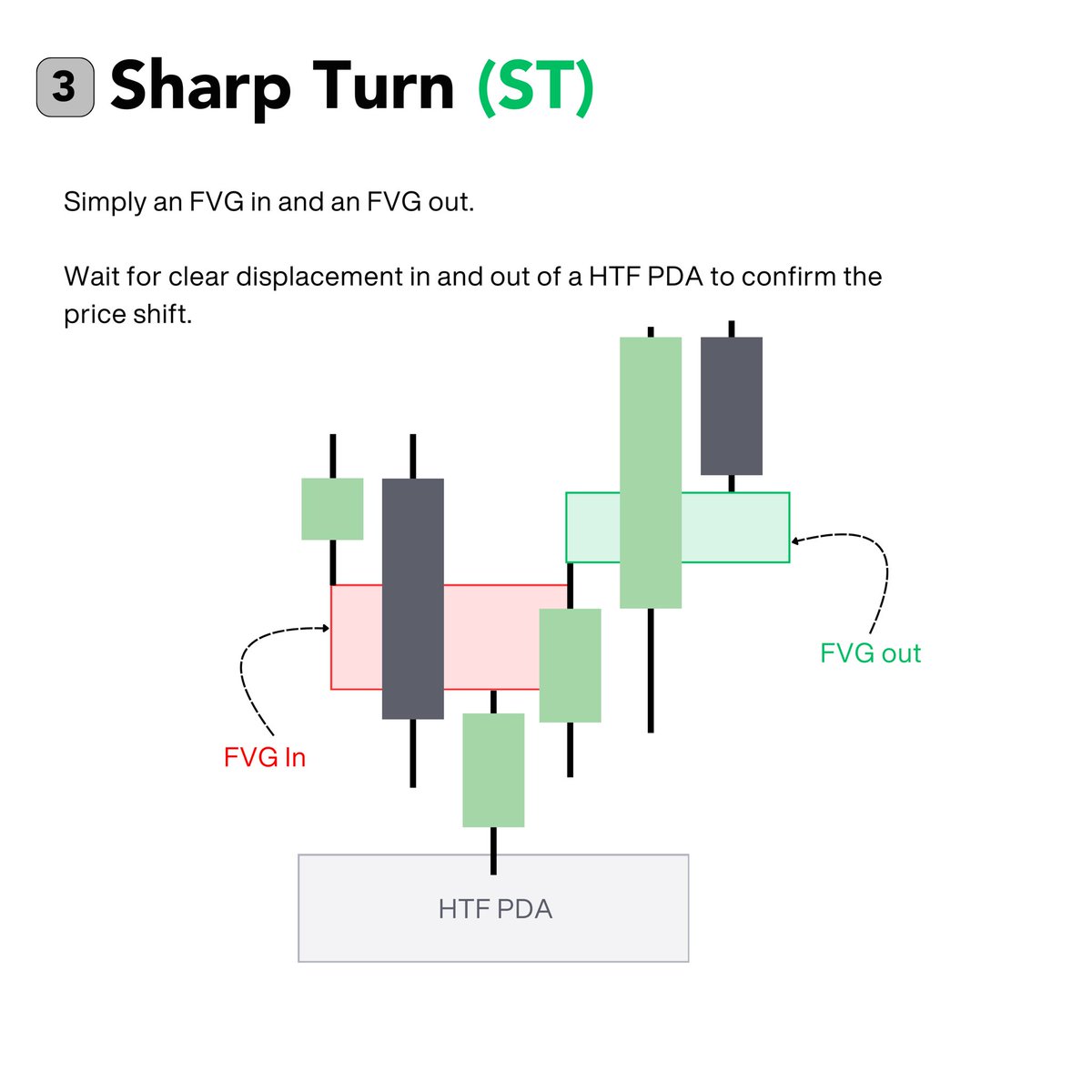

𝗦𝗵𝗮𝗿𝗽 𝗧𝘂𝗿𝗻 (𝗦𝗧)

A FVG in & FVG out.

We are waiting for clear displacement in and out of a HTF PDA to confirm price has shifted.

A FVG in & FVG out.

We are waiting for clear displacement in and out of a HTF PDA to confirm price has shifted.

𝗡𝗼𝘁𝗶𝗰𝗲 𝗵𝗼𝘄 𝗮𝗹𝗹 𝘁𝗵𝗿𝗲𝗲 𝗮𝗿𝗲 𝗵𝗶𝗴𝗵𝗲𝘀𝘁 𝗽𝗿𝗼𝗯𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝘄𝗵𝗲𝗻 𝗮𝗻 𝗙𝗩𝗚 𝗳𝗼𝗿𝗺𝘀?

This is why I prefer to read the FVG’s to confirm a shift in order flow.

They show the true intention of price and are extremely simple to spot.

This is why I prefer to read the FVG’s to confirm a shift in order flow.

They show the true intention of price and are extremely simple to spot.

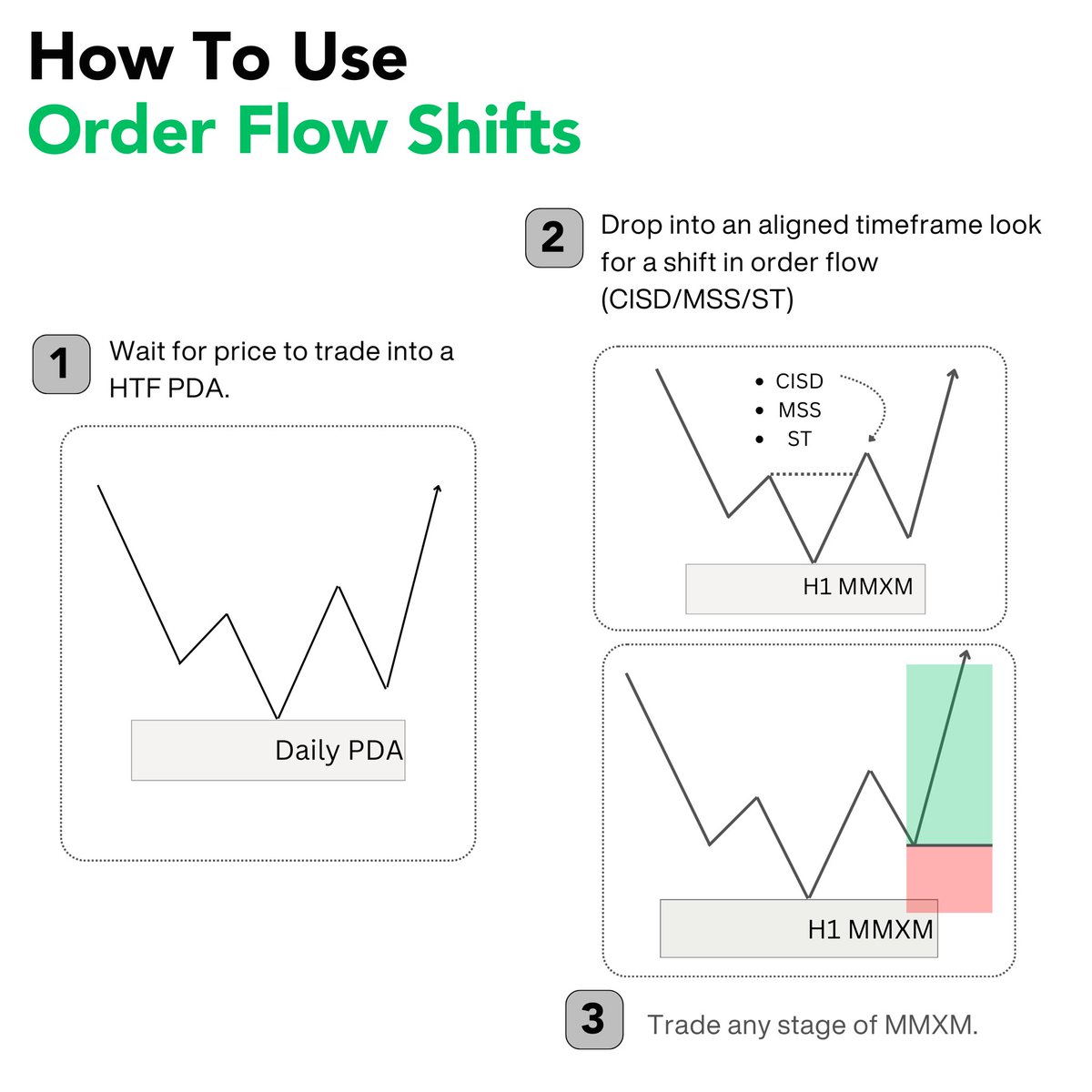

𝗛𝗼𝘄 𝘁𝗼 𝘂𝘀𝗲 𝗼𝗿𝗱𝗲𝗿 𝗳𝗹𝗼𝘄 𝘀𝗵𝗶𝗳𝘁𝘀:

- Wait for price to trade into HTF PDA

- Drop into aligned timeframe

- Look for a shift in order flow

(CISD/MSS/ST)

- Trade any stage of MMXM until DOL is taken

- Wait for price to trade into HTF PDA

- Drop into aligned timeframe

- Look for a shift in order flow

(CISD/MSS/ST)

- Trade any stage of MMXM until DOL is taken

Proper understanding of narrative & draw on liquidity is the key to using order flow shifts correctly. 𝗬𝗼𝘂 𝗺𝘂𝘀𝘁 𝘂𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱 𝗽𝗿𝗶𝗰𝗲’𝘀 𝗶𝗻𝘁𝗲𝗻𝘁𝗶𝗼𝗻 𝗳𝗿𝗼𝗺 𝘁𝗵𝗲 𝘁𝗼𝗽 𝗱𝗼𝘄𝗻.

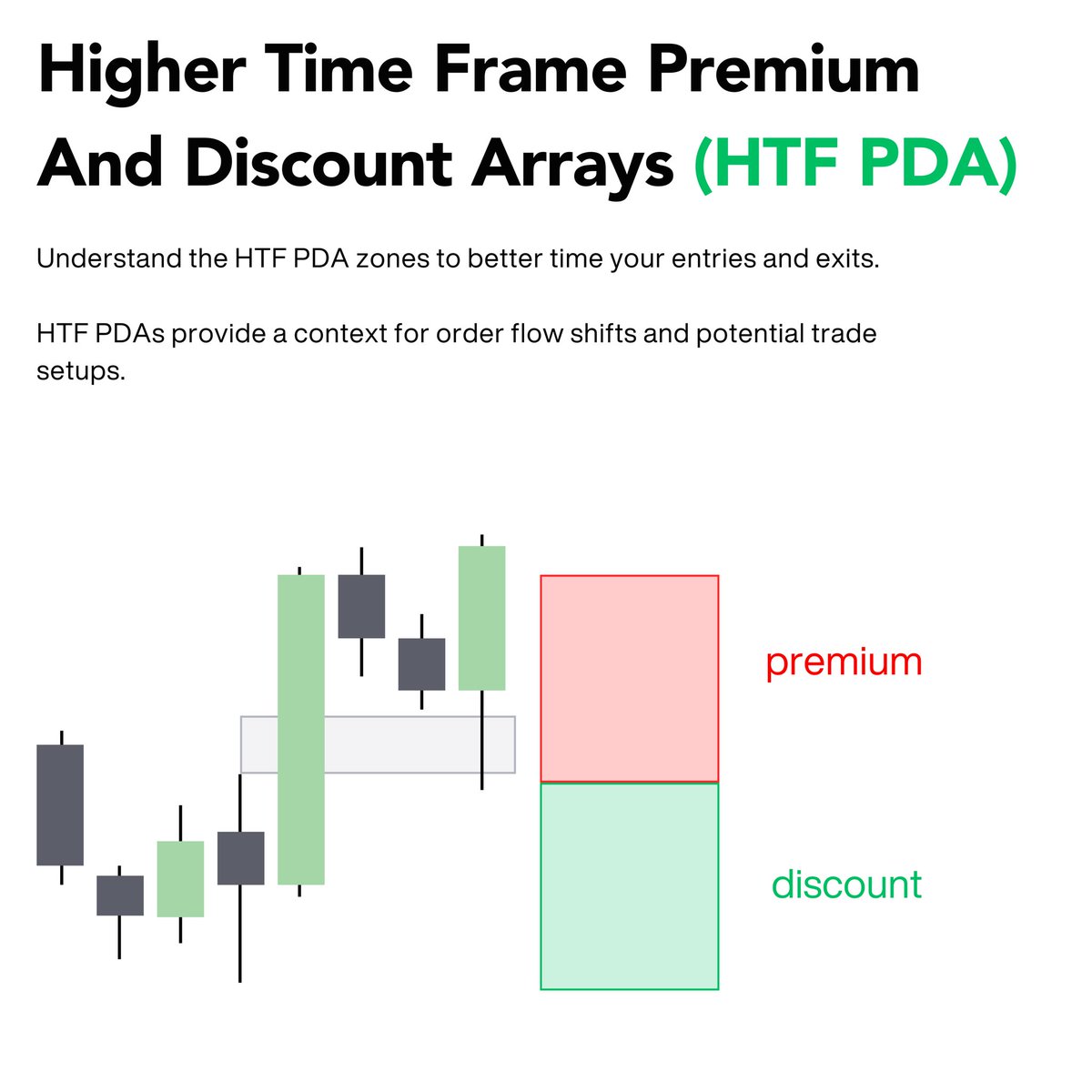

There are only 𝘁𝘄𝗼 𝘁𝗵𝗶𝗻𝗴𝘀 I use as my HTF PDA:

- Fair Value Gaps

- Liquidity Pools

This is truly ALL YOU NEED.

- Fair Value Gaps

- Liquidity Pools

This is truly ALL YOU NEED.

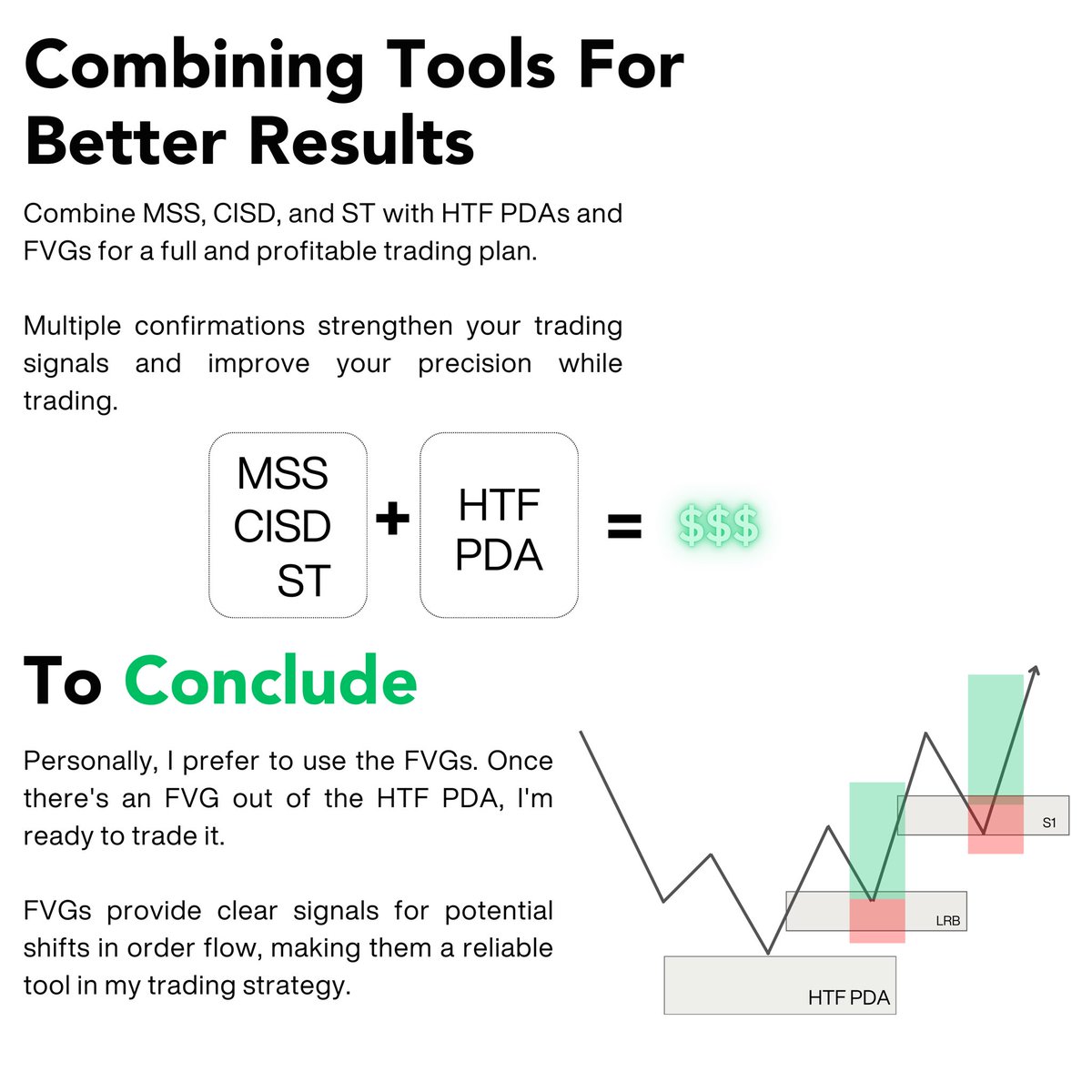

Pick one of the 3 methods to spot an order flow shift, combine it with narrative, draw on liquidity and HTF PDA… BOOM. You have an extremely profitable model on your hands.

I personally just read the FVG’s. I don’t need anything else.

I personally just read the FVG’s. I don’t need anything else.

Want to learn more? I go EVEN MORE in-depth on this topic in my latest YouTube video:

For direct access to me, FREE educational content & resources click here:

↓ ↓ ↓ ↓ ↓

discord.gg/ironsharpensir…

↓ ↓ ↓ ↓ ↓

discord.gg/ironsharpensir…

• • •

Missing some Tweet in this thread? You can try to

force a refresh