Who is Nicolas Darvas?

Nicolas Darvas was a professional dancer with having a keen interest in traveling. Once he got some stocks as a gift, and this made him become obsessed with the markets, he put countless hours into the study of market movements and internal mechanics.

Nicolas Darvas was a professional dancer with having a keen interest in traveling. Once he got some stocks as a gift, and this made him become obsessed with the markets, he put countless hours into the study of market movements and internal mechanics.

He himself learned to trade the markets just by reading books and newspapers.

His favorite books were 'The Battle for Investment Survival' and 'Tape Reading and Market Tactics'.

He also wrote the book “How I made $2000000 in Stock Market”

His favorite books were 'The Battle for Investment Survival' and 'Tape Reading and Market Tactics'.

He also wrote the book “How I made $2000000 in Stock Market”

Darvas used to track stocks making new highs.

He used to only enter stocks that were in confirmed uptrends and breaking out of consolidation patterns to make new highs.

This system works best in bull markets..

He used to only enter stocks that were in confirmed uptrends and breaking out of consolidation patterns to make new highs.

This system works best in bull markets..

Darvas Box Rules-

Darvas’s rules were fairly simple, as stated in his book "How I Made $2M in the Stock Market"-

-A stock is making a new 52-week high or ATH -

-After the high is set, there are three consecutive days that do not exceed the high

Darvas’s rules were fairly simple, as stated in his book "How I Made $2M in the Stock Market"-

-A stock is making a new 52-week high or ATH -

-After the high is set, there are three consecutive days that do not exceed the high

-The new high becomes the top of the box and the breakout point leading to the new high becomes the low of the box

-Buy the break of the box once it exceeds the high by a few points

-Sell the low of the box if it is breached Add more to your position as it moves into your favor.

-Buy the break of the box once it exceeds the high by a few points

-Sell the low of the box if it is breached Add more to your position as it moves into your favor.

-the first step is a stock making 250-day high. Stock should report higher volumes.

Darvas emphasized a lot on Volume

Darvas emphasized a lot on Volume

Once the new high is marked, wait for three candles followed by that high that does not cross the high.

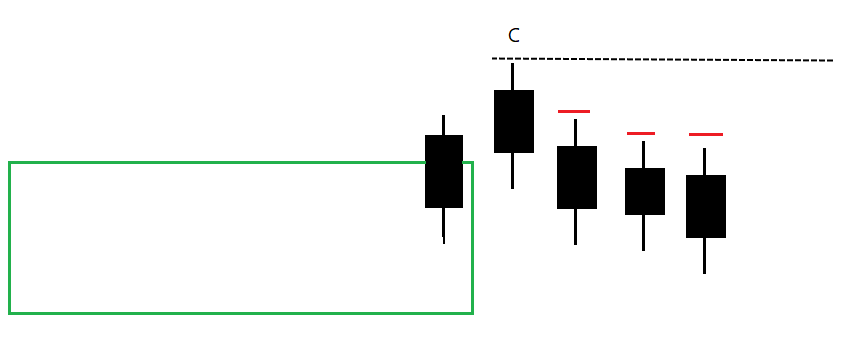

If that happens, let us mark the unbroken high as C. Check the image below for details.

If that happens, let us mark the unbroken high as C. Check the image below for details.

Once the C is in place, look for F. F is Low of the candle which does not get broken for next 3 sessions. If that happens, F gets marked at unbroken low.

Now we have a box.

C is Ceiling of the box

and F is floor of the box.

If price closes above C , it is a Darvas Box breakout and a buy point. Stop should be placed below F.

C is Ceiling of the box

and F is floor of the box.

If price closes above C , it is a Darvas Box breakout and a buy point. Stop should be placed below F.

Understood how Darvas box is formed?

Buy if price closes above Ceiling and put a stop-loss below Floor price.

Darvas followed a Pilot buying method. He would generally make a small pilot buy and add to winners. He believed in pyramiding or adding more on subsequent breakouts.

Buy if price closes above Ceiling and put a stop-loss below Floor price.

Darvas followed a Pilot buying method. He would generally make a small pilot buy and add to winners. He believed in pyramiding or adding more on subsequent breakouts.

After the breakout of the box, if price moves higher and forms another box, then trail stop-loss to the Floor price of the newly formed box and keep trailing on each subsequent floor.

Exit the trade when price goes below the floor price of the recent box.

Exit the trade when price goes below the floor price of the recent box.

here chart is 250-day on daily chart instead of 52-week on weekly chart because Darvas said 3-day retracement in his book. He called himself mental chartist as he was not using the charts.

So, he was observing a new high in numbers, drawing virtual box from observations

So, he was observing a new high in numbers, drawing virtual box from observations

of prices and followed a 3-day rule.

Nonetheless, one can use it on weekly or any other timeframe.

There are no rules for height and width of the box. Meaning, stock can remain for any number of days within the box after forming the C.

Nonetheless, one can use it on weekly or any other timeframe.

There are no rules for height and width of the box. Meaning, stock can remain for any number of days within the box after forming the C.

When Darvas Box Works the Best -

Without a doubt, the Darvas box strategy works best in strong bull markets.

The market simply goes higher and you just keep buying the strength.

Without a doubt, the Darvas box strategy works best in strong bull markets.

The market simply goes higher and you just keep buying the strength.

The Darvas box can put you in a tight spot under the following scenarios:

-Buying breakouts into stocks that are not near highs

-Buying breakouts during bear markets

-Scaling too heavily when adding to your position ---

-Using the Darvas Box within sideways markets

--Ignoring Your Stop Levels

-Buying breakouts into stocks that are not near highs

-Buying breakouts during bear markets

-Scaling too heavily when adding to your position ---

-Using the Darvas Box within sideways markets

--Ignoring Your Stop Levels

Quite simple it is.

• • •

Missing some Tweet in this thread? You can try to

force a refresh