The Canadian economy is in trouble.

Thread.

1/

Thread.

1/

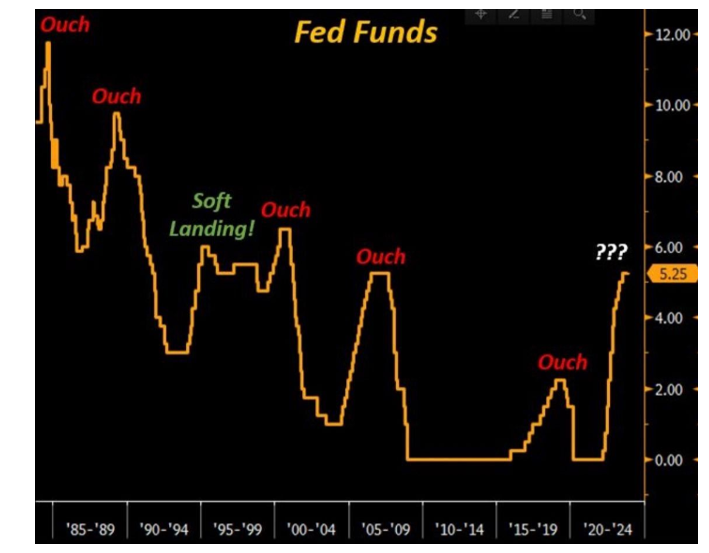

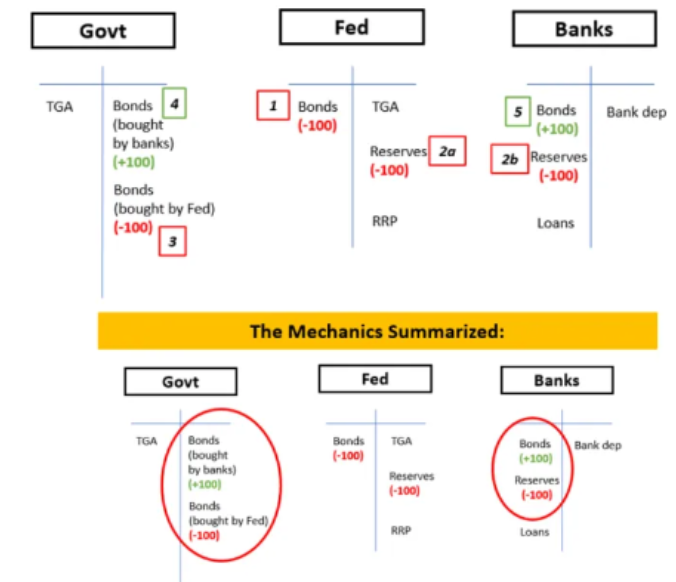

Central Banks hikes can be very punitive if an economy has:

- High levels of private sector debt

- A high share of floating rate mortgages and corporate loans/bonds

- A high share of short-term reset mortgages and loans

- Big refinancing cliffs

2/

- High levels of private sector debt

- A high share of floating rate mortgages and corporate loans/bonds

- A high share of short-term reset mortgages and loans

- Big refinancing cliffs

2/

Canadian households are highly leveraged, and the Canadian mortgage market relies on floating rate and short-term reset mortgages.

This means the Bank of Canada hikes are transferred rapidly to the private sector.

And that's a problem.

3/

This means the Bank of Canada hikes are transferred rapidly to the private sector.

And that's a problem.

3/

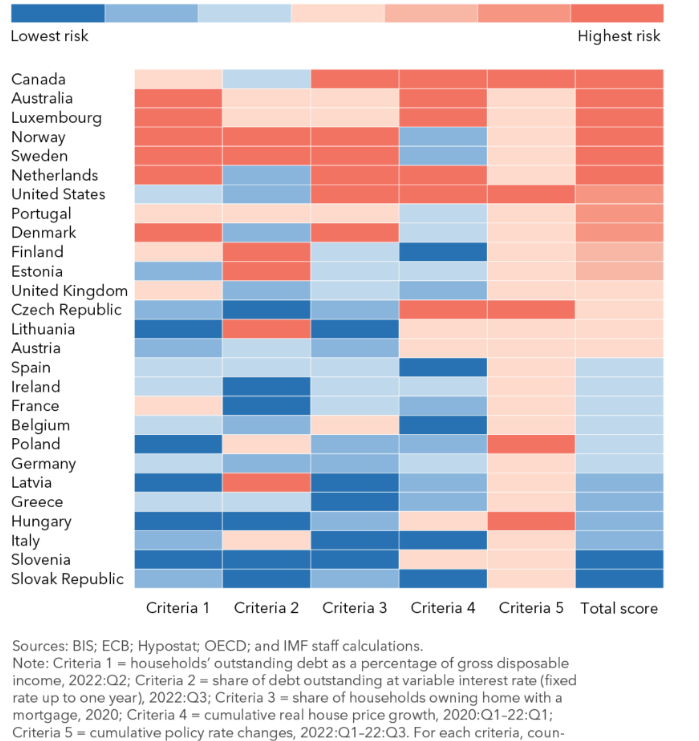

According to a 2023 IMF study, Canadian mortgages have the highest risk of default in the world followed by Australia, Norway and Sweden.

4/

4/

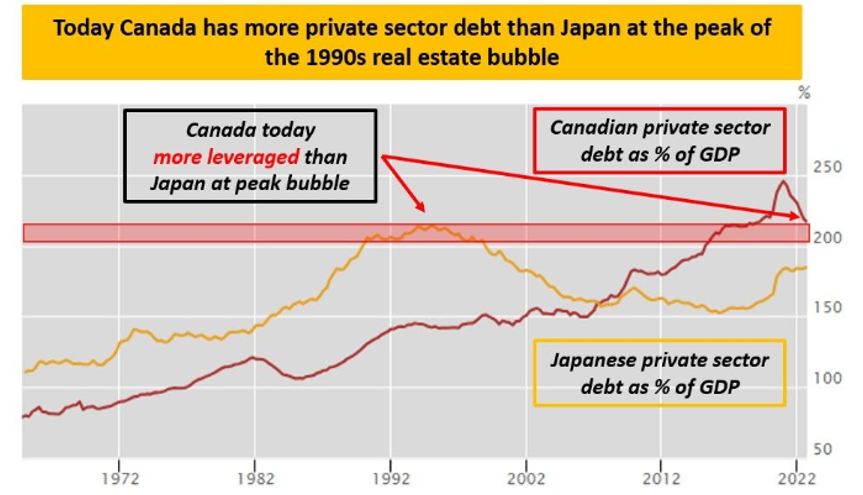

The Canadian private sector today is more leveraged than the Japanese private sector at the peak (!) of their 1990s real estate bubble.

As a reminder, back then the Imperial Palace of Tokyo was ''valued'' more than the entire real estate market in California.

5/

As a reminder, back then the Imperial Palace of Tokyo was ''valued'' more than the entire real estate market in California.

5/

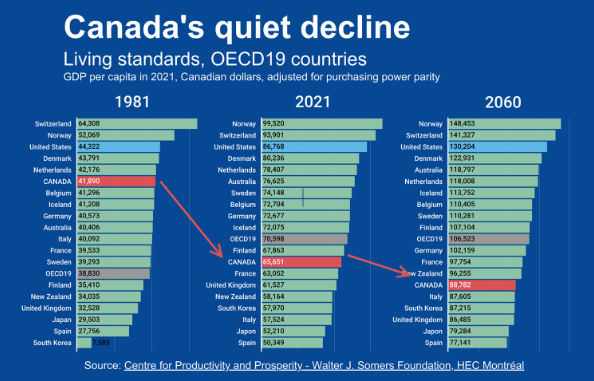

The Bank of Canada has started cutting interest rates, but GDP per capita is already looking poor and the labor market is not nearly able to create enough jobs to offset population growth.

6/

6/

I am scratching my head at how the Canadian housing market and broader economy will be able to withstand this combination of excessive leverage and high interest rates?

The Canadian economy might be in trouble.

7/

The Canadian economy might be in trouble.

7/

Thanks for reading!

I am soon launching my global macro hedge fund.

If you want to chat with me, take a look here:

8/8docs.google.com/forms/d/e/1FAI…

I am soon launching my global macro hedge fund.

If you want to chat with me, take a look here:

8/8docs.google.com/forms/d/e/1FAI…

• • •

Missing some Tweet in this thread? You can try to

force a refresh