Comparing @Uniswap vs. @RaydiumProtocol

The relative value debate between $ETH and @solana extends to the #1 DEX's on each. Token valuation paints a baffling picture.

Fundamentals

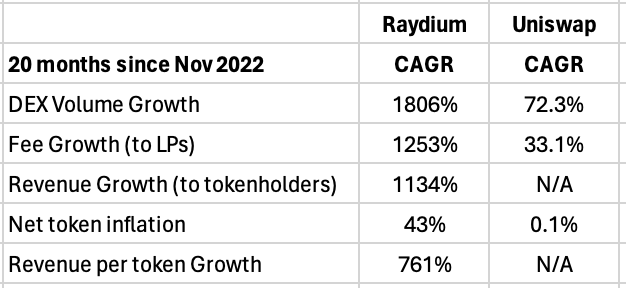

- Raydium has seen tremendous growth over the last year, with daily volumes now at roughly 50% of that of Uniswap

- Raydium takes 25bps fees, 22bps of which goes to LPs and 3bps of which goes to buyback $RAY. By contrast, Uniswap's average fees are ~13bps, 100% of which goes to LPs and none of which goes to the $UNI holders today.

- The result is that Raydium now generates higher protocol fees than Uniswap, and $RAY token holders actually can accrue value.

- $RAY has seen much higher token inflation than $UNI but higher orders of magnitude top line growth meant revenue (that accrue to tokenholders) per token still grew 761% CAGR since November 2022.

Yet.. Valuations

- $RAY's MC is just over 10% of that of $UNI

- MC/protocol fees of $UNI at 6.7x vs. $RAY 1.4x, when @uniswap's protocol fees actually don't flow through to the holders just yet. And as mentioned before, Uniswap has a very complex ecosystem structure whereby equity holders of Uniswap Labs and the $UNI token holders compete for value accrual from the protocol.

- Raydium's MC/Revenues (which is actually more like P/E) now stands at <17x, which seems crazy low for a protocol that has been delivering a 3-digit % growth.

Why the mispricing?

Impossible to be definitive here, but possible explanations are:

- market is skeptical of the sustainability of meme/shitcoin/bot trading on Solana

- Uniswap has a well-regarded brand, team and investor base with contribution to thoughtful research.

- Liquid token investors aren't paying attention and markets are inefficient

- Investors are overly afraid of $RAY's token issuance (FDV/MC is 2.1x, though circulating supply has been steady since May 2024 with early investors/team unlock mostly all through).

What do you think?

The relative value debate between $ETH and @solana extends to the #1 DEX's on each. Token valuation paints a baffling picture.

Fundamentals

- Raydium has seen tremendous growth over the last year, with daily volumes now at roughly 50% of that of Uniswap

- Raydium takes 25bps fees, 22bps of which goes to LPs and 3bps of which goes to buyback $RAY. By contrast, Uniswap's average fees are ~13bps, 100% of which goes to LPs and none of which goes to the $UNI holders today.

- The result is that Raydium now generates higher protocol fees than Uniswap, and $RAY token holders actually can accrue value.

- $RAY has seen much higher token inflation than $UNI but higher orders of magnitude top line growth meant revenue (that accrue to tokenholders) per token still grew 761% CAGR since November 2022.

Yet.. Valuations

- $RAY's MC is just over 10% of that of $UNI

- MC/protocol fees of $UNI at 6.7x vs. $RAY 1.4x, when @uniswap's protocol fees actually don't flow through to the holders just yet. And as mentioned before, Uniswap has a very complex ecosystem structure whereby equity holders of Uniswap Labs and the $UNI token holders compete for value accrual from the protocol.

- Raydium's MC/Revenues (which is actually more like P/E) now stands at <17x, which seems crazy low for a protocol that has been delivering a 3-digit % growth.

Why the mispricing?

Impossible to be definitive here, but possible explanations are:

- market is skeptical of the sustainability of meme/shitcoin/bot trading on Solana

- Uniswap has a well-regarded brand, team and investor base with contribution to thoughtful research.

- Liquid token investors aren't paying attention and markets are inefficient

- Investors are overly afraid of $RAY's token issuance (FDV/MC is 2.1x, though circulating supply has been steady since May 2024 with early investors/team unlock mostly all through).

What do you think?

• • •

Missing some Tweet in this thread? You can try to

force a refresh