The largest perp aggregator on @HyperliquidX is launching with:

1. $10M MC

2. >$880M Volume and >4000 users

3. $30m FDV

Here's everything you need to know about $RAGE, the first low FDV high float token launch on @HyperliquidX L1

👇

1/8

1. $10M MC

2. >$880M Volume and >4000 users

3. $30m FDV

Here's everything you need to know about $RAGE, the first low FDV high float token launch on @HyperliquidX L1

👇

1/8

$RAGE tokenomics

- $10m Market Capitalization ($30m FDV)

- 35% public sale (No cliff no vest) 6.5% token airdrop (3 month cliff 3 month vest)

- 13.5% private investors (3 month cliff 21 month vesting)

- 15% Team and 30% Treasury (12 month cliff 24 month vesting)

2/8

- $10m Market Capitalization ($30m FDV)

- 35% public sale (No cliff no vest) 6.5% token airdrop (3 month cliff 3 month vest)

- 13.5% private investors (3 month cliff 21 month vesting)

- 15% Team and 30% Treasury (12 month cliff 24 month vesting)

2/8

Rage Quit

- Airdrop recipients and private investors can forfeit 60% of their allocation to

- ⬇️ Inflationary pressure and ⬆️ community ownership of $RAGE

Rage quit is frankly one of the boldest moves I've seen ANY project pull off even with a stellar list of investors.

3/8

- Airdrop recipients and private investors can forfeit 60% of their allocation to

- ⬇️ Inflationary pressure and ⬆️ community ownership of $RAGE

Rage quit is frankly one of the boldest moves I've seen ANY project pull off even with a stellar list of investors.

3/8

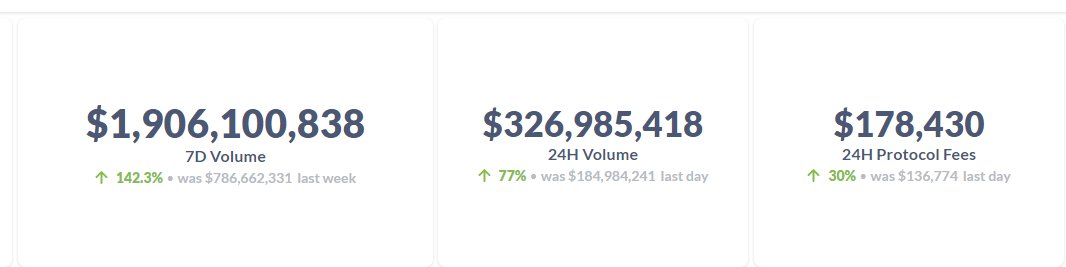

Rage stats

- 4,234 total users since launch

- $884M total volume

- Based on $10m MC, 0.011 MC to vol ratio

Over 154 assets are supported across chains with aggregated liq from @aevoxyz @GMX_IO @synthetix_io @dYdX and @HyperliquidX

4/8

- 4,234 total users since launch

- $884M total volume

- Based on $10m MC, 0.011 MC to vol ratio

Over 154 assets are supported across chains with aggregated liq from @aevoxyz @GMX_IO @synthetix_io @dYdX and @HyperliquidX

4/8

Why offer $RAGE on @HyperliquidX L1?

Hyperliquid has the largest robust base of perp users currently with > 180k users, $1.58B 24 hr, >$600m TVL

Hyperliquid spot tokens such as $JEFF , $POINTS $HFUN have been making 8 - 10x from launch while earning HL points for holders

5/8

Hyperliquid has the largest robust base of perp users currently with > 180k users, $1.58B 24 hr, >$600m TVL

Hyperliquid spot tokens such as $JEFF , $POINTS $HFUN have been making 8 - 10x from launch while earning HL points for holders

5/8

By being a $RAGE token holder you decide how $RAGE invests it's treasury as a hyperliquid LP and made decisions on hyperliquid's ecosystem direction

6/8

6/8

https://twitter.com/1328977776523808769/status/1816428830044639266

$RAGE aims to be the defacto perp aggregator across every chain with upcoming plans to integrate

- Solana (Drift, Zeta)

- Appchains (Reya blackwing)

- Berachain perps

7/8

- Solana (Drift, Zeta)

- Appchains (Reya blackwing)

- Berachain perps

7/8

When is the rage TGE happening?

The $RAGE TGE will be happening on Fjord foundry on july 31 while $RAGE will be spot seeded onto hyperliquid L1 and available on August 7 - 9

More details here

👇

The $RAGE TGE will be happening on Fjord foundry on july 31 while $RAGE will be spot seeded onto hyperliquid L1 and available on August 7 - 9

More details here

👇

https://twitter.com/1328977776523808769/status/1815341196337946645

This content is done in collaboration with @rage_trade

• • •

Missing some Tweet in this thread? You can try to

force a refresh