This is Steve Cohen.

He’s the owner of the New York Mets and America’s most profitable day trader with a net worth of $19.8B

He didn’t come from riches, and he definitely didn’t have anything handed to him.

Here’s his story:

He’s the owner of the New York Mets and America’s most profitable day trader with a net worth of $19.8B

He didn’t come from riches, and he definitely didn’t have anything handed to him.

Here’s his story:

1) Early Story

Steve grew up in a middle-class family on Long Island with 7 siblings.

He liked sports - played basketball, soccer, and golf just like everyone else did.

He developed an obsession for poker which eventually led him into trading.

Here’s how he got started:

Steve grew up in a middle-class family on Long Island with 7 siblings.

He liked sports - played basketball, soccer, and golf just like everyone else did.

He developed an obsession for poker which eventually led him into trading.

Here’s how he got started:

2) Traded College Tuition Money

Steve went to Wharton at the University of Pennsylvania and studied economics.

His Father put the money for his college tuition in his checking account and Steve traded that money but ended up breaking even by the end of the school year.

Until..

Steve went to Wharton at the University of Pennsylvania and studied economics.

His Father put the money for his college tuition in his checking account and Steve traded that money but ended up breaking even by the end of the school year.

Until..

3) First Day At Gruntal

On his first day at the firm, Steve made $8k buying stock and put options.

He was supposed to make $12k per year, but his earnings went up when he started to make the firm roughly $100k/day.

So he said screw the firm 👇

On his first day at the firm, Steve made $8k buying stock and put options.

He was supposed to make $12k per year, but his earnings went up when he started to make the firm roughly $100k/day.

So he said screw the firm 👇

4) Starting His Firm

Steve stayed at Gruntal for 14 years managing over $75M and eventually decided to start his own firm

“SAC”

His approach remained the same, and his goal was simply to make more money.

The firm did extremely well and traded with shocking numbers:

Steve stayed at Gruntal for 14 years managing over $75M and eventually decided to start his own firm

“SAC”

His approach remained the same, and his goal was simply to make more money.

The firm did extremely well and traded with shocking numbers:

5) SAC Success

“SAC” - named after Steven A. Cohen’s initials, started trading with $25M in 1992.

The firm averaged 30% annual returns and eventually managed $16B in funds.

Everything was going well until something unexpected happened:

“SAC” - named after Steven A. Cohen’s initials, started trading with $25M in 1992.

The firm averaged 30% annual returns and eventually managed $16B in funds.

Everything was going well until something unexpected happened:

6) Legal Issues

In 2013, Cohen and SAC pleaded guilty to insider trading and paid $1.8B in fines

Steve was prohibited from managing any outside money for 2 years, and his capital portfolio manager Mathew Martoma went to prison for 9 years.

In 2013, Cohen and SAC pleaded guilty to insider trading and paid $1.8B in fines

Steve was prohibited from managing any outside money for 2 years, and his capital portfolio manager Mathew Martoma went to prison for 9 years.

7) Second Firm

In 2014, Cohen got a fresh start when he founded his new firm “Point72 Ventures”.

The firm was wildly successful, but its short squeeze in the infamous “Gamestop frenzy” cost Point72 15% of a whopping $19B portfolio.

A movie was made about this, and Vincent D’Onofrio plays Steve’s character in the 2023 film “Dumb Money”.

Here’s how he bounced back from this loss:

In 2014, Cohen got a fresh start when he founded his new firm “Point72 Ventures”.

The firm was wildly successful, but its short squeeze in the infamous “Gamestop frenzy” cost Point72 15% of a whopping $19B portfolio.

A movie was made about this, and Vincent D’Onofrio plays Steve’s character in the 2023 film “Dumb Money”.

Here’s how he bounced back from this loss:

8) Using Data

Point72 doesn’t use data as their entire strategy, they use it as a “tool” to get a real-time look at what’s going on inside companies.

More specifically, Point72 uses credit card data to see trends in the economy.

Data plays a huge roll in Steve’s strategy, but what comes next is even more important:

Point72 doesn’t use data as their entire strategy, they use it as a “tool” to get a real-time look at what’s going on inside companies.

More specifically, Point72 uses credit card data to see trends in the economy.

Data plays a huge roll in Steve’s strategy, but what comes next is even more important:

9) Investing Edge

“You need to interrogate the data.”

Steve finds out that companies are running tests of new products, he finds out where it’s happening, and if the tests were successful or not.

Based on the product’s success, he will determine whether or not the company will deliver it to the rest of the country, giving him a certain inclination of the stock’s likelihood to go up or down.

Something unexpected:

“You need to interrogate the data.”

Steve finds out that companies are running tests of new products, he finds out where it’s happening, and if the tests were successful or not.

Based on the product’s success, he will determine whether or not the company will deliver it to the rest of the country, giving him a certain inclination of the stock’s likelihood to go up or down.

Something unexpected:

10) Worst Investment Ever

Steve lost roughly $100M in a single company in 2002.

Even the “Hedge Fund King” takes big losses.

“You’re going to have bad days if you stick around long enough.”

So, what have we learned?

Steve lost roughly $100M in a single company in 2002.

Even the “Hedge Fund King” takes big losses.

“You’re going to have bad days if you stick around long enough.”

So, what have we learned?

11) Conclusion

Steve Cohen is undoubtedly one of the most profitable and overall successful hedge fund managers of all time.

Now, had he avoided the legal trouble, he would have saved himself billions.

What if I told you there’s a simple way he could’ve avoided this?

Steve Cohen is undoubtedly one of the most profitable and overall successful hedge fund managers of all time.

Now, had he avoided the legal trouble, he would have saved himself billions.

What if I told you there’s a simple way he could’ve avoided this?

12) New Investment Vehicle

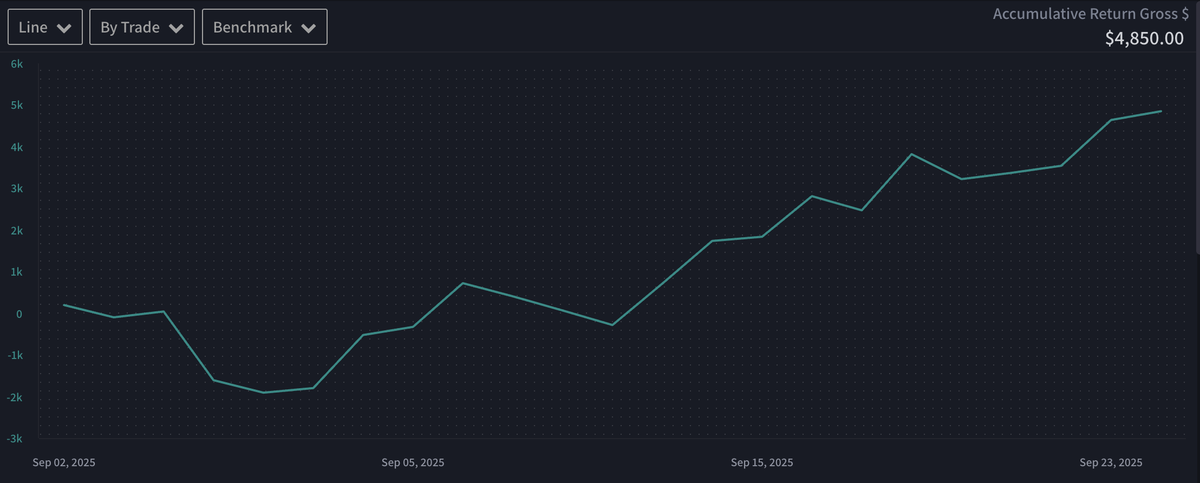

There's a new investment, "Trading Bots" that average a 39% yearly ROI

With over $150m in trading volume and 100,000 orders, it's the next best thing

There's a free waitlist to access it right now with the link below 👇

041dooxq0xo.typeform.com/to/QKw3VX1s

There's a new investment, "Trading Bots" that average a 39% yearly ROI

With over $150m in trading volume and 100,000 orders, it's the next best thing

There's a free waitlist to access it right now with the link below 👇

041dooxq0xo.typeform.com/to/QKw3VX1s

And if you guys enjoyed this thread...

Feel free to follow me @FT__Trading

I'm a Full Time Day Trader 7 years and make weekly threads about trading and investing!

Feel free to follow me @FT__Trading

I'm a Full Time Day Trader 7 years and make weekly threads about trading and investing!

• • •

Missing some Tweet in this thread? You can try to

force a refresh