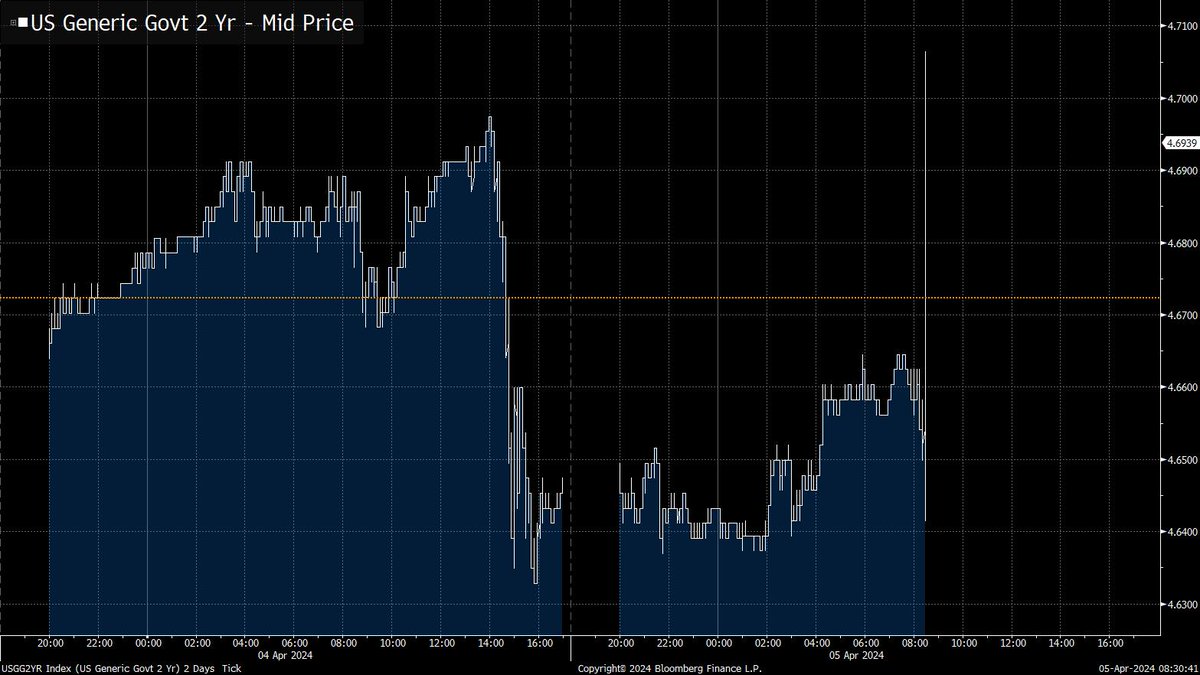

BREAKING:

BIG MISS ON UNEMPLOYMENT. UNEMPLOYMENT RISES TO 4.3%

JUST 114K NEW JOBS

Economists had expected 175K jobs and an unemployment rate of 4.1%.

bloomberg.com/news/live-blog…

BIG MISS ON UNEMPLOYMENT. UNEMPLOYMENT RISES TO 4.3%

JUST 114K NEW JOBS

Economists had expected 175K jobs and an unemployment rate of 4.1%.

bloomberg.com/news/live-blog…

Last two months revised downward by 29K

Average hourly earnings grow just 0.2%

U6 Underemployment rises to 7.8% from 7.4%

Average Weekly Hours falls to 34.2

Average hourly earnings grow just 0.2%

U6 Underemployment rises to 7.8% from 7.4%

Average Weekly Hours falls to 34.2

Also credit to Neil Dutta of @RenMacLLC who was warning about this risk a month and a half ago podcasts.apple.com/us/podcast/lot…

"The number of unemployed people increased by 352,000 to 7.2 million"

• • •

Missing some Tweet in this thread? You can try to

force a refresh