The house always wins.

What if YOU could be the house with JLP ?!

In this thread, I’ll tell you everything about the not-so-hidden gem of @JupiterExchange

What if YOU could be the house with JLP ?!

In this thread, I’ll tell you everything about the not-so-hidden gem of @JupiterExchange

Introdcution

JLP is the liquidity provider token for @JupiterExchange's perpetual exchange.

Before we dive into JLP, it's important to understand what a perpetual exchange is.

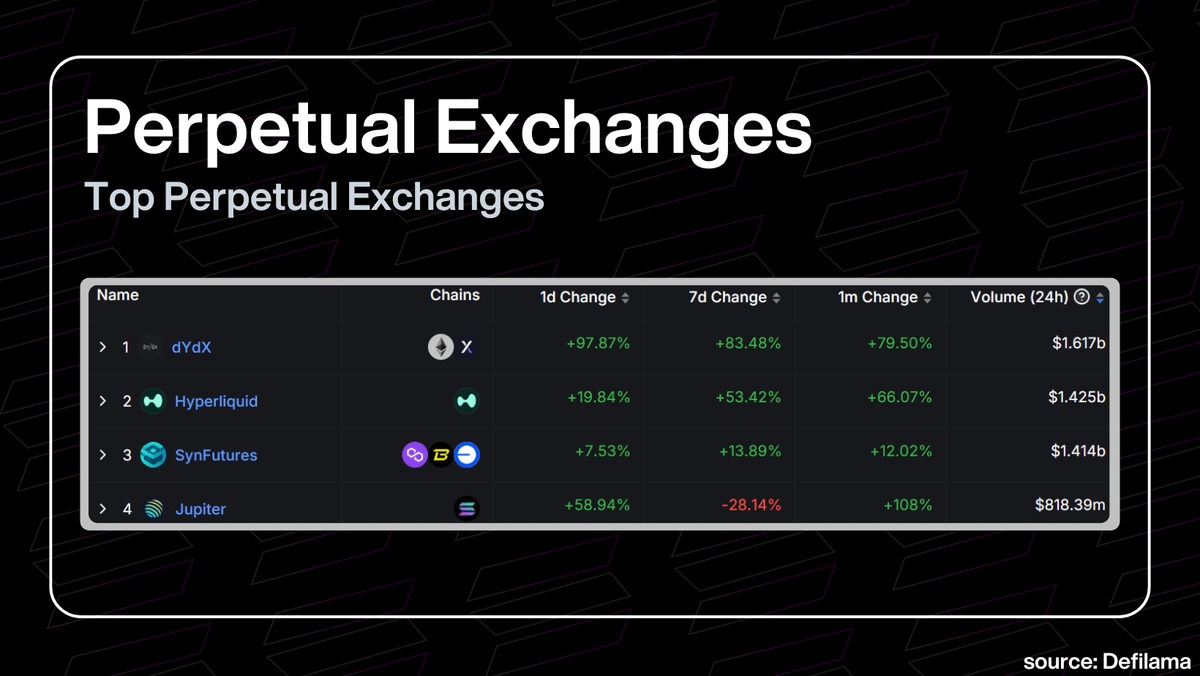

Perps trading is booming in 2024, making a strong comeback after 2022 highs.

JLP is the liquidity provider token for @JupiterExchange's perpetual exchange.

Before we dive into JLP, it's important to understand what a perpetual exchange is.

Perps trading is booming in 2024, making a strong comeback after 2022 highs.

Mechanism of Perps Trading

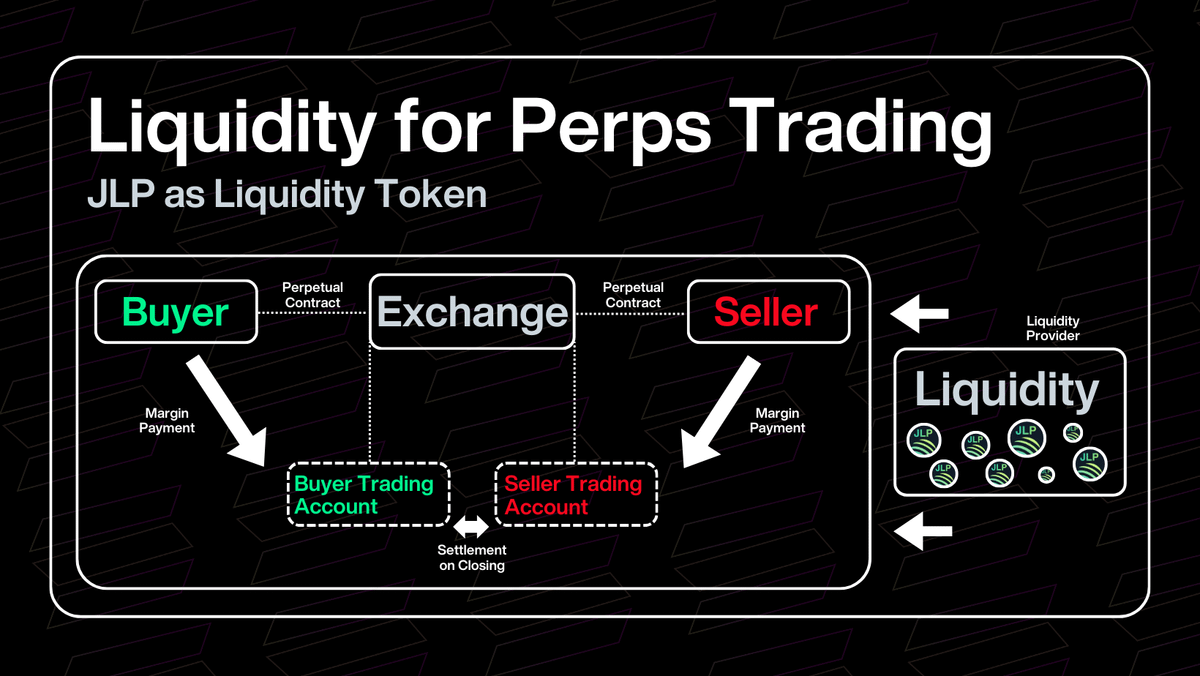

Perpetual trading allows you to speculate on future token prices. It lets you buy or sell an asset at a set price without an expiry date.

When placing an order, the user makes an initial margin payment to the exchange. Additional margin payments may be required as long as the position remains open.

→ This is how Perpetual Exchanges generate revenue.

Perpetual trading allows you to speculate on future token prices. It lets you buy or sell an asset at a set price without an expiry date.

When placing an order, the user makes an initial margin payment to the exchange. Additional margin payments may be required as long as the position remains open.

→ This is how Perpetual Exchanges generate revenue.

Perps Trading on Jupiter

@JupiterExchange offers its own Perpetual Exchange with up to 100x leverage. It ensures zero price impact, zero slippage, and deep liquidity.

Since its launch last February, Jupiter's Perpetuals Exchange has quickly become the largest on Solana and one of the top five in the entire crypto space.

@JupiterExchange offers its own Perpetual Exchange with up to 100x leverage. It ensures zero price impact, zero slippage, and deep liquidity.

Since its launch last February, Jupiter's Perpetuals Exchange has quickly become the largest on Solana and one of the top five in the entire crypto space.

Back to JLP

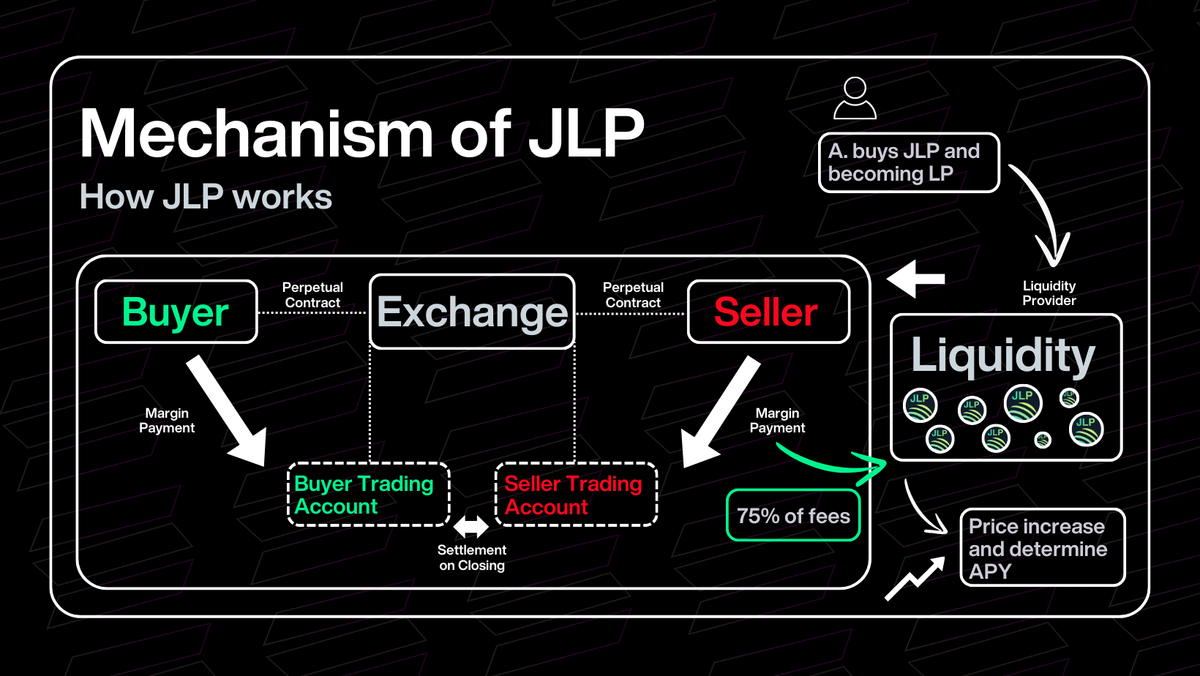

JLP is the LP token for @JupiterExchange's perpetual exchange.

For a perpetual exchange to function, it needs liquidity for traders. Liquidity providers, also known as JLP holders, ensure there is sufficient liquidity.

By holding JLP, you automatically become a liquidity provider for Jupiter's Perps Exchange. At the same time, you can be the house...

JLP is the LP token for @JupiterExchange's perpetual exchange.

For a perpetual exchange to function, it needs liquidity for traders. Liquidity providers, also known as JLP holders, ensure there is sufficient liquidity.

By holding JLP, you automatically become a liquidity provider for Jupiter's Perps Exchange. At the same time, you can be the house...

Benefits for LPs

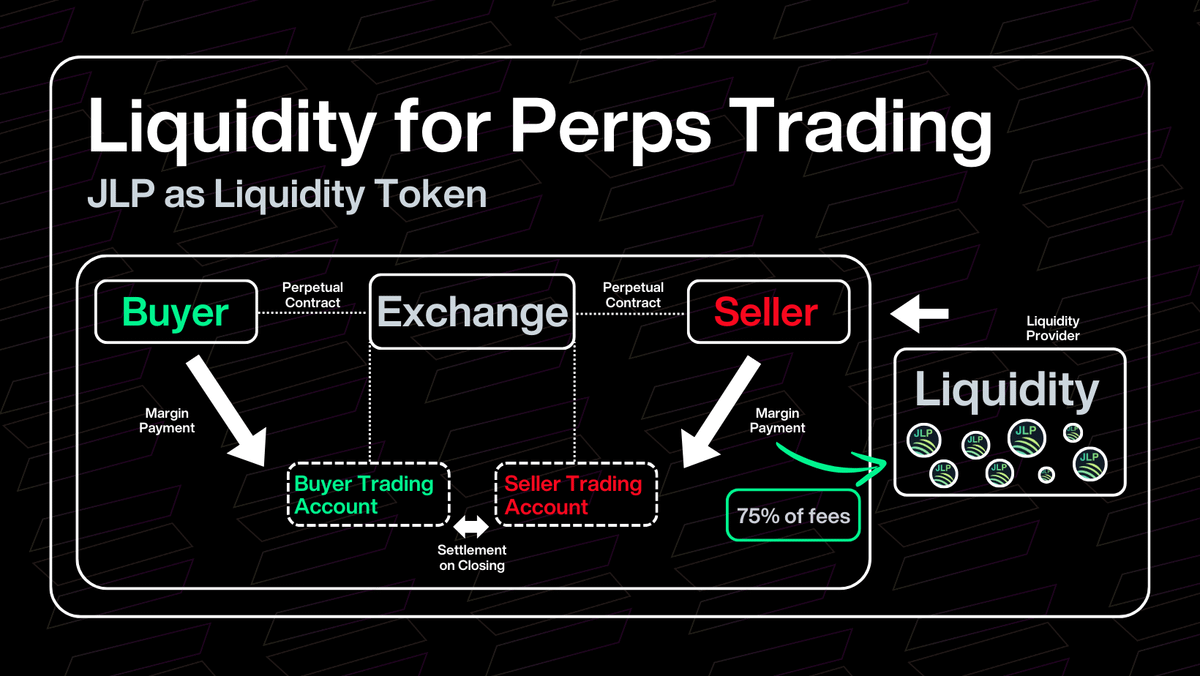

Be the house as JLP holders receive 75% of the Perpetual Exchange trading fees.

So will Jupiter airdrop the fees? NO, Jupiter reinvests your fees automatically, increasing your share over time

Be the house as JLP holders receive 75% of the Perpetual Exchange trading fees.

So will Jupiter airdrop the fees? NO, Jupiter reinvests your fees automatically, increasing your share over time

APY

75% of the fees generated from Jup perps are allocated to the JLP pool, which results in an increase in both the JLP pool size and the JLP price.

This generates an APY displayed on @JupiterExchange.

→ The current APY is 70% (subject to change).

So, is JLP an infinite money glitch?

75% of the fees generated from Jup perps are allocated to the JLP pool, which results in an increase in both the JLP pool size and the JLP price.

This generates an APY displayed on @JupiterExchange.

→ The current APY is 70% (subject to change).

So, is JLP an infinite money glitch?

Money Glitch?

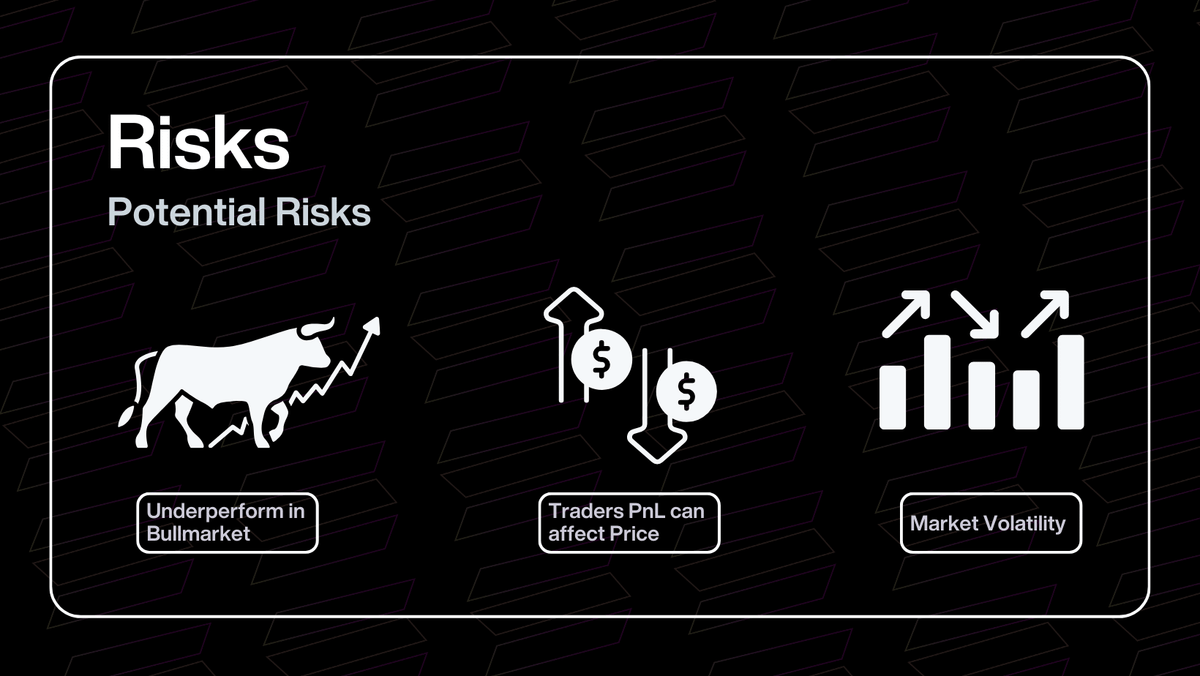

Not really. Reward comes with risks.

JLP might underperform SOL, ETH, or BTC in a bull market due to its token mix. On top of that there other risks too.

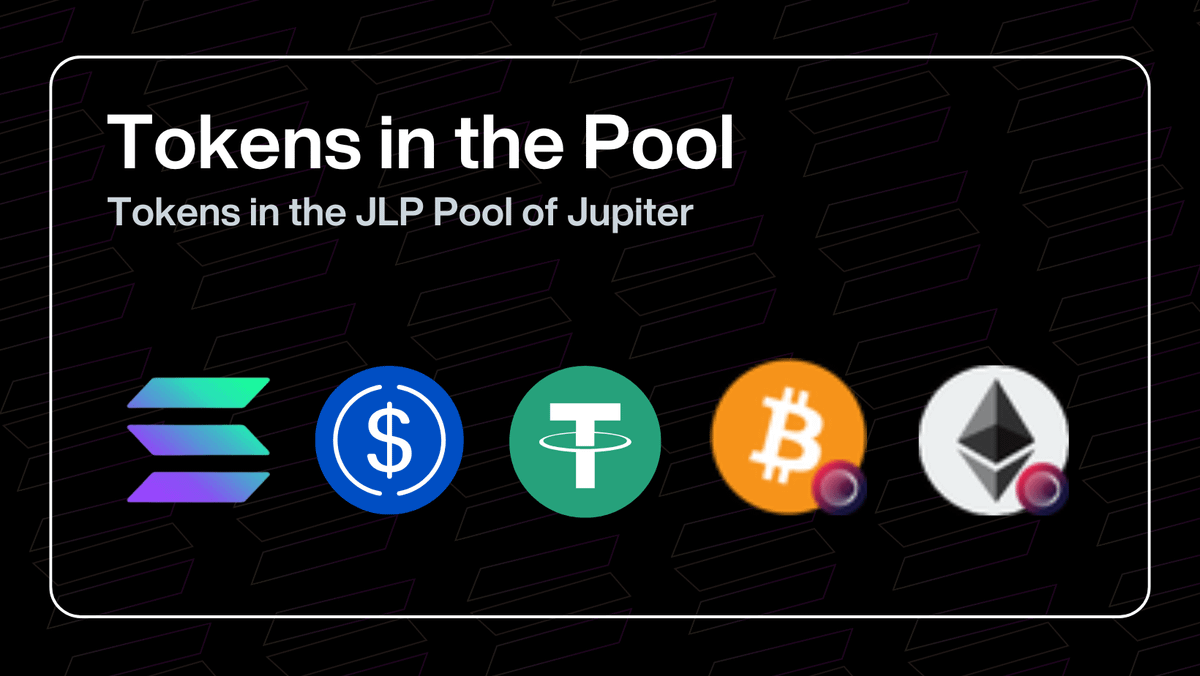

When an LP adds liquidity to the JLP pool, they increase the total value locked (TVL), enhancing the liquidity for trading. The pool currently comprises the following tokens

Not really. Reward comes with risks.

JLP might underperform SOL, ETH, or BTC in a bull market due to its token mix. On top of that there other risks too.

When an LP adds liquidity to the JLP pool, they increase the total value locked (TVL), enhancing the liquidity for trading. The pool currently comprises the following tokens

Other Risks

→ Bull Markets: JLP might underperform SOL, ETH, or BTC because of its token mix. You might want to exchange stablecoins (USDC/USDT) for JLP to boost trading yield.

→ PNL Effects: Traders' PNL can affect the JLP pool—profits for traders mean losses for the pool, while traders' losses result in gains for the pool.

→ Value Volatility: The worth of JLP might drop owing to market swings and fees, potentially making the withdrawn tokens less valuable than your original deposit.

→ Bull Markets: JLP might underperform SOL, ETH, or BTC because of its token mix. You might want to exchange stablecoins (USDC/USDT) for JLP to boost trading yield.

→ PNL Effects: Traders' PNL can affect the JLP pool—profits for traders mean losses for the pool, while traders' losses result in gains for the pool.

→ Value Volatility: The worth of JLP might drop owing to market swings and fees, potentially making the withdrawn tokens less valuable than your original deposit.

Using JLP in DeFi - NxFinance

On @NX_Finance you can leverage JLP up to 5x. This ofc comes with a bigger risk (Liquidation). Still JLP has a steady uptrend with much less volatility than other tokens.

Join my team for a 30% Boost:

🔗 Read this thread if you want to know more about NxFinance: nxfinance.io/airdrop?invite…

On @NX_Finance you can leverage JLP up to 5x. This ofc comes with a bigger risk (Liquidation). Still JLP has a steady uptrend with much less volatility than other tokens.

Join my team for a 30% Boost:

🔗 Read this thread if you want to know more about NxFinance: nxfinance.io/airdrop?invite…

https://x.com/FabianoSolana/status/1807713740898414831

Using JLP in DeFi - Kamino

Kamino has a similar feature called Multiply.

Multiply is a one-click vault that leverages yield-bearing assets using K-Lend mechanisms.

You can boost your yield exposure up to 5x (Liquidation Risk)!

🔗 Read this thread if you want to know more about Multiply:

Kamino has a similar feature called Multiply.

Multiply is a one-click vault that leverages yield-bearing assets using K-Lend mechanisms.

You can boost your yield exposure up to 5x (Liquidation Risk)!

🔗 Read this thread if you want to know more about Multiply:

https://x.com/jussy_world/status/1819645680194838752

tl;dr

JLP and its holders benefit from high yields generated by user fees, making it a good opportunity to hedge the market during a downtrend.

Higher trading volume means higher earnings for JLP holders, so JLP can be advantageous in volatile markets as well.

JLP and its holders benefit from high yields generated by user fees, making it a good opportunity to hedge the market during a downtrend.

Higher trading volume means higher earnings for JLP holders, so JLP can be advantageous in volatile markets as well.

• • •

Missing some Tweet in this thread? You can try to

force a refresh