If you just woke up and are wondering what's happening with the markets, grab a cup of tea and buckle up.. let me explain:

🧵

🧵

What has really happened in the markets?

▶️ USDJPY is down 0.85% today and down 10.31% from 3rd July. The Yen has strengthened after the surprise 15ps rate hike to 0.25%.

▶️ Bitcoin is down 7.66% today after making some recovery. It was down 11.5% earlier today. Compared to last week's high, it is down 22% from$70k to $54.6k. Other cryptos are dumping harder.

▶️ The Nasdaq is down 2.13% today and down 13.25% from it's all-time high recorded on 11th July 2024. This is officially a correction and if it extends the losses to 25% drom, now we will enter a crash territory.

▶️ Last week on Friday, Warren Buffet declared that Berkshire sold 55.8% of its Apple stocks in Q1 and Q2. That's about 505 million shares.

▶️ Japan's Nikkei 225 index is down over 2% this morning. Last week on Friday, it dropped over 5%. The index is down about 20% since its all-time high of ¥42,493 on 11th July.

▶️ The Tokyo Stock Price Index (TOPIX) is down 5.73% today and down over 17% in the last 30 days.

▶️ The Korea Composite Stock Price Index (KOSPI) is down 5.55% today and over 11% in the last month.

▶️ The US 10-yr treasury is down -0.015 to 3.779% today. It was at 5% on 19th Oct 2023, and 4.7% in April this year.

▶️ USDJPY is down 0.85% today and down 10.31% from 3rd July. The Yen has strengthened after the surprise 15ps rate hike to 0.25%.

▶️ Bitcoin is down 7.66% today after making some recovery. It was down 11.5% earlier today. Compared to last week's high, it is down 22% from$70k to $54.6k. Other cryptos are dumping harder.

▶️ The Nasdaq is down 2.13% today and down 13.25% from it's all-time high recorded on 11th July 2024. This is officially a correction and if it extends the losses to 25% drom, now we will enter a crash territory.

▶️ Last week on Friday, Warren Buffet declared that Berkshire sold 55.8% of its Apple stocks in Q1 and Q2. That's about 505 million shares.

▶️ Japan's Nikkei 225 index is down over 2% this morning. Last week on Friday, it dropped over 5%. The index is down about 20% since its all-time high of ¥42,493 on 11th July.

▶️ The Tokyo Stock Price Index (TOPIX) is down 5.73% today and down over 17% in the last 30 days.

▶️ The Korea Composite Stock Price Index (KOSPI) is down 5.55% today and over 11% in the last month.

▶️ The US 10-yr treasury is down -0.015 to 3.779% today. It was at 5% on 19th Oct 2023, and 4.7% in April this year.

How's Japan involved in all this?

Well, Japan cut rates to 0% in 2010 and then to -0.1% in 2016. This ensured that the cost of money remained close to zero.

This led to Japanese and international investors borrowing from Japan at near zero rates and investing majorly in the US for higher returns from US bonds, stocks, and even cryptocurrencies.

Japan's monetary policy also involved massive JGB purchases that basically means printing a whole lot of Yen. This was meant to fight deflation.

So, the investors holding JPY-denominated loans also benefited from the JPY losing value to the USD as the BOJ increased the Yen supply.

In Jan 2010, USDJPY was trading at 90. The Yen continued losing to the dollar and hit 161.9 in July this year. All the Yen carry traders enjoyed this since their forex earnings lowered their obligations.

As of April 2024, Japan was the biggest holder of US bonds with an accumulated position of $1.15 trillion.

As the US hiked rates from <0.25% in March 2022 to <5.50% in August 2023 and kept the rates there to date, more investors borrowed from Japan and invested in the US. This built a massive collective carry trade.

What changed?

The Bank of Japan hiked rates in March from <-0.1% to <+0.1%. It the hiked to +0.25% on July 31st. This was done to tackle high inflation that was making Japanse imports expensive and terrorizing Japanese household budgets.

Within the same period, Japan removed the yield curve control (YCC) program that locked Japan's 10-yr bond yields at +/- 0.5%. This means that yields can go much higher. The 10-yr JGP increased from 0.65% at the start of the year to over 1% before dropping to the current 0.97%.

This led to a strengthening of the Yen from last month's low of 161.9 to the current 144.9. This means that the JPY has gained about 11.3% to the USD in about 1 month. Anyone holding JPY denominated debt and invested in the US just got their debt increased by 11.3%.

The returns they are getting on US stocks and bonds just got reduced since bond yields are tanking and equities are entering correction territory, or are already there.

The interest they are paying on JPY-denomiated debt is also up since the BOJ has been hiking interest rates.

So, what's the reaction so far?

Investors are dumping US bonds (at losses), US equities (mostly in profit, albeit the recent selloff), Bitcoin (in profit, albeit the selloff) to repay their JPY-denominated loans before the BOJ hikes rates further and the JPY strengthens further, and before JGBs become more attractive due to increasing yields.

What could possibly stop this train?

BOJ cutting rates again and re-implementing YCC with more quantitative easing (QE). Is it happening? No. Japan's inflation has remained above the 2% BOJ target since March 2022. It has led to increase in household prices.

Nothing can stop this train.

That's why I told @DavidNdii that getting a JPY bond this year was synonymous to monetary policy suicide on the Kenyan side.

Why is the market overreacting?

When there is an arbitrage opportunity, people get greedy. The JPY carry trade was levered over 10x which means there's even more risk in the derivatives market. Anyone who assumed the BOJ would hold rates below zero or close to zero forever without an appropriate hedge is basically fucked.

Did you see Nvidia gaining over $1 trillion in market cap in H1? The JPY carry trade was the backdrop fuelling this and the entire magnificient seven.

Well, Japan cut rates to 0% in 2010 and then to -0.1% in 2016. This ensured that the cost of money remained close to zero.

This led to Japanese and international investors borrowing from Japan at near zero rates and investing majorly in the US for higher returns from US bonds, stocks, and even cryptocurrencies.

Japan's monetary policy also involved massive JGB purchases that basically means printing a whole lot of Yen. This was meant to fight deflation.

So, the investors holding JPY-denominated loans also benefited from the JPY losing value to the USD as the BOJ increased the Yen supply.

In Jan 2010, USDJPY was trading at 90. The Yen continued losing to the dollar and hit 161.9 in July this year. All the Yen carry traders enjoyed this since their forex earnings lowered their obligations.

As of April 2024, Japan was the biggest holder of US bonds with an accumulated position of $1.15 trillion.

As the US hiked rates from <0.25% in March 2022 to <5.50% in August 2023 and kept the rates there to date, more investors borrowed from Japan and invested in the US. This built a massive collective carry trade.

What changed?

The Bank of Japan hiked rates in March from <-0.1% to <+0.1%. It the hiked to +0.25% on July 31st. This was done to tackle high inflation that was making Japanse imports expensive and terrorizing Japanese household budgets.

Within the same period, Japan removed the yield curve control (YCC) program that locked Japan's 10-yr bond yields at +/- 0.5%. This means that yields can go much higher. The 10-yr JGP increased from 0.65% at the start of the year to over 1% before dropping to the current 0.97%.

This led to a strengthening of the Yen from last month's low of 161.9 to the current 144.9. This means that the JPY has gained about 11.3% to the USD in about 1 month. Anyone holding JPY denominated debt and invested in the US just got their debt increased by 11.3%.

The returns they are getting on US stocks and bonds just got reduced since bond yields are tanking and equities are entering correction territory, or are already there.

The interest they are paying on JPY-denomiated debt is also up since the BOJ has been hiking interest rates.

So, what's the reaction so far?

Investors are dumping US bonds (at losses), US equities (mostly in profit, albeit the recent selloff), Bitcoin (in profit, albeit the selloff) to repay their JPY-denominated loans before the BOJ hikes rates further and the JPY strengthens further, and before JGBs become more attractive due to increasing yields.

What could possibly stop this train?

BOJ cutting rates again and re-implementing YCC with more quantitative easing (QE). Is it happening? No. Japan's inflation has remained above the 2% BOJ target since March 2022. It has led to increase in household prices.

Nothing can stop this train.

That's why I told @DavidNdii that getting a JPY bond this year was synonymous to monetary policy suicide on the Kenyan side.

Why is the market overreacting?

When there is an arbitrage opportunity, people get greedy. The JPY carry trade was levered over 10x which means there's even more risk in the derivatives market. Anyone who assumed the BOJ would hold rates below zero or close to zero forever without an appropriate hedge is basically fucked.

Did you see Nvidia gaining over $1 trillion in market cap in H1? The JPY carry trade was the backdrop fuelling this and the entire magnificient seven.

What next?

▶️ Warren Buffet and a cabal of other major players are holding insane cash positions. Like voltures, they will observe your panic reactions in the markets, and narrow down on some really good businesses, and then buy them at a huge discount. So, I haven't seen a company grow it revenue and sales better than Nvidia. Be on the lookout.

▶️ Due to the heated political environment in the USA, the stock market panic is not good for Biden and Kamala. We could see a bailout of the trapped banks, a negotioation with Japan to slow down the carnage, or even 50+ bps rate cuts to allow for easy money and a resumption of the bullish trend. The money printer could come back on steriods. In the last week, US debt grew by over $100 billion. At the peak of QE infinity in Covid, the US was printing about $150 billion per month.

▶️ Stocks with crazy P/E ratios could take a huge beating as investors rotate to defense and consumer cuclicals.

▶️ Warren Buffet and a cabal of other major players are holding insane cash positions. Like voltures, they will observe your panic reactions in the markets, and narrow down on some really good businesses, and then buy them at a huge discount. So, I haven't seen a company grow it revenue and sales better than Nvidia. Be on the lookout.

▶️ Due to the heated political environment in the USA, the stock market panic is not good for Biden and Kamala. We could see a bailout of the trapped banks, a negotioation with Japan to slow down the carnage, or even 50+ bps rate cuts to allow for easy money and a resumption of the bullish trend. The money printer could come back on steriods. In the last week, US debt grew by over $100 billion. At the peak of QE infinity in Covid, the US was printing about $150 billion per month.

▶️ Stocks with crazy P/E ratios could take a huge beating as investors rotate to defense and consumer cuclicals.

What is the wildcard?

▶️ Israel-Iran conflict could heat up today if Iran retaliates hard. This would open up the Fed printer as Biden looks to support Israel.

▶️ Energy - An all out war in the Middle-East would disrupt major oil supplychains and lead to a shortage that would lead to $100+ Brent crude prices.

▶️ Safe Haven - In times of war and other similar risks, investors trust gold and the USD. We could see a short-term rally in the DXY and a big rally in gold. Why gold? Gold is performing better than all treasuries and rivalling SP500 ytd returns.

▶️ Bitcoin - BlackRock is currently stacking Bitcoin as if its life and books depend on it. We all know that bond holdings that were bought before 2023 are in massive losses, REITs too, and now the stocks are plummeting. The only assymetric bet left is Bitcoin and the panic is yielding discounted prices.

▶️ Israel-Iran conflict could heat up today if Iran retaliates hard. This would open up the Fed printer as Biden looks to support Israel.

▶️ Energy - An all out war in the Middle-East would disrupt major oil supplychains and lead to a shortage that would lead to $100+ Brent crude prices.

▶️ Safe Haven - In times of war and other similar risks, investors trust gold and the USD. We could see a short-term rally in the DXY and a big rally in gold. Why gold? Gold is performing better than all treasuries and rivalling SP500 ytd returns.

▶️ Bitcoin - BlackRock is currently stacking Bitcoin as if its life and books depend on it. We all know that bond holdings that were bought before 2023 are in massive losses, REITs too, and now the stocks are plummeting. The only assymetric bet left is Bitcoin and the panic is yielding discounted prices.

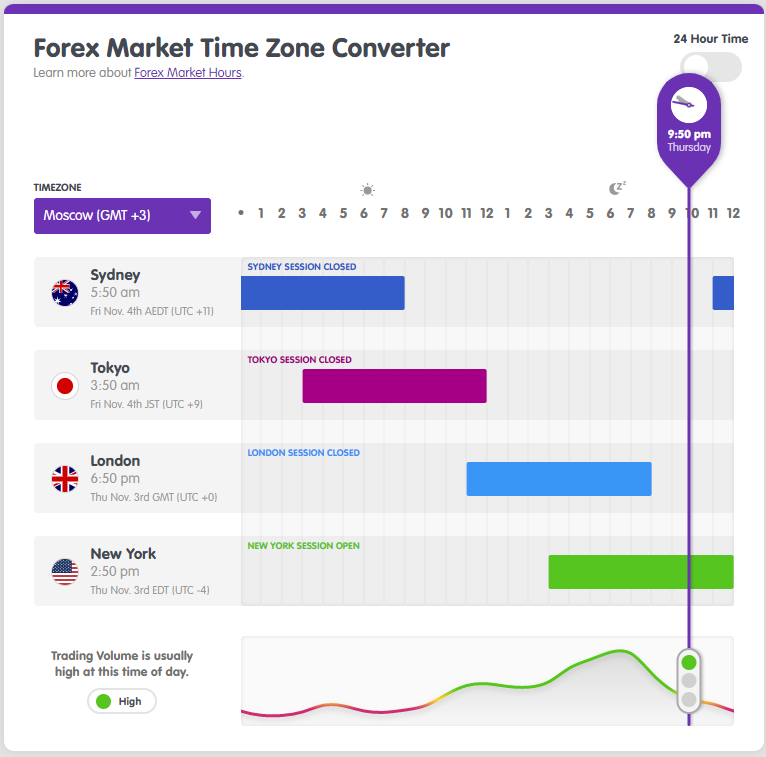

Trade forex, CFD stocks, indices, ETFs, and commodities with @FXPesa_Official. The company offers a one-stop-shop app called Equiti Trader where you can seamlessly deposit, withdraw, trade, and access trading, updates, & risk management tools. Check it out now on Google Play and Apple App Store.

• • •

Missing some Tweet in this thread? You can try to

force a refresh