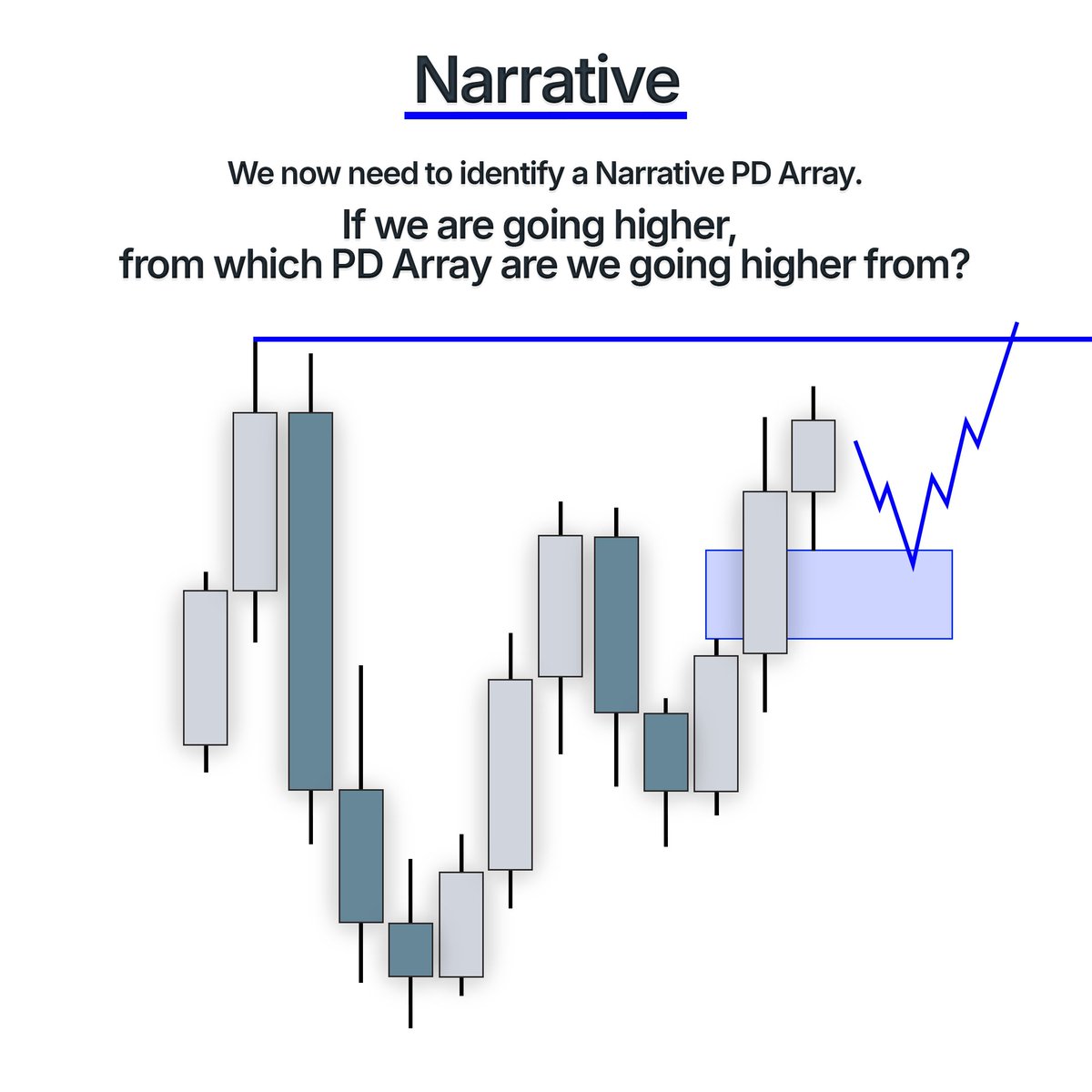

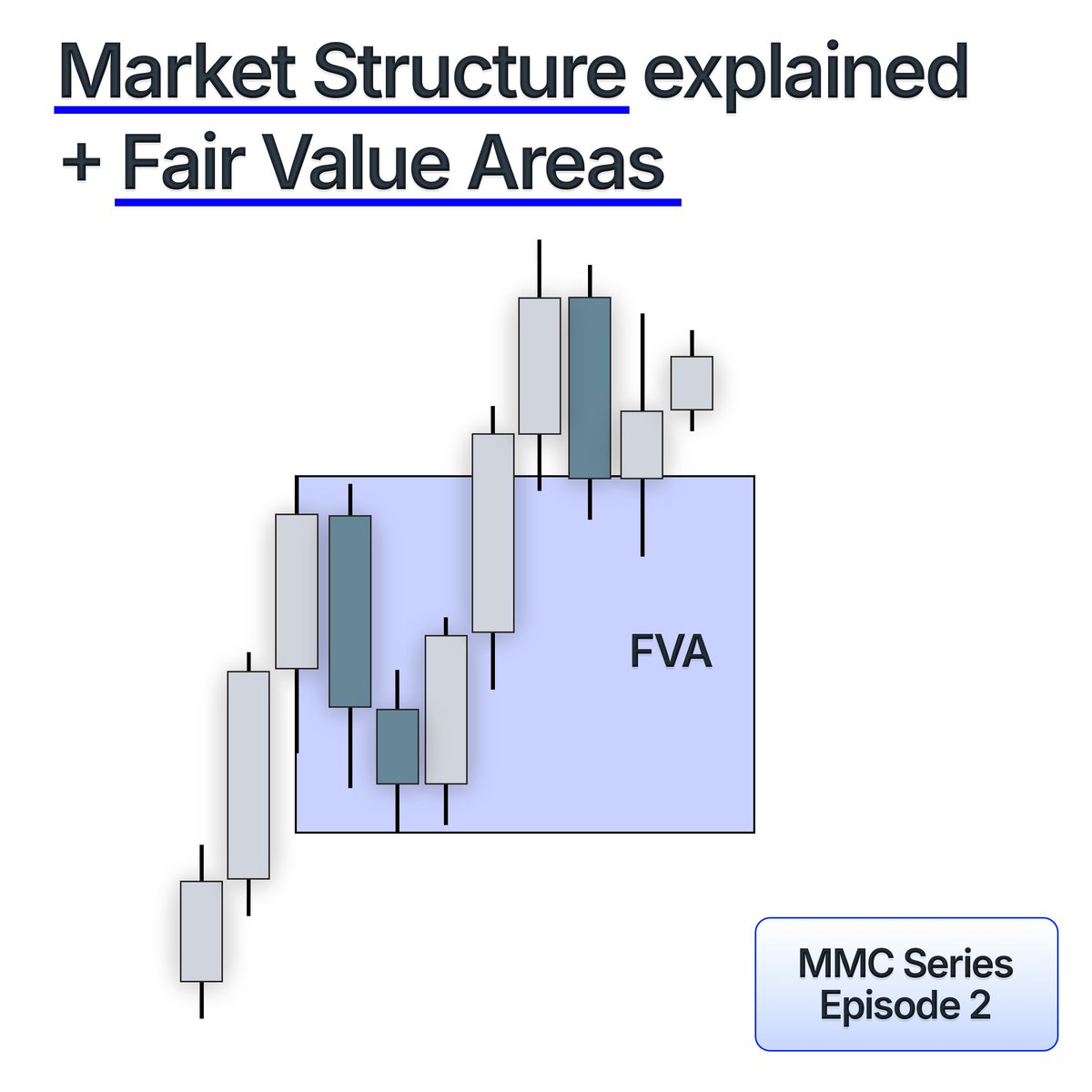

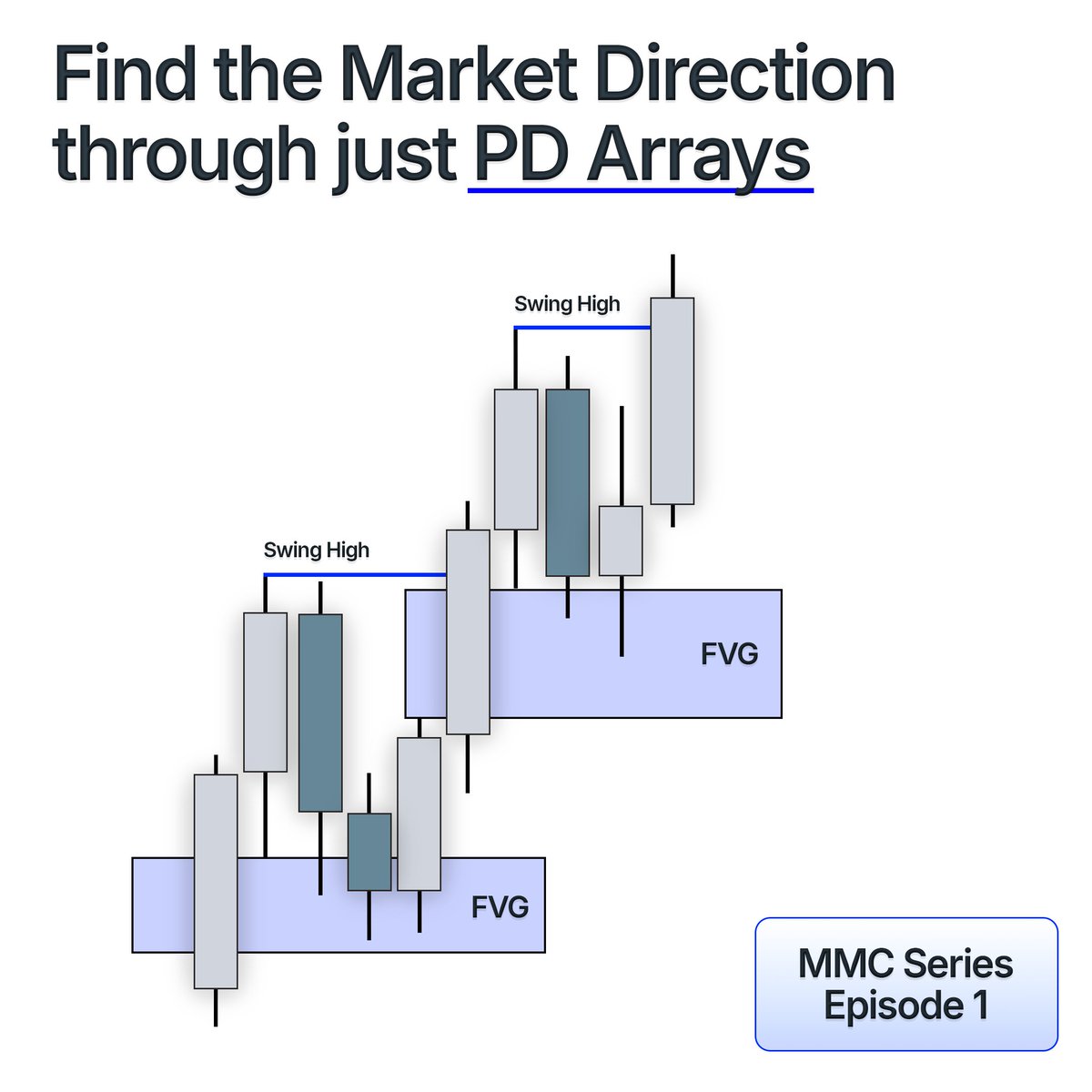

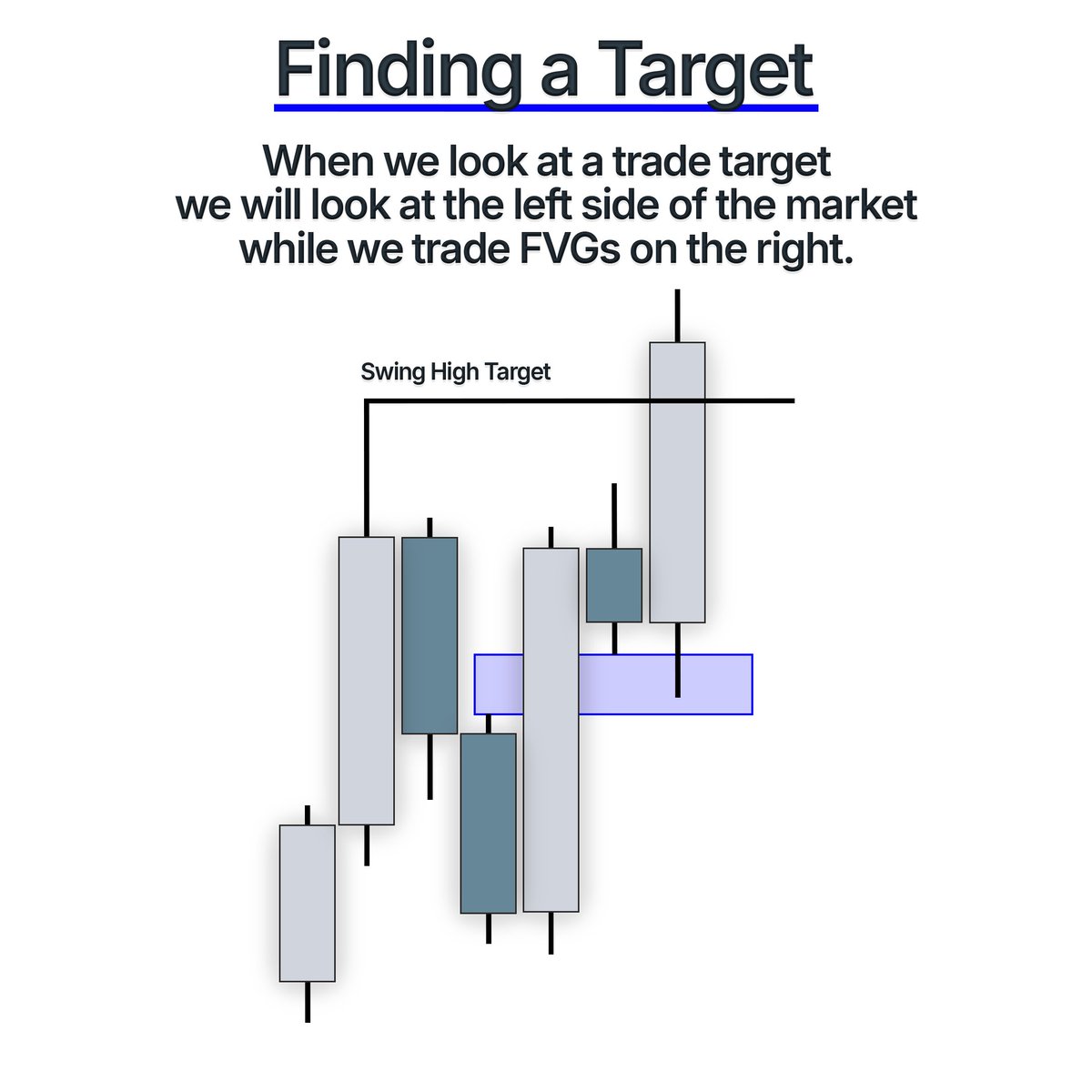

First we need to find a Target on the left side of the chart. Then we will look on the right side for a FVG to trade off of.

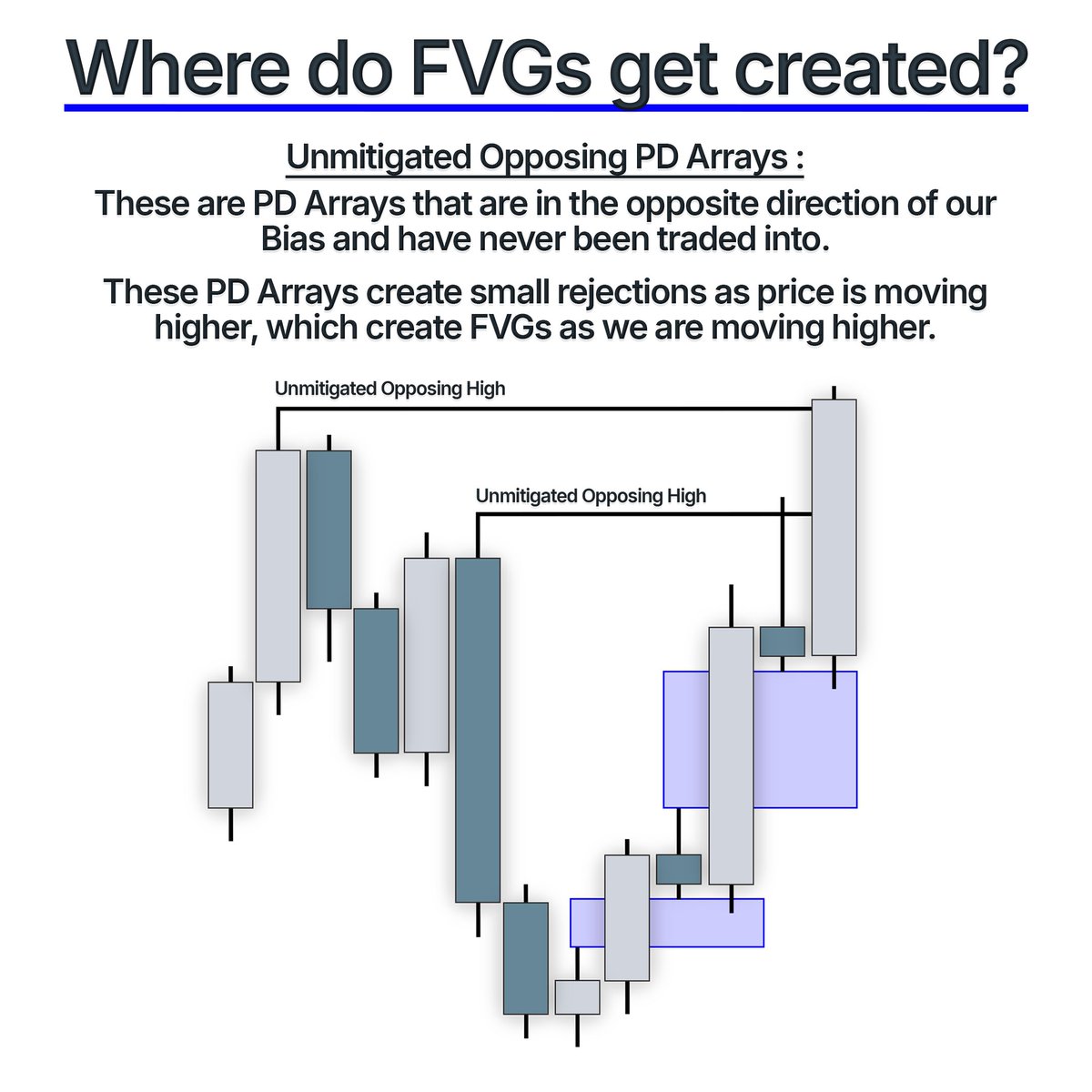

Now we need to know how these FVGs actually get created. For this we need to understand Unmitigated Opposing PD Arrays.

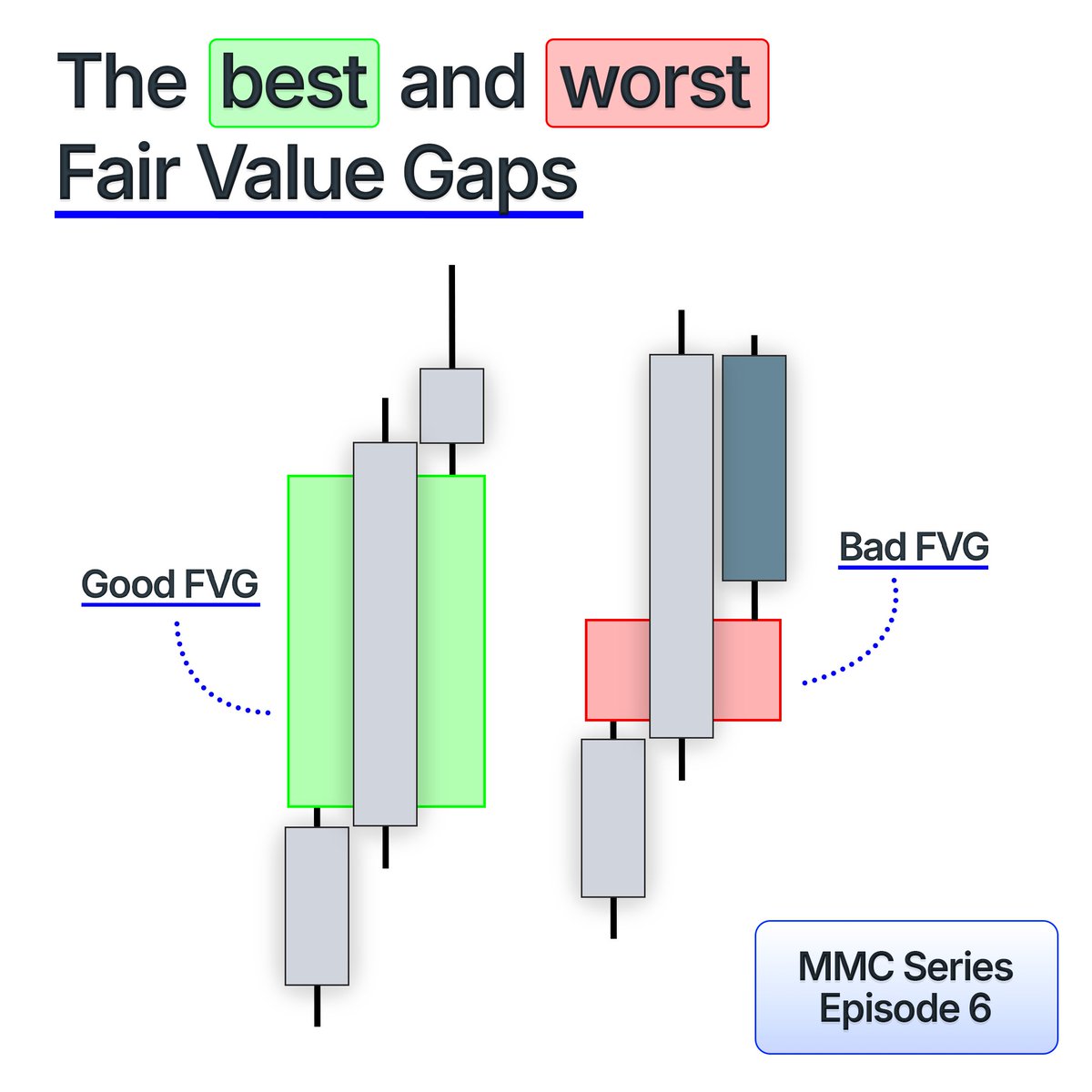

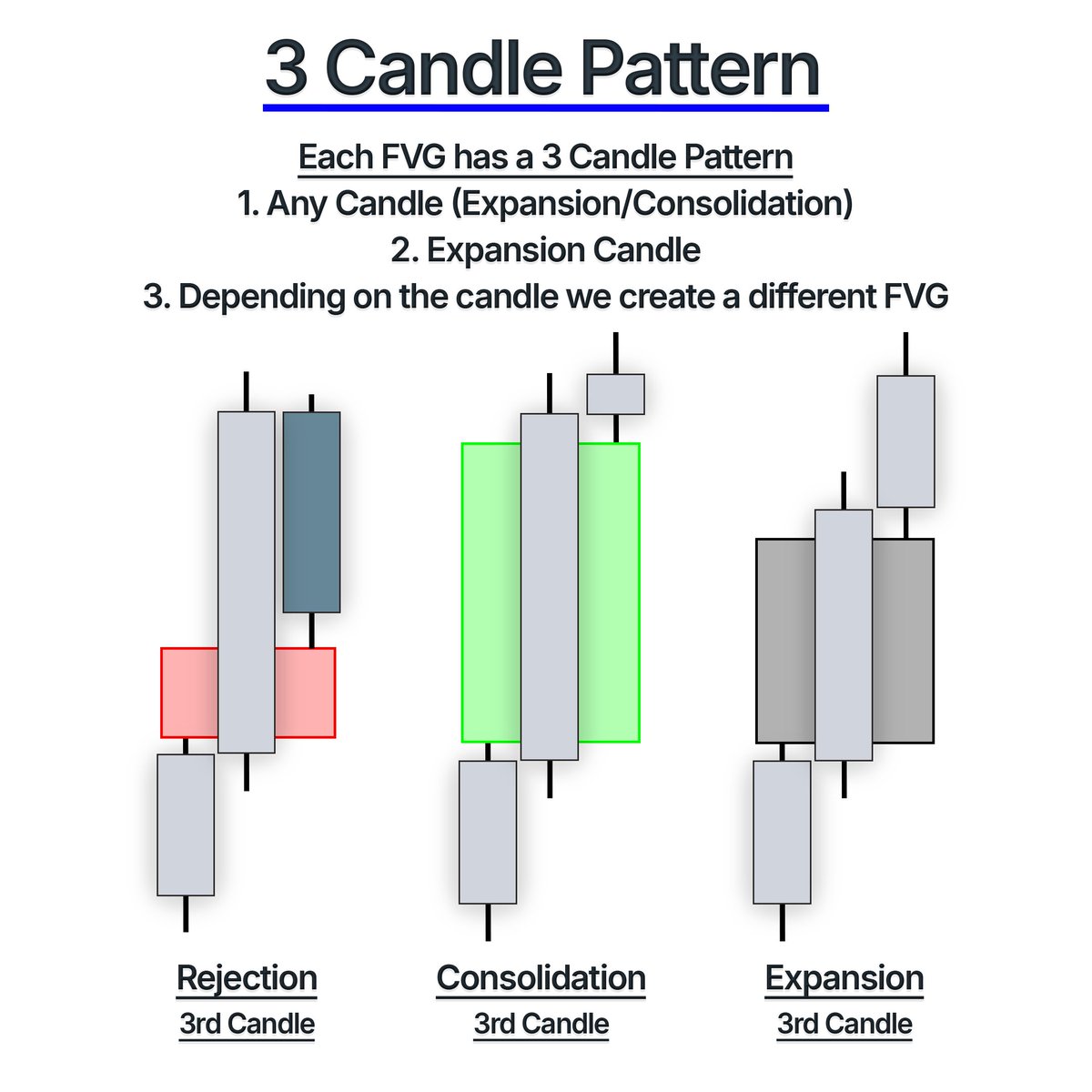

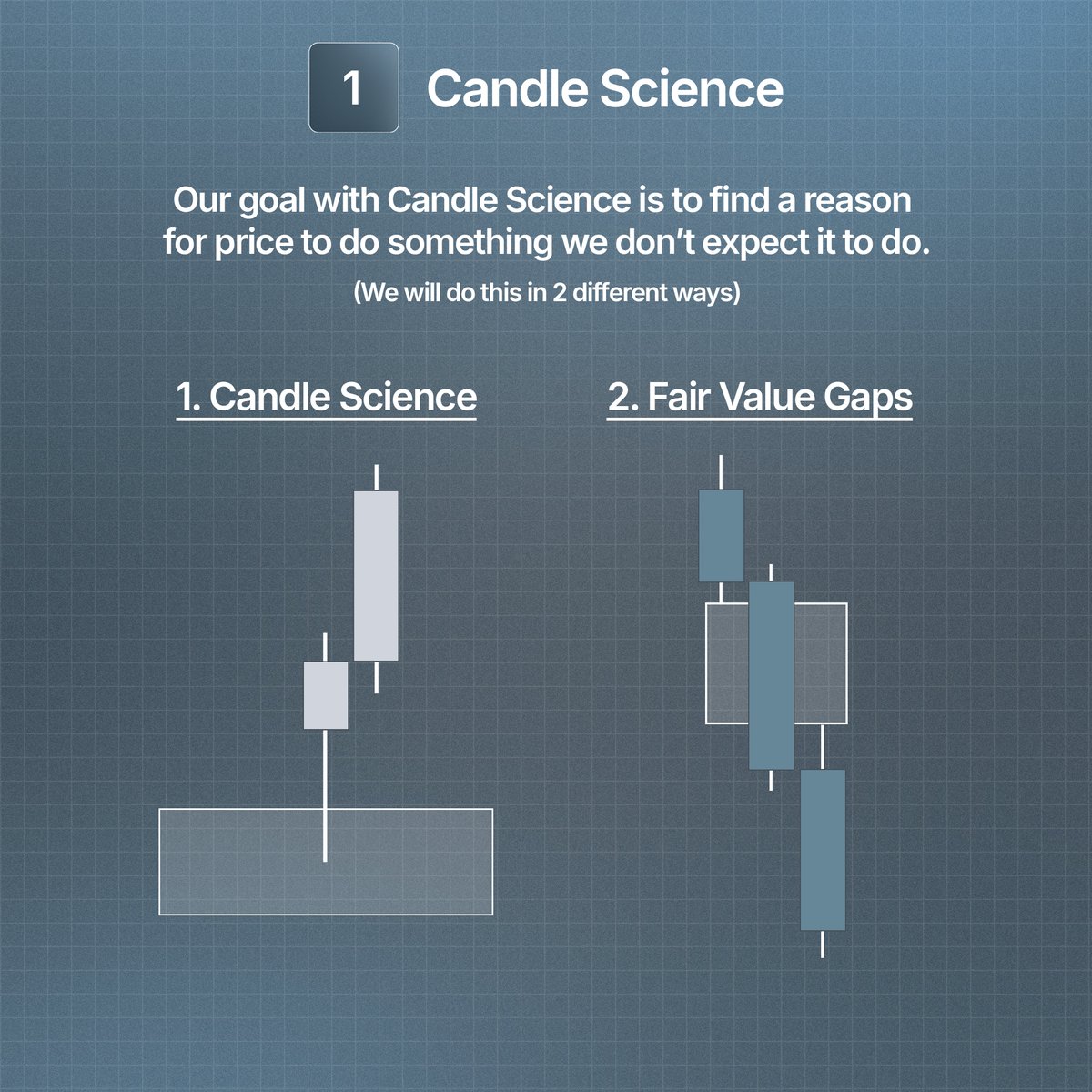

The first FVG is the RFVG. Here we have a Rejection as the 3rd candle. This is the worst FVG to trade from.

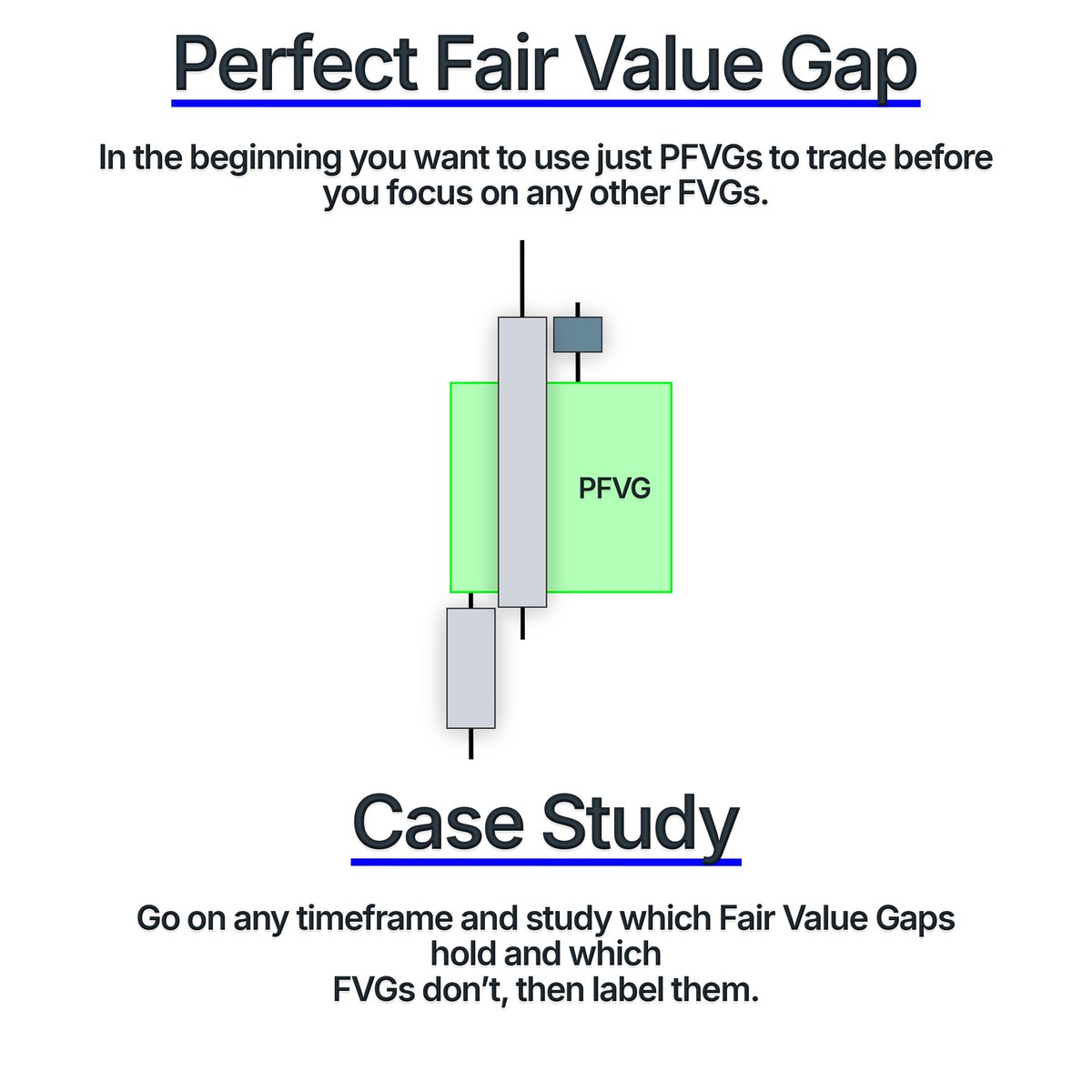

Then we have the PFVG. This is the best FVG to trade from. The 3rd candle in this FVG is a consolidation candle.

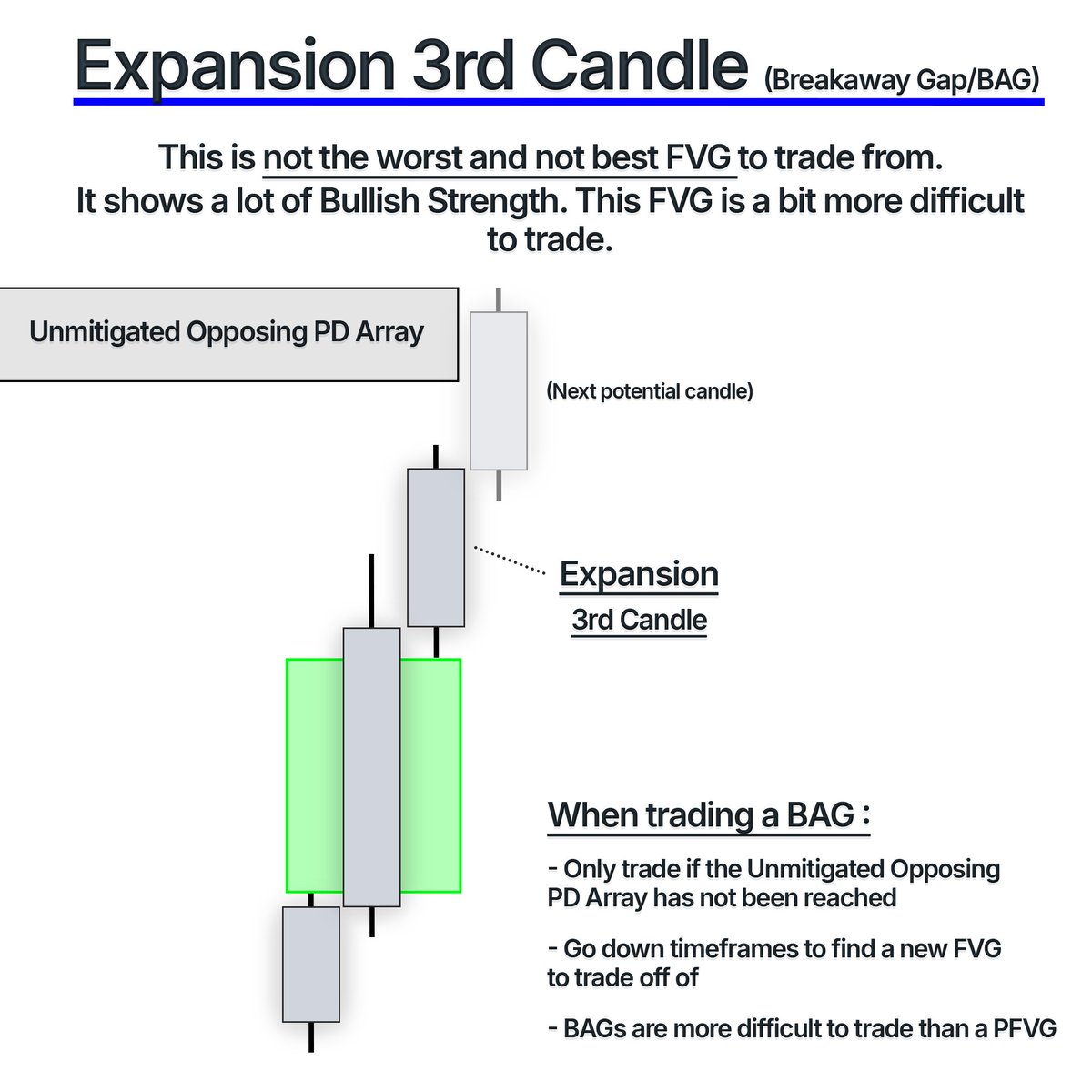

Lastly we have a Breakaway Gap (BAG). This FVG has an expansion candle as the 3rd candle. This FVG is more difficult to trade from and will require more confirmation.

As a beginner it is best to stick to just PFVGs in the beginning. To practice finding and seeing these FVGs we can do a Case Study.

Full Episode👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh