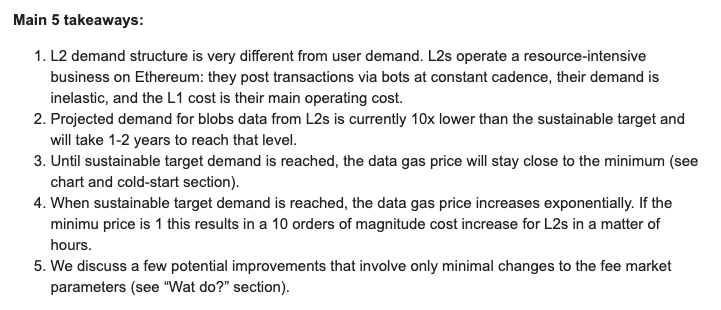

There's a post on EIP-4844 in the Ethereum research forum from last year where a researcher wrote:

"Projected demand for blob data from L2s is currently 10x lower than the sustainable target and will take 1-2 years to reach that level"

People told him he was wrong, yet his prediction was basically spot on. We're now in the "cold start" phase where demand for blobs hasn't matched the longterm target, leading to near zero blob fees.

I actually think many of the justifications for why he was wrong made sense at the time (storing NFT metadata on blobs was brought up), but this just goes to show how quickly the crypto space moves.

We're in a phase where L2s are able to tap into Ethereum's security essentially for free, without accruing any value back to L1. On a longterm horizon, if we see magnitudes of growth on rollups, blob and settlement costs back to Ethereum will start to add up making this a non-issue.

"Projected demand for blob data from L2s is currently 10x lower than the sustainable target and will take 1-2 years to reach that level"

People told him he was wrong, yet his prediction was basically spot on. We're now in the "cold start" phase where demand for blobs hasn't matched the longterm target, leading to near zero blob fees.

I actually think many of the justifications for why he was wrong made sense at the time (storing NFT metadata on blobs was brought up), but this just goes to show how quickly the crypto space moves.

We're in a phase where L2s are able to tap into Ethereum's security essentially for free, without accruing any value back to L1. On a longterm horizon, if we see magnitudes of growth on rollups, blob and settlement costs back to Ethereum will start to add up making this a non-issue.

The research post if you're interested: .ethresear.ch/t/eip-4844-fee…

• • •

Missing some Tweet in this thread? You can try to

force a refresh