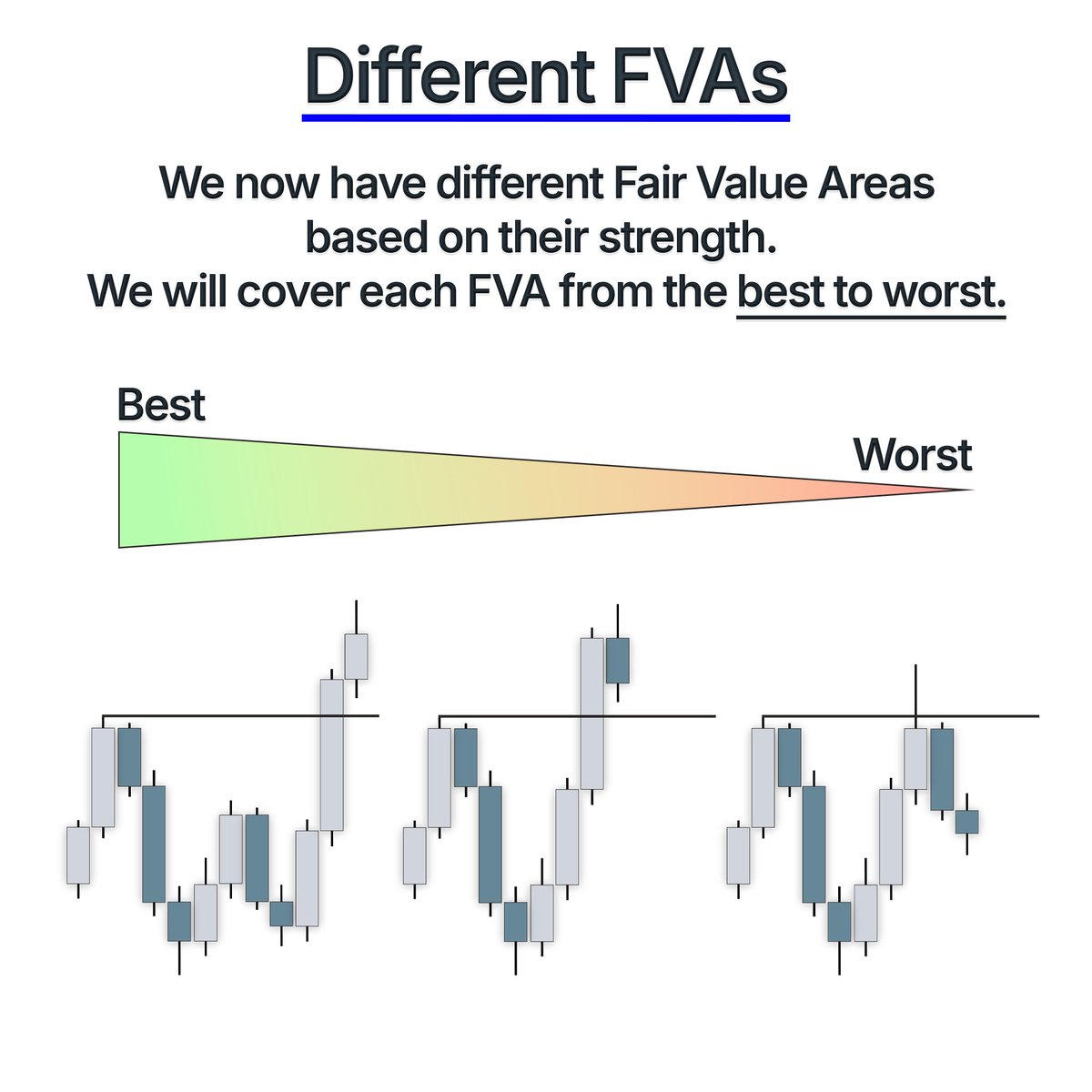

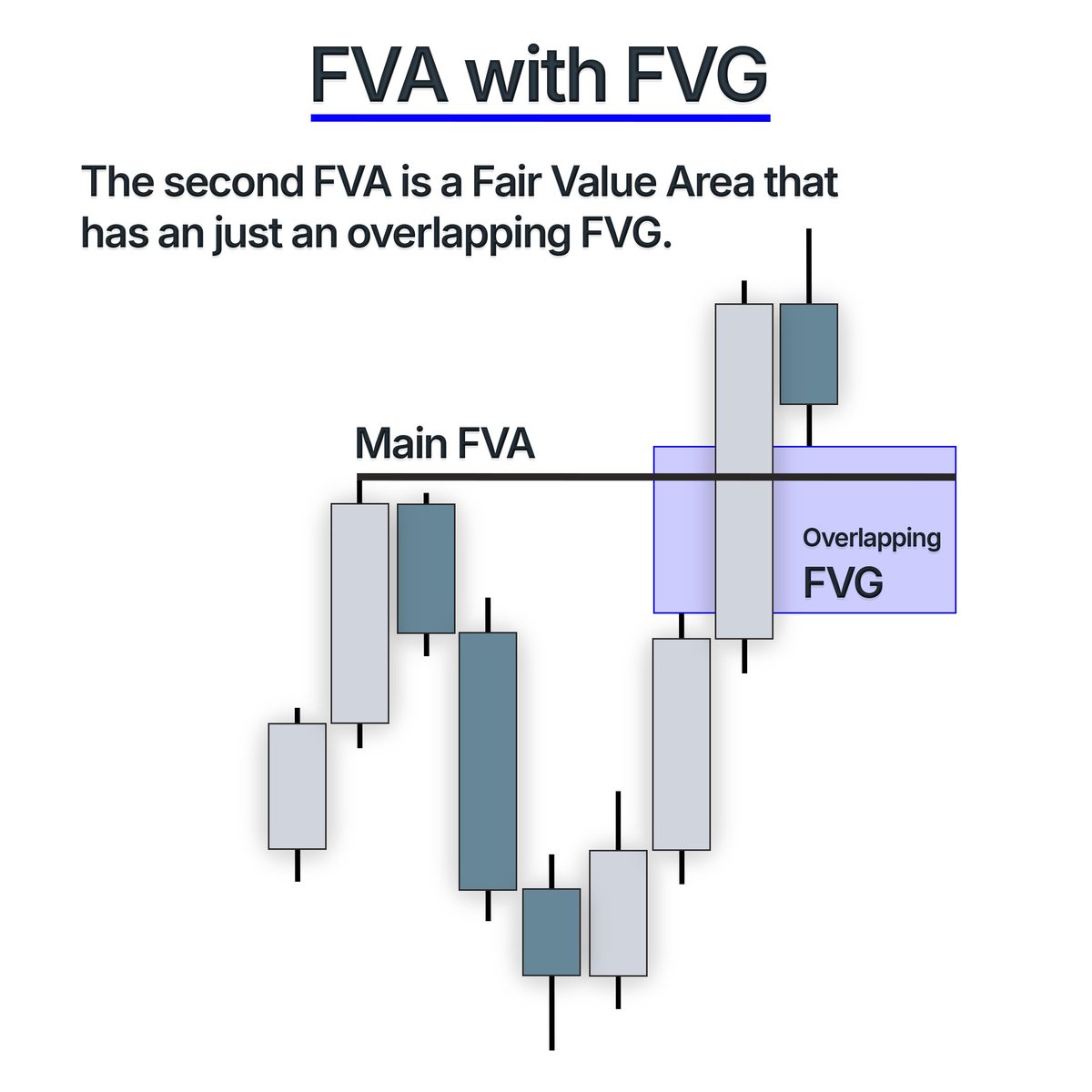

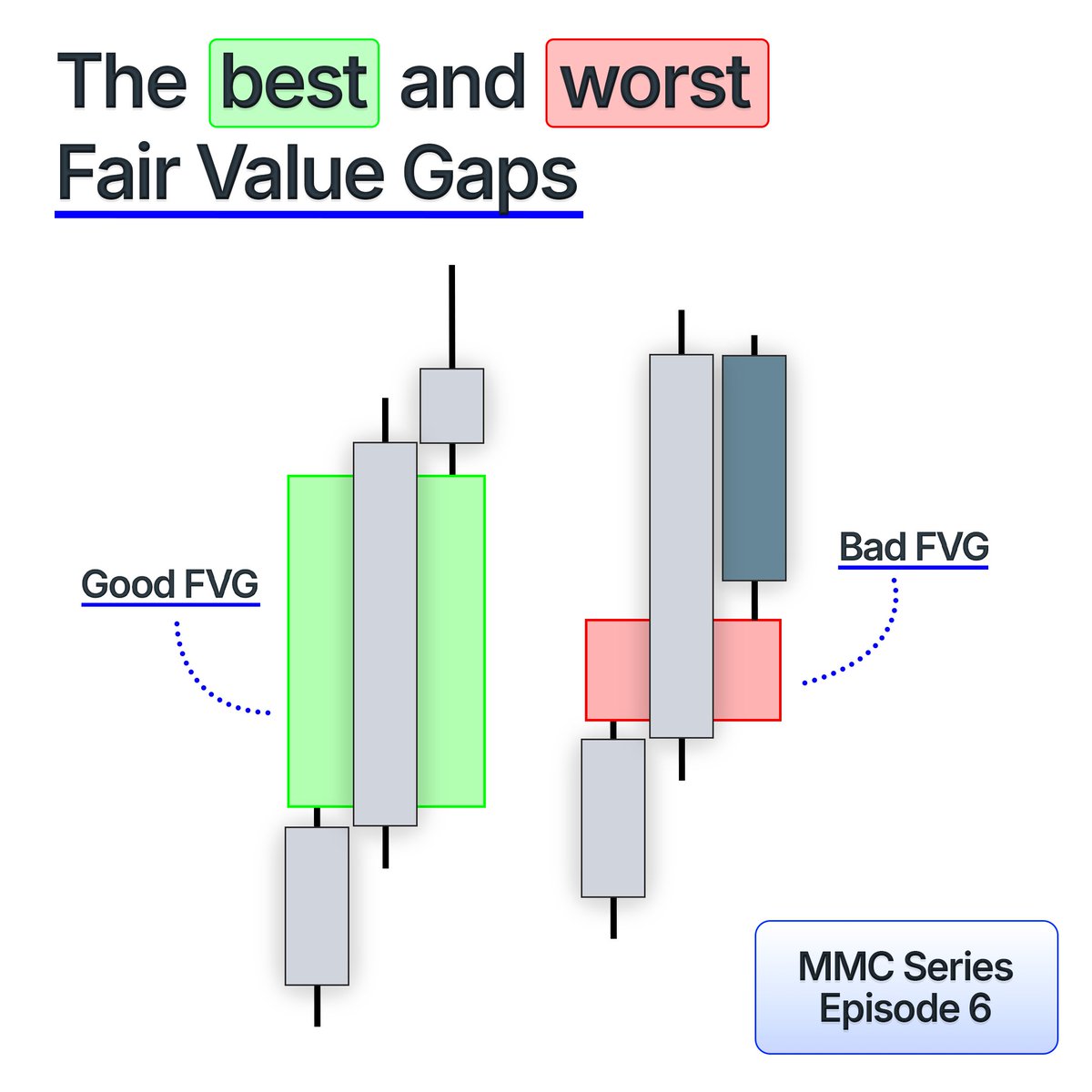

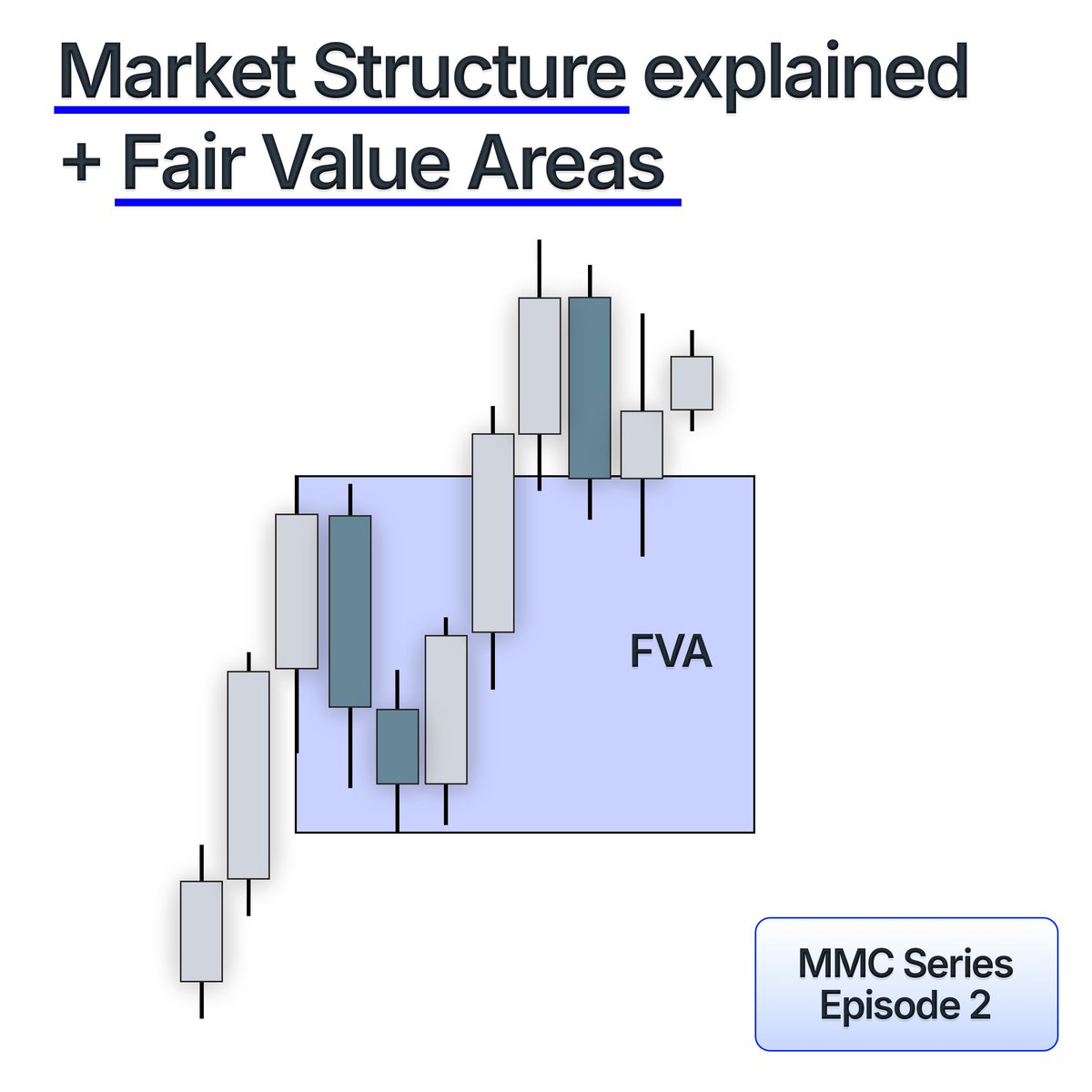

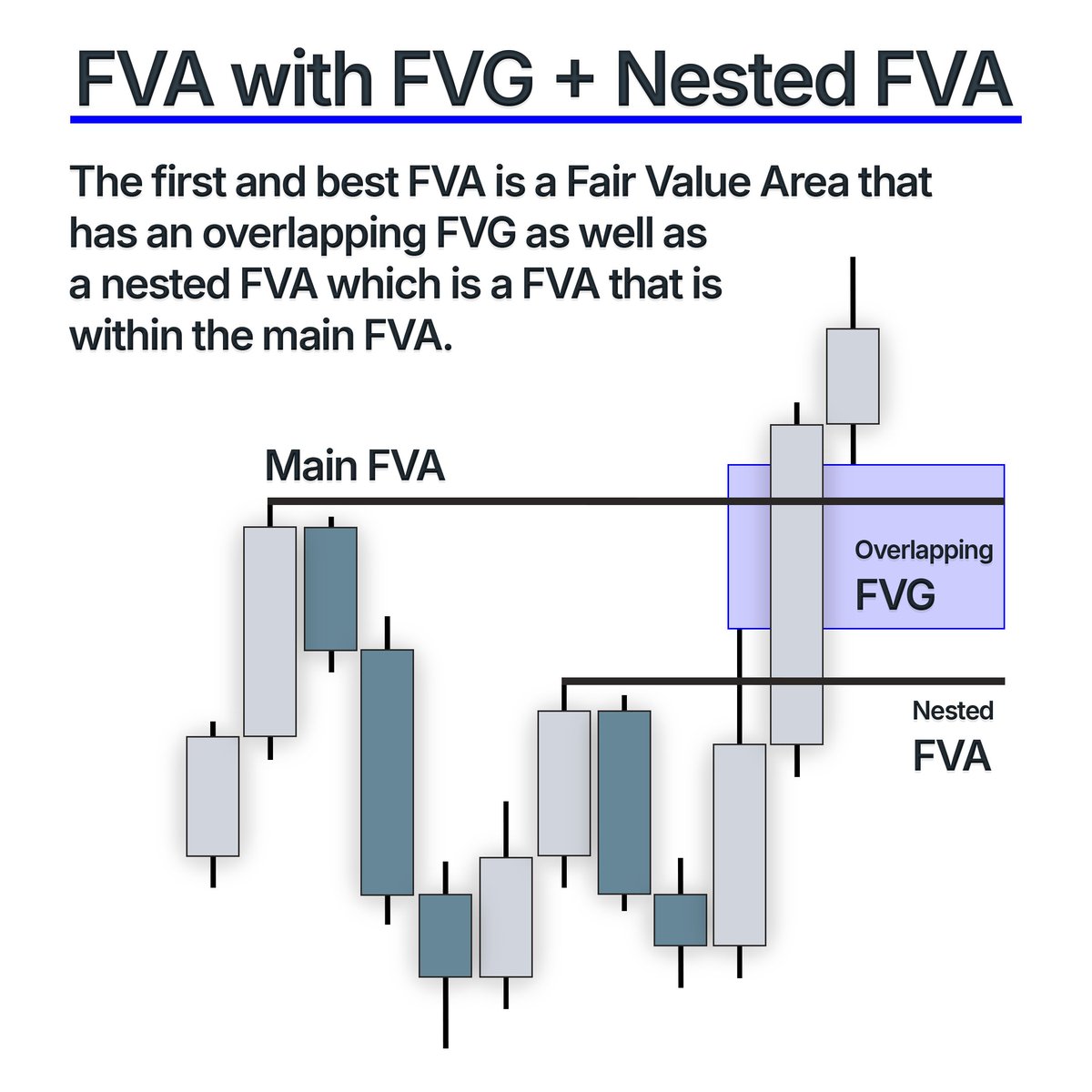

The first FVA and the best FVA, is the Fair Value Area that has an Overlapping FVG as well as a Nested FVA. A nested FVA is a Fair Value Area that is within the main FVA.

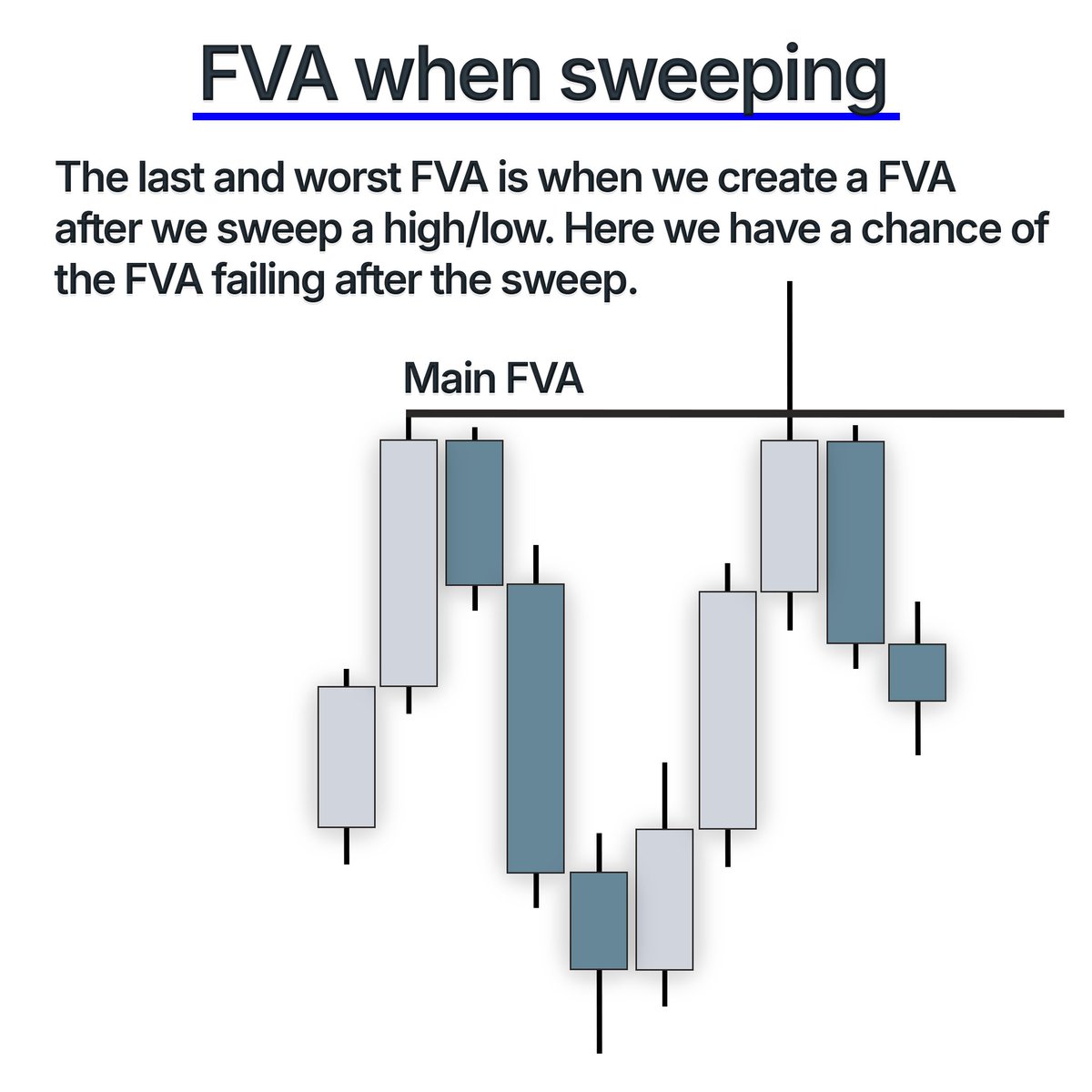

The last and worst FVA is when we create a Fair Value Area after sweeping a High or Low. In this scenario we have the potential to have a reversal as the FVA is not very high probability.

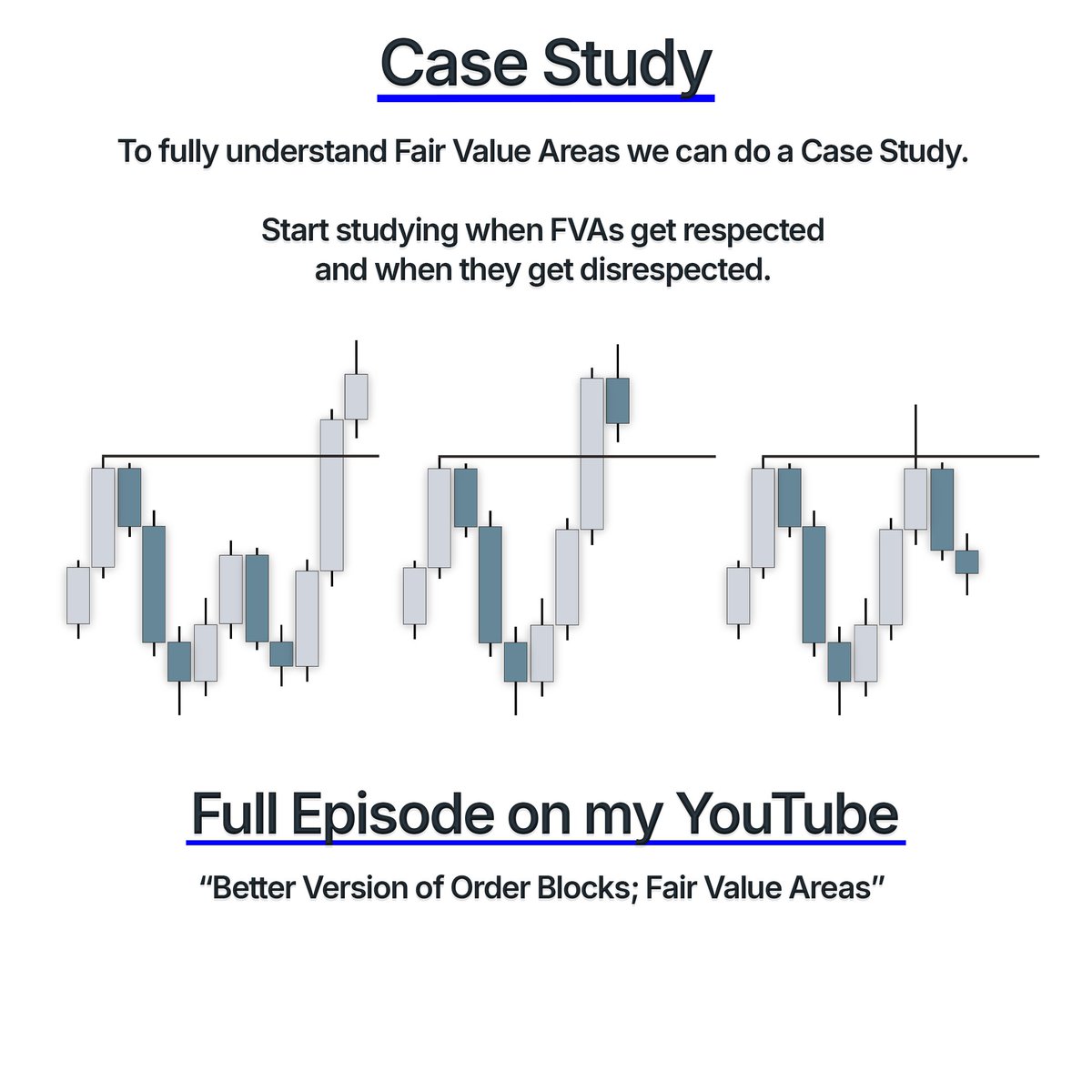

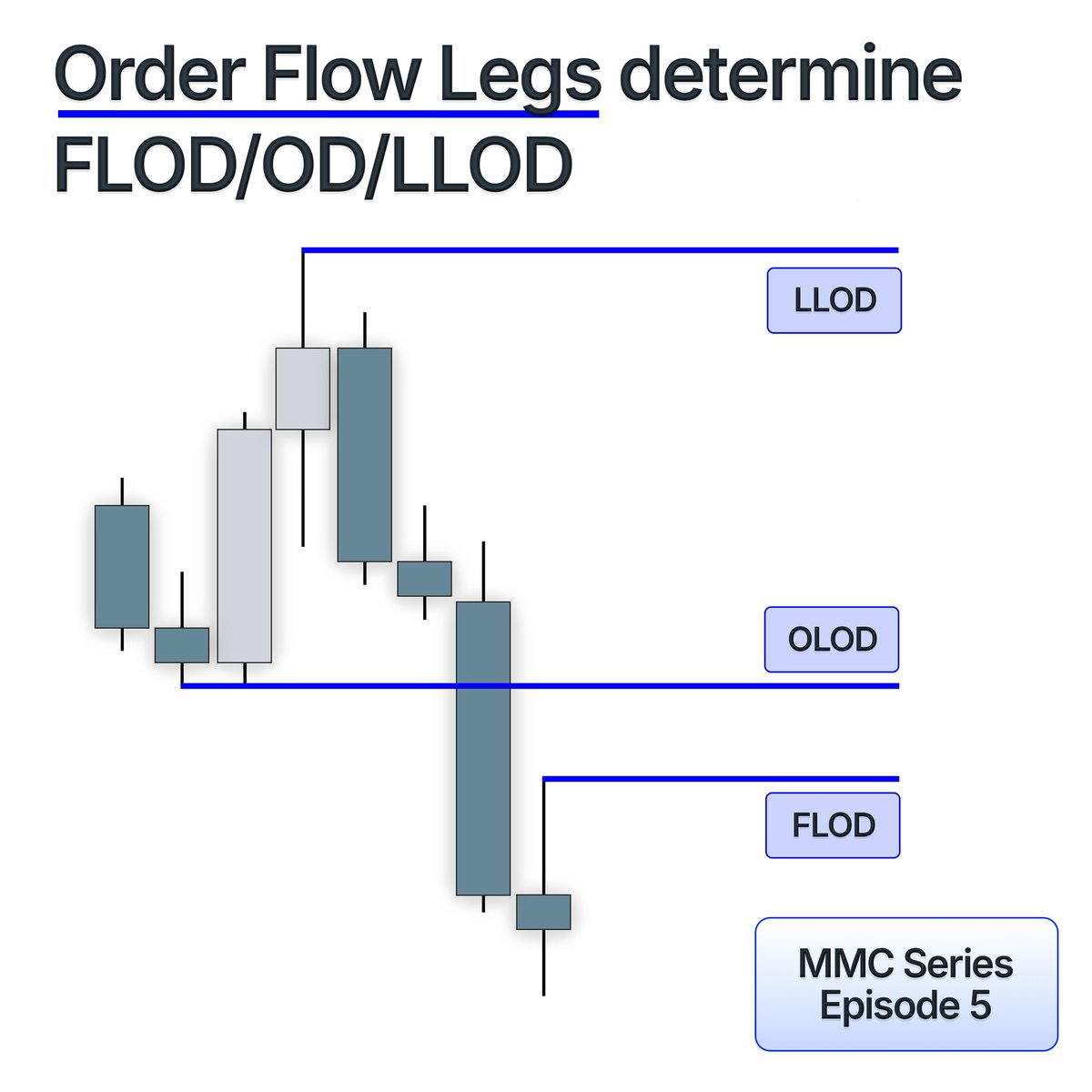

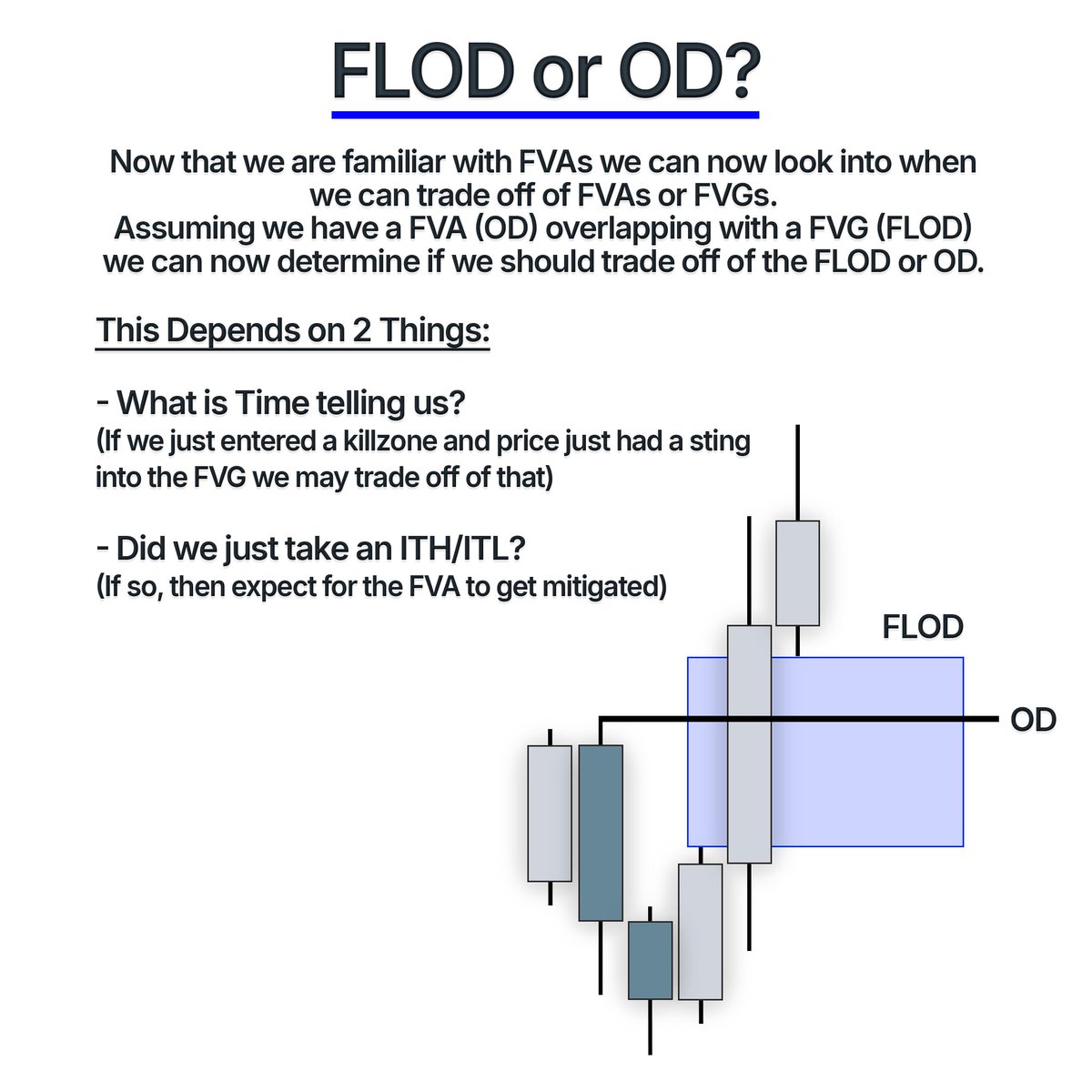

Now that we understand the different types of FVAs we can now understand if we should trade off of the FLOD or the OD. This depends on two factors.

Full Video👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh