Ofsted has published new data showing how children's homes have become a huge, money-spinning business. If you are squeamish about these things, look away now. 🧵

More than 4 in 5 children’s homes were owned by private companies (2,748 homes, 83%), which accounted for 9,648 places (77%) of 12,458 places.

The 22 largest companies owned 968 homes, which is 35% of all private children’s homes, and 28% of all children’s homes.

Just 1 in 6 private children’s homes (434, 16%) were owned by a single provider rather than part of the ownership chain of a larger company.

Just 1 in 6 private children’s homes (434, 16%) were owned by a single provider rather than part of the ownership chain of a larger company.

Almost all of the 22 largest companies are owned by investment firms (mostly private equity) and are loaded with debt. The biggest is CareTech, which owns 200 children's homes.

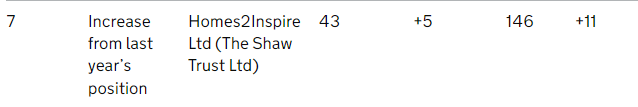

Strangely, Ofsted includes Homes2Inspire as a company akin to CareTech or Witherslack. In reality, it is owned by a charity, Shaw Trust, and subject to very different financial criteria.

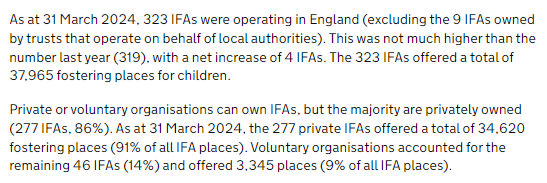

There has been a significant decline in places available via voluntary foster care agencies

"There were 46 voluntary IFAs, which had 3,345 places between them, a decrease of 490 places from 2023."

"There were 46 voluntary IFAs, which had 3,345 places between them, a decrease of 490 places from 2023."

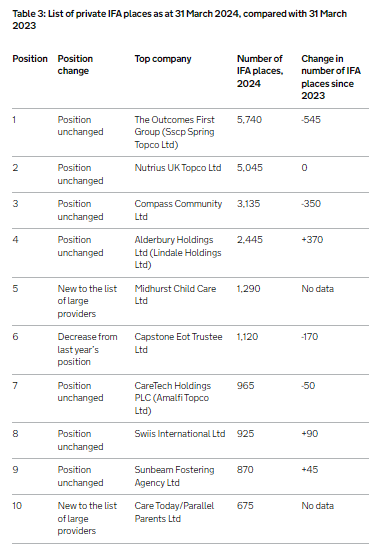

A number of private equity-owned companies are big in both children's homes and foster care (CareTech is not referenced here but it also big in both)

Business is extracting hundreds of millions of pounds a year from children's social care, at a time when the whole system is on the verge of financial collapse. Vulnerable children and families are being exploited.

It doesn't have to be this way.

It doesn't have to be this way.

The Ofsted data is here: gov.uk/government/pub…

Provatisation and profiteering in children's social care is so deeply embedded in the system that people think you are mad when you suggest that it doesn't have to be this way.

A final point (because it tends to be overlooked): Lorna and I have been local authority foster carers for 15 years. We have stuck with them through thick and thin. Going private is never an option.

We currently are foster parents to three children. Given their ages, this commitment could easily extend for another 12 to 15 years. So please don't @ me about LA foster care. We have seen it all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh