The buzz around Restaking might cool off after initial airdrops from EigenLayer, EtherFi, and Renzo, but this landscape is heating up with interesting updates.

Here are the top Liquid Restaking Protocols primed for rewards and airdrops👇 🧠

1/17

Here are the top Liquid Restaking Protocols primed for rewards and airdrops👇 🧠

1/17

First, I highly recommend you check out @DefiIgnas's tweet for a quick overview of the restaking sector before diving into some major LRTs.

2/17

2/17

https://twitter.com/DefiIgnas/status/1823745586765406625

🧠 @ether_fi

EtherFi S3 will distribute 25M $ETHFI in Sep.

You can earn more ETHFI per ETH deposited (0.1 ETHFI/ETH/day) or stake $ETHFI to collect Karak and EtherFi Points.

Highlight vaults:

- @symbioticfi $eETHs and $eBTC LRTs by @veda_labs

- @Karak_Network $ETH LRTs

3/17

EtherFi S3 will distribute 25M $ETHFI in Sep.

You can earn more ETHFI per ETH deposited (0.1 ETHFI/ETH/day) or stake $ETHFI to collect Karak and EtherFi Points.

Highlight vaults:

- @symbioticfi $eETHs and $eBTC LRTs by @veda_labs

- @Karak_Network $ETH LRTs

3/17

🧠 @swellnetworkio

They announced the snapshot for the first $SWELL airdrop: 8% of $SWELL supply for White Pearls at TGE.

- After snapshot: Wavedrops - $swETH, $rswETH, and their derivatives holders earn Black Pearls => 2% of $SWELL on Oct 8, and 1% in every 10 weeks.

4/17

They announced the snapshot for the first $SWELL airdrop: 8% of $SWELL supply for White Pearls at TGE.

- After snapshot: Wavedrops - $swETH, $rswETH, and their derivatives holders earn Black Pearls => 2% of $SWELL on Oct 8, and 1% in every 10 weeks.

4/17

- Swell L2: Swell assets stakers pre-launch can get Swell L2 airdrops. Post-snapshot depositors get a 1.5x multiplier on $SWELL airdrop + Symbiotic + EigenLayer points.

5/17

5/17

Remarkably, @swellnetworkio introduces $swBTC, the first Bitcoin LRT protocol for restaking on @symbioticfi.

This vault offers restaking rewards, 3x Black Pearls + Symbiotic Points. Eigen and Karak are next.

6/17

This vault offers restaking rewards, 3x Black Pearls + Symbiotic Points. Eigen and Karak are next.

6/17

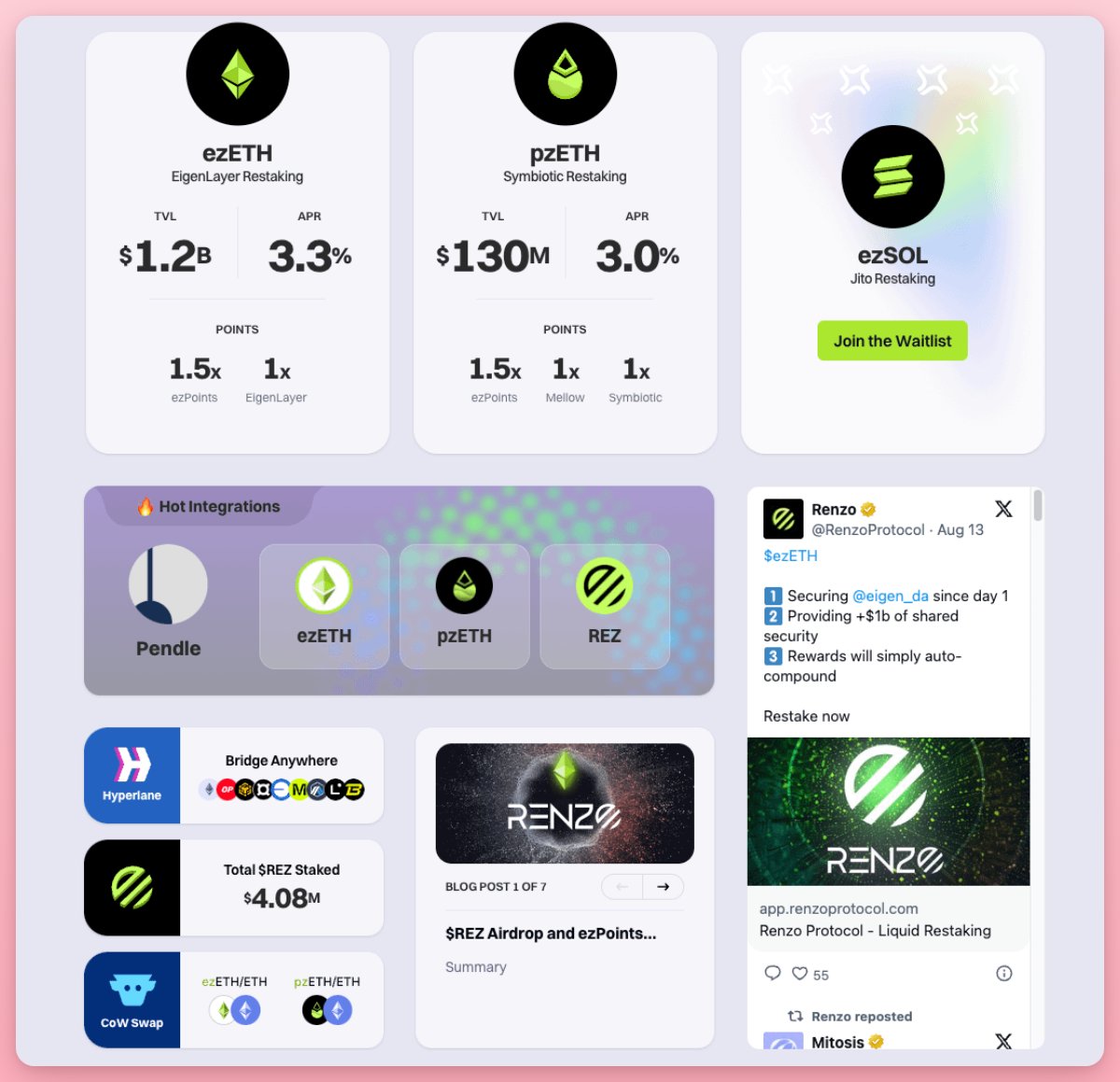

🧠 @RenzoProtocol

Renzo completed the S2 airdrop, distributing 543M $REZ to over 70k wallets. S3 soon be revealed.

They launched Symbiotic LRT $pzETH for ETH restaking on @mellowprotocol's vault, earning Renzo, Mellow, and Symbiotic Points.

7/17

Renzo completed the S2 airdrop, distributing 543M $REZ to over 70k wallets. S3 soon be revealed.

They launched Symbiotic LRT $pzETH for ETH restaking on @mellowprotocol's vault, earning Renzo, Mellow, and Symbiotic Points.

7/17

Renzo is also attempting to bring native ETH liquid restaking to new L2s like Mode, Fraxtal.

More excitingly, Renzo introduced the first Solana LRT $ezSOL on @jito_labs SOL liquid staking. You can join in the waitlist by connecting Solana wallets.

8/17

More excitingly, Renzo introduced the first Solana LRT $ezSOL on @jito_labs SOL liquid staking. You can join in the waitlist by connecting Solana wallets.

8/17

🧠 @KelpDAO

KelpDAO introduced the Airdrop Gain Vault, an airdrop strategy platform.

You can deposit $ETH $stETH $ETHx $rsETH to get $agETH in return and farm duo airdrops: L2s (@LineaBuild @Scroll_ZKP), Kelp, EigenLayer, Karak...

$43M deposited. Withdrawals take 3 days.

9/17

KelpDAO introduced the Airdrop Gain Vault, an airdrop strategy platform.

You can deposit $ETH $stETH $ETHx $rsETH to get $agETH in return and farm duo airdrops: L2s (@LineaBuild @Scroll_ZKP), Kelp, EigenLayer, Karak...

$43M deposited. Withdrawals take 3 days.

9/17

🧠 @puffer_finance Token airdrop details are sparse. However, here are some highlights:

- Puffer Chapter 4: Pendle $pufETH matures Sep 26 (195x Puffer Points + 98x EL Points)

- Puffer UniFi: a rollup to improve Ethereum's fragmentation and boost L1 value.

10/17

- Puffer Chapter 4: Pendle $pufETH matures Sep 26 (195x Puffer Points + 98x EL Points)

- Puffer UniFi: a rollup to improve Ethereum's fragmentation and boost L1 value.

10/17

https://twitter.com/DeFi_Dad/status/1823048153932743015

- Partnered with @EverclearOrg for native L2 restaking: one-click restaking, zero gas fees on Ethereum, and yields.

11/17

11/17

🧠 @Eigenpiexyz_io

Eigenpie confirmed 34% of the total $EGP supply to Eigenpie Points owners at the TGE.

You can boost Eigenpie Points by depositing $mstETH, $mswETH, and $mwBETH from Eigenpie on Pancakeswap or Curve Finance, along with $ARB rewards and Swell Pearls.

12/17

Eigenpie confirmed 34% of the total $EGP supply to Eigenpie Points owners at the TGE.

You can boost Eigenpie Points by depositing $mstETH, $mswETH, and $mwBETH from Eigenpie on Pancakeswap or Curve Finance, along with $ARB rewards and Swell Pearls.

12/17

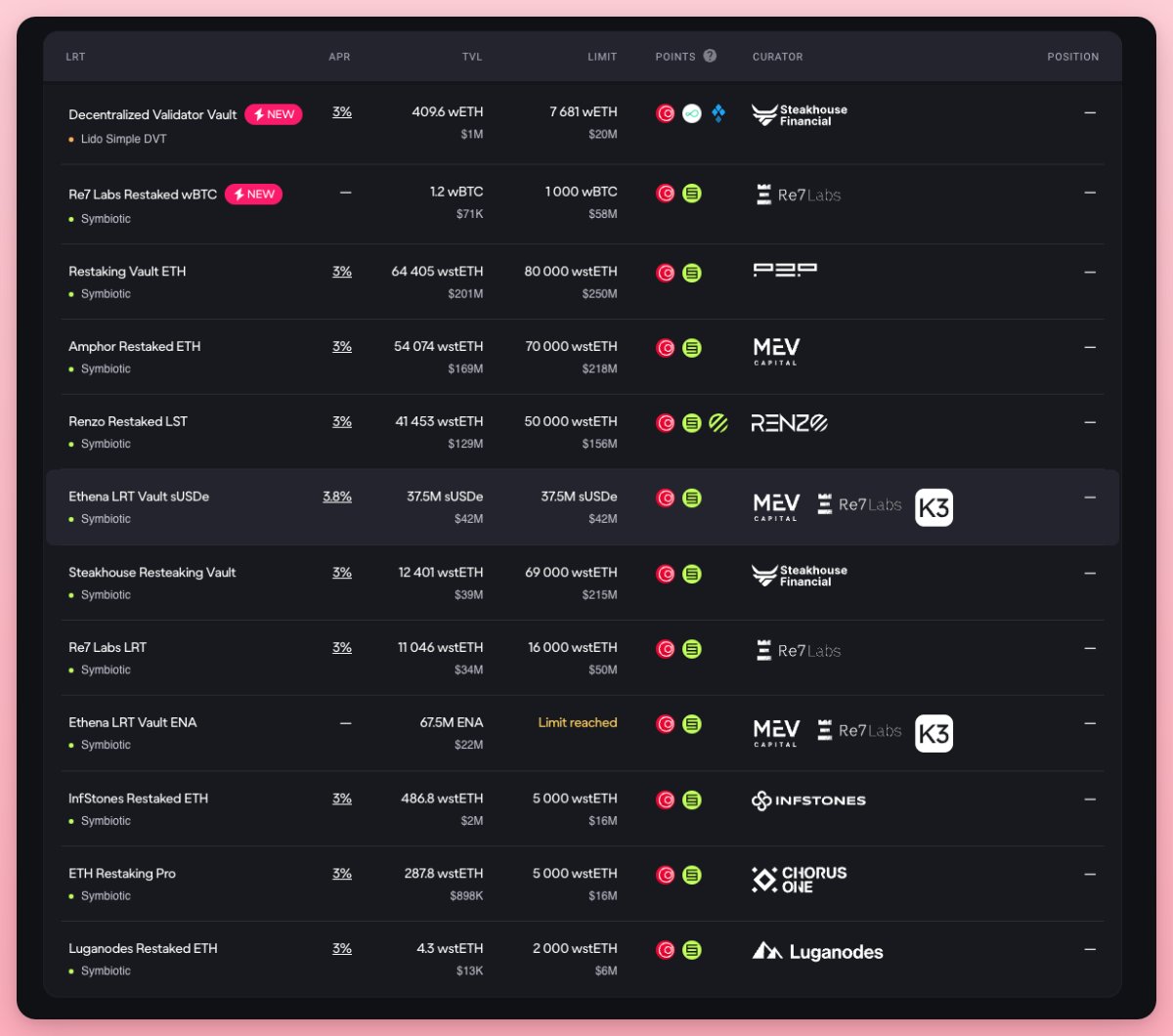

🧠 @mellowprotocol

Mellow is rising as a powerhouse in Ethereum liquid restaking with $650M+ TVL, making up 40% of Symbiotic's TVL.

Below are some strategies to farm Mellow Points and other airdrops 👇

13/17

Mellow is rising as a powerhouse in Ethereum liquid restaking with $650M+ TVL, making up 40% of Symbiotic's TVL.

Below are some strategies to farm Mellow Points and other airdrops 👇

13/17

- Staking on curator vaults (Mellow Points + Symbiotic Points + curator's points)

- New integration on @ZircuitL2, Swell L2, @fuel_network

- @LidoFinance Simple DVT (Obol and SSV points)

- Pendle YT strategies (mature on 26 Sep)

- LRTs pools on Balancer, Uniswap, Curve

14/17

- New integration on @ZircuitL2, Swell L2, @fuel_network

- @LidoFinance Simple DVT (Obol and SSV points)

- Pendle YT strategies (mature on 26 Sep)

- LRTs pools on Balancer, Uniswap, Curve

14/17

🧠 @Bedrock_DeFi

Bedrock provided an all-in-one platform for liquid restaking on Ethereum, @babylonlabs_io, and @iotex_io.

$uniBTC - Bedrock's $BTC LRT offers $BTC rewards from Babylon, and can be minted across ETH L2s and BTC L2s (Merlin, B² Network, Bitlayer).

15/17

Bedrock provided an all-in-one platform for liquid restaking on Ethereum, @babylonlabs_io, and @iotex_io.

$uniBTC - Bedrock's $BTC LRT offers $BTC rewards from Babylon, and can be minted across ETH L2s and BTC L2s (Merlin, B² Network, Bitlayer).

15/17

Tagging some top brains to follow:

@DefiIgnas

@phtevenstrong

@DeFi_Dad

@PendleIntern

@ViktorDefi

@monosarin

@Hercules_Defi

@2lambro

@Louround_

@lstmaximalist

@Subli_Defi

@SamuelXeus

@eli5_defi

@Kairos_Res

@Route2FI

@CryptoKoryo

@stacy_muur

@Only1temm

16/17

@DefiIgnas

@phtevenstrong

@DeFi_Dad

@PendleIntern

@ViktorDefi

@monosarin

@Hercules_Defi

@2lambro

@Louround_

@lstmaximalist

@Subli_Defi

@SamuelXeus

@eli5_defi

@Kairos_Res

@Route2FI

@CryptoKoryo

@stacy_muur

@Only1temm

16/17

What LRTs are you farming? Comment down below.

If you like this content, please follow us @PinkBrains_io for more DeFi and Web3 Marketing insights. 🧠

Like/RT the first tweet and bookmark to support us!

17/17

If you like this content, please follow us @PinkBrains_io for more DeFi and Web3 Marketing insights. 🧠

Like/RT the first tweet and bookmark to support us!

17/17

https://twitter.com/PinkBrains_io/status/1824038352309678500

• • •

Missing some Tweet in this thread? You can try to

force a refresh