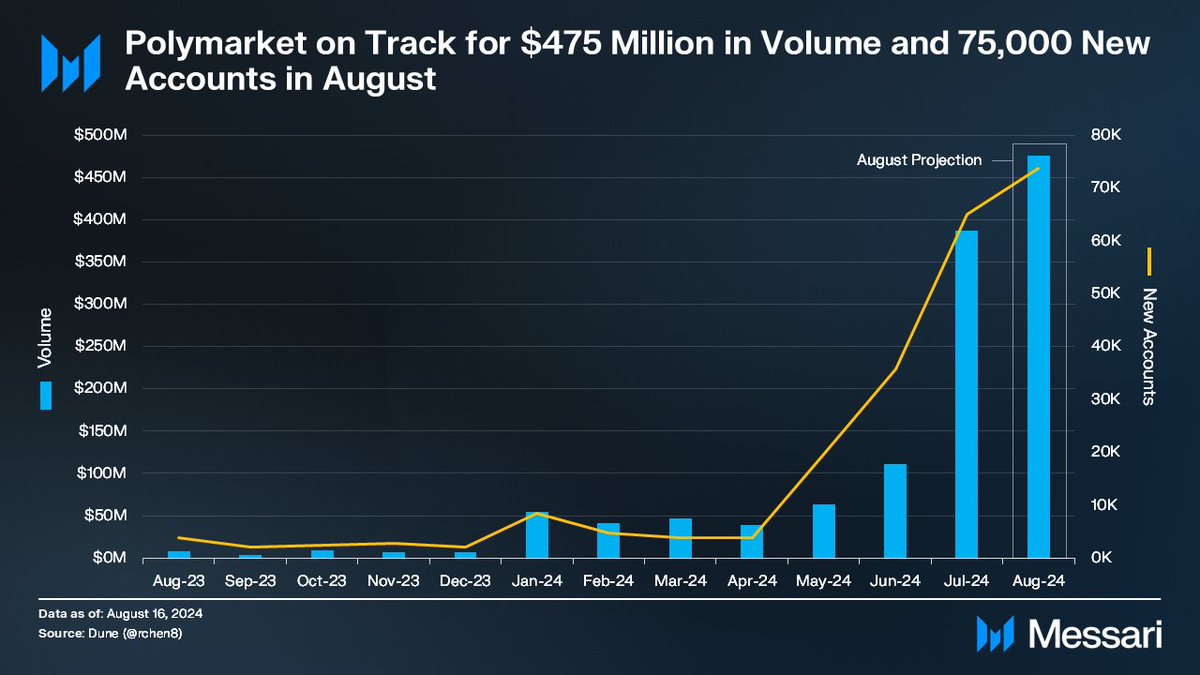

Hard to argue that @Polymarket is not the crypto app of the year.

It is on track to reach $475 million in volume and 75,000 new accounts in August alone.

It is universally cited by pollsters, pundits, normies, and campaigns.

Usage and relevance are only going to accelerate as we get closer to November.

🚀

It is on track to reach $475 million in volume and 75,000 new accounts in August alone.

It is universally cited by pollsters, pundits, normies, and campaigns.

Usage and relevance are only going to accelerate as we get closer to November.

🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh