Key reasons I'm bullish about @0xMantle and continue farming their ongoing $cmETH and $FBTC programs:

⊕ Two airdrops from Mantle are coming;

⊕ $3B treasury;

⊕ Impressive product traction & more.

Yield thesis ↓

⊕ Two airdrops from Mantle are coming;

⊕ $3B treasury;

⊕ Impressive product traction & more.

Yield thesis ↓

Amidst over 40 competing Ethereum L2s, @0xMantle stands out with strategic products and partnerships, as well as the second-largest treasury in Web3.

Mantle's ecosystem now includes five tokens: MNT, mETH, FBTC, and the upcoming cmETH and COOK, each offering unique value.

Mantle's ecosystem now includes five tokens: MNT, mETH, FBTC, and the upcoming cmETH and COOK, each offering unique value.

Some highlights of their product traction:

• Since its launch in November 2023, Mantle's staked ETH ($mETH) has become the 5th largest LST with a TVL of $1.4B.

• @FBTC_official reached $125M one month after launch.

• Over 50% of the $MNT circulating supply is staked.

• Since its launch in November 2023, Mantle's staked ETH ($mETH) has become the 5th largest LST with a TVL of $1.4B.

• @FBTC_official reached $125M one month after launch.

• Over 50% of the $MNT circulating supply is staked.

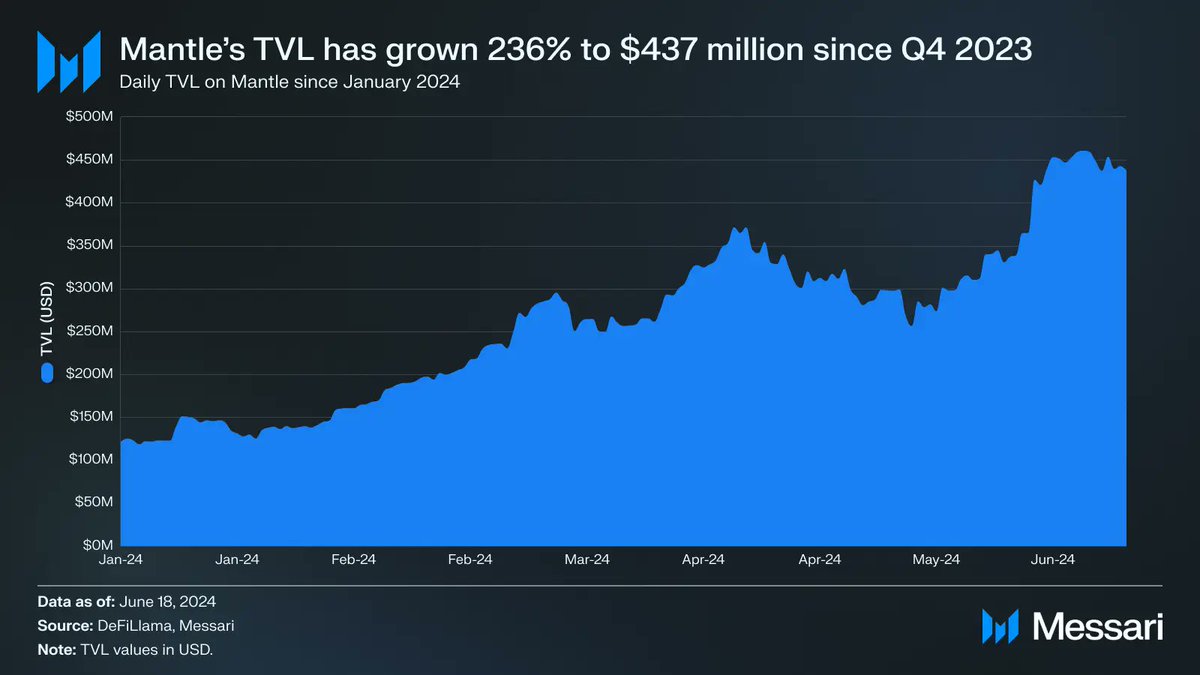

• Since Q4 2023, @0xMantle's TVL has grown by over 230%.

• $MNT holders consistently receive additional bonuses from the ecosystem, such as Eigenlayer points and $COOK allocations.

• Mantle has committed $5 million to boost SocialFi and gaming innovation on the network.

• $MNT holders consistently receive additional bonuses from the ecosystem, such as Eigenlayer points and $COOK allocations.

• Mantle has committed $5 million to boost SocialFi and gaming innovation on the network.

I've been holding MNT since the launch of the L2 and have never regretted being part of this community.

When L2s were just emerging, many airdrop farmers ignored @0xMantle as an L2 with a token. However, time has proven that this has never been an issue in generating value.

When L2s were just emerging, many airdrop farmers ignored @0xMantle as an L2 with a token. However, time has proven that this has never been an issue in generating value.

This summer, Mantle announced several new products:

$cmETH – a new restaking token. Ongoing discussions with ecosystem partners like @pendle_fi and @ethena_labs highlight the collaborative efforts to integrate cmETH.

$COOK – new the governance token for $mETH and $cmETH.

$cmETH – a new restaking token. Ongoing discussions with ecosystem partners like @pendle_fi and @ethena_labs highlight the collaborative efforts to integrate cmETH.

$COOK – new the governance token for $mETH and $cmETH.

$FBTC – an omnichain Bitcoin asset pegged 1:1 to BTC, designed to be liquid and easily composable across blockchains like Ethereum, Mantle, and Solana.

It introduces yield enhancement strategies like Babylon Staking, providing more profitable ways to use Bitcoin assets.

It introduces yield enhancement strategies like Babylon Staking, providing more profitable ways to use Bitcoin assets.

One week ago, @FBTC_official announced the launch of its Sparkle Campaign that actually increases the capital efficiency of your Bitcoin positions with minimal risks.

If you buy and hold $FBTC in wallet, you get 1 Spark per 0.001 $FBTC daily. Use it in DeFi → 2 Sparks per day.

If you buy and hold $FBTC in wallet, you get 1 Spark per 0.001 $FBTC daily. Use it in DeFi → 2 Sparks per day.

https://twitter.com/1779519551685984257/status/1826232115446284770

Various chain multipliers are available: 2x for Mantle, 1x for the Ethereum, and 1x for BNB Chain.

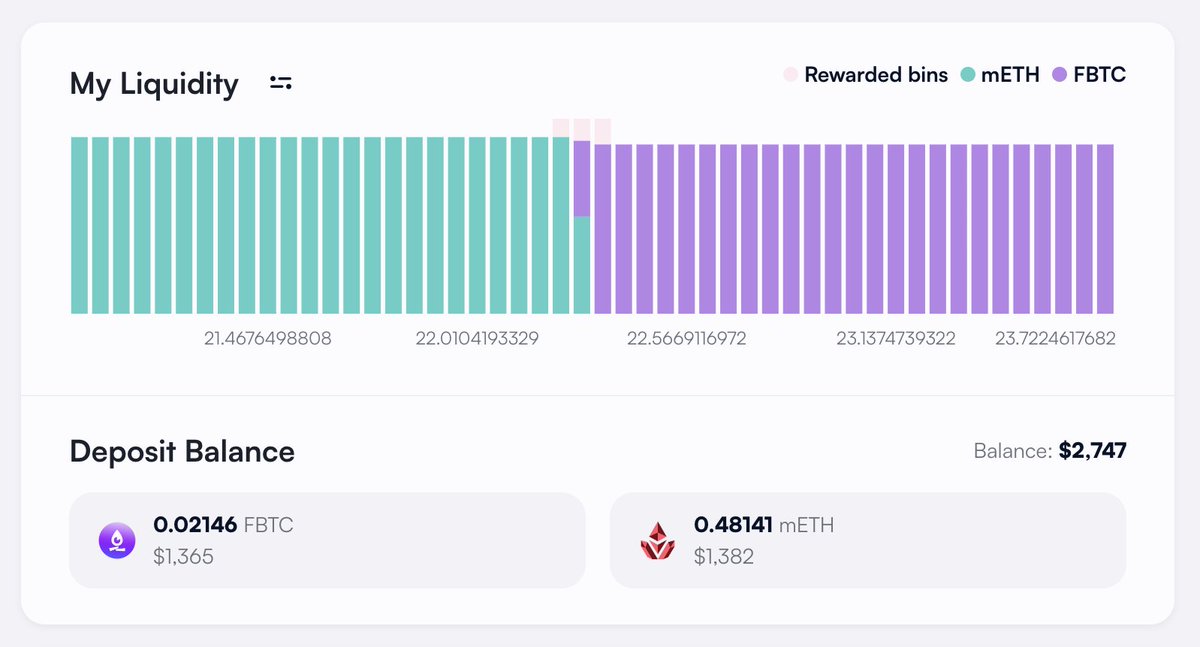

When used within the @babylonlabs_io ecosystem, it also accumulates Babylon points. Additionally, mETH/FBTC on @MerchantMoe_xyz earn users Powder in the $COOK campaign.

When used within the @babylonlabs_io ecosystem, it also accumulates Babylon points. Additionally, mETH/FBTC on @MerchantMoe_xyz earn users Powder in the $COOK campaign.

Both $COOK and $FBTC campaigns are excellent events to join, considering Mantle's influence in the space and proven track record of delivering top-grade products that are widely used beyond the ecosystem.

Don't underscore Mantle, anon!

Don't underscore Mantle, anon!

• • •

Missing some Tweet in this thread? You can try to

force a refresh