DISCLAIMER: You can learn this approach but if you ARE NOT disciplined enough to follow every step it will NEVER work for you.

Do not expect instant results, submit to time and mastery will be achieved.

I DO NOT answer DMs, so any questions you have ask them in the final tweet.

Do not expect instant results, submit to time and mastery will be achieved.

I DO NOT answer DMs, so any questions you have ask them in the final tweet.

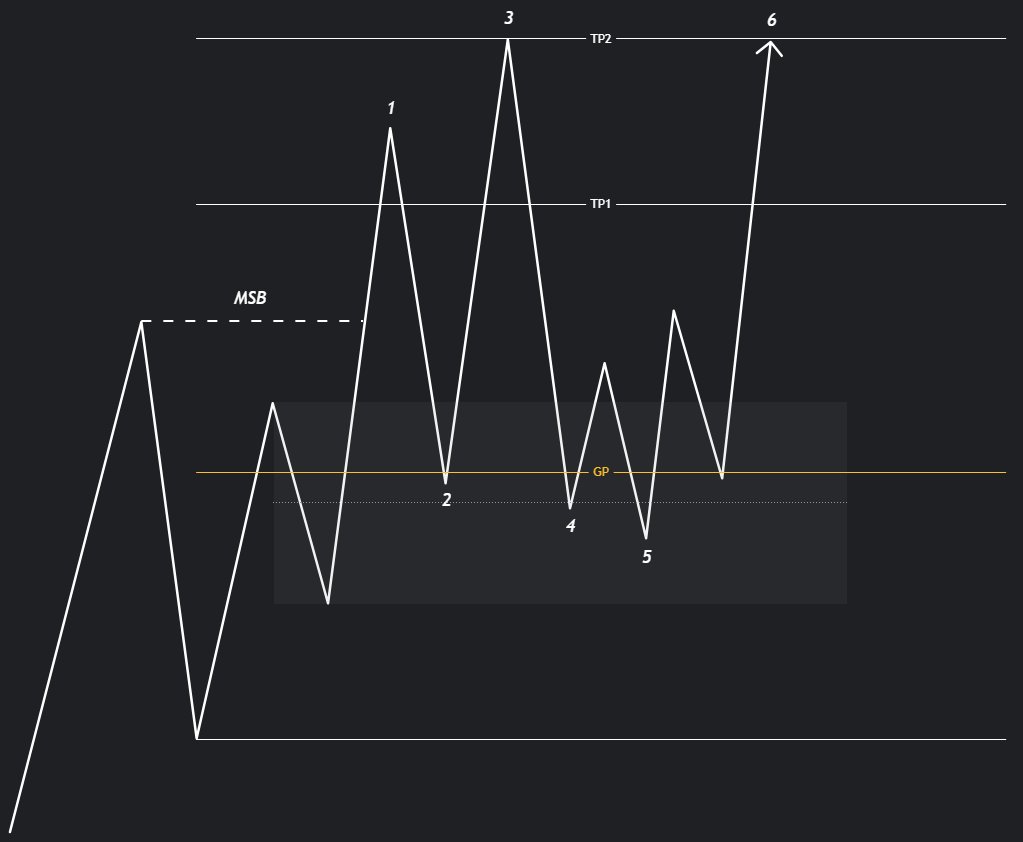

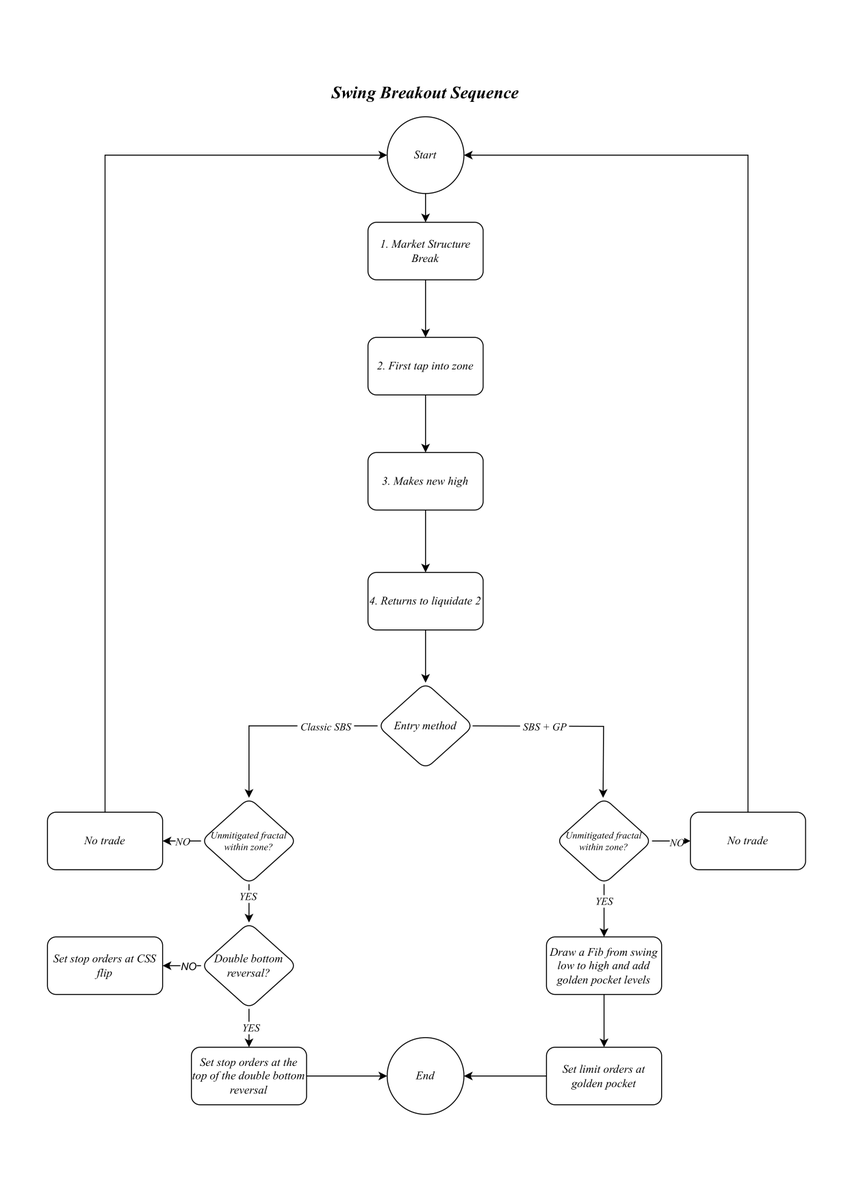

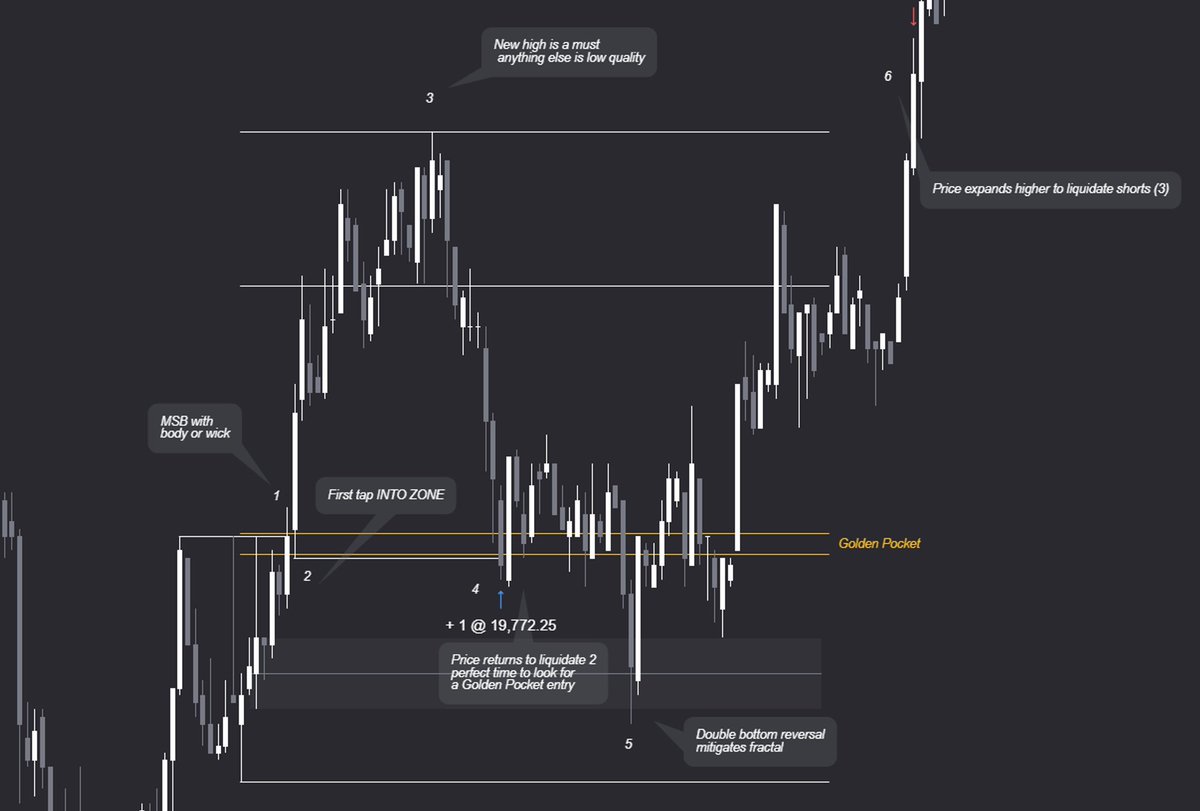

In order to understand the Swing Breakout Sequence, I have simplified it into a flowchart that will help you find A+ setups.

Step 1. Market Structure Break (MSB)

For this first step, you dont need a candle closure above or below the swing point that is being broken, a wick is just fine.

For this first step, you dont need a candle closure above or below the swing point that is being broken, a wick is just fine.

Step 2. First tap into zone

Once MSB happens, you now have to wait for a candle to tap into the zone.

There are mixed opinions about this step but I prefer to be picky with my setups, I recommend you to be picky as well.

Once MSB happens, you now have to wait for a candle to tap into the zone.

There are mixed opinions about this step but I prefer to be picky with my setups, I recommend you to be picky as well.

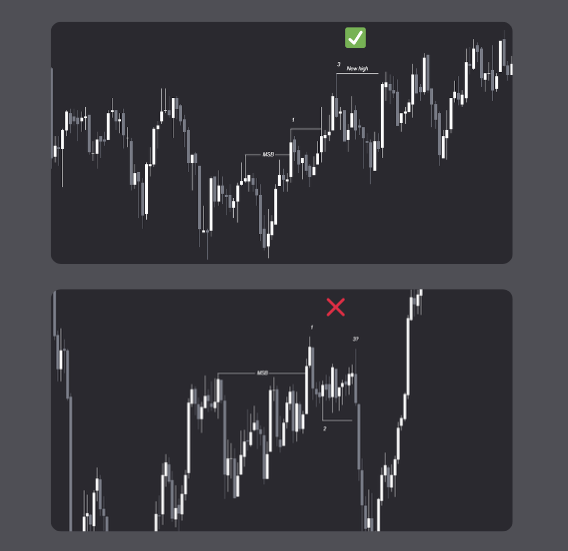

Step 3. Makes new high

After the zone gets tapped, a new high (or low in case of a bearish setup) needs to form.

You can look for equal highs but dont expect them to be high probability trades, I would advice to avoid them.

After the zone gets tapped, a new high (or low in case of a bearish setup) needs to form.

You can look for equal highs but dont expect them to be high probability trades, I would advice to avoid them.

Step 4. Returns to liquidate 2

Once price returns back into the zone, it must sweep the swing point of 2.

At this step you must be ready to start looking for an entry. Here you can take 2 routes:

Once price returns back into the zone, it must sweep the swing point of 2.

At this step you must be ready to start looking for an entry. Here you can take 2 routes:

Entry method #1: Classic SBS

Is there an unmitigated fractal within the zone?

If the answer is no then I would advice to not look for a trade since price likes to return to these areas and respect them so they are a valid confirmation for your trades.

Is there an unmitigated fractal within the zone?

If the answer is no then I would advice to not look for a trade since price likes to return to these areas and respect them so they are a valid confirmation for your trades.

If the answer is yes then you move to next filter question:

Is there a double bottom reversal (5 in the SBS sequence)?

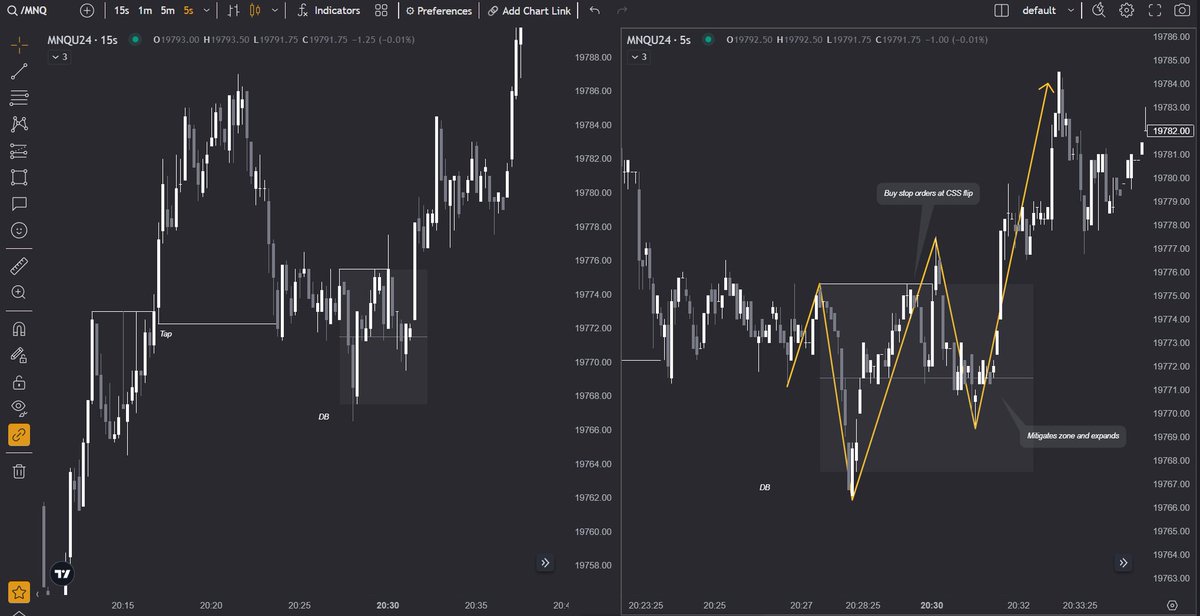

If the answer is no then you should be ready to set stop orders at the CSS flip.

I would advice using an even lower timeframe for the CSS flips.

Is there a double bottom reversal (5 in the SBS sequence)?

If the answer is no then you should be ready to set stop orders at the CSS flip.

I would advice using an even lower timeframe for the CSS flips.

On the the other hand, if you do have a double bottom reversal, meaning your answer is yes then you should set your stop orders at the top of the double bottom reversal, it will still be at the CSS flip.

Entry method #2: SBS + Golden Pocket

This entry method is way more simple and precise than the other entry method.

You will also need an unmitigated fractal which I already explained above.

This entry method is way more simple and precise than the other entry method.

You will also need an unmitigated fractal which I already explained above.

So what is the Golden Pocket?

It is the area between the Fibonacci 61.8% and 65% levels, price often retraces to that area and then bounces.

It is the area between the Fibonacci 61.8% and 65% levels, price often retraces to that area and then bounces.

What does it have to do with SBS?

Often times the 4 or 5 of the sequence matches with the Golden Pocket levels, making the setup a really high probability trade.

Often times the 4 or 5 of the sequence matches with the Golden Pocket levels, making the setup a really high probability trade.

So all you have to do is draw a Fibonacci with the Golden Pocket levels from the low to the high of the expansion leg, just like in this example and set a limit order on the GP level.

You can also add the 23.6% level to aim for a 1R trade, or just aim for the high of step 3.

You can also add the 23.6% level to aim for a 1R trade, or just aim for the high of step 3.

This is my approach to the SBS system, all credits goes to @StoicTA, without his free teachings this wouldnt be possible.

This is a very detailed thread, so Im sure many of you will have a lot of questions, make sure to ask them in this thread and will happily answer them.

This is a very detailed thread, so Im sure many of you will have a lot of questions, make sure to ask them in this thread and will happily answer them.

• • •

Missing some Tweet in this thread? You can try to

force a refresh