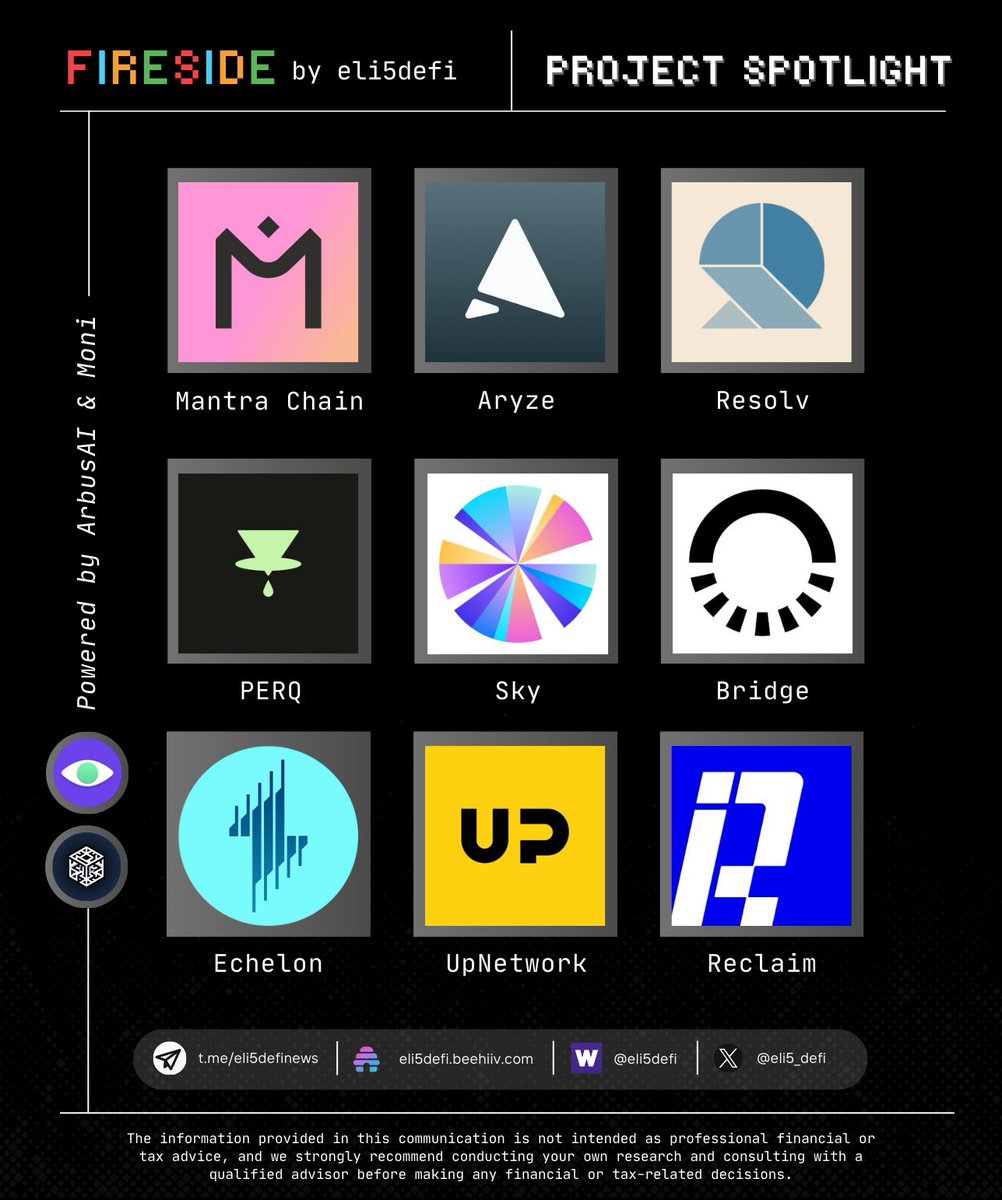

Project Spotlight - Week 36/2024

September is often marked by downturns in Bitcoin and the broader crypto market; however, new and promising projects continue to launch every day.

This week, explore these 9 handpicked projects you'll love.

▷ @MANTRA_Chain

▷ @ARYZEofficial

▷ @ResolvLabs

▷ @PERQ_FI

▷ @SkyEcosystem

▷ @stablecoin

▷ @EchelonMarket

▷ @upnetworkhq

▷ @reclaimprotocol

Powered by @arbusai and @getmoni_io, giving you the cutting edge to discover the earliest alpha!

Below you will find brief summaries for each.

Let's dive in!

…

…

— 📌 | Mantra Chain

⇢ MANTRA Chain is a permissionless Layer 1 blockchain built for real-world asset (RWA) tokenization, aiming to bring the world’s financial ecosystem onchain with features like DID-powered identity verification, regulatory compliance, and IBC compatibility

⇢ MANTRA Chain enables seamless fractionalization and tokenization of real-world assets, including art, commodities, and real estate.

⇢ MANTRA leverage @cosmos Hub and @IBCProtocol for secure token movement and seamless transactions across the Cosmos ecosystem

…

— 📌 | Aryze

⇢ Aryze is building a unified stablecoin infrastructure, offering cross-chain creation of stablecoin services with shared liquidity and revenue.

⇢ Aryze aims to transform digital finance with asset-agnostic stablecoins backed by real-world collateral.

…

— 📌 | Resolv

⇢ Resolv, accelerated by @Delphi_Digital, is a new stablecoin and yield-generating protocol utilizing a delta-neutral architecture for stability, efficiency, and transparency.

⇢ This architecture separates $ETH into two parts: one staked on-chain and the other used to hedge market risk.

⇢ The dual-tranche structure divides risk into a stablecoin (USR) and a leveraged yield instrument (RLP). USR holders are shielded from market fluctuations and funding rate volatility by RLP.

…

— 📌 | PERQ

⇢ PERQ (formerly known as Drip Finance) allows users to earn tokens by staking stablecoins and $ETH in three types of pools: Earn Pools, Launchpools, and Droppools.

⇢ Earn Pools enable users to acquire existing tokens, while Launchpools grant access to tokens close to launch. Droppools allow users to farm airdrop points that can be converted into rewards.

…

— 📌 | Sky

⇢ Sky (formerly MakerDAO) is a decentralized, non-custodial platform that offers savings and rewards, representing the next evolution of DeFi.

⇢ $SKY Token Rewards are coming soon, offering double rewards to eligible users. Once Sky launches, users can accumulate boosted rewards by supplying $USDS (formerly $DAI) to the Sky Token Rewards module.

…

— 📌 | Bridge

⇢ Bridge is a platform that simplifies global money transfers using stablecoins, enabling individuals and businesses to send, receive, and manage funds worldwide.

⇢ Users can issue their own stablecoin in minutes, backed by reserves invested in US Treasuries. Bridge streamlines global treasury management, allowing businesses to quickly convert local currency to stablecoins.

…

— 📌 | Echelon

⇢ Echelon is a universal lending market that connects liquidity and enhances yields on @AptosLabs. It is designed to scale Move DeFi and liquidity with LST, RWA, and stablecoin-focused strategies.

⇢ Echelon recently completed a $3.5M raise led by @ambergroup_io, with participation from @LaserDigital_, @SaisonCapital, @Cypher_Capital, @280Capital, @SeliniCapital, @InteropVC, @Serafund, @Re7Capital, and other angels such as @dcfgod, the @LayerZero_Labs core team, and more.

…

— 📌 | Up Network

⇢ Up Network, powered by @movementlabsxyz, is a decentralized mobile infrastructure network (DeMIN) aiming to create a Web3 smartphone ecosystem by turning every Android device into a lite node.

⇢ Up Network is also developing a Web3 mobile operating system (OS) called Up OS, based on Android. Their goal is to become the hub for dApps and the DePIN ecosystem.

⇢ Up Mobile will be available on September 9 at 13:00 UTC, priced at $999. Only 15,000 units will be available in the first batch.

…

— 📌 | Reclaim

⇢ Reclaim Protocol harnesses zero knowledge proofs to create cryptographic proofs on HTTPS traffic, empowering users to control their data sharing.

⇢ Reclaim platform offers SDKs for web, mobile, and on-chain applications, streamlining the integration of user activity data.

⇢ These SDKs let any dApp build applications that access users' activity, reputation, and identity from sites across the internet.

…

— 🔴| Disclaimer

The information provided in this post is not intended as professional financial or tax advice, and we strongly recommend conducting your own research and consulting with a qualified advisor before making any financial or tax-related decisions.

September is often marked by downturns in Bitcoin and the broader crypto market; however, new and promising projects continue to launch every day.

This week, explore these 9 handpicked projects you'll love.

▷ @MANTRA_Chain

▷ @ARYZEofficial

▷ @ResolvLabs

▷ @PERQ_FI

▷ @SkyEcosystem

▷ @stablecoin

▷ @EchelonMarket

▷ @upnetworkhq

▷ @reclaimprotocol

Powered by @arbusai and @getmoni_io, giving you the cutting edge to discover the earliest alpha!

Below you will find brief summaries for each.

Let's dive in!

…

…

— 📌 | Mantra Chain

⇢ MANTRA Chain is a permissionless Layer 1 blockchain built for real-world asset (RWA) tokenization, aiming to bring the world’s financial ecosystem onchain with features like DID-powered identity verification, regulatory compliance, and IBC compatibility

⇢ MANTRA Chain enables seamless fractionalization and tokenization of real-world assets, including art, commodities, and real estate.

⇢ MANTRA leverage @cosmos Hub and @IBCProtocol for secure token movement and seamless transactions across the Cosmos ecosystem

…

— 📌 | Aryze

⇢ Aryze is building a unified stablecoin infrastructure, offering cross-chain creation of stablecoin services with shared liquidity and revenue.

⇢ Aryze aims to transform digital finance with asset-agnostic stablecoins backed by real-world collateral.

…

— 📌 | Resolv

⇢ Resolv, accelerated by @Delphi_Digital, is a new stablecoin and yield-generating protocol utilizing a delta-neutral architecture for stability, efficiency, and transparency.

⇢ This architecture separates $ETH into two parts: one staked on-chain and the other used to hedge market risk.

⇢ The dual-tranche structure divides risk into a stablecoin (USR) and a leveraged yield instrument (RLP). USR holders are shielded from market fluctuations and funding rate volatility by RLP.

…

— 📌 | PERQ

⇢ PERQ (formerly known as Drip Finance) allows users to earn tokens by staking stablecoins and $ETH in three types of pools: Earn Pools, Launchpools, and Droppools.

⇢ Earn Pools enable users to acquire existing tokens, while Launchpools grant access to tokens close to launch. Droppools allow users to farm airdrop points that can be converted into rewards.

…

— 📌 | Sky

⇢ Sky (formerly MakerDAO) is a decentralized, non-custodial platform that offers savings and rewards, representing the next evolution of DeFi.

⇢ $SKY Token Rewards are coming soon, offering double rewards to eligible users. Once Sky launches, users can accumulate boosted rewards by supplying $USDS (formerly $DAI) to the Sky Token Rewards module.

…

— 📌 | Bridge

⇢ Bridge is a platform that simplifies global money transfers using stablecoins, enabling individuals and businesses to send, receive, and manage funds worldwide.

⇢ Users can issue their own stablecoin in minutes, backed by reserves invested in US Treasuries. Bridge streamlines global treasury management, allowing businesses to quickly convert local currency to stablecoins.

…

— 📌 | Echelon

⇢ Echelon is a universal lending market that connects liquidity and enhances yields on @AptosLabs. It is designed to scale Move DeFi and liquidity with LST, RWA, and stablecoin-focused strategies.

⇢ Echelon recently completed a $3.5M raise led by @ambergroup_io, with participation from @LaserDigital_, @SaisonCapital, @Cypher_Capital, @280Capital, @SeliniCapital, @InteropVC, @Serafund, @Re7Capital, and other angels such as @dcfgod, the @LayerZero_Labs core team, and more.

…

— 📌 | Up Network

⇢ Up Network, powered by @movementlabsxyz, is a decentralized mobile infrastructure network (DeMIN) aiming to create a Web3 smartphone ecosystem by turning every Android device into a lite node.

⇢ Up Network is also developing a Web3 mobile operating system (OS) called Up OS, based on Android. Their goal is to become the hub for dApps and the DePIN ecosystem.

⇢ Up Mobile will be available on September 9 at 13:00 UTC, priced at $999. Only 15,000 units will be available in the first batch.

…

— 📌 | Reclaim

⇢ Reclaim Protocol harnesses zero knowledge proofs to create cryptographic proofs on HTTPS traffic, empowering users to control their data sharing.

⇢ Reclaim platform offers SDKs for web, mobile, and on-chain applications, streamlining the integration of user activity data.

⇢ These SDKs let any dApp build applications that access users' activity, reputation, and identity from sites across the internet.

…

— 🔴| Disclaimer

The information provided in this post is not intended as professional financial or tax advice, and we strongly recommend conducting your own research and consulting with a qualified advisor before making any financial or tax-related decisions.

Tagging my friends to review and give feedback on the projects I selected above. ⬆️

> @Slappjakke

> @tombheads

> @0xTindorr

> @belizardd

> @lstmaximalist

> @sherifdefi

> @Flowslikeosmo

> @zerokn0wledge_

> @Haylesdefi

> @takegreenpill

> @Route2FI

> @JayLovesPotato

> @Hercules_Defi

> @CryptoGideon_

> @TheDeFISaint

> @DeRonin_

> @0xAndrewMoh

> @louround

> @TheDeFinvestor

> @DeFiMinty

> @thedefiedge

> @Defi_Warhol

> @0xSalazar

> @2lambro

> @CryptMoose_

> @0xelonmoney

> @wacy_time1

> @TheDeFiPlug

> @arndxt_xo

> @CryptoShiro_

> @Beacon_Early

> @stacy_muur

> @the_smart_ape

> @hmalviya9

> @Slappjakke

> @tombheads

> @0xTindorr

> @belizardd

> @lstmaximalist

> @sherifdefi

> @Flowslikeosmo

> @zerokn0wledge_

> @Haylesdefi

> @takegreenpill

> @Route2FI

> @JayLovesPotato

> @Hercules_Defi

> @CryptoGideon_

> @TheDeFISaint

> @DeRonin_

> @0xAndrewMoh

> @louround

> @TheDeFinvestor

> @DeFiMinty

> @thedefiedge

> @Defi_Warhol

> @0xSalazar

> @2lambro

> @CryptMoose_

> @0xelonmoney

> @wacy_time1

> @TheDeFiPlug

> @arndxt_xo

> @CryptoShiro_

> @Beacon_Early

> @stacy_muur

> @the_smart_ape

> @hmalviya9

• • •

Missing some Tweet in this thread? You can try to

force a refresh