Avalanche9000 🔺

The catalyst that unlocks an expansive world of purpose-built blockchains that all feel like one, giving builders a suite of out-of-the-box tools with complete customization controls.

Build with no compromises.

Let’s dig in 👇

The catalyst that unlocks an expansive world of purpose-built blockchains that all feel like one, giving builders a suite of out-of-the-box tools with complete customization controls.

Build with no compromises.

Let’s dig in 👇

Avalanche9000 is the largest network upgrade that Avalanche has undergone since mainnet launch.

This upgrade will make launching your own L1 more economically feasible, easier to customize, smoother to maintain and quicker to bring to market.

avax.network/blog/building-…

This upgrade will make launching your own L1 more economically feasible, easier to customize, smoother to maintain and quicker to bring to market.

avax.network/blog/building-…

Its all about SCALE

Building on-chain has created many opportunities to reimagine how value is created and transferred, but scaling comes with limitations.

❌Network Congestion

❌Technical Constraints

❌Fragmented Users & Liquidity

Why Avalanche9000 👇

academy.avax.network/guide/etna-upg…

Building on-chain has created many opportunities to reimagine how value is created and transferred, but scaling comes with limitations.

❌Network Congestion

❌Technical Constraints

❌Fragmented Users & Liquidity

Why Avalanche9000 👇

academy.avax.network/guide/etna-upg…

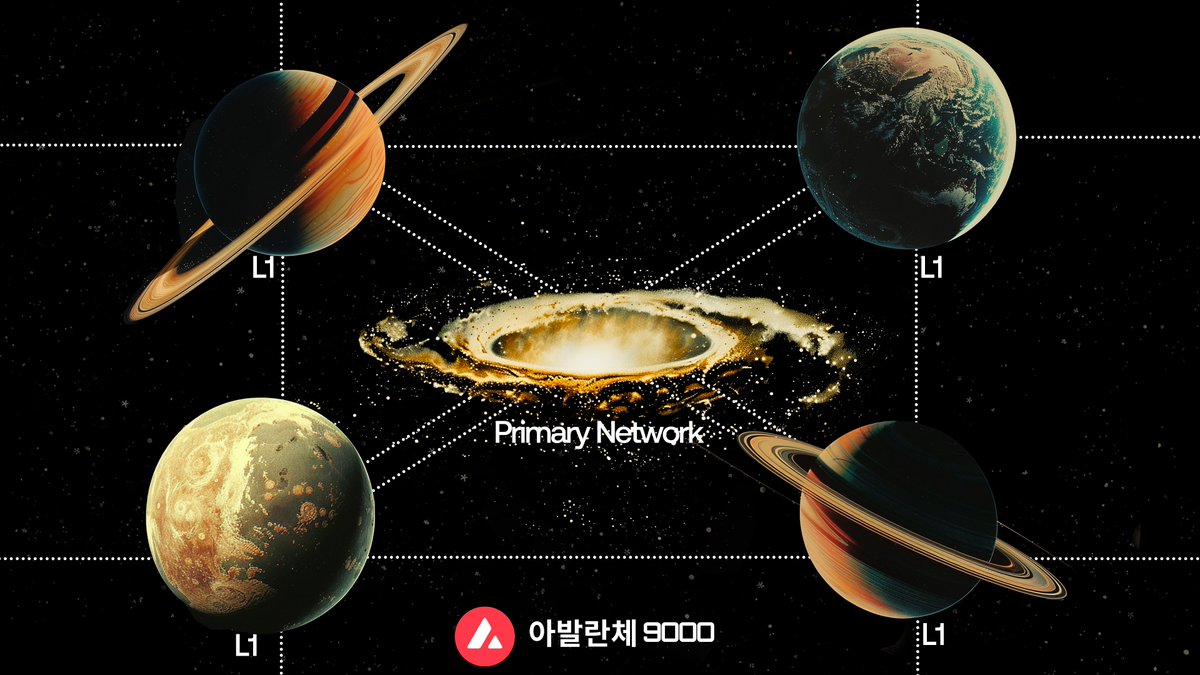

Why Avalanche?

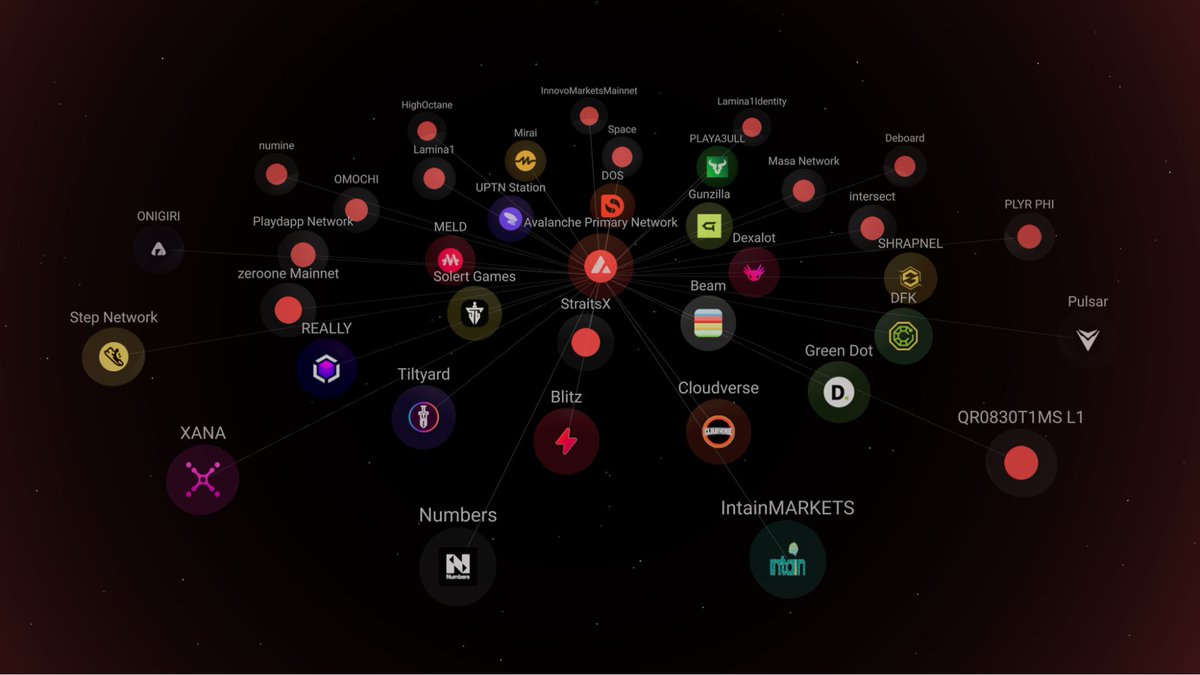

The full power of the Avalanche network comes from the unique combination of a highly performant primary chain, the vast network of L1s, and the unified experience that comes from Avalanche Interchain Messaging.

All combined with the groundbreaking Avalanche Consensus that gives applications near-instant finality 👊

The full power of the Avalanche network comes from the unique combination of a highly performant primary chain, the vast network of L1s, and the unified experience that comes from Avalanche Interchain Messaging.

All combined with the groundbreaking Avalanche Consensus that gives applications near-instant finality 👊

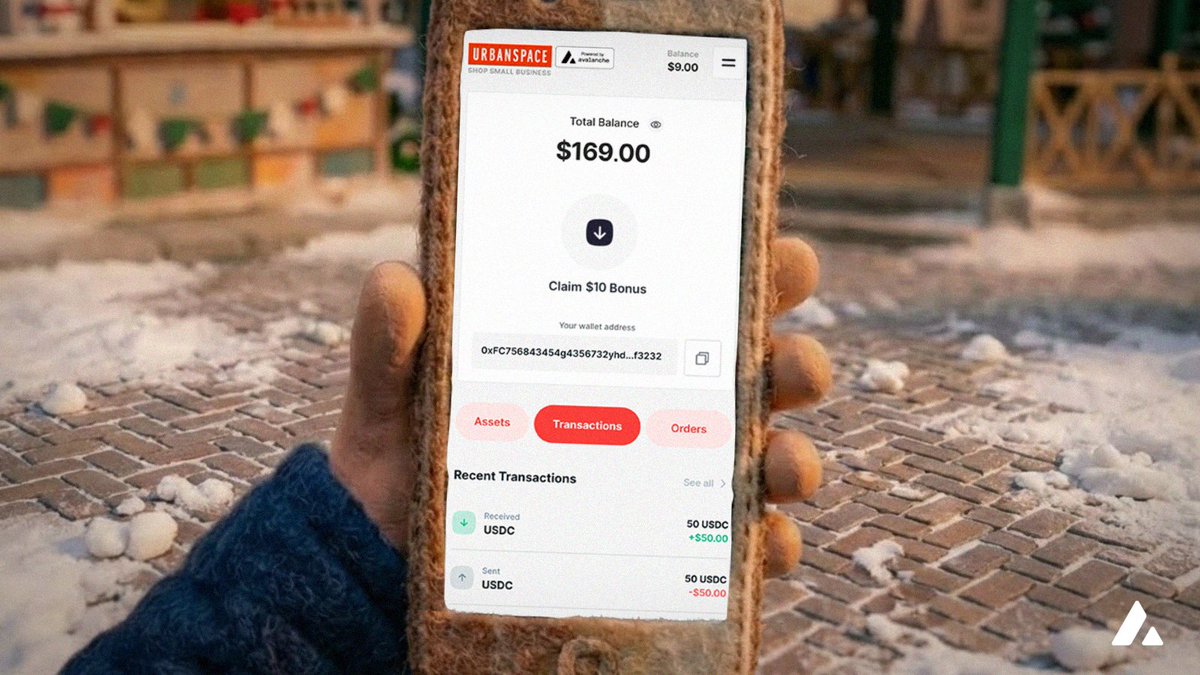

The Primary Chain (C-Chain)

The primary chain will serve as the economic and foundational hub that powers the network, where liquidity can flow easily to every other L1.

Builders can have the peace of mind that they don’t have to create all of their own infrastructure from scratch, all of the pre-built tools on the c-chain can be accessed by any new Avalanche L1.

The primary chain will serve as the economic and foundational hub that powers the network, where liquidity can flow easily to every other L1.

Builders can have the peace of mind that they don’t have to create all of their own infrastructure from scratch, all of the pre-built tools on the c-chain can be accessed by any new Avalanche L1.

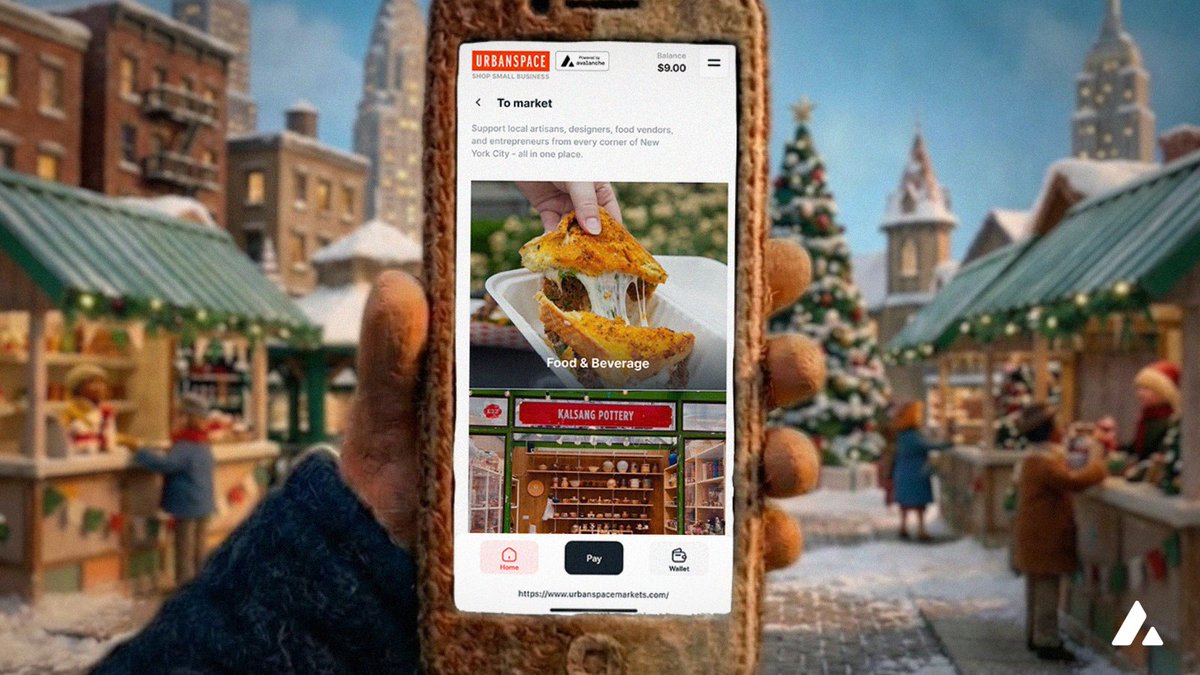

The Network of Avalanche L1s

Build what you want, the way you want.

Avalanche L1s come complete with full customization controls, permissionless validator sets, tools for regulatory compliance, and the ability to use any virtual machine.

Build what you want, the way you want.

Avalanche L1s come complete with full customization controls, permissionless validator sets, tools for regulatory compliance, and the ability to use any virtual machine.

Avalanche Interchain Messaging

Every L1 is connected through Avalanche ICM, meaning all Avalanche L1’s can benefit from the collective success of being interoperable.

Every L1 is connected through Avalanche ICM, meaning all Avalanche L1’s can benefit from the collective success of being interoperable.

This isn’t all just theory either. Avalanche L1’s have been successfully deployed by @Deloitte, @DeFiKingdoms, @GunzillaGames, @MapleStoryU, @PlayShrapnel, SK Planet and more.

snowpeer.io/l1s

snowpeer.io/l1s

The vision is clear, it’s time to build, so what’s next?!

The Avalanche9000 testnet will be launching soon, with the ability for developers to be rewarded for building the foundation for the expansive network of Avalanche L1s.

We will also be releasing all of the tools and documentation needed to launch your own L1 on Avalanche!

The Avalanche9000 testnet will be launching soon, with the ability for developers to be rewarded for building the foundation for the expansive network of Avalanche L1s.

We will also be releasing all of the tools and documentation needed to launch your own L1 on Avalanche!

• • •

Missing some Tweet in this thread? You can try to

force a refresh