🧵 1/

$ETH is probably the most hated coin right now.

Everyone's dunking on it with people jumping to other L1s as alternatives.

But Why ?

A thread on why ETH is underperforming and whether we could still see it hit $10,000 this cycle ? 👇

$ETH is probably the most hated coin right now.

Everyone's dunking on it with people jumping to other L1s as alternatives.

But Why ?

A thread on why ETH is underperforming and whether we could still see it hit $10,000 this cycle ? 👇

2/

Let’s start with the FUD.

$ETH is mainly being hated because its underperforming

Currently down 55% from its 2021 ATH despite several catalysts like;

Multiple spot ETF approvalsCME futures & more

Let’s start with the FUD.

$ETH is mainly being hated because its underperforming

Currently down 55% from its 2021 ATH despite several catalysts like;

Multiple spot ETF approvalsCME futures & more

3/

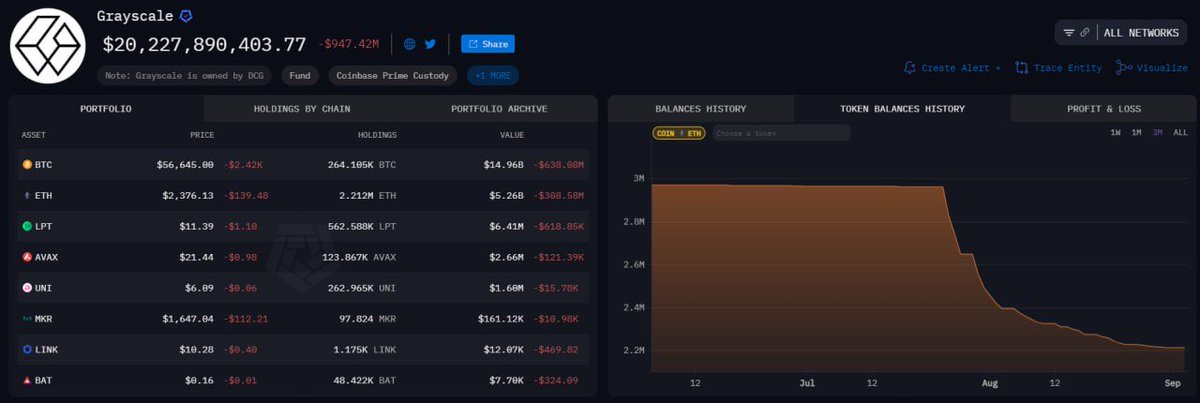

So what’s dragging $ETH down?

A major sell off while demand is less. Here’s what the data says: 👇

Since the $ETH ETF approval:

1) Grayscale has sold 1.2M ETH worth $3B

So what’s dragging $ETH down?

A major sell off while demand is less. Here’s what the data says: 👇

Since the $ETH ETF approval:

1) Grayscale has sold 1.2M ETH worth $3B

4/

2) Jump Crypto has sold 160,000 ETH worth $400M

3) Paradigm has sold 60,000 ETH worth $150M

4) The Ethereum Foundation has sold 35,000 ETH worth $87.5M

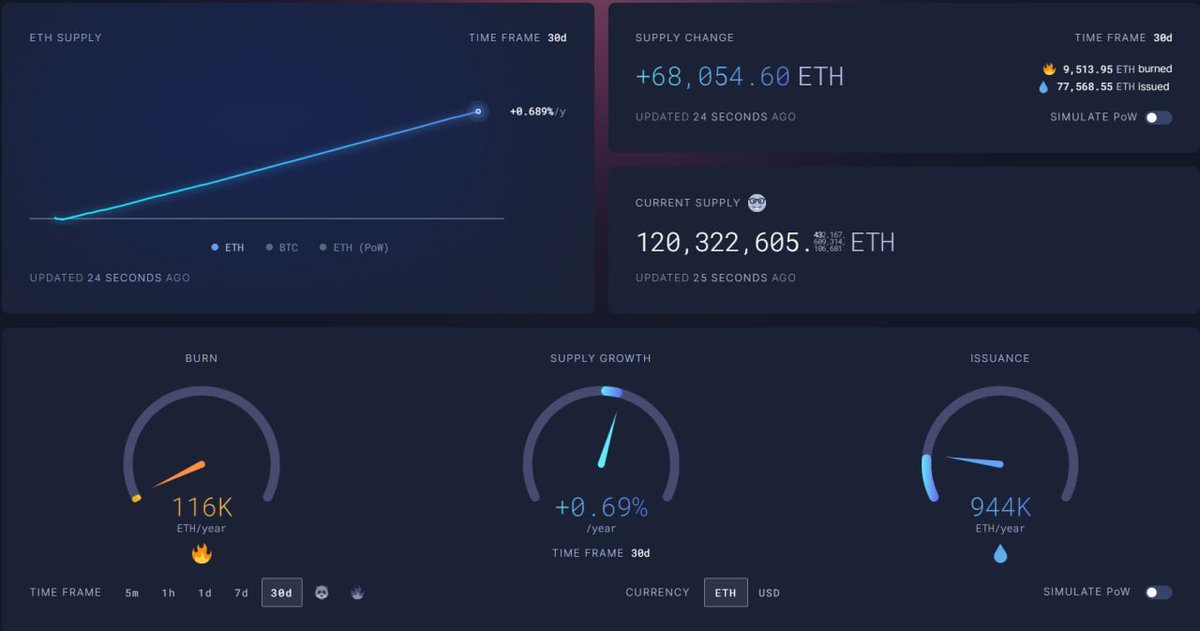

5) Along with that, 92,361 newly issued ETH worth $231M has entered the circulation

2) Jump Crypto has sold 160,000 ETH worth $400M

3) Paradigm has sold 60,000 ETH worth $150M

4) The Ethereum Foundation has sold 35,000 ETH worth $87.5M

5) Along with that, 92,361 newly issued ETH worth $231M has entered the circulation

5/

Now, let’s talk about demand. Since $ETH ETF approval:

- BlackRock’s ETH ETF bought 400K ETH ($1B)

But outside of this, ETH demand has been almost non-existent.

Gas fees are at record lows, a sign that network activity is down, and historically, that’s bearish for ETH.

Now, let’s talk about demand. Since $ETH ETF approval:

- BlackRock’s ETH ETF bought 400K ETH ($1B)

But outside of this, ETH demand has been almost non-existent.

Gas fees are at record lows, a sign that network activity is down, and historically, that’s bearish for ETH.

https://twitter.com/arkhamintel/status/1831370364334625025

6/

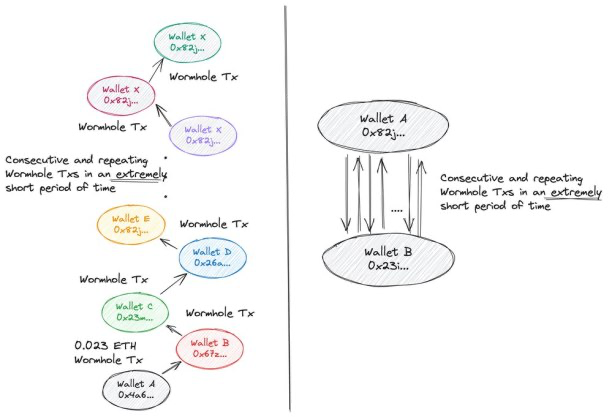

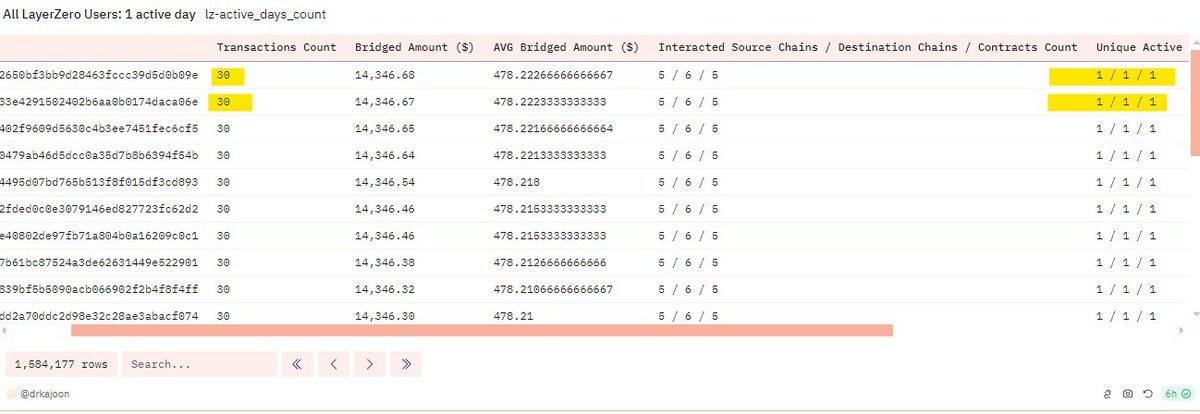

So when does this change?

With the gold rally, investors are still risk-off.

Retail is also absent, likely spooked by scams and rug pulls.

But this won't last forever.

Here’s why I think ETH’s luck will turn soon, and we could see a big rally 👇

So when does this change?

With the gold rally, investors are still risk-off.

Retail is also absent, likely spooked by scams and rug pulls.

But this won't last forever.

Here’s why I think ETH’s luck will turn soon, and we could see a big rally 👇

7/

Key catalysts are coming up:

1️⃣ Fed rate cuts in September will make risk assets like $ETH more attractive

2️⃣ FTX’s $12B stablecoin distribution will inject liquidity

3️⃣ Potential for a pro-crypto president, leading to a bullish regulatory environment.

4️⃣ Global rising liquidity

The stage is being set.

Key catalysts are coming up:

1️⃣ Fed rate cuts in September will make risk assets like $ETH more attractive

2️⃣ FTX’s $12B stablecoin distribution will inject liquidity

3️⃣ Potential for a pro-crypto president, leading to a bullish regulatory environment.

4️⃣ Global rising liquidity

The stage is being set.

8/

Like every cycle, $BTC will lead the charge with a new ATH, followed by $ETH, and then alts.

Once ETH demand picks up:

- ETH ETF inflow will go up

- Retail will start bidding on alts again

- ETH gas fees will go up

- High ETH gas fees, more ETH burn,

deflationary supply combined with growing demand; $ETH rally to $10,000 will start

Like every cycle, $BTC will lead the charge with a new ATH, followed by $ETH, and then alts.

Once ETH demand picks up:

- ETH ETF inflow will go up

- Retail will start bidding on alts again

- ETH gas fees will go up

- High ETH gas fees, more ETH burn,

deflationary supply combined with growing demand; $ETH rally to $10,000 will start

9/

Also, Don't forget that

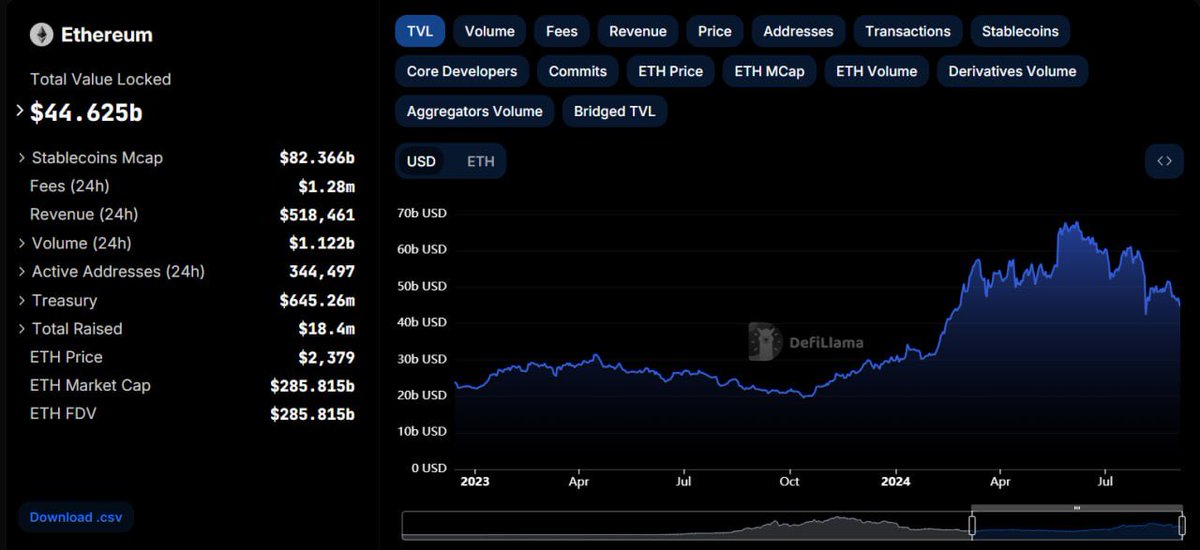

- $ETH has the most liquidity ($82B worth of stablecoins)

- BlackRock and big banks are betting on it

- Highest TVL ($44.62B)

- Highest no. of protocols (1158) and most developers.

Once it starts to pump, there will be no stopping.

Also, Don't forget that

- $ETH has the most liquidity ($82B worth of stablecoins)

- BlackRock and big banks are betting on it

- Highest TVL ($44.62B)

- Highest no. of protocols (1158) and most developers.

Once it starts to pump, there will be no stopping.

10/

The current ETH situation feels like $SOL back in November 2022 after the FTX crash.

SOL was down bad, everyone thought it would dump more, and yet it rallied from $8 to $200 in just 15 months.

ETH could be gearing up for something similar. lets see lol

I’m staying patient, accumulating, and waiting for Q1-Q2 2025

The current ETH situation feels like $SOL back in November 2022 after the FTX crash.

SOL was down bad, everyone thought it would dump more, and yet it rallied from $8 to $200 in just 15 months.

ETH could be gearing up for something similar. lets see lol

I’m staying patient, accumulating, and waiting for Q1-Q2 2025

I hope you've found this thread helpful.

Follow me @Axel_bitblaze69 to:

• Learn more valuable crypto related stuff

• Stay up to date with the latest crypto alpha & airdrops

Like/Retweet the first tweet below if you can please:

Follow me @Axel_bitblaze69 to:

• Learn more valuable crypto related stuff

• Stay up to date with the latest crypto alpha & airdrops

Like/Retweet the first tweet below if you can please:

https://twitter.com/axel_bitblaze69/status/1831652009834922108

• • •

Missing some Tweet in this thread? You can try to

force a refresh