☀️#MMTLP☀️

🧵1/10

The X-ray of #FINRAfraud - (What lies beneath.)

Ten years ago, my doctor ordered an X-ray of my abdomen. He received the images from the technician within 20 minutes. The last thing I expected was a call from my doctor telling me to go straight to the hospital. Little did I know that those X-rays saved my life. It turns out I had an inflammation that was spreading inside my gut. Next came the intense emotional journey, from the shock of the news to the relief of knowing I would be getting treatment. The funny thing is that, before listening to the news and that I had to rush to the hospital, I wasn't feeling any pain. Yet, as the news started sinking in, I began to feel it…all of it.

If you’ve ever had an X-ray, CT Scan, MRI, etc., on a part of your body, you understand it allows us to see everything inside without getting opened up. So here’s a question: could we do the same with @FINRA? Just like an X-ray reveals what's inside our bodies, @FINRA's actions (or lack thereof), data, and available information can reveal what's happening inside that organization without getting in on the inside.

I used to think that @FINRA was not transparent, but now I know that couldn't be further from the truth! Stick with me on this - @FINRA is exceptionally transparent for most of its operations but selectively transparent when there is a problem. In this work, I will show you that @FINRA has trapped itself within its transparency. Their actions, or lack thereof, are now in plain sight for all to see.

@FINRA is suspected of potential fraud in the #MMTLP case, and the following data is about to confirm this. This revelation should raise serious concerns about the ethical behavior we expect from those in a position of trust and power.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵1/10

The X-ray of #FINRAfraud - (What lies beneath.)

Ten years ago, my doctor ordered an X-ray of my abdomen. He received the images from the technician within 20 minutes. The last thing I expected was a call from my doctor telling me to go straight to the hospital. Little did I know that those X-rays saved my life. It turns out I had an inflammation that was spreading inside my gut. Next came the intense emotional journey, from the shock of the news to the relief of knowing I would be getting treatment. The funny thing is that, before listening to the news and that I had to rush to the hospital, I wasn't feeling any pain. Yet, as the news started sinking in, I began to feel it…all of it.

If you’ve ever had an X-ray, CT Scan, MRI, etc., on a part of your body, you understand it allows us to see everything inside without getting opened up. So here’s a question: could we do the same with @FINRA? Just like an X-ray reveals what's inside our bodies, @FINRA's actions (or lack thereof), data, and available information can reveal what's happening inside that organization without getting in on the inside.

I used to think that @FINRA was not transparent, but now I know that couldn't be further from the truth! Stick with me on this - @FINRA is exceptionally transparent for most of its operations but selectively transparent when there is a problem. In this work, I will show you that @FINRA has trapped itself within its transparency. Their actions, or lack thereof, are now in plain sight for all to see.

@FINRA is suspected of potential fraud in the #MMTLP case, and the following data is about to confirm this. This revelation should raise serious concerns about the ethical behavior we expect from those in a position of trust and power.

$MMTLP #MMAT #DJT #GME #FINRAfraud

📎#MMTLP📎

🧵2/10

List of Topics

3/10 - Fundamental Questions about MMTLP.

4/10 - The UPC Committee.

4.1/10 - The UPC Members in 2022.

5/10 - The Meta Materials Instructions.

6/10 - FINRA Fillings.

6.1/10 - Meta Materials Pref. A #MMTLP Corporate Actions.

6.2/10 - UPC Notice (#35-22) - #MMTLP.

7/10 - The Reason for the Deep Dive.

8/10 - The Entire UPC Data.

8.1/10 - The UPC Numbers.

8.2/10 - Filtering the UPC Data & Methodology.

8.3/10 - UPC “Halted” Notices Deep Dive.

8.4/10 - More Halted Notices.

8.5/10 - Even More Halted Notices.

8.6/10 - One More Notice.

8.7/10 - The Trading and Quoting Halt Will End Concurrent With the Deletion.

8.8/10 - UPC "Halted" Timeframe Comparison.

9/10 - UPC Committee Possible Rules Broken.

10/10 - The Price of Silence: Erosion of Trust and the Future of Market Integrity.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵2/10

List of Topics

3/10 - Fundamental Questions about MMTLP.

4/10 - The UPC Committee.

4.1/10 - The UPC Members in 2022.

5/10 - The Meta Materials Instructions.

6/10 - FINRA Fillings.

6.1/10 - Meta Materials Pref. A #MMTLP Corporate Actions.

6.2/10 - UPC Notice (#35-22) - #MMTLP.

7/10 - The Reason for the Deep Dive.

8/10 - The Entire UPC Data.

8.1/10 - The UPC Numbers.

8.2/10 - Filtering the UPC Data & Methodology.

8.3/10 - UPC “Halted” Notices Deep Dive.

8.4/10 - More Halted Notices.

8.5/10 - Even More Halted Notices.

8.6/10 - One More Notice.

8.7/10 - The Trading and Quoting Halt Will End Concurrent With the Deletion.

8.8/10 - UPC "Halted" Timeframe Comparison.

9/10 - UPC Committee Possible Rules Broken.

10/10 - The Price of Silence: Erosion of Trust and the Future of Market Integrity.

$MMTLP #MMAT #DJT #GME #FINRAfraud

3⃣ #MMTLP 3⃣

🧵3/10

Fundamental Questions about #MMTLP

Unfortunately, this work will not answer the most fundamental questions about #MMTLP, which are:

1. What parties provoked @FINRA to create and list #MMTLP for trading on the OTC? Who made the unsolicited request to a broker, and who is the market maker involved?

2. What process, including exemptions, was used to list #MMTLP to trade on the @OTCMarkets? When the issuers alerted @FINRA and @OTCMarkets that the information used on the forms to list #MMTLP to trade was outdated, why was the data not corrected by the party responsible for the listing?

3. Why did @FINRA halt #MMTLP without a clear plan to resolve the extraordinary settlement issue?

Why did @FINRA, in accordance with Rule #6490, not deem the corporate action "deficient" if three different investigative groups were investigating the issuers and the Series A Preferred Shares as part of a market manipulation scheme?

5. What is the aggregated audited share count for #MMTLP after the halt?

As I said before, @FINRA is very transparent but only selectively transparent. After 20 months, we don't know the answers to these straightforward questions.

So, why should I care about this work if you can't answer the five fundamental questions?

I'm glad you asked! This work will delve deep into the UPC committee, who it is, and its function on the markets. Most importantly, we will review its past decisions to assess whether the UPC notice from #MMTLP met its standards and practices or if there was more to it.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵3/10

Fundamental Questions about #MMTLP

Unfortunately, this work will not answer the most fundamental questions about #MMTLP, which are:

1. What parties provoked @FINRA to create and list #MMTLP for trading on the OTC? Who made the unsolicited request to a broker, and who is the market maker involved?

2. What process, including exemptions, was used to list #MMTLP to trade on the @OTCMarkets? When the issuers alerted @FINRA and @OTCMarkets that the information used on the forms to list #MMTLP to trade was outdated, why was the data not corrected by the party responsible for the listing?

3. Why did @FINRA halt #MMTLP without a clear plan to resolve the extraordinary settlement issue?

Why did @FINRA, in accordance with Rule #6490, not deem the corporate action "deficient" if three different investigative groups were investigating the issuers and the Series A Preferred Shares as part of a market manipulation scheme?

5. What is the aggregated audited share count for #MMTLP after the halt?

As I said before, @FINRA is very transparent but only selectively transparent. After 20 months, we don't know the answers to these straightforward questions.

So, why should I care about this work if you can't answer the five fundamental questions?

I'm glad you asked! This work will delve deep into the UPC committee, who it is, and its function on the markets. Most importantly, we will review its past decisions to assess whether the UPC notice from #MMTLP met its standards and practices or if there was more to it.

$MMTLP #MMAT #DJT #GME #FINRAfraud

4⃣ #MMTLP 4⃣

🧵4/10

The UPC committee

The UPC Committee (Uniform Practice Code Committee) oversees the implementation and interpretation of the Uniform Practice Code (UPC), which is a series of rules designed to standardize business practices in the investment banking and securities industries. Their primary responsibility is ensuring uniformity in trade terms, settlement procedures, dividends, interest payments, and other operational issues related to securities transactions. By doing so, they aim to simplify day-to-day operations, prevent disputes, and remove obstacles to the smooth functioning of the market.

What they are:

1. They are responsible for interpreting and ensuring adherence to the UPC, which is a comprehensive set of rules governing operational and settlement issues in over-the-counter (OTC) securities transactions.

2. They issue rulings and advisories on operational matters, such as large dividends, settlement dates, and IPO cancellations, to eliminate misunderstandings and enhance market efficiency.

3. The UPC Committee plays a significant role in advising the FINRA Regulation Board on necessary modifications to the UPC and other FINRA rules related to financial responsibility and securities transactions. This advisory function is crucial in ensuring the smooth operation of the financial markets.

What they are not:

1. They do not function like a legal court in issuing binding legal judgements. Instead, they provide interpretations and rulings concerning the UPC and FINRA rules, particularly regarding operational issues and disputes.

2. While they may interpret and enforce market standards, they are not involved in imposing penalties or criminal enforcement like a judicial body.

NOTE: @FINRA does issue fines as part of their regulator duties.

The UPC Committee plays a higher-level interpretative role in corporate actions, ensuring market order and consistency with established market practices.

However, unlike a court, they don't pass legal judgments or impose judgements but ensure corporate actions align with market standards and investor protections.

They focus more on maintaining procedural uniformity than resolving individual disputes or addressing deeper transaction issues. In the case of #MMTLP, the UPC notice issued by FINRA, which halted trading and quoting, acted more like a final decision that trapped investors without addressing the underlying extraordinary settlement problem.

This decision, which @FINRA claims sought to protect the public interest, left investors without timely recourse. As we delve deeper into this issue, we may gain further insight into the consequences of the #MMTLP U3 HALT and its broader implications.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵4/10

The UPC committee

The UPC Committee (Uniform Practice Code Committee) oversees the implementation and interpretation of the Uniform Practice Code (UPC), which is a series of rules designed to standardize business practices in the investment banking and securities industries. Their primary responsibility is ensuring uniformity in trade terms, settlement procedures, dividends, interest payments, and other operational issues related to securities transactions. By doing so, they aim to simplify day-to-day operations, prevent disputes, and remove obstacles to the smooth functioning of the market.

What they are:

1. They are responsible for interpreting and ensuring adherence to the UPC, which is a comprehensive set of rules governing operational and settlement issues in over-the-counter (OTC) securities transactions.

2. They issue rulings and advisories on operational matters, such as large dividends, settlement dates, and IPO cancellations, to eliminate misunderstandings and enhance market efficiency.

3. The UPC Committee plays a significant role in advising the FINRA Regulation Board on necessary modifications to the UPC and other FINRA rules related to financial responsibility and securities transactions. This advisory function is crucial in ensuring the smooth operation of the financial markets.

What they are not:

1. They do not function like a legal court in issuing binding legal judgements. Instead, they provide interpretations and rulings concerning the UPC and FINRA rules, particularly regarding operational issues and disputes.

2. While they may interpret and enforce market standards, they are not involved in imposing penalties or criminal enforcement like a judicial body.

NOTE: @FINRA does issue fines as part of their regulator duties.

The UPC Committee plays a higher-level interpretative role in corporate actions, ensuring market order and consistency with established market practices.

However, unlike a court, they don't pass legal judgments or impose judgements but ensure corporate actions align with market standards and investor protections.

They focus more on maintaining procedural uniformity than resolving individual disputes or addressing deeper transaction issues. In the case of #MMTLP, the UPC notice issued by FINRA, which halted trading and quoting, acted more like a final decision that trapped investors without addressing the underlying extraordinary settlement problem.

This decision, which @FINRA claims sought to protect the public interest, left investors without timely recourse. As we delve deeper into this issue, we may gain further insight into the consequences of the #MMTLP U3 HALT and its broader implications.

$MMTLP #MMAT #DJT #GME #FINRAfraud

4⃣ #MMTLP 4⃣

🧵4.1/10

The UPC Members in 2022

The FINRA UPC (Uniform Practice Code) Committee comprises industry professionals and representatives from various member firms who are well-versed in market operations, securities regulations, and the trading environment.

These members provide guidance and recommendations on UPC matters to ensure market transparency and fairness. Committee members typically serve for three years, though members' tenure can be extended based on their continued contributions and expertise. Their combined experience and knowledge play a critical role in shaping the guidelines that govern over-the-counter securities transactions.

In 2022, 10 members composed the UPC committee, two from @FINRA and eight from market participants (financial institutions) employees.

All eight member firms in the UPC committee were directly or indirectly involved in trading #MMTLP.

But there is nothing to see here, right?!

If you sum up the group experience, the combined total is over 150 years!

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵4.1/10

The UPC Members in 2022

The FINRA UPC (Uniform Practice Code) Committee comprises industry professionals and representatives from various member firms who are well-versed in market operations, securities regulations, and the trading environment.

These members provide guidance and recommendations on UPC matters to ensure market transparency and fairness. Committee members typically serve for three years, though members' tenure can be extended based on their continued contributions and expertise. Their combined experience and knowledge play a critical role in shaping the guidelines that govern over-the-counter securities transactions.

In 2022, 10 members composed the UPC committee, two from @FINRA and eight from market participants (financial institutions) employees.

All eight member firms in the UPC committee were directly or indirectly involved in trading #MMTLP.

But there is nothing to see here, right?!

If you sum up the group experience, the combined total is over 150 years!

$MMTLP #MMAT #DJT #GME #FINRAfraud

5⃣ #MMTLP 5⃣

🧵5/10

The Meta Materials Instructions

On November 23rd, 2022, Meta Materials released a press release (PR) outlining the details of the upcoming spin-off of their Series A Preferred Shares (MMTLP) into Next Bridge Hydrocarbons, Inc. According to the PR, shareholders of record, as of December 12th, 2022, would receive shares of Next Bridge Hydrocarbons in exchange for their #MMTLP shares. The company specified that Next Bridge Hydrocarbons shares would be distributed on December 14th, 2022, and that trading of #MMTLP shares would cease after this point.

Importantly, Meta Materials stated that all Series A Preferred Shares would be canceled following the spin-off, meaning they would no longer exist or be tradable.

In summary, the PR provided two critical dates: the record date of December 12th, 2022, for eligibility to receive Next Bridge shares, and December 14th, 2022, when the actual distribution would occur, along with the cancellation of #MMTLP shares. This transition marked the end of trading for the preferred shares, as they would cease to exist once the process was completed.

On November 30th, 2022, George Palikaras posted on X, doubling down on his instructions to @FINRA before @FINRA released their first Corporate Action.

The most important point was

"[NO EX-DIVIDEND DATE]"

I suggest you open a new tab and read @raredealshere's excellent post. He covers this topic with absolute mastery, and I totally recommend all of his posts.

[LINK]

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵5/10

The Meta Materials Instructions

On November 23rd, 2022, Meta Materials released a press release (PR) outlining the details of the upcoming spin-off of their Series A Preferred Shares (MMTLP) into Next Bridge Hydrocarbons, Inc. According to the PR, shareholders of record, as of December 12th, 2022, would receive shares of Next Bridge Hydrocarbons in exchange for their #MMTLP shares. The company specified that Next Bridge Hydrocarbons shares would be distributed on December 14th, 2022, and that trading of #MMTLP shares would cease after this point.

Importantly, Meta Materials stated that all Series A Preferred Shares would be canceled following the spin-off, meaning they would no longer exist or be tradable.

In summary, the PR provided two critical dates: the record date of December 12th, 2022, for eligibility to receive Next Bridge shares, and December 14th, 2022, when the actual distribution would occur, along with the cancellation of #MMTLP shares. This transition marked the end of trading for the preferred shares, as they would cease to exist once the process was completed.

On November 30th, 2022, George Palikaras posted on X, doubling down on his instructions to @FINRA before @FINRA released their first Corporate Action.

The most important point was

"[NO EX-DIVIDEND DATE]"

I suggest you open a new tab and read @raredealshere's excellent post. He covers this topic with absolute mastery, and I totally recommend all of his posts.

[LINK]

$MMTLP #MMAT #DJT #GME #FINRAfraud

https://x.com/RareDealsHere/status/1695786767335759931

6⃣ #MMTLP 6⃣

🧵6/10

FINRA Fillings

Corporate Actions: @FINRA posts corporate actions on the Daily List to ensure that investors, brokers, and the market have timely and accurate information about significant events that impact securities, such as mergers, spin-offs, symbol changes, or dividend payments. This transparency helps everyone make informed decisions and stay updated on changes that could affect trading or settlement processes.

UPC Notices: Some corporate actions, such as trading halts, symbol deletions, or special distributions, are followed by UPC notices because they involve complex situations that could disrupt the market or investor expectations. UPC notices provide additional guidance and ensure that these actions are handled uniformly and fairly across the market, protecting investors and maintaining market integrity.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵6/10

FINRA Fillings

Corporate Actions: @FINRA posts corporate actions on the Daily List to ensure that investors, brokers, and the market have timely and accurate information about significant events that impact securities, such as mergers, spin-offs, symbol changes, or dividend payments. This transparency helps everyone make informed decisions and stay updated on changes that could affect trading or settlement processes.

UPC Notices: Some corporate actions, such as trading halts, symbol deletions, or special distributions, are followed by UPC notices because they involve complex situations that could disrupt the market or investor expectations. UPC notices provide additional guidance and ensure that these actions are handled uniformly and fairly across the market, protecting investors and maintaining market integrity.

$MMTLP #MMAT #DJT #GME #FINRAfraud

6⃣ #MMTLP 6⃣

🧵6.1/10

Meta Materials Pref. A #MMTLP Corporate Actions

@FINRA published the first corporate action on its daily list on December 6th, 2022. Some of the instructions matched the company's wishes, but some of the language used was dissimilar to the issuer’s fillings creating a lot confusion.

December 6, 2022 - Comments: #MMTLP shareholders with settled positions as of 12/12/22 Record Date will receive one (1) share of Next Bridge Hydrocarbons, Inc. for every one (1) share of #MMTLP held on Pay Date of 12/14/22. Purchases of #MMTLP executed after 12/8/22 will not receive the distribution. Will not be quoted Ex. #MMTLP shares will be CANCELED effective 12/13/22.

December 8, 2022 - Comments: See Daily List of 12/6/2022. Announcement Revised: #MMTLP shareholders with settled positions as of 12/12/22 will receive one (1) share of Next Bridge Hydrocarbons, Inc. for every one (1) share of #MMTLP held. Purchases of #MMTLP executed after 12/8/22 will not receive the distribution. Will not be quoted Ex. Symbol: #MMTLP will be DELETED effective 12/13/22.

Once again, I suggest you open a new tab and read the great post by @raredealshere. He explains the problems in detail.

[LINK]

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵6.1/10

Meta Materials Pref. A #MMTLP Corporate Actions

@FINRA published the first corporate action on its daily list on December 6th, 2022. Some of the instructions matched the company's wishes, but some of the language used was dissimilar to the issuer’s fillings creating a lot confusion.

December 6, 2022 - Comments: #MMTLP shareholders with settled positions as of 12/12/22 Record Date will receive one (1) share of Next Bridge Hydrocarbons, Inc. for every one (1) share of #MMTLP held on Pay Date of 12/14/22. Purchases of #MMTLP executed after 12/8/22 will not receive the distribution. Will not be quoted Ex. #MMTLP shares will be CANCELED effective 12/13/22.

December 8, 2022 - Comments: See Daily List of 12/6/2022. Announcement Revised: #MMTLP shareholders with settled positions as of 12/12/22 will receive one (1) share of Next Bridge Hydrocarbons, Inc. for every one (1) share of #MMTLP held. Purchases of #MMTLP executed after 12/8/22 will not receive the distribution. Will not be quoted Ex. Symbol: #MMTLP will be DELETED effective 12/13/22.

Once again, I suggest you open a new tab and read the great post by @raredealshere. He explains the problems in detail.

[LINK]

$MMTLP #MMAT #DJT #GME #FINRAfraud

https://x.com/RareDealsHere/status/1695786767335759931

6⃣ #MMTLP 6⃣

🧵6.2/10

UPC Notice (#35-22) - #MMTLP

On the morning of December 9th, 2022, before the opening of the markets, @FINRA halted the trading of #MMTLP. Later that day, @FINRA released UPC Notice #35-22 explaining the trading halt of #MMTLP.

The text said the following:

"Trading and Quotation Halt for META MATERIALS PFD SER A (#MMTLP)

Effective Friday, December 9th, 2022, the Financial Industry Regulatory Authority, Inc. ("FINRA") halted trading and quoting in the Series A preferred shares of Meta Materials Inc. (OTC Symbol: #MMTLP). Pursuant to Rule 6440(a)(3), FINRA has determined that an extraordinary event has occurred or is ongoing that has caused or has the potential to cause significant uncertainty in the settlement and clearance process for shares in #MMTLP and that, therefore, halting trading and quoting in #MMTLP is necessary to protect investors and the public interest.

The trading and quoting halt will end concurrent with the deletion of the symbol effective Tuesday, December 13th, 2022. See updated FINRA Daily List announcement of December 8th, 2022, regarding #MMTLP; available here: .

See also Form S1 Registration Statement for Next Bridge Hydrocarbons, Inc. stating that "…immediately after the Spin-Off, all shares of Series A Non-Voting Preferred Stock of Meta shall be cancelled." Available here:

"

For now, I'm only including the text and image of the UPC Notice, but I won't explain the problem yet.

Next, we will enter the deep-dive part of this work so everything will be clear.

$MMTLP #MMAT #DJT #GME #FINRAfraudotce.finra.org/otce/dailyList

sec.gov/Archives/edgar…

🧵6.2/10

UPC Notice (#35-22) - #MMTLP

On the morning of December 9th, 2022, before the opening of the markets, @FINRA halted the trading of #MMTLP. Later that day, @FINRA released UPC Notice #35-22 explaining the trading halt of #MMTLP.

The text said the following:

"Trading and Quotation Halt for META MATERIALS PFD SER A (#MMTLP)

Effective Friday, December 9th, 2022, the Financial Industry Regulatory Authority, Inc. ("FINRA") halted trading and quoting in the Series A preferred shares of Meta Materials Inc. (OTC Symbol: #MMTLP). Pursuant to Rule 6440(a)(3), FINRA has determined that an extraordinary event has occurred or is ongoing that has caused or has the potential to cause significant uncertainty in the settlement and clearance process for shares in #MMTLP and that, therefore, halting trading and quoting in #MMTLP is necessary to protect investors and the public interest.

The trading and quoting halt will end concurrent with the deletion of the symbol effective Tuesday, December 13th, 2022. See updated FINRA Daily List announcement of December 8th, 2022, regarding #MMTLP; available here: .

See also Form S1 Registration Statement for Next Bridge Hydrocarbons, Inc. stating that "…immediately after the Spin-Off, all shares of Series A Non-Voting Preferred Stock of Meta shall be cancelled." Available here:

"

For now, I'm only including the text and image of the UPC Notice, but I won't explain the problem yet.

Next, we will enter the deep-dive part of this work so everything will be clear.

$MMTLP #MMAT #DJT #GME #FINRAfraudotce.finra.org/otce/dailyList

sec.gov/Archives/edgar…

7⃣ #MMTLP 7⃣

🧵7/10

The Reason for the Deep-Dive

The following sentence of UPC Notice (#35-22) for #MMTLP inspired this work.

"The trading and quoting halt will end concurrent with the deletion of the symbol effective Tuesday, December 13th, 2022."

After better understanding the UPC Committee's role, I was disturbed by this sentence. This sentence does not protect investors in any way, shape, or form, so it brought many questions to my mind.

Has a situation like this ever happened before?

How does the UPC committee handle these notices?

What are their objectives?

How clear are their instructions?

How did they handle deletions, spin-offs, trading halts, and extraordinary events of other securities?

Have they acted according to UPC rules?

Have they acted according to @FINRA general rules?

There's only one way to find out: We have to download and study all of the UPC notices to see how this committee acted and informed the public in the past.

Without further ado, let's go to the data part.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵7/10

The Reason for the Deep-Dive

The following sentence of UPC Notice (#35-22) for #MMTLP inspired this work.

"The trading and quoting halt will end concurrent with the deletion of the symbol effective Tuesday, December 13th, 2022."

After better understanding the UPC Committee's role, I was disturbed by this sentence. This sentence does not protect investors in any way, shape, or form, so it brought many questions to my mind.

Has a situation like this ever happened before?

How does the UPC committee handle these notices?

What are their objectives?

How clear are their instructions?

How did they handle deletions, spin-offs, trading halts, and extraordinary events of other securities?

Have they acted according to UPC rules?

Have they acted according to @FINRA general rules?

There's only one way to find out: We have to download and study all of the UPC notices to see how this committee acted and informed the public in the past.

Without further ado, let's go to the data part.

$MMTLP #MMAT #DJT #GME #FINRAfraud

8⃣ #MMTLP 8⃣

🧵8/10

The Entire UPC Data

You can find the all the UPC notices issued by @FINRA on the following link.

LINK: UPC Advisory |

This page contains thousands of UPC notices from 1997 to 2024. This is public information.

We will focus on the data from August 1st, 2007, to their latest notice in 2024.

But why from 2007 and not 1997?

On July 31st, 2007, NASD became @FINRA. All of the filings before July 31st were issued by NASDAQ.

So, how big is the data?

From August 1st, 2007, to August 31st, 2024, @FINRA issued 1,040 UPC notices.

By the end of this post, I hope you will understand how @FINRA's handling of #MMTLP deviated from its standard practices, procedures, and treatment of ALL other UPC notices and related actions.

Let's dive.

$MMTLP #MMAT #DJT #GME #FINRAfraudFINRA.org

🧵8/10

The Entire UPC Data

You can find the all the UPC notices issued by @FINRA on the following link.

LINK: UPC Advisory |

This page contains thousands of UPC notices from 1997 to 2024. This is public information.

We will focus on the data from August 1st, 2007, to their latest notice in 2024.

But why from 2007 and not 1997?

On July 31st, 2007, NASD became @FINRA. All of the filings before July 31st were issued by NASDAQ.

So, how big is the data?

From August 1st, 2007, to August 31st, 2024, @FINRA issued 1,040 UPC notices.

By the end of this post, I hope you will understand how @FINRA's handling of #MMTLP deviated from its standard practices, procedures, and treatment of ALL other UPC notices and related actions.

Let's dive.

$MMTLP #MMAT #DJT #GME #FINRAfraudFINRA.org

8⃣ #MMTLP 8⃣

🧵8.1/10

The UPC Numbers

As I said before, I analyzed 1,040 UPC notices issued between August 1st, 2007, and August 31st, 2024, to explore patterns in regulatory actions.

"Reorganization" was the most frequently used term, with 695 occurrences (66.83%). This is often tied to significant corporate changes such as mergers or bankruptcies, frequently resulting in share cancellations.

The overlap between the terms "Cancelled" (480 occurrences) and "Canceled" (101 occurrences) with reorganization events reflects this, as share cancellations are a standard part of the bankruptcy process.

The keyword "When Issued" appeared in 114 notices (10.96%), generally indicating new securities issued following a merger or reorganization.

Notices related to trading halts, such as "Halted" (25 occurrences) and "HALT" (24 occurrences), are typically associated with FINRA Rule 6440, which governs trading and quotation halts on the OTC markets. Together, these terms point to temporary suspensions of trading when uncertainties exist around a company's securities.

"Significant Uncertainty" appeared in 10 notices (0.96%); in this context, it refers to uncertainties related to settlement and clearance processes.

Overall, the data shows a regulatory focus on corporate reorganizations and share cancellations, with occasional trading halts and settlement-related concerns playing a more minor but still important role.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵8.1/10

The UPC Numbers

As I said before, I analyzed 1,040 UPC notices issued between August 1st, 2007, and August 31st, 2024, to explore patterns in regulatory actions.

"Reorganization" was the most frequently used term, with 695 occurrences (66.83%). This is often tied to significant corporate changes such as mergers or bankruptcies, frequently resulting in share cancellations.

The overlap between the terms "Cancelled" (480 occurrences) and "Canceled" (101 occurrences) with reorganization events reflects this, as share cancellations are a standard part of the bankruptcy process.

The keyword "When Issued" appeared in 114 notices (10.96%), generally indicating new securities issued following a merger or reorganization.

Notices related to trading halts, such as "Halted" (25 occurrences) and "HALT" (24 occurrences), are typically associated with FINRA Rule 6440, which governs trading and quotation halts on the OTC markets. Together, these terms point to temporary suspensions of trading when uncertainties exist around a company's securities.

"Significant Uncertainty" appeared in 10 notices (0.96%); in this context, it refers to uncertainties related to settlement and clearance processes.

Overall, the data shows a regulatory focus on corporate reorganizations and share cancellations, with occasional trading halts and settlement-related concerns playing a more minor but still important role.

$MMTLP #MMAT #DJT #GME #FINRAfraud

8⃣ #MMTLP 8⃣

🧵8.2/10

Filtering the UPC Data & Methodology

First, I selected eight main keywords from UPC notice #35-22 regarding #MMTLP to identify similar cases across other notices.

By filtering keywords like "Trading and Quoting Halt," "Deletion," "Significant Uncertainty," and "6440," I compiled a list of other UPC notices with these same terms. This allows us to explore similar situations where FINRA applied these terms, helping to uncover patterns and delve deeper into the regulatory responses to such events.

Important Note:

I excluded the following notices because they are not relevant to our analysis:

FINRA OTC MARKET WIDE HALTS: #47-13, #48-13, #37-14 and #38-14.

ATP OIL & GAS CORP: #33-14 - It was a ticker suspended by the @SECgov.

Important Files:

ALL UPC Notices from August 1st 2007 to August 30th 2024:

All Trading and Quotation Halt notices used for this post:

$MMTLP #MMAT #DJT #GME #FINRAfrauddrive.google.com/file/d/1eJLIoX…

drive.google.com/file/d/1f79piO…

🧵8.2/10

Filtering the UPC Data & Methodology

First, I selected eight main keywords from UPC notice #35-22 regarding #MMTLP to identify similar cases across other notices.

By filtering keywords like "Trading and Quoting Halt," "Deletion," "Significant Uncertainty," and "6440," I compiled a list of other UPC notices with these same terms. This allows us to explore similar situations where FINRA applied these terms, helping to uncover patterns and delve deeper into the regulatory responses to such events.

Important Note:

I excluded the following notices because they are not relevant to our analysis:

FINRA OTC MARKET WIDE HALTS: #47-13, #48-13, #37-14 and #38-14.

ATP OIL & GAS CORP: #33-14 - It was a ticker suspended by the @SECgov.

Important Files:

ALL UPC Notices from August 1st 2007 to August 30th 2024:

All Trading and Quotation Halt notices used for this post:

$MMTLP #MMAT #DJT #GME #FINRAfrauddrive.google.com/file/d/1eJLIoX…

drive.google.com/file/d/1f79piO…

8⃣ #MMTLP 8⃣

🧵8.3/10

UPC “Halted” Notices Deep Dive

In my deep dive into these notices, I focused on the keyword "Halted" because it defines the core action in UPC notice (#35-22) for #MMTLP. Additionally, the keyword "Extraordinary" (overlaps with halted) was selected to highlight the severity of the situation, underscoring the significant impact of these events.

Let’s take a close look at all of the Trading and Quotation Halt notices.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵8.3/10

UPC “Halted” Notices Deep Dive

In my deep dive into these notices, I focused on the keyword "Halted" because it defines the core action in UPC notice (#35-22) for #MMTLP. Additionally, the keyword "Extraordinary" (overlaps with halted) was selected to highlight the severity of the situation, underscoring the significant impact of these events.

Let’s take a close look at all of the Trading and Quotation Halt notices.

$MMTLP #MMAT #DJT #GME #FINRAfraud

8⃣ #MMTLP 8⃣

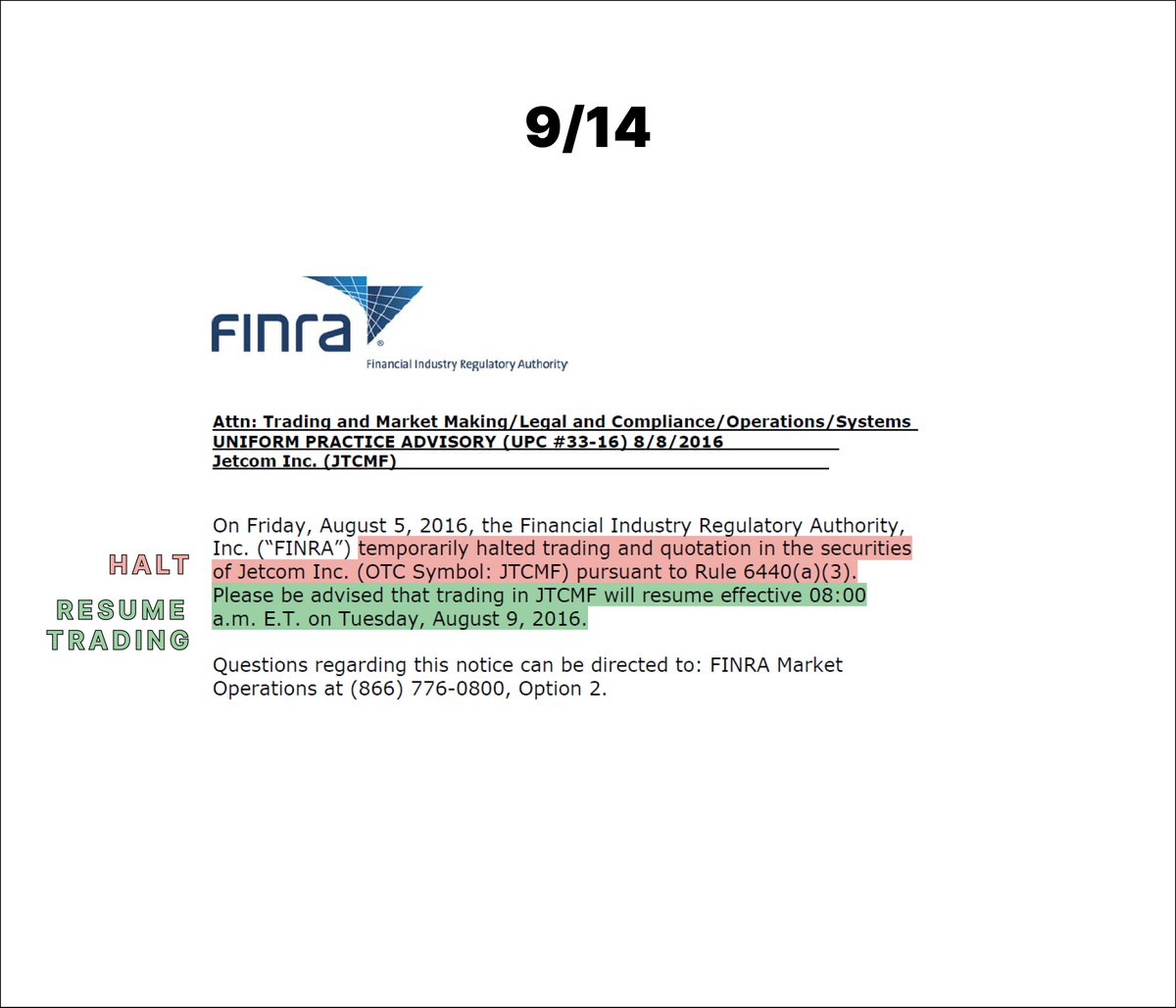

🧵8.6/10

One More Notice

This is the last notice we are looking at before I show you the #MMTLP notice.

By now, you are familiar with the pattern. They always have the section discussing the HALT and give us a REASON for most notices. Lastly, they inform the market how and when it will RESUME TRADING.

It’s a pretty simple formula, right?

Now, let’s look at the #MMTLP notice.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵8.6/10

One More Notice

This is the last notice we are looking at before I show you the #MMTLP notice.

By now, you are familiar with the pattern. They always have the section discussing the HALT and give us a REASON for most notices. Lastly, they inform the market how and when it will RESUME TRADING.

It’s a pretty simple formula, right?

Now, let’s look at the #MMTLP notice.

$MMTLP #MMAT #DJT #GME #FINRAfraud

8⃣ #MMTLP 8⃣

🧵8.7/10

The Trading and Quoting Halt Will End Concurrent With the Deletion.

Hey, what happened here? Interesting right? We just looked at and trained our eyes for their entire history of “halted” notices, and for some reason this UPC Notice (#35-22) for #MMTLP is not like the others, but why?

If you go back to read the other notices, NONE OF THEM will say:

“The Trading and Quoting Halt Will End Concurrent With the Deletion of the symbol effective (date).”

In fact, this phrase was never been used in any other UPC notice EVER.

Why is that a problem?

If you HALT a security and you delete it concurrent with the HALT, you will never settle anything, but everyone involved will stay trapped forever. I wonder who had this brilliant idea.

Does that language "Trading and Quoting Halt Will End Concurrent With the Deletion" look like it was accidental?

Do think the UPC Committee was so amateur that they "forgot" to settle #MMTLP?

But why would you ever delete a security you said has an extraordinary settlement and clearance process issue instead of solving it?

That’s the question we have been asking @FINRA for the past 21 months!

Knowing what you know now, how would you feel about this notice if you were the oversight of @FINRA and @SECgov?

Why after 638+ days @FINRA never made any attempts to correct the “extraordinary event has occurred or is ongoing that has caused or has the potential to cause significant uncertainty in the settlement and clearance process for shares in #MMTLP”?

Why on @FINRA Corporate Action they fabricated the December 13, 2022 date as the Cancellation and later as the Deletion date?

The issuer never used this date (December 13, 2022) on the filings but @FINRA actually fabricated and used it as an argument for a T+2 settlement issue!

#MMTLP Investors demand a thorough investigation of @FINRA and their UPC Committee for any potential violations of their own rules, potential conflicts of interest, and fraudulent activities surrounding the #MMTLP corporate actions and subsequent U3 HALT. Furthermore, we demand the investigation include any potential knowledge of or role the @SECgov may have played in the decision to issue either the modified corporate actions or the U3 HALT.

If you are unconvinced, let’s look at the notices' overall timeframe.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵8.7/10

The Trading and Quoting Halt Will End Concurrent With the Deletion.

Hey, what happened here? Interesting right? We just looked at and trained our eyes for their entire history of “halted” notices, and for some reason this UPC Notice (#35-22) for #MMTLP is not like the others, but why?

If you go back to read the other notices, NONE OF THEM will say:

“The Trading and Quoting Halt Will End Concurrent With the Deletion of the symbol effective (date).”

In fact, this phrase was never been used in any other UPC notice EVER.

Why is that a problem?

If you HALT a security and you delete it concurrent with the HALT, you will never settle anything, but everyone involved will stay trapped forever. I wonder who had this brilliant idea.

Does that language "Trading and Quoting Halt Will End Concurrent With the Deletion" look like it was accidental?

Do think the UPC Committee was so amateur that they "forgot" to settle #MMTLP?

But why would you ever delete a security you said has an extraordinary settlement and clearance process issue instead of solving it?

That’s the question we have been asking @FINRA for the past 21 months!

Knowing what you know now, how would you feel about this notice if you were the oversight of @FINRA and @SECgov?

Why after 638+ days @FINRA never made any attempts to correct the “extraordinary event has occurred or is ongoing that has caused or has the potential to cause significant uncertainty in the settlement and clearance process for shares in #MMTLP”?

Why on @FINRA Corporate Action they fabricated the December 13, 2022 date as the Cancellation and later as the Deletion date?

The issuer never used this date (December 13, 2022) on the filings but @FINRA actually fabricated and used it as an argument for a T+2 settlement issue!

#MMTLP Investors demand a thorough investigation of @FINRA and their UPC Committee for any potential violations of their own rules, potential conflicts of interest, and fraudulent activities surrounding the #MMTLP corporate actions and subsequent U3 HALT. Furthermore, we demand the investigation include any potential knowledge of or role the @SECgov may have played in the decision to issue either the modified corporate actions or the U3 HALT.

If you are unconvinced, let’s look at the notices' overall timeframe.

$MMTLP #MMAT #DJT #GME #FINRAfraud

8⃣ #MMTLP 8⃣

🧵8.8/10

UPC "Halted" Timeframe Comparison

The table is straightforward, with columns showing the UPC notice number, the company name and ticker symbol of the affected security, the halt date, the resolution date, and how many days it took to resolve it. Most halts were resolved within days, ranging from one day to two weeks. However, one glaring difference stands out: #MMTLP, associated with notice (#35-22), remains unresolved after 638+ days, far exceeding any other cases.

This lengthy unresolved halt stands alone compared to the others, which typically have clear resolutions within a short period. It highlights the complexity, uncertainty, and obscurity created by @FINRA surrounding the #MMTLP HALT, signaling a deeper issue than similar cases.

Still not convinced there’s something wrong with @FINRA?

It will get worse. Let’s look at the possible rules @FINRA broke.

$MMTLP #MMAT #DJT #GME #FINRAfraud

🧵8.8/10

UPC "Halted" Timeframe Comparison

The table is straightforward, with columns showing the UPC notice number, the company name and ticker symbol of the affected security, the halt date, the resolution date, and how many days it took to resolve it. Most halts were resolved within days, ranging from one day to two weeks. However, one glaring difference stands out: #MMTLP, associated with notice (#35-22), remains unresolved after 638+ days, far exceeding any other cases.

This lengthy unresolved halt stands alone compared to the others, which typically have clear resolutions within a short period. It highlights the complexity, uncertainty, and obscurity created by @FINRA surrounding the #MMTLP HALT, signaling a deeper issue than similar cases.

Still not convinced there’s something wrong with @FINRA?

It will get worse. Let’s look at the possible rules @FINRA broke.

$MMTLP #MMAT #DJT #GME #FINRAfraud

9⃣ #MMTLP 9⃣

🧵9/10

UPC Committee Possible Rules Broken

(NOT LEGAL ADVICE, I'M NOT A LAWYER)

To make this assessment, I imported the entire rule book from the @FINRA UPC committee to Google Gemini, the other Trading and Quoting Halt notices, and I gave Gemini the context that 8 out of 10 members from the committee traded directly or indirectly #MMTLP. I asked Gemini to verify if any of the @FINRA general rules and UPC committee rules were broken, and that’s the final report.

It detected that 11 rules (besides rule #6490), six @FINRA general rules, and five UPC committee rules have been broken.

FINRA Rules:

FINRA Rule 2010: Standards of Commercial Honor and Principles of Trade

Quote: "A member, in the conduct of its business, shall observe high standards of commercial honor and just and equitable principles of trade."

Issue: The involvement of UPC Committee members in trading #MMTLP while participating in decision-making undermined the principles of commercial honor and just and equitable principles of trade, as their financial interests likely influenced decisions, causing unfair treatment to other market participants.

FINRA Rule 2020: Use of Manipulative, Deceptive, or Other Fraudulent Devices

Quote: "No member shall effect any transaction in, or induce the purchase or sale of, any security by means of any manipulative, deceptive or other fraudulent device or contrivance."

Issue: The sudden halt and deletion of #MMTLP without sufficient transparency or guidance, coupled with UPC Committee members' personal interests, could be seen as manipulative or deceptive, leaving investors without the ability to manage their positions effectively.

FINRA Rule 5121: Public Offerings of Securities with Conflicts of Interest

Quote: "This rule applies to public offerings in which a FINRA member with a conflict of interest participates."

Issue: The direct or indirect trading by UPC Committee members in #MMTLP constitutes a conflict of interest, as these individuals were involved in regulatory decisions that affected a security in which they had a financial stake.

FINRA Rule 5310: Best Execution and Interpositioning

Quote: "In any transaction for or with a customer or a customer of another broker-dealer, a member and persons associated with a member shall use reasonable diligence to ascertain the best market for the subject security and buy or sell in such market so that the resultant price to the customer is as favorable as possible under prevailing market conditions."

Issue: The trading halt, which may have been influenced by UPC Committee members' own interests, failed to provide investors with an opportunity to obtain the best execution for their trades, especially with the sudden deletion of the shares.

FINRA Rule 5330: Adjustment of Orders

Quote: "Members must adjust open orders in response to certain corporate actions (e.g., stock splits, reverse stock splits, dividends, etc.) unless the member receives contrary instructions from the customer."

Issue: There were no clear instructions for adjusting open orders related to #MMTLP trades before the halt and deletion, leaving many market participants confused about the fate of their orders.

FINRA Rule 11880: Confirmations and Delivery of Securities

Quote:

"Members shall issue a confirmation to customers containing the information required by SEA Rule 10b-10... and shall deliver securities promptly."

Issue: The immediate deletion of #MMTLP without a clear path for confirmations and deliveries left investors uncertain about their unsettled trades, violating this rule's focus on ensuring prompt confirmations and deliveries.

Next, we are looking at the UPC Rules individually.

$MMTLP #MMAT #DJT #GME #AMC #FINRAfraudfinra.org/rules-guidance…

finra.org/rules-guidance…

finra.org/rules-guidance…

finra.org/rules-guidance…

finra.org/rules-guidance…

finra.org/rules-guidance…

🧵9/10

UPC Committee Possible Rules Broken

(NOT LEGAL ADVICE, I'M NOT A LAWYER)

To make this assessment, I imported the entire rule book from the @FINRA UPC committee to Google Gemini, the other Trading and Quoting Halt notices, and I gave Gemini the context that 8 out of 10 members from the committee traded directly or indirectly #MMTLP. I asked Gemini to verify if any of the @FINRA general rules and UPC committee rules were broken, and that’s the final report.

It detected that 11 rules (besides rule #6490), six @FINRA general rules, and five UPC committee rules have been broken.

FINRA Rules:

FINRA Rule 2010: Standards of Commercial Honor and Principles of Trade

Quote: "A member, in the conduct of its business, shall observe high standards of commercial honor and just and equitable principles of trade."

Issue: The involvement of UPC Committee members in trading #MMTLP while participating in decision-making undermined the principles of commercial honor and just and equitable principles of trade, as their financial interests likely influenced decisions, causing unfair treatment to other market participants.

FINRA Rule 2020: Use of Manipulative, Deceptive, or Other Fraudulent Devices

Quote: "No member shall effect any transaction in, or induce the purchase or sale of, any security by means of any manipulative, deceptive or other fraudulent device or contrivance."

Issue: The sudden halt and deletion of #MMTLP without sufficient transparency or guidance, coupled with UPC Committee members' personal interests, could be seen as manipulative or deceptive, leaving investors without the ability to manage their positions effectively.

FINRA Rule 5121: Public Offerings of Securities with Conflicts of Interest

Quote: "This rule applies to public offerings in which a FINRA member with a conflict of interest participates."

Issue: The direct or indirect trading by UPC Committee members in #MMTLP constitutes a conflict of interest, as these individuals were involved in regulatory decisions that affected a security in which they had a financial stake.

FINRA Rule 5310: Best Execution and Interpositioning

Quote: "In any transaction for or with a customer or a customer of another broker-dealer, a member and persons associated with a member shall use reasonable diligence to ascertain the best market for the subject security and buy or sell in such market so that the resultant price to the customer is as favorable as possible under prevailing market conditions."

Issue: The trading halt, which may have been influenced by UPC Committee members' own interests, failed to provide investors with an opportunity to obtain the best execution for their trades, especially with the sudden deletion of the shares.

FINRA Rule 5330: Adjustment of Orders

Quote: "Members must adjust open orders in response to certain corporate actions (e.g., stock splits, reverse stock splits, dividends, etc.) unless the member receives contrary instructions from the customer."

Issue: There were no clear instructions for adjusting open orders related to #MMTLP trades before the halt and deletion, leaving many market participants confused about the fate of their orders.

FINRA Rule 11880: Confirmations and Delivery of Securities

Quote:

"Members shall issue a confirmation to customers containing the information required by SEA Rule 10b-10... and shall deliver securities promptly."

Issue: The immediate deletion of #MMTLP without a clear path for confirmations and deliveries left investors uncertain about their unsettled trades, violating this rule's focus on ensuring prompt confirmations and deliveries.

Next, we are looking at the UPC Rules individually.

$MMTLP #MMAT #DJT #GME #AMC #FINRAfraudfinra.org/rules-guidance…

finra.org/rules-guidance…

finra.org/rules-guidance…

finra.org/rules-guidance…

finra.org/rules-guidance…

finra.org/rules-guidance…

9⃣ #MMTLP 9⃣

🧵9.1/10

(NOT LEGAL ADVICE, I'M NOT A LAWYER)

UPC Rule 11100: Scope of Uniform Practice Code

Quote:

(a) "All over-the-counter secondary market transactions in securities (including restricted securities, as defined in Rule 144(a)(3) under the Securities Act) between members, including the rights and liabilities of the members participating in the transaction, and those operational procedures that affect the day-to-day business of members shall be subject to the provisions of this Code except:

(List of exceptions not relevant here)"

(c) "In trades between members, failure to deliver the securities sold, or failure to pay for securities as delivered, on or after the settlement date, does not effect a cancellation of the contract. The remedy for the buyer or seller is provided for by Rules 11810 and 11820 respectively unless the parties mutually consent to cancel the trade. In every such case of non-delivery of securities, the party in default shall be liable for any damages which may accrue thereby. All claims for such damages shall be made promptly."

Issue:

The key points from Rule 11100 relevant to the issue are:

1. Applicability: All over-the-counter secondary market transactions between members are subject to the Uniform Practice Code (UPC), ensuring standardized procedures and fairness in trade settlements.

2. Non-Cancellation of Contracts: Failure to deliver securities or payment does not cancel the contract. Instead, remedies are provided under Rules 11810 (Buy-In Procedures and Notices) and 11820 (Close-Out Procedures).

In the case of the MMTLP trading halt and deletion:

Sudden Halt and Deletion: The immediate halt and deletion of the MMTLP symbol without prior notice or clear instructions left many trades unsettled.

Lack of Guidance: Members and investors received no clear guidance on how to handle unsettled trades, failures to deliver, or receive securities after the deletion of the symbol.

Violation of Rule 11100(c):

Contracts Not Canceled: According to Rule 11100(c), even if there is a failure to deliver, the contract remains valid and must be resolved using specified remedies.

Failure to Provide Remedies: The UPC Committee did not facilitate the use of Rules 11810 and 11820 as remedies. By not providing a pathway to resolve unsettled trades, the Committee effectively left members without the means to fulfill their contractual obligations.

Impact on Uniform Practices:

The Uniform Practice Code aims to ensure consistency and fairness in the handling of securities transactions.

The abrupt action taken with MMTLP disrupted the standard procedures, leading to confusion and potential financial losses, which contradicts the purpose of Rule 11100.

Summary of the Issue:

Non-Compliance with UPC: By not adhering to the provisions of Rule 11100, the UPC Committee failed to ensure that all over-the-counter transactions in MMTLP were handled according to the Uniform Practice Code.

Investor Harm: Investors and members were left without clear remedies for unsettled trades, violating the principles of fairness and uniformity mandated by the rule.

$MMTLP #MMAT #DJT #GME #AMC #FINRAfraudfinra.org/rules-guidance…

🧵9.1/10

(NOT LEGAL ADVICE, I'M NOT A LAWYER)

UPC Rule 11100: Scope of Uniform Practice Code

Quote:

(a) "All over-the-counter secondary market transactions in securities (including restricted securities, as defined in Rule 144(a)(3) under the Securities Act) between members, including the rights and liabilities of the members participating in the transaction, and those operational procedures that affect the day-to-day business of members shall be subject to the provisions of this Code except:

(List of exceptions not relevant here)"

(c) "In trades between members, failure to deliver the securities sold, or failure to pay for securities as delivered, on or after the settlement date, does not effect a cancellation of the contract. The remedy for the buyer or seller is provided for by Rules 11810 and 11820 respectively unless the parties mutually consent to cancel the trade. In every such case of non-delivery of securities, the party in default shall be liable for any damages which may accrue thereby. All claims for such damages shall be made promptly."

Issue:

The key points from Rule 11100 relevant to the issue are:

1. Applicability: All over-the-counter secondary market transactions between members are subject to the Uniform Practice Code (UPC), ensuring standardized procedures and fairness in trade settlements.

2. Non-Cancellation of Contracts: Failure to deliver securities or payment does not cancel the contract. Instead, remedies are provided under Rules 11810 (Buy-In Procedures and Notices) and 11820 (Close-Out Procedures).

In the case of the MMTLP trading halt and deletion:

Sudden Halt and Deletion: The immediate halt and deletion of the MMTLP symbol without prior notice or clear instructions left many trades unsettled.

Lack of Guidance: Members and investors received no clear guidance on how to handle unsettled trades, failures to deliver, or receive securities after the deletion of the symbol.

Violation of Rule 11100(c):

Contracts Not Canceled: According to Rule 11100(c), even if there is a failure to deliver, the contract remains valid and must be resolved using specified remedies.

Failure to Provide Remedies: The UPC Committee did not facilitate the use of Rules 11810 and 11820 as remedies. By not providing a pathway to resolve unsettled trades, the Committee effectively left members without the means to fulfill their contractual obligations.

Impact on Uniform Practices:

The Uniform Practice Code aims to ensure consistency and fairness in the handling of securities transactions.

The abrupt action taken with MMTLP disrupted the standard procedures, leading to confusion and potential financial losses, which contradicts the purpose of Rule 11100.

Summary of the Issue:

Non-Compliance with UPC: By not adhering to the provisions of Rule 11100, the UPC Committee failed to ensure that all over-the-counter transactions in MMTLP were handled according to the Uniform Practice Code.

Investor Harm: Investors and members were left without clear remedies for unsettled trades, violating the principles of fairness and uniformity mandated by the rule.

$MMTLP #MMAT #DJT #GME #AMC #FINRAfraudfinra.org/rules-guidance…

9⃣ #MMTLP 9⃣

🧵9.2/10

(NOT LEGAL ADVICE, I'M NOT A LAWYER)

UPC Rule 11120: Definitions

Quote:

(a) Code or UPC Code:

"The term 'Code' or 'UPC Code' as used in the FINRA Rule 11000 Series shall mean the FINRA Rule 11000 Series."

(b) Committee:

"The term 'Committee' as used in this Code, unless the context otherwise requires, shall mean the Uniform Practice Code (UPC) Committee delegated the authority to administer this Code by the Board of Governors."

(c) Delivery Date:

"The term 'delivery date' as used in this Code shall be used interchangeably with 'settlement date' and shall mean the date designated for the delivery of securities."

(d) Ex-Date:

"The term 'ex-date' as used in this Code shall mean the date on and after which the security is traded without a specific dividend or distribution."

(e) Immediate Return Receipt:

"The term 'immediate return receipt' as used in this Code, shall mean the acknowledgement by the receiving member of a written notice and which shall be issued, upon receipt, via the media in which such notice is received."

(f) Record Date:

"The term 'record date' as used in this Code means the date fixed by the trustee, registrar, paying agent or issuer for the purpose of determining the holders of equity securities, bonds, similar evidences of indebtedness or unit investment trust securities entitled to receive dividends, interest or principal payments or any other distributions."

(g) Trade Date:

"In a transaction between time zones where the bid or offer is accepted in a later time zone than that of the originator, the correct trade date shall be the day on which the dealer in the later time zone accepts the trade."

(h) Written Notices:

"The term 'written notice,' as used in this Code, shall include a notice delivered by hand, letter, facsimile transmission, electronic mail or other comparable media."

Issue:

The main issue in Notice #35-22 (Meta Materials, MMTLP) was the failure of the UPC Committee to provide clear definitions or guidance related to several terms and processes as outlined in Rule 11120, which led to confusion and lack of transparency for market participants. This rule defines critical terms such as Committee, delivery date (settlement date), ex-date, and record date, all of which are essential in corporate actions like the one in the MMTLP case. Here’s how these terms and processes were inadequately addressed:

Committee's Role (11120(b)):

The UPC Committee is tasked with administering the UPC and ensuring orderly practices. In the MMTLP case, the Committee failed to provide adequate oversight or communicate how trades would be settled in light of the halt and deletion. The lack of guidance from the Committee, which is specifically tasked with administering the Code, caused market disruption and confusion.

Delivery Date and Settlement Issues (11120(c)):

The delivery date (settlement date) is crucial when securities are halted or deleted. MMTLP shares were scheduled for cancellation on December 13, 2022, without clear instructions on how settlement of trades conducted before this date would be handled. The lack of clarity about the settlement process for investors holding unsettled trades directly violated the intent of Rule 11120(c), which defines the date by which securities must be delivered and settled.

Ex-Date and Dividend Confusion (11120(d)):

The ex-date is defined as the date after which a security is traded without a specific dividend or distribution. In the case of MMTLP, which was tied to the spin-off of Next Bridge Hydrocarbons, the Committee did not properly communicate how the ex-date was being applied to the spin-off. Investors were confused about their entitlement to the distribution (Next Bridge shares) and how their trades would be settled. This lack of guidance violated the clarity expected around the ex-date process.

Record Date (11120(f)):

The record date is the date that determines which shareholders are entitled to a dividend or distribution. In the case of MMTLP, investors were uncertain about how the record date was being handled for the spin-off, further compounding confusion about who was entitled to receive Next Bridge Hydrocarbons shares. The lack of clear communication regarding the record date, and its implications for MMTLP shareholders, violated the principle of fairness in corporate actions.

Written Notices and Communication (11120(h)):

Written notice includes communications by hand, letter, or electronic means. In the MMTLP case, many market participants felt that the notice of the trading halt and deletion was not communicated in a timely or effective manner. The lack of clear, written guidance on how investors should proceed or manage their unsettled trades violated the rule’s expectation of proper notice.

Summary of the Issue:

The UPC Committee failed to administer its role as defined in Rule 11120(b), leaving investors without clear guidance on how to handle delivery dates, ex-dates, and record dates—all of which are key elements in corporate actions and settlement processes.

The lack of communication regarding the settlement and clearance of MMTLP shares before the halt and deletion, as well as the entitlement to distributions, created confusion and negatively impacted investors.

The written notices related to the halt were insufficient in clarity and timeliness, leaving market participants unprepared for the sudden halt and symbol deletion, violating Rule 11120(h).

$MMTLP #MMAT #DJT #GME #AMC #FINRAfraudfinra.org/rules-guidance…

🧵9.2/10

(NOT LEGAL ADVICE, I'M NOT A LAWYER)

UPC Rule 11120: Definitions

Quote:

(a) Code or UPC Code:

"The term 'Code' or 'UPC Code' as used in the FINRA Rule 11000 Series shall mean the FINRA Rule 11000 Series."

(b) Committee:

"The term 'Committee' as used in this Code, unless the context otherwise requires, shall mean the Uniform Practice Code (UPC) Committee delegated the authority to administer this Code by the Board of Governors."

(c) Delivery Date:

"The term 'delivery date' as used in this Code shall be used interchangeably with 'settlement date' and shall mean the date designated for the delivery of securities."

(d) Ex-Date:

"The term 'ex-date' as used in this Code shall mean the date on and after which the security is traded without a specific dividend or distribution."

(e) Immediate Return Receipt:

"The term 'immediate return receipt' as used in this Code, shall mean the acknowledgement by the receiving member of a written notice and which shall be issued, upon receipt, via the media in which such notice is received."

(f) Record Date:

"The term 'record date' as used in this Code means the date fixed by the trustee, registrar, paying agent or issuer for the purpose of determining the holders of equity securities, bonds, similar evidences of indebtedness or unit investment trust securities entitled to receive dividends, interest or principal payments or any other distributions."

(g) Trade Date:

"In a transaction between time zones where the bid or offer is accepted in a later time zone than that of the originator, the correct trade date shall be the day on which the dealer in the later time zone accepts the trade."

(h) Written Notices:

"The term 'written notice,' as used in this Code, shall include a notice delivered by hand, letter, facsimile transmission, electronic mail or other comparable media."

Issue:

The main issue in Notice #35-22 (Meta Materials, MMTLP) was the failure of the UPC Committee to provide clear definitions or guidance related to several terms and processes as outlined in Rule 11120, which led to confusion and lack of transparency for market participants. This rule defines critical terms such as Committee, delivery date (settlement date), ex-date, and record date, all of which are essential in corporate actions like the one in the MMTLP case. Here’s how these terms and processes were inadequately addressed:

Committee's Role (11120(b)):

The UPC Committee is tasked with administering the UPC and ensuring orderly practices. In the MMTLP case, the Committee failed to provide adequate oversight or communicate how trades would be settled in light of the halt and deletion. The lack of guidance from the Committee, which is specifically tasked with administering the Code, caused market disruption and confusion.

Delivery Date and Settlement Issues (11120(c)):

The delivery date (settlement date) is crucial when securities are halted or deleted. MMTLP shares were scheduled for cancellation on December 13, 2022, without clear instructions on how settlement of trades conducted before this date would be handled. The lack of clarity about the settlement process for investors holding unsettled trades directly violated the intent of Rule 11120(c), which defines the date by which securities must be delivered and settled.

Ex-Date and Dividend Confusion (11120(d)):

The ex-date is defined as the date after which a security is traded without a specific dividend or distribution. In the case of MMTLP, which was tied to the spin-off of Next Bridge Hydrocarbons, the Committee did not properly communicate how the ex-date was being applied to the spin-off. Investors were confused about their entitlement to the distribution (Next Bridge shares) and how their trades would be settled. This lack of guidance violated the clarity expected around the ex-date process.

Record Date (11120(f)):

The record date is the date that determines which shareholders are entitled to a dividend or distribution. In the case of MMTLP, investors were uncertain about how the record date was being handled for the spin-off, further compounding confusion about who was entitled to receive Next Bridge Hydrocarbons shares. The lack of clear communication regarding the record date, and its implications for MMTLP shareholders, violated the principle of fairness in corporate actions.

Written Notices and Communication (11120(h)):

Written notice includes communications by hand, letter, or electronic means. In the MMTLP case, many market participants felt that the notice of the trading halt and deletion was not communicated in a timely or effective manner. The lack of clear, written guidance on how investors should proceed or manage their unsettled trades violated the rule’s expectation of proper notice.

Summary of the Issue:

The UPC Committee failed to administer its role as defined in Rule 11120(b), leaving investors without clear guidance on how to handle delivery dates, ex-dates, and record dates—all of which are key elements in corporate actions and settlement processes.

The lack of communication regarding the settlement and clearance of MMTLP shares before the halt and deletion, as well as the entitlement to distributions, created confusion and negatively impacted investors.

The written notices related to the halt were insufficient in clarity and timeliness, leaving market participants unprepared for the sudden halt and symbol deletion, violating Rule 11120(h).

$MMTLP #MMAT #DJT #GME #AMC #FINRAfraudfinra.org/rules-guidance…

9⃣ #MMTLP 9⃣

🧵9.3/10

(NOT LEGAL ADVICE, I'M NOT A LAWYER)

UPC Rule 11810: Buy-In Procedures and Requirements

Quote:

"(a) A securities contract that has not been completed by the seller according to its terms may be closed by the buyer not sooner than the third business day following the date delivery was due, in accordance with this Rule."

Issue:

The buy-in procedures outlined in Rule 11810 provide a structured way to close a contract if the seller has failed to deliver the securities. This ensures that buyers can protect their positions by purchasing the securities from the market after notifying the seller. In the case of Notice #35-22 (Meta Materials, MMTLP), the buy-in procedures were not clearly communicated or executed, leading to significant issues for investors holding unsettled trades.

Here’s how Rule 11810 was violated or improperly addressed in the MMTLP case:

Failure to Provide Clear Buy-In Procedures: Rule 11810(a) specifies that if a seller fails to deliver securities, the buyer has the right to execute a buy-in not sooner than the third business day after the delivery date was missed. However, in the case of MMTLP, no clear communication was provided to explain how investors could initiate a buy-in or protect their positions after the trading halt and the sudden deletion of the MMTLP symbol.

As a result, investors were left with unsettled positions and no guidance on how to enforce their rights under the buy-in provisions, leading to violations of Rule 11810.

No Buy-In Notice Given to Sellers: Rule 11810(b)(1) states that written notice of buy-in must be delivered to the seller no later than two business days preceding the execution of the proposed buy-in. However, in the MMTLP case, there was no clear mechanism provided for buyers to issue a buy-in notice to sellers who failed to deliver the securities. This lack of communication left market participants in limbo regarding their unsettled trades.

No Confirmation or Proper Channels for Notice: Rule 11810(b)(2) further emphasizes that the buy-in notice must be sent through a medium that provides immediate return receipt capability, such as facsimile transmission or a computerized network facility. In the case of MMTLP, there were no clear instructions on how to issue a buy-in notice or any return receipt functionality that could have allowed buyers to confirm that their notice was properly received.

Without proper channels to communicate and confirm buy-in notices, investors were unable to enforce their rights, compounding the failure to deliver securities issue.

No Timely Buy-In Execution: Rule 11810(d) outlines procedures for closing contracts through buy-ins, specifying that if a seller does not deliver the securities, the buyer may purchase the necessary securities on the open market to close the contract. In the MMTLP case, the trading halt and subsequent deletion of the symbol prevented the execution of buy-ins, as no trades could occur once the shares were removed from the market. This left buyers without the ability to close their contracts, resulting in unfulfilled delivery obligations.

Failure to Provide Extensions for Securities in Transit: Rule 11810(g) allows for a seven-day extension if the securities are in transit or being transferred. However, this provision was not properly addressed in the MMTLP situation. Investors had no clear guidance on how to request or grant extensions, leaving unresolved delivery issues for those holding unsettled trades.

Summary of the Issue:

No Clear Guidance on Buy-Ins: Investors holding unsettled MMTLP shares received no guidance on how to execute buy-ins or protect their positions after the halt and deletion, violating the structured buy-in procedures outlined in Rule 11810.

Failure to Provide Notice Mechanisms: The rule requires clear notice procedures for buy-ins, but these mechanisms were not communicated or available to investors, leading to unresolved delivery issues.

Inability to Close Contracts: Due to the deletion of the MMTLP symbol, buyers were unable to execute buy-ins, which is a fundamental right under Rule 11810 when sellers fail to deliver securities. This lack of execution violated the spirit of the rule, which seeks to protect buyers in cases of non-delivery.

Conclusion: The UPC Committee and FINRA did not follow the buy-in procedures outlined in Rule 11810 for MMTLP shares. This left investors holding unsettled trades with no recourse to close out their contracts or ensure the delivery of their securities, violating the core principles of the rule.

UPC Rule 11130: When, As and If Issued/Distributed Contracts

Quote:

(a) Confirmations or Comparisons

"(1) Each party to the transaction shall send a written 'when, as and if issued' or 'when, as and if distributed' confirmation or comparison in the same form as set forth in the Sample Form appearing in Supplementary Material .01 of this Rule and pursuant to the requirements of Rules 11210(a), 11220, and 11860."

"(2) Each confirmation or comparison covering a contract in a 'when, as and if issued' or 'when, as and if distributed' security shall, at a minimum, contain:

(A) an adequate description of the security and the plan, if any, under which the security is proposed to be issued or distributed;

(B) designation of FINRA as the authority which shall rule upon the performance of the contract; and

(C) provision for marking the contract to the market."

Issue:

Rule 11130 outlines the requirements for handling "when, as and if issued" or "when, as and if distributed" contracts, which are used for securities that are authorized but not yet issued or distributed. This rule is crucial for maintaining order and clarity in cases where securities are expected to be distributed at a later date, but the actual timing and delivery of the securities remain uncertain.

In the case of Notice #35-22 (Meta Materials, MMTLP), the spin-off of Next Bridge Hydrocarbons involved securities that were to be distributed to MMTLP holders, making Rule 11130 applicable. Here’s how the rule was violated or improperly addressed:

Failure to Provide Clear and Timely Confirmations:

Rule 11130(a)(1) requires both parties to send written confirmations or comparisons for "when, as and if issued" securities, ensuring that both buyer and seller are on the same page regarding the pending issuance or distribution of securities. In the MMTLP case, investors received no clear confirmations on how their positions would be handled following the halt and the planned distribution of Next Bridge Hydrocarbons shares. This left investors uncertain about their entitlements and the status of their securities.

Inadequate Description of the Security and Distribution Plan:

Rule 11130(a)(2)(A) mandates that each confirmation must include an adequate description of the security and the plan under which the security is proposed to be issued or distributed. In the case of MMTLP, there was no clear description provided to investors regarding the spin-off of Next Bridge Hydrocarbons. Investors were left confused about whether they would receive shares, how the shares would be distributed, and what the cancellation of MMTLP meant for their holdings.

The lack of detailed communication about the distribution plan violated the rule’s requirement for adequate descriptions in "when, as and if distributed" contracts.

Failure to Designate FINRA as the Ruling Authority:

Rule 11130(a)(2)(B) requires that each confirmation designate FINRA as the authority that will rule upon the performance of the contract. This designation ensures that a central authority is responsible for adjudicating any disputes or issues that arise. In the case of MMTLP, there was no clarity about FINRA’s role in overseeing the completion of the distribution of Next Bridge Hydrocarbons shares, leaving investors without recourse to address any potential disputes.

No Marking to the Market: