𝗪𝗵𝗮𝘁 𝗶𝘀 𝗣𝗼𝘄𝗲𝗿 𝗼𝗳 𝟯 (𝗣𝗢𝟯)

"Power of 3" involves understanding 𝗮𝗰𝗰𝘂𝗺𝘂𝗹𝗮𝘁𝗶𝗼𝗻, 𝗺𝗮𝗻𝗶𝗽𝘂𝗹𝗮𝘁𝗶𝗼𝗻, and 𝗱𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻 phases.

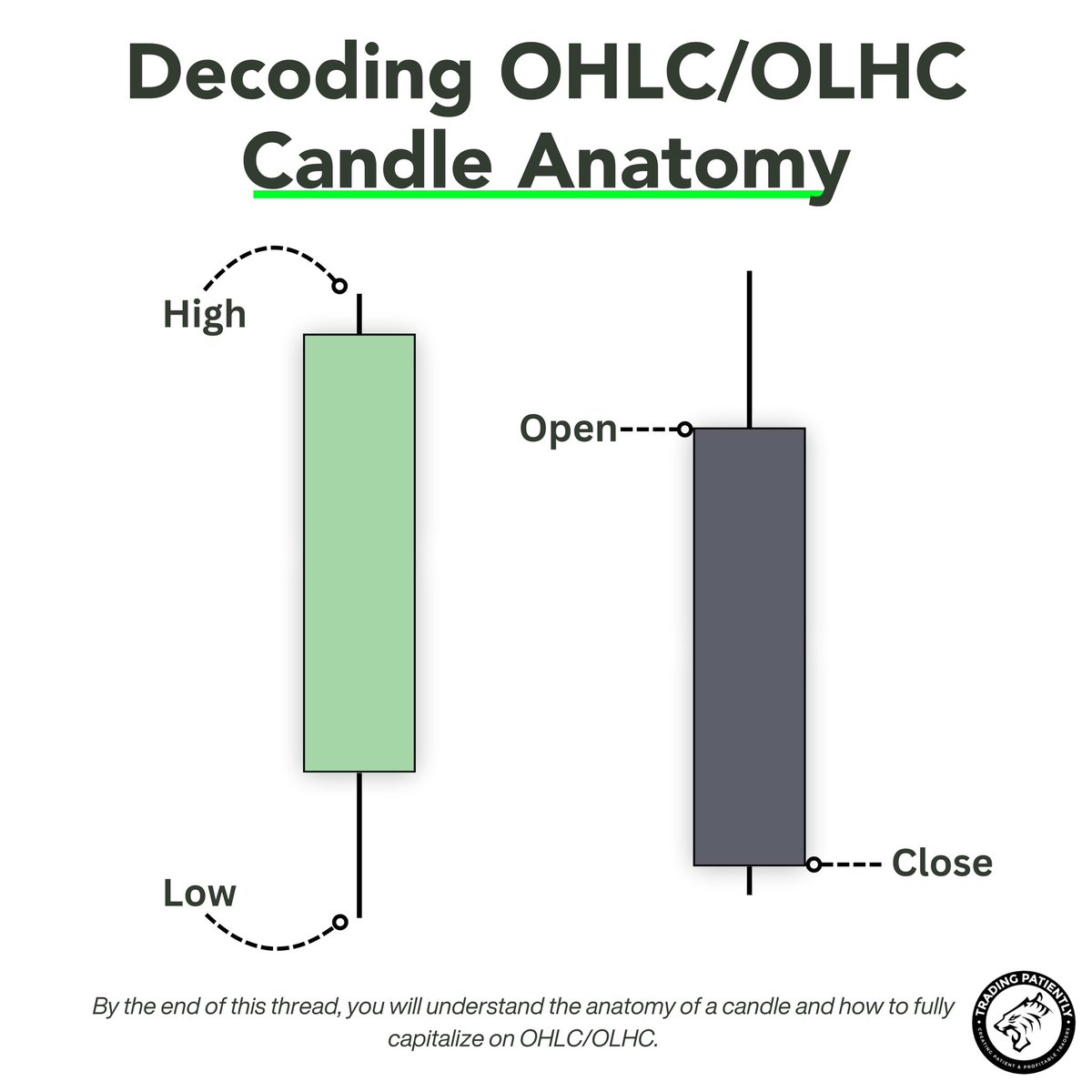

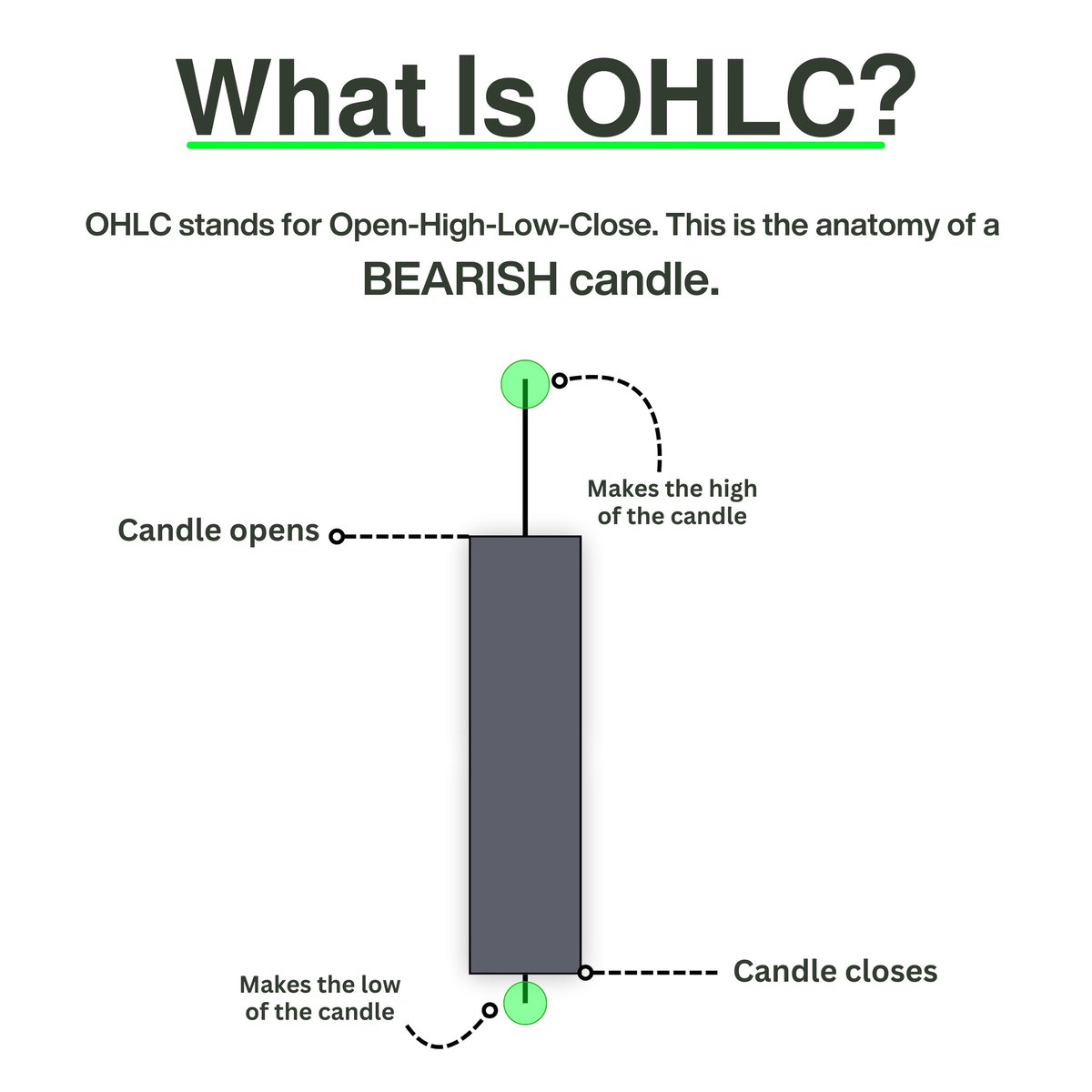

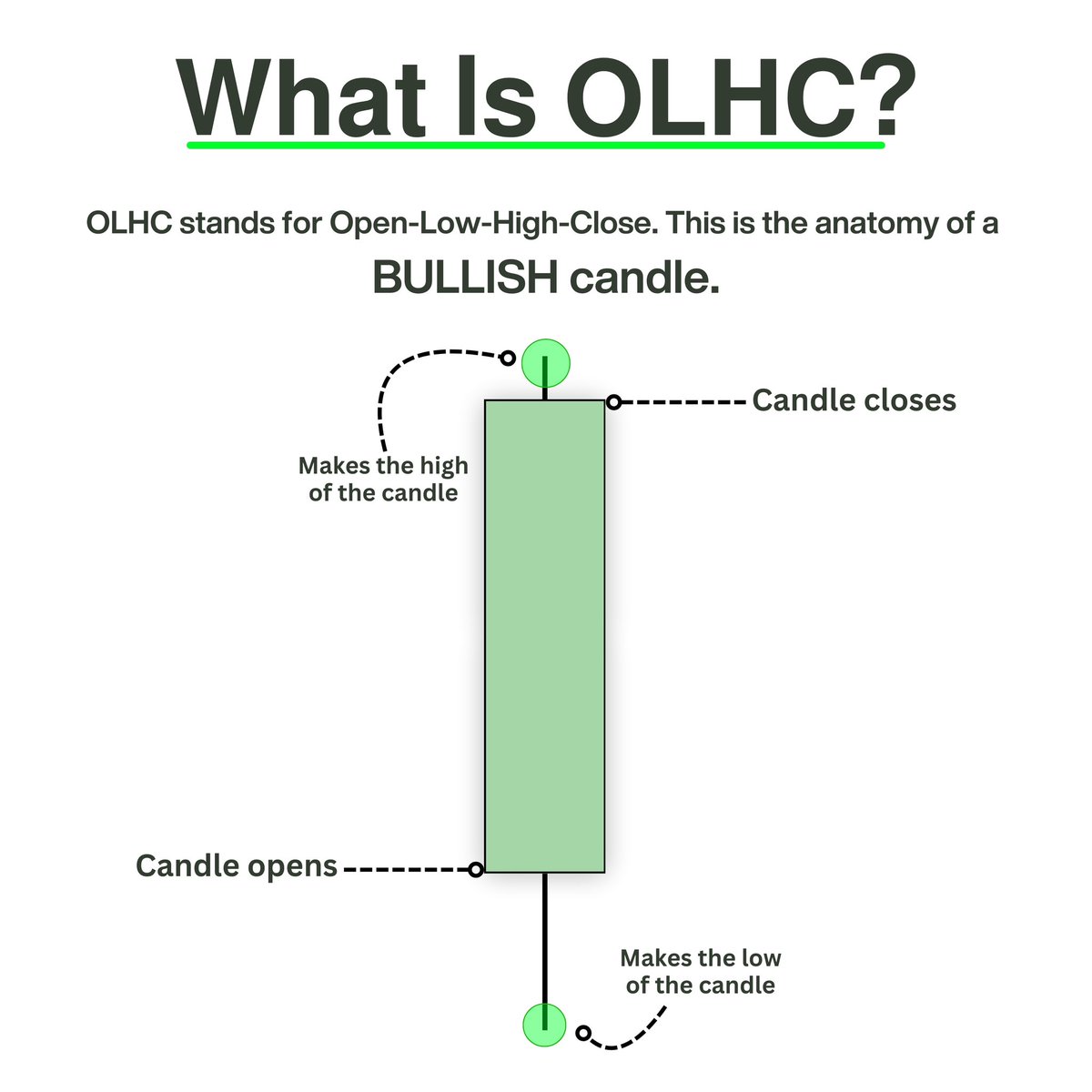

To grasp this concept, you must first learn candlestick anatomy, as it is crucial for interpreting price.

"Power of 3" involves understanding 𝗮𝗰𝗰𝘂𝗺𝘂𝗹𝗮𝘁𝗶𝗼𝗻, 𝗺𝗮𝗻𝗶𝗽𝘂𝗹𝗮𝘁𝗶𝗼𝗻, and 𝗱𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻 phases.

To grasp this concept, you must first learn candlestick anatomy, as it is crucial for interpreting price.

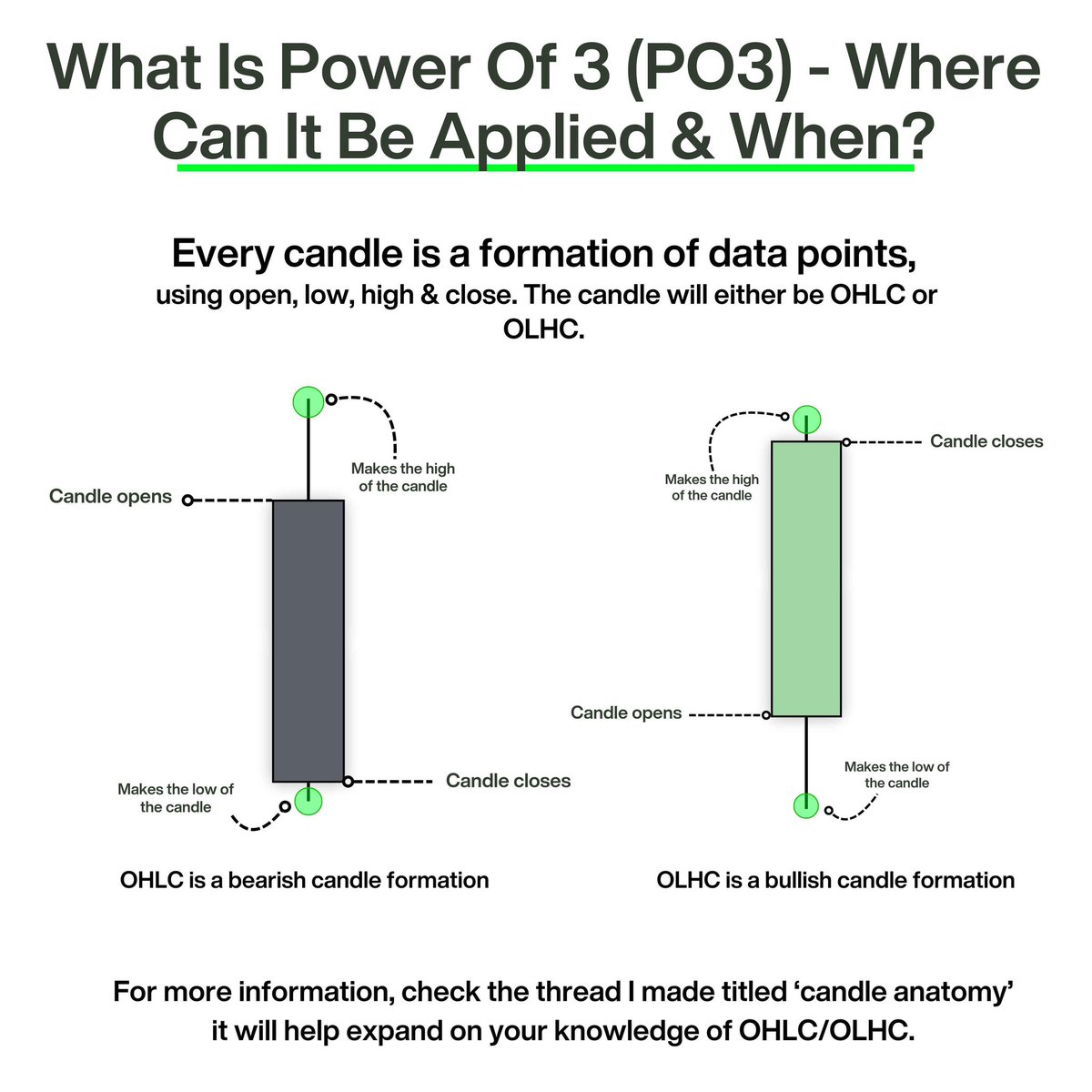

Every candle is a formation of data points, using open, low, high & close.

The candle will either be OHLC or OLHC.

𝗢𝗟𝗛𝗖 is a bullish candle formation.

𝗢𝗛𝗟𝗖 is a bearish candle formation.

Next, let’s talk about the 3 phases of PO3.

The candle will either be OHLC or OLHC.

𝗢𝗟𝗛𝗖 is a bullish candle formation.

𝗢𝗛𝗟𝗖 is a bearish candle formation.

Next, let’s talk about the 3 phases of PO3.

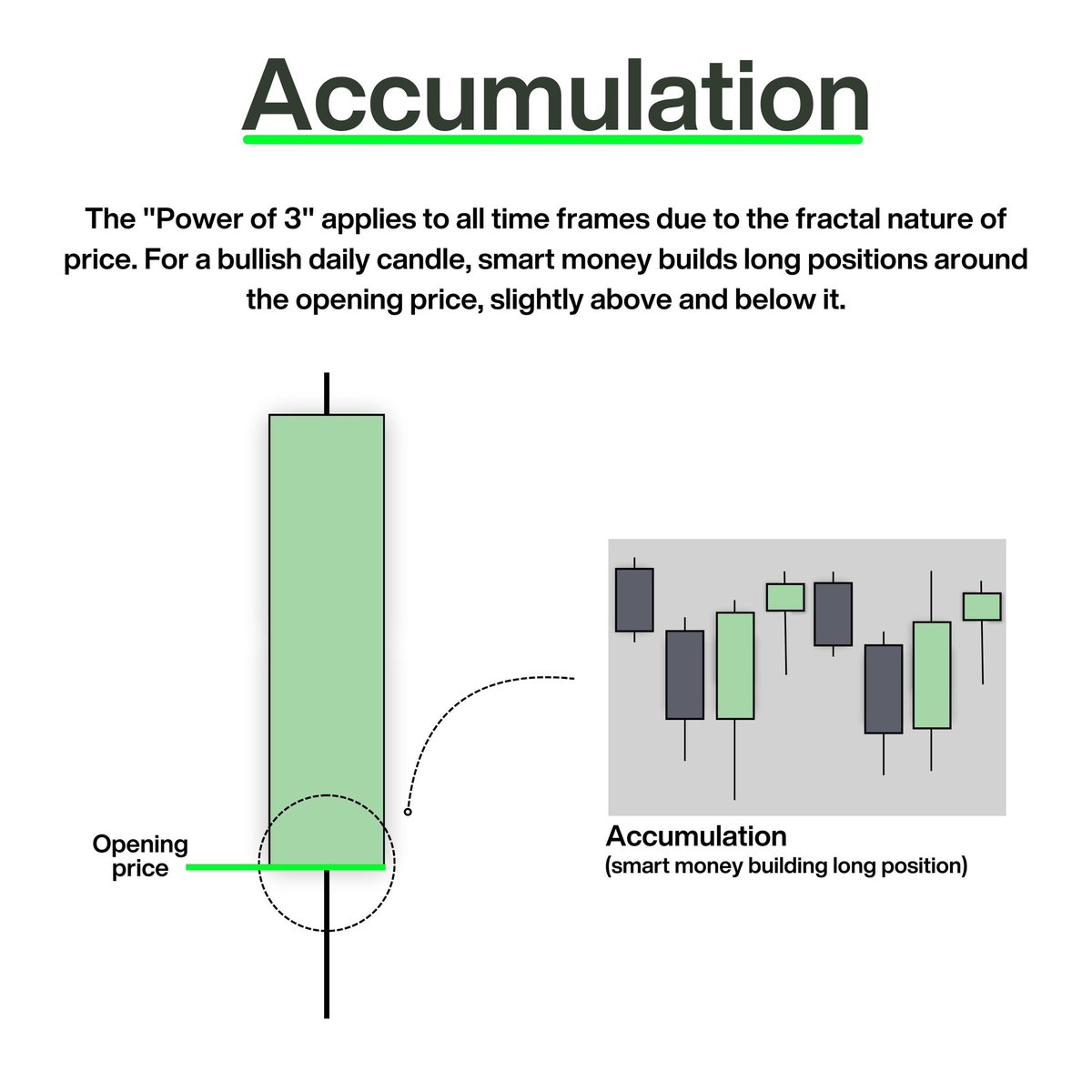

𝟭. 𝗔𝗰𝗰𝘂𝗺𝘂𝗹𝗮𝘁𝗶𝗼𝗻

“Power of 3" applies to all time frames due to the fractal nature of price.

For a bullish daily candle, smart money builds long positions around the opening price, slightly above and below it.

“Power of 3" applies to all time frames due to the fractal nature of price.

For a bullish daily candle, smart money builds long positions around the opening price, slightly above and below it.

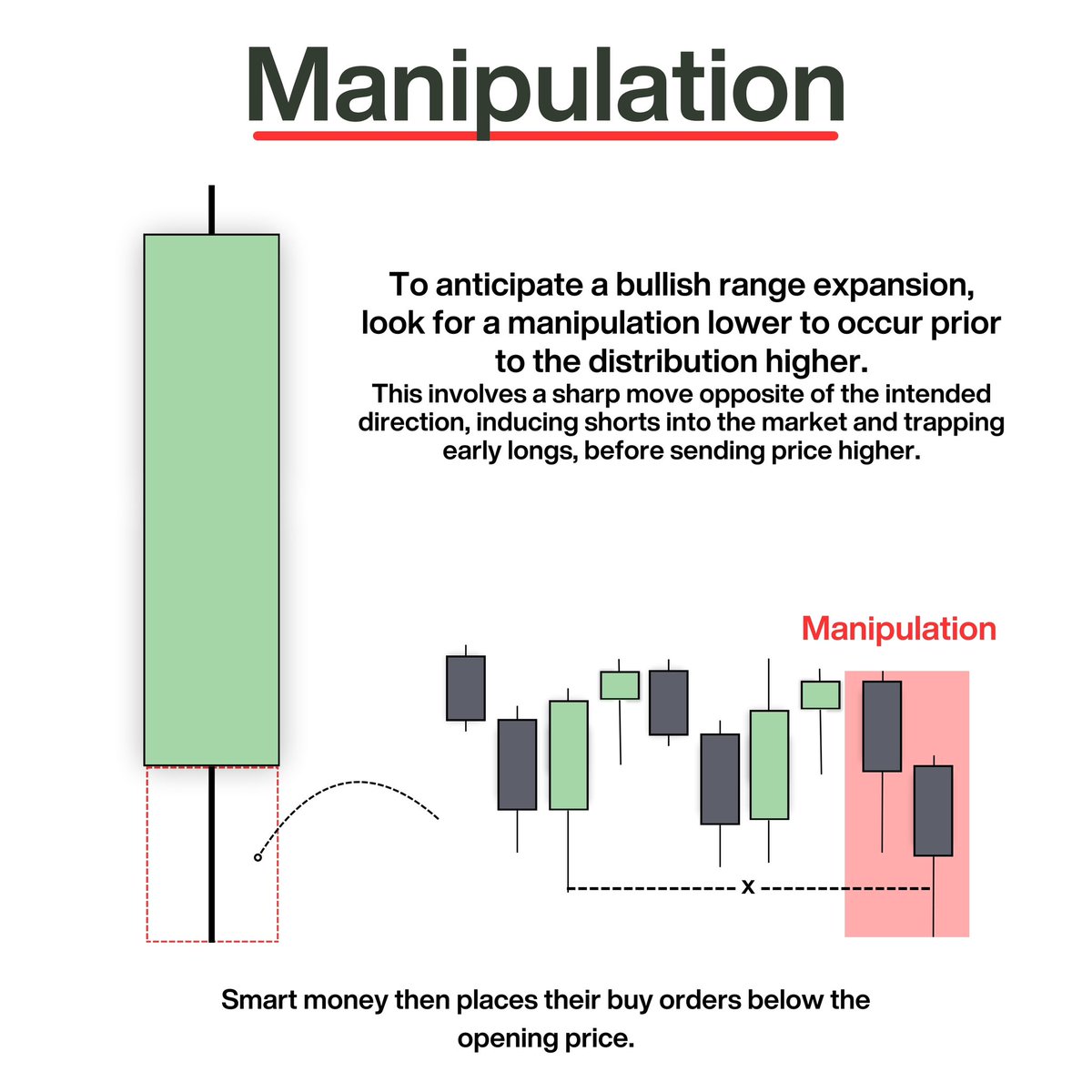

𝟮. 𝗠𝗮𝗻𝗶𝗽𝘂𝗹𝗮𝘁𝗶𝗼𝗻

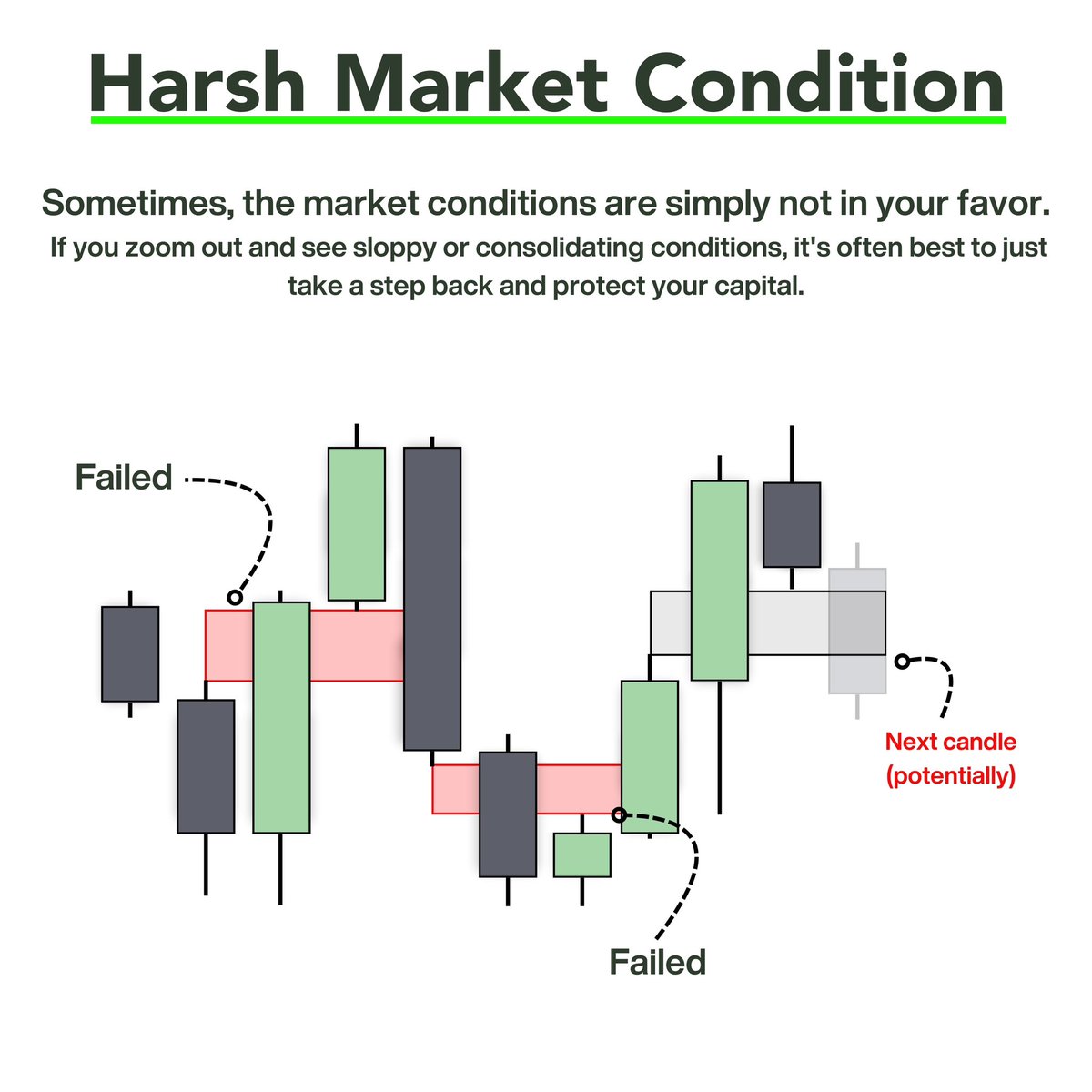

To anticipate a bullish expansion, look for manipulation lower to occur prior to the distribution.

This involves a sharp move opposite of the intended direction, inducing shorts into the market and trapping early longs, before sending price higher.

To anticipate a bullish expansion, look for manipulation lower to occur prior to the distribution.

This involves a sharp move opposite of the intended direction, inducing shorts into the market and trapping early longs, before sending price higher.

𝟯. 𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻

This is where smart money begins to offload their positions to willing buyers.

This is where you will see the “expansion” in price.

This is where smart money begins to offload their positions to willing buyers.

This is where you will see the “expansion” in price.

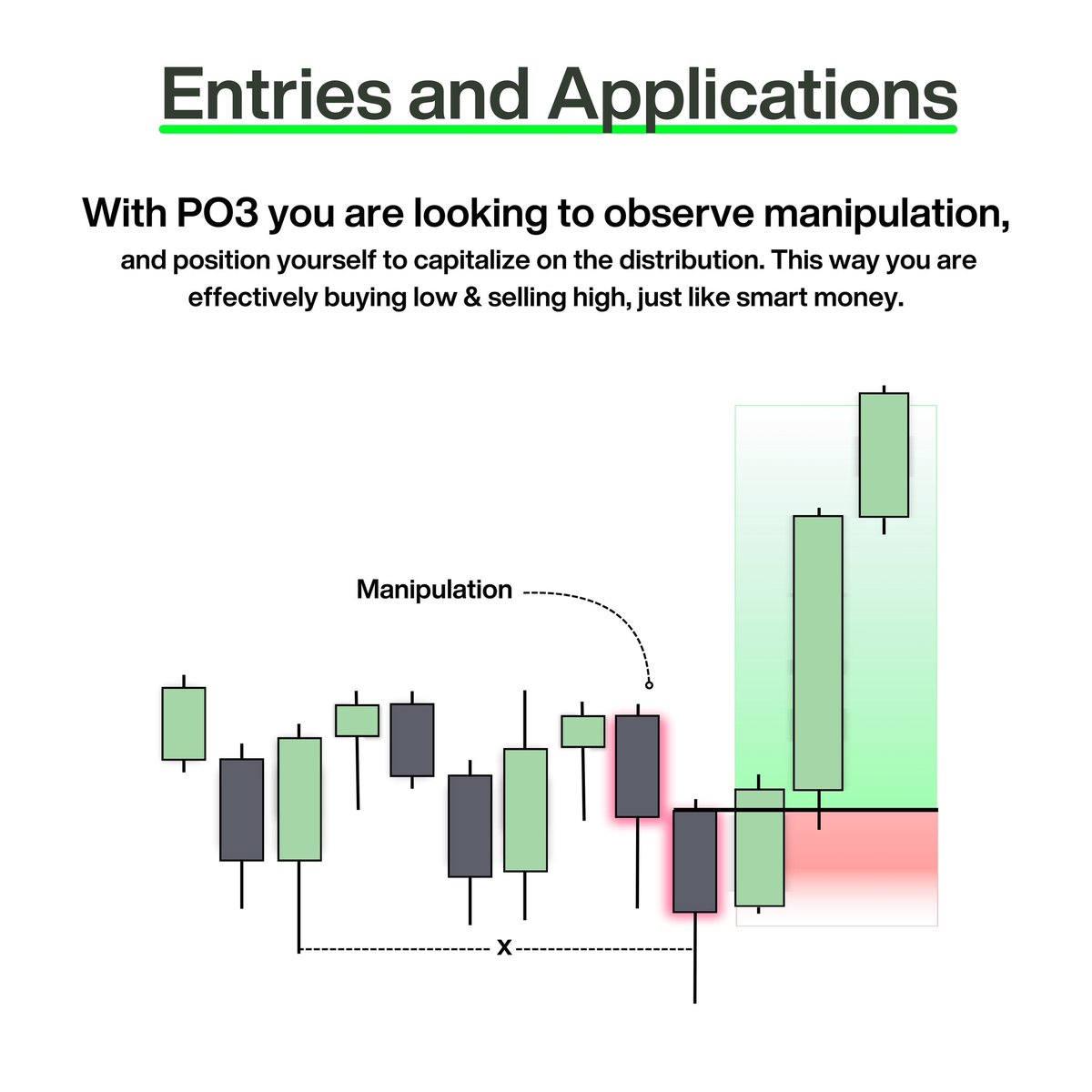

𝗘𝗻𝘁𝗿𝗶𝗲𝘀 𝗮𝗻𝗱 𝗔𝗽𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀

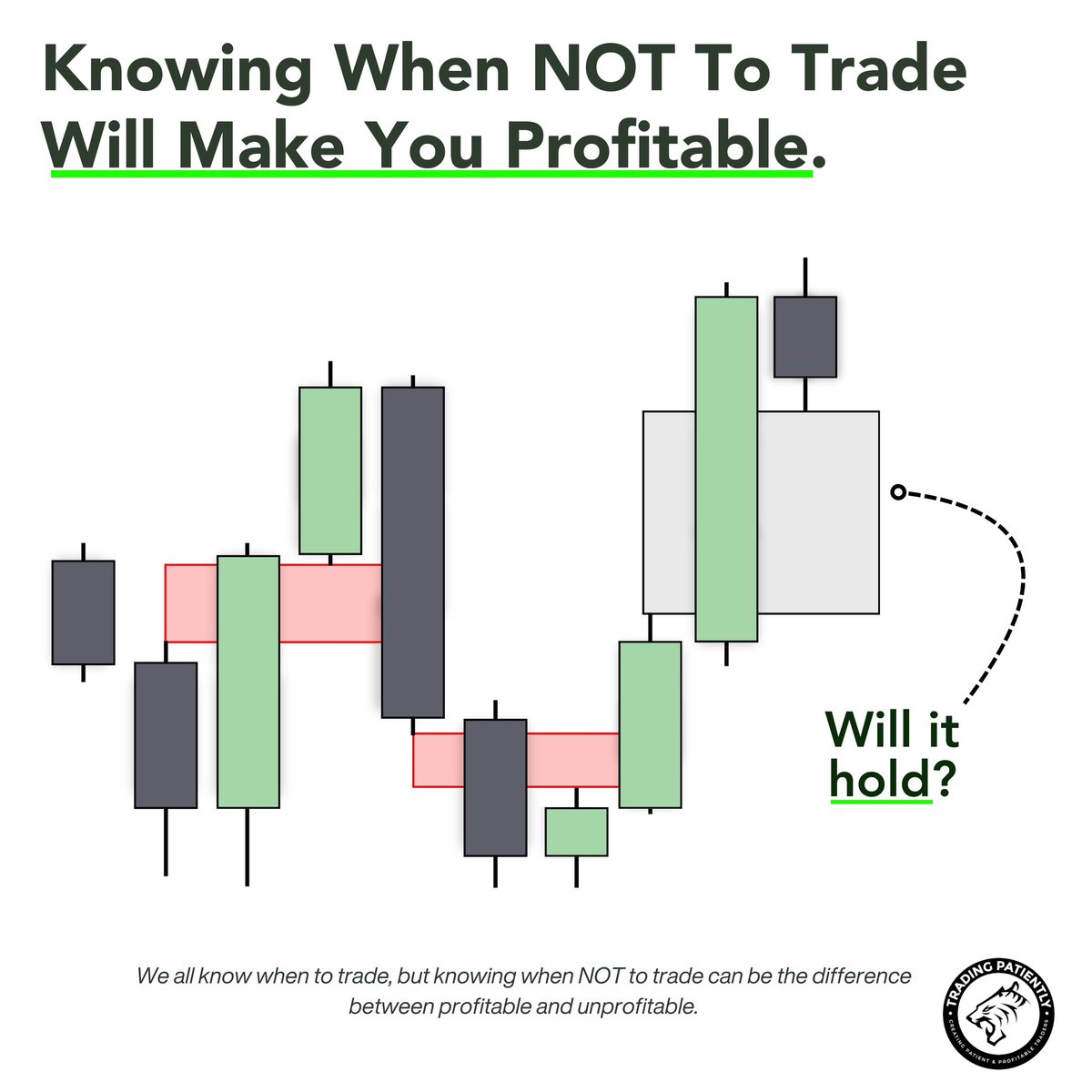

With PO3, you are looking to observe manipulation and position yourself to capitalize on the distribution.

This way you are effectively buying low & selling high, just like smart money.

With PO3, you are looking to observe manipulation and position yourself to capitalize on the distribution.

This way you are effectively buying low & selling high, just like smart money.

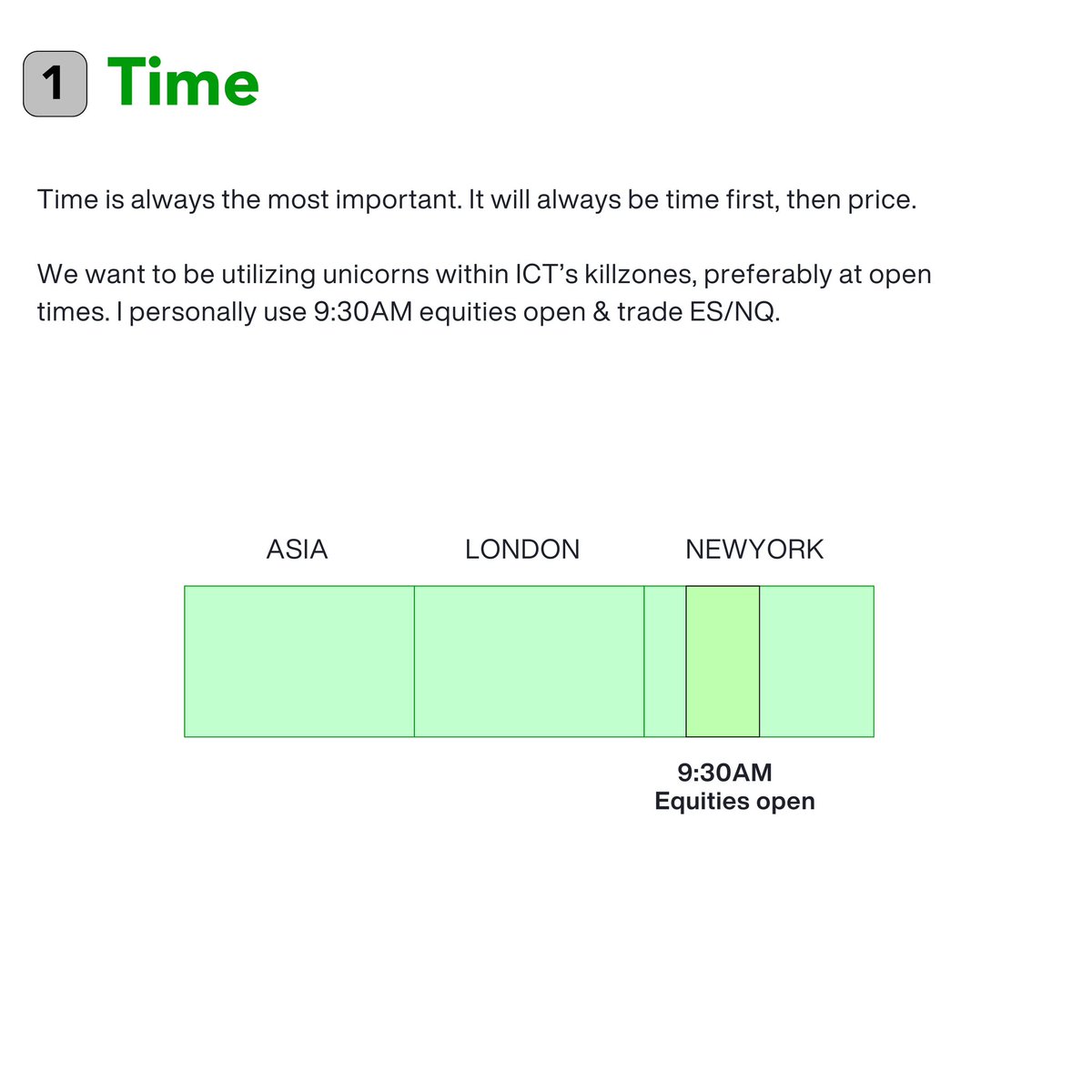

𝗧𝗶𝗺𝗲

Time is crucial in price movement.

For any candle, the "power of 3" theory applies to three phases: the beginning, middle, and end.

Accumulation occurs at the start, distribution happens lastly and manipulation occurs in between.

Time is crucial in price movement.

For any candle, the "power of 3" theory applies to three phases: the beginning, middle, and end.

Accumulation occurs at the start, distribution happens lastly and manipulation occurs in between.

If you found this thread insightful, show some love! <3

If you want to live trade with me for FREE for 7 days, click here:

↓ ↓ ↓ ↓ ↓

tradingpatiently.com

If you want to live trade with me for FREE for 7 days, click here:

↓ ↓ ↓ ↓ ↓

tradingpatiently.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh