Data is great, but most don't know how to use it to profit.

@tokenterminal Discover Page just launched.

Making data-driven analysis easy and profitable.

Here are 5 key insights I discovered using this new feature and how you can use it to profit while the market is down.

🧵⬇️

@tokenterminal Discover Page just launched.

Making data-driven analysis easy and profitable.

Here are 5 key insights I discovered using this new feature and how you can use it to profit while the market is down.

🧵⬇️

Token Terminal is a crypto data analytics platform focused on analytics using fundamental metrics.

This allows you to value protocols and applications using metrics such as:

➜ TVL

➜ Daily Active Users

➜ Price to Sales

➜ Price to Fees

➜ Volume

➜ Revenue per user

This allows you to value protocols and applications using metrics such as:

➜ TVL

➜ Daily Active Users

➜ Price to Sales

➜ Price to Fees

➜ Volume

➜ Revenue per user

Discovery takes this to a new level by allowing me to cross-compare across protocols, metrics, and tokens.

Here's what I've discovered and my thought process for creating an investment framework with this tool.

Here's what I've discovered and my thought process for creating an investment framework with this tool.

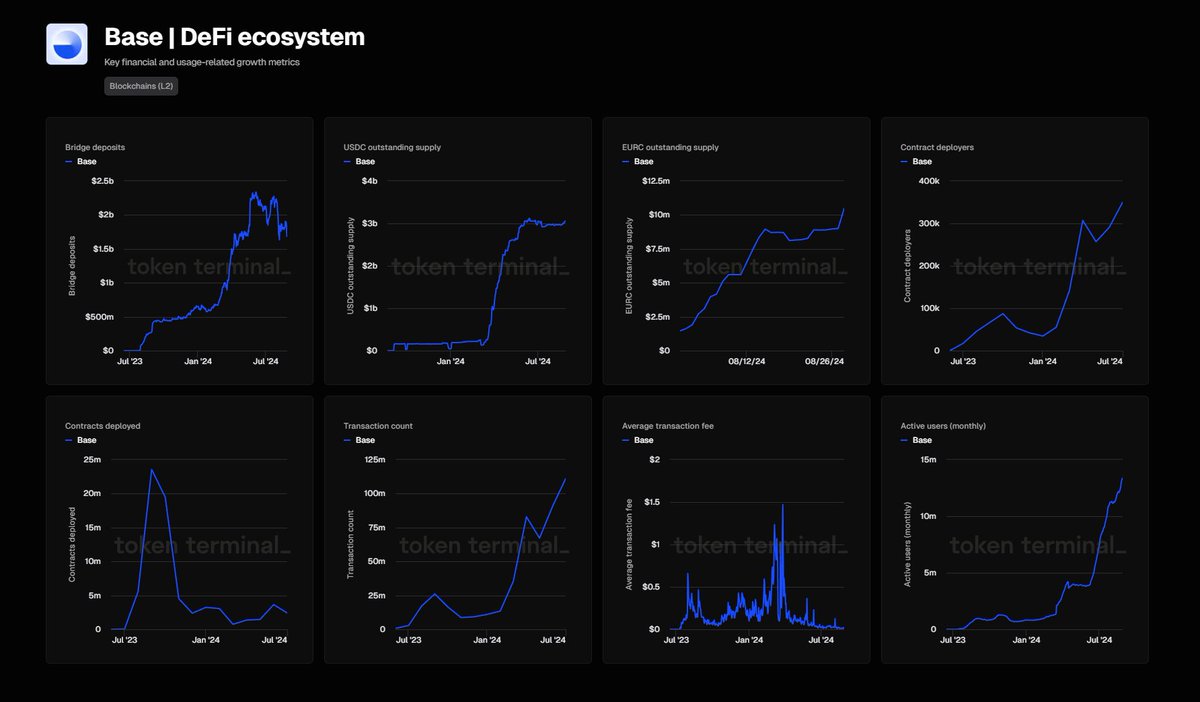

1️⃣ @base

Protocol metrics are up and to the right, but what does this mean, and how do you bet on continued growth?

➜ Bridge deposits

➜ USDC supply growing

➜ Contract deployers are still growing

➜ Transaction counts accelerating

Direct beneficiaries: $AERO $AAVE.

Protocol metrics are up and to the right, but what does this mean, and how do you bet on continued growth?

➜ Bridge deposits

➜ USDC supply growing

➜ Contract deployers are still growing

➜ Transaction counts accelerating

Direct beneficiaries: $AERO $AAVE.

2️⃣ @aave

Established protocols have achieved a clear product market fit without the hangover of expensive incentive models to incentivize liquidity, leading to:

➜ Higher fees

➜ Organic Loan growth

➜ Increase in net deposits

➜ Meaningful increase in earnings

As a result, net expenses are at historical lows. The $AAVE token can flourish while the team can focus on expansion.

Established protocols have achieved a clear product market fit without the hangover of expensive incentive models to incentivize liquidity, leading to:

➜ Higher fees

➜ Organic Loan growth

➜ Increase in net deposits

➜ Meaningful increase in earnings

As a result, net expenses are at historical lows. The $AAVE token can flourish while the team can focus on expansion.

3️⃣ @avax

Avalanche's stablecoin growth is being led by @withAUSD.

➜ $AUSD has seen over $22m in deposits in less than a month

➜ It is now the 4th largest stablecoin within Avalanche

One takeaway here is that Avalanche is offering incentives on @TraderJoe_xyz.

This showcases their commitment to growing stablecoin liquidity.

Avalanche's stablecoin growth is being led by @withAUSD.

➜ $AUSD has seen over $22m in deposits in less than a month

➜ It is now the 4th largest stablecoin within Avalanche

One takeaway here is that Avalanche is offering incentives on @TraderJoe_xyz.

This showcases their commitment to growing stablecoin liquidity.

4️⃣ @Celo

Celo has experienced explosive growth entirely under the radar for the past year.

➜ Transaction count almost at ATHs

➜ Active users at ATHs

➜ Monthly Fees at ATHs

The takeaway is that the number of $CELO token-holders has been in tandem with protocol growth.

Celo has experienced explosive growth entirely under the radar for the past year.

➜ Transaction count almost at ATHs

➜ Active users at ATHs

➜ Monthly Fees at ATHs

The takeaway is that the number of $CELO token-holders has been in tandem with protocol growth.

5️⃣ DeFi Blue Chips

Not all Blue Chips are built the same; however, when it comes to positioning, Lido, Uniswap, Maker (now Sky), and Aave are the strongest.

➜ Lido, Aave, and Sky all lead in earnings

➜ Lido fees are exponentially higher

➜ Sky's growth has hit an inflection point

If I were to rate protocol quality based on the metrics, it would go as follows:

1. $AAVE: Strongest metrics all around

2. $LDO: Best positioning within Staking and Restaking ( Fees show this)

3. $MAKER: Expansion to RWAs & Institutional market is reflected in fees

4. $UNI: Market leadership has not translated into meaningful revenue

Not all Blue Chips are built the same; however, when it comes to positioning, Lido, Uniswap, Maker (now Sky), and Aave are the strongest.

➜ Lido, Aave, and Sky all lead in earnings

➜ Lido fees are exponentially higher

➜ Sky's growth has hit an inflection point

If I were to rate protocol quality based on the metrics, it would go as follows:

1. $AAVE: Strongest metrics all around

2. $LDO: Best positioning within Staking and Restaking ( Fees show this)

3. $MAKER: Expansion to RWAs & Institutional market is reflected in fees

4. $UNI: Market leadership has not translated into meaningful revenue

I encourage you to explore the Discover page, analyze the data, and draw conclusions about the featured protocols.

Go to @tokenterminal ➜ Discover

Go to @tokenterminal ➜ Discover

Sharing this with other chads who may find value from the data:

- @Deebs_DeFi

- @defi_mochi

- @CryptoKoryo

- @luigidemeo

- @Curious__J

- @stacy_muur

- @JiraiyaReal

- @crypto_linn

- @TheCryptoLark

- @crypthoem

- @jake_pahor

- @0xSalazar

- @rektdiomedes

- @poopmandefi

- @arndxt_xo

- @Deebs_DeFi

- @defi_mochi

- @CryptoKoryo

- @luigidemeo

- @Curious__J

- @stacy_muur

- @JiraiyaReal

- @crypto_linn

- @TheCryptoLark

- @crypthoem

- @jake_pahor

- @0xSalazar

- @rektdiomedes

- @poopmandefi

- @arndxt_xo

Thank you for reading!

I hope you've found this thread interesting.

Follow me @Flowslikeosmo for more.

If you found this content valuable, give it a Like and Retweet the first tweet below. 👇

I hope you've found this thread interesting.

Follow me @Flowslikeosmo for more.

If you found this content valuable, give it a Like and Retweet the first tweet below. 👇

https://twitter.com/1373788838250876928/status/1834970403208675674

• • •

Missing some Tweet in this thread? You can try to

force a refresh