When you or I press the ‘BUY’ button in any financial market, there will always be a willing ‘ SELLER’ to match our order. However, that is not the case for larger entities.

Huge players can’t just ‘BUY’ and ‘SELL’ as they need opposite orders on the other end to match their order.

That is why liquidity sweeps or turtle soups occur in the market.

Huge players can’t just ‘BUY’ and ‘SELL’ as they need opposite orders on the other end to match their order.

That is why liquidity sweeps or turtle soups occur in the market.

Liquidity sweep happens when price trades above/below a swing high/low and aggressively displaces in the opposite direction.

In this example, we can see that the swing low was taken first. At this moment, trend trades tend to place sell orders with their stop loss near the recent swing high.

These stop-loss orders are ‘BUY’ orders to protect the short positions of trend traders.

𝐓𝐡𝐞𝐬𝐞 𝐨𝐫𝐝𝐞𝐫𝐬 𝐬𝐞𝐫𝐯𝐞 𝐚𝐬 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐭𝐨 𝐦𝐚𝐭𝐜𝐡 𝐭𝐡𝐞 ‘𝐒𝐄𝐋𝐋’ 𝐨𝐫𝐝𝐞𝐫𝐬 𝐰𝐡𝐢𝐜𝐡 𝐢𝐬 𝐭𝐡𝐞 ‘𝐭𝐚𝐤𝐞 𝐩𝐫𝐨𝐟𝐢𝐭’ 𝐟𝐨𝐫 𝐥𝐚𝐫𝐠𝐞 𝐞𝐧𝐭𝐢𝐭𝐢𝐞𝐬.

In this example, we can see that the swing low was taken first. At this moment, trend trades tend to place sell orders with their stop loss near the recent swing high.

These stop-loss orders are ‘BUY’ orders to protect the short positions of trend traders.

𝐓𝐡𝐞𝐬𝐞 𝐨𝐫𝐝𝐞𝐫𝐬 𝐬𝐞𝐫𝐯𝐞 𝐚𝐬 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐭𝐨 𝐦𝐚𝐭𝐜𝐡 𝐭𝐡𝐞 ‘𝐒𝐄𝐋𝐋’ 𝐨𝐫𝐝𝐞𝐫𝐬 𝐰𝐡𝐢𝐜𝐡 𝐢𝐬 𝐭𝐡𝐞 ‘𝐭𝐚𝐤𝐞 𝐩𝐫𝐨𝐟𝐢𝐭’ 𝐟𝐨𝐫 𝐥𝐚𝐫𝐠𝐞 𝐞𝐧𝐭𝐢𝐭𝐢𝐞𝐬.

Liquidity sweeps happen regularly but only two kinds of liquidity sweeps are ideal to trade from. They are:

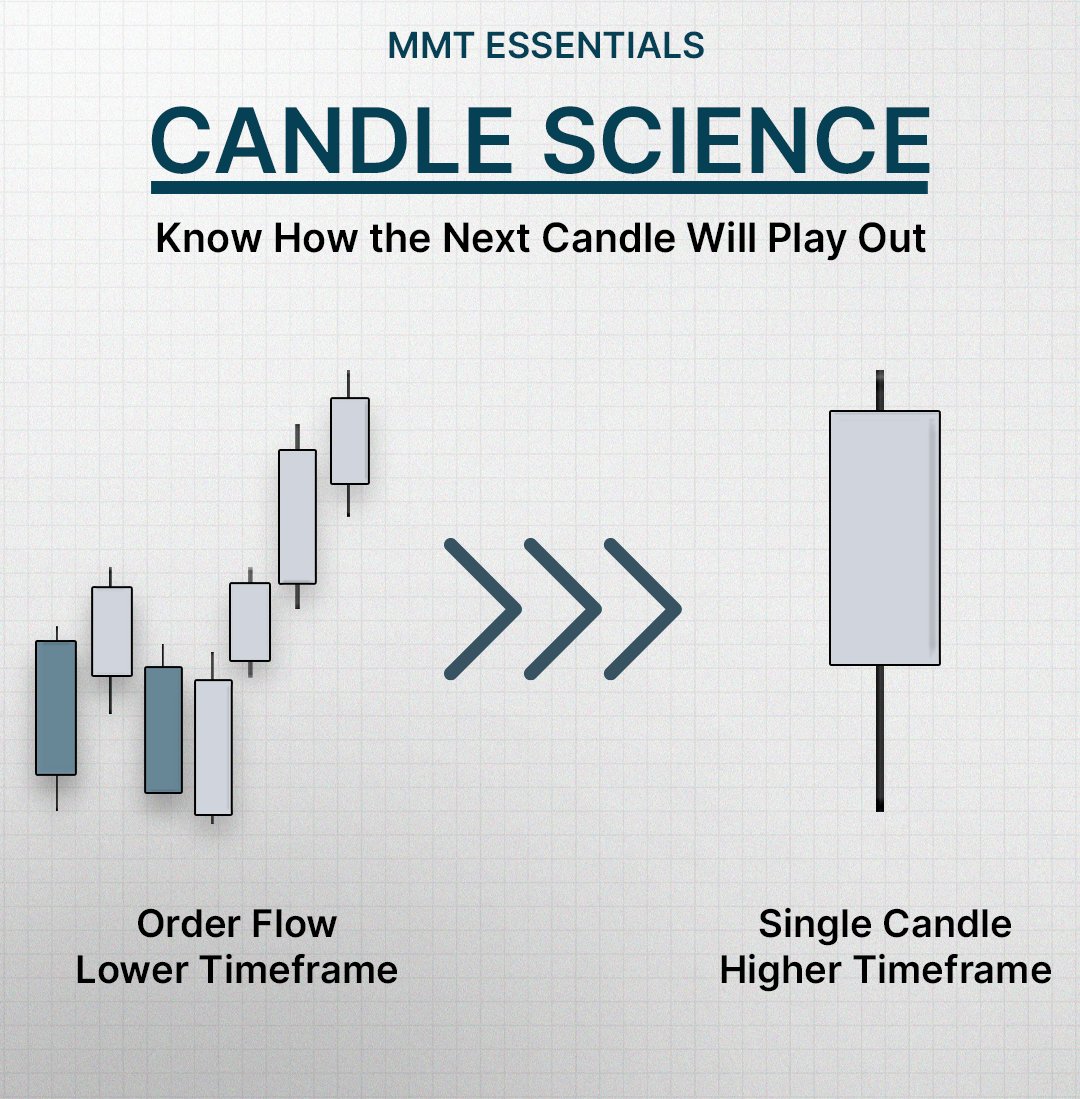

. 𝐎𝐫𝐝𝐞𝐫 𝐅𝐥𝐨𝐰 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐒𝐰𝐞𝐞𝐩

. 𝐂𝐚𝐧𝐝𝐥𝐞 𝐒𝐜𝐢𝐞𝐧𝐜𝐞 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐒𝐰𝐞𝐞𝐩

An order flow liquidity sweep can be seen as a candle science liquidity sweep in the higher timeframe.

The Hourly sweep(order flow liquidity sweep) in this example can be seen as a previous candle sweep(candle science liquidity sweep) in the daily timeframe.

. 𝐎𝐫𝐝𝐞𝐫 𝐅𝐥𝐨𝐰 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐒𝐰𝐞𝐞𝐩

. 𝐂𝐚𝐧𝐝𝐥𝐞 𝐒𝐜𝐢𝐞𝐧𝐜𝐞 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐒𝐰𝐞𝐞𝐩

An order flow liquidity sweep can be seen as a candle science liquidity sweep in the higher timeframe.

The Hourly sweep(order flow liquidity sweep) in this example can be seen as a previous candle sweep(candle science liquidity sweep) in the daily timeframe.

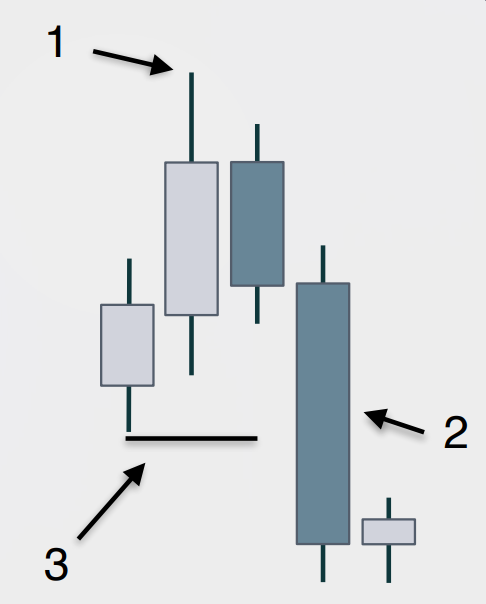

𝑂𝑟𝑑𝑒𝑟 𝐹𝑙𝑜𝑤 𝐿𝑖𝑞𝑢𝑖𝑑𝑖𝑡𝑦 𝑆𝑤𝑒𝑒𝑝

We have seen that there are FLOD (Fair Value Gap), OD (Fair Value Area), and LLOD (Swing High) in an order flow leg. The last line of defence (LLOD) is the swing high.

𝐖𝐞 𝐨𝐧𝐥𝐲 𝐞𝐱𝐩𝐞𝐜𝐭 𝐭𝐡𝐞 𝐋𝐋𝐎𝐃(𝐬𝐰𝐢𝐧𝐠 𝐥𝐨𝐰) 𝐭𝐨 𝐡𝐨𝐥𝐝 𝐚𝐧𝐝 𝐚 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐬𝐰𝐞𝐞𝐩 𝐭𝐨 𝐡𝐚𝐩𝐩𝐞𝐧 𝐨𝐧𝐥𝐲 𝐰𝐡𝐞𝐧 𝐭𝐡𝐞𝐫𝐞 𝐢𝐬 𝐧𝐨 𝐅𝐕𝐆 𝐢𝐧 𝐭𝐡𝐞 𝐨𝐫𝐝𝐞𝐫 𝐟𝐥𝐨𝐰 𝐥𝐞𝐠.

With no FVG, the swing low becomes the only PD array that price can use to displace higher.

We have seen that there are FLOD (Fair Value Gap), OD (Fair Value Area), and LLOD (Swing High) in an order flow leg. The last line of defence (LLOD) is the swing high.

𝐖𝐞 𝐨𝐧𝐥𝐲 𝐞𝐱𝐩𝐞𝐜𝐭 𝐭𝐡𝐞 𝐋𝐋𝐎𝐃(𝐬𝐰𝐢𝐧𝐠 𝐥𝐨𝐰) 𝐭𝐨 𝐡𝐨𝐥𝐝 𝐚𝐧𝐝 𝐚 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐬𝐰𝐞𝐞𝐩 𝐭𝐨 𝐡𝐚𝐩𝐩𝐞𝐧 𝐨𝐧𝐥𝐲 𝐰𝐡𝐞𝐧 𝐭𝐡𝐞𝐫𝐞 𝐢𝐬 𝐧𝐨 𝐅𝐕𝐆 𝐢𝐧 𝐭𝐡𝐞 𝐨𝐫𝐝𝐞𝐫 𝐟𝐥𝐨𝐰 𝐥𝐞𝐠.

With no FVG, the swing low becomes the only PD array that price can use to displace higher.

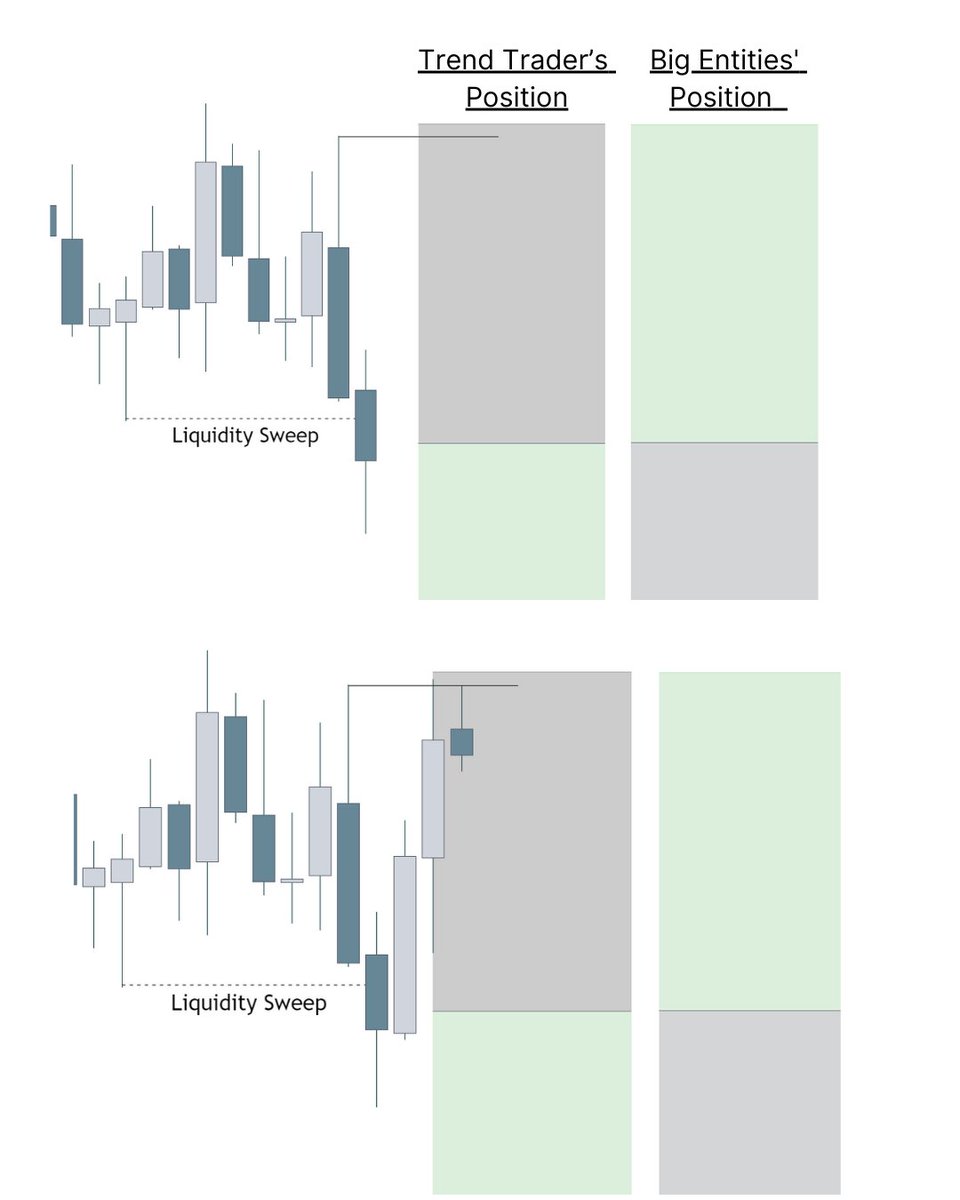

𝐶𝑎𝑛𝑑𝑙𝑒 𝑆𝑐𝑖𝑒𝑛𝑐𝑒 𝐿𝑖𝑞𝑢𝑖𝑑𝑖𝑡𝑦 𝑆𝑤𝑒𝑒𝑝

𝐖𝐡𝐞𝐧 𝐭𝐡𝐞 𝐟𝐢𝐫𝐬𝐭 𝟏𝐬𝐭 𝐜𝐚𝐧𝐝𝐥𝐞 𝐜𝐨𝐦𝐞𝐬 𝐢𝐧 𝐜𝐨𝐧𝐭𝐚𝐜𝐭 𝐰𝐢𝐭𝐡 𝐚 𝐏𝐃 𝐀𝐫𝐫𝐚𝐲 𝐚𝐧𝐝 𝐝𝐨𝐞𝐬 𝐧𝐨𝐭 𝐫𝐞𝐣𝐞𝐜𝐭 𝐡𝐢𝐠𝐡𝐞𝐫, 𝐰𝐞 𝐜𝐚𝐧 𝐞𝐱𝐩𝐞𝐜𝐭 𝐭𝐡𝐞 𝐧𝐞𝐱𝐭 𝐜𝐚𝐧𝐝𝐥𝐞 𝐭𝐨 𝐬𝐰𝐞𝐞𝐩 𝐭𝐡𝐞 𝐥𝐨𝐰 𝐨𝐟 𝐭𝐡𝐞 𝐟𝐢𝐫𝐬𝐭 𝐜𝐚𝐧𝐝𝐥𝐞 𝐚𝐧𝐝 𝐝𝐢𝐬𝐩𝐥𝐚𝐜𝐞 𝐡𝐢𝐠𝐡𝐞𝐫.

In this example, the first candle that comes inside the Daily FVG does not reject. The second candle sweeps the previous candle low to displace higher.

This happens so often. In the lower timeframe, we can see order flow legs going lower at first and then changing direction to displace higher

𝐖𝐡𝐞𝐧 𝐭𝐡𝐞 𝐟𝐢𝐫𝐬𝐭 𝟏𝐬𝐭 𝐜𝐚𝐧𝐝𝐥𝐞 𝐜𝐨𝐦𝐞𝐬 𝐢𝐧 𝐜𝐨𝐧𝐭𝐚𝐜𝐭 𝐰𝐢𝐭𝐡 𝐚 𝐏𝐃 𝐀𝐫𝐫𝐚𝐲 𝐚𝐧𝐝 𝐝𝐨𝐞𝐬 𝐧𝐨𝐭 𝐫𝐞𝐣𝐞𝐜𝐭 𝐡𝐢𝐠𝐡𝐞𝐫, 𝐰𝐞 𝐜𝐚𝐧 𝐞𝐱𝐩𝐞𝐜𝐭 𝐭𝐡𝐞 𝐧𝐞𝐱𝐭 𝐜𝐚𝐧𝐝𝐥𝐞 𝐭𝐨 𝐬𝐰𝐞𝐞𝐩 𝐭𝐡𝐞 𝐥𝐨𝐰 𝐨𝐟 𝐭𝐡𝐞 𝐟𝐢𝐫𝐬𝐭 𝐜𝐚𝐧𝐝𝐥𝐞 𝐚𝐧𝐝 𝐝𝐢𝐬𝐩𝐥𝐚𝐜𝐞 𝐡𝐢𝐠𝐡𝐞𝐫.

In this example, the first candle that comes inside the Daily FVG does not reject. The second candle sweeps the previous candle low to displace higher.

This happens so often. In the lower timeframe, we can see order flow legs going lower at first and then changing direction to displace higher

• • •

Missing some Tweet in this thread? You can try to

force a refresh