In the first quarters of 2024, following a series of disappointing airdrops, the hype has diminished and competition for allocations has eased.

Here is my compilation of airdrop programs worth joining in Q4 2024, with FDV expectations ↓

Here is my compilation of airdrop programs worth joining in Q4 2024, with FDV expectations ↓

Covering every detail of each airdrop in a thread is quite challenging.

For a more in-depth exploration and steps to farm each airdrop, check out my publication on Substack (and don't forget to subscribe!) ↓

stacymuur.substack.com/p/airdrops-to-…

For a more in-depth exploration and steps to farm each airdrop, check out my publication on Substack (and don't forget to subscribe!) ↓

stacymuur.substack.com/p/airdrops-to-…

#1: @MorphoLabs

Morpho is a trustless, efficient lending platform that facilitates the creation of permissionless markets. It rapidly achieved the position of the 6th largest lending market on @DefiLlama by TVL, with a current TVL of $1.4 billion.

Morpho is a trustless, efficient lending platform that facilitates the creation of permissionless markets. It rapidly achieved the position of the 6th largest lending market on @DefiLlama by TVL, with a current TVL of $1.4 billion.

Morpho’s Airdrop campaign isn't point-based. Instead, users can specify the expected FDV to observe changes in the asset supply and borrow APY.

For instance, the example below uses a $1B FDV.

For instance, the example below uses a $1B FDV.

In terms of FDV expectations, @MorphoLabs' closest competitors are @compoundfinance ($444M FDMC), @VenusProtocol ($210M FDMC), and @KaminoFinance ($660M FDMC).

On August 1, Morpho raised $50M in a strategic funding round (FDV not disclosed). Assuming 10–15% of tokens were sold during this round, this implies an FDV of $330M–$500M.

Given that all VC rounds are typically discounted, Morpho's FDV at launch might be close to $1B.

Given that all VC rounds are typically discounted, Morpho's FDV at launch might be close to $1B.

#2: @SunriseLayer

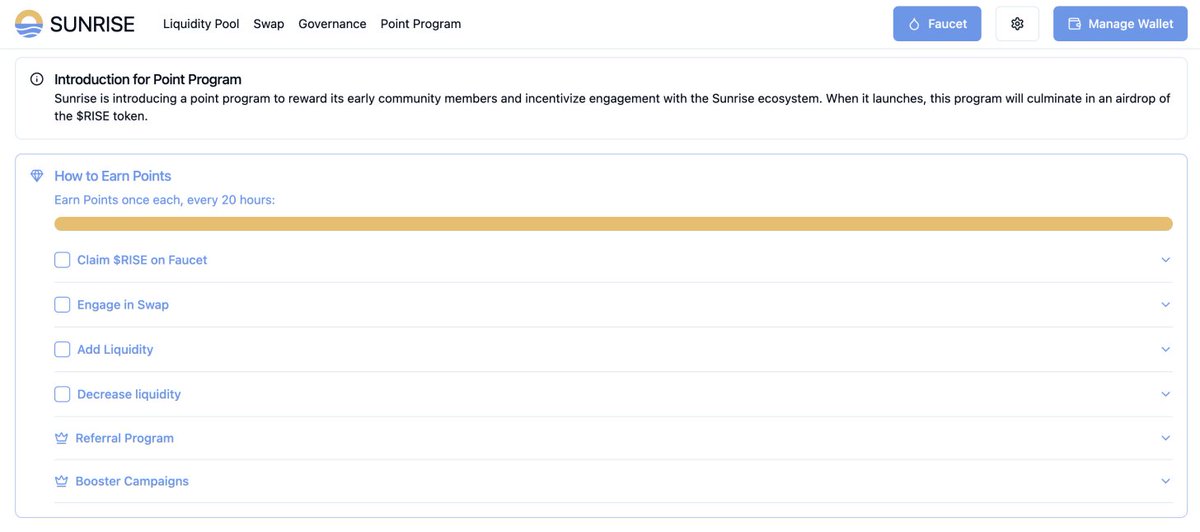

Sunrise is a specialized data availability (DA) layer designed for proof-of-liquidity (PoL) and fee abstraction. In the genesis $RISE airdrop, 12% are to be distributed to early users.

Sunrise is a specialized data availability (DA) layer designed for proof-of-liquidity (PoL) and fee abstraction. In the genesis $RISE airdrop, 12% are to be distributed to early users.

So far, over 200K users have joined the testnet and the DAUs have grown to around 50,000 and are still increasing.

Sunrise's closest competitors are Celestia ($4.7B FDV), Avail ($1.2B FDV), and KYVE ($24M FDV).

I anticipate the launch FDV to be between $300M and $500M.

Sunrise's closest competitors are Celestia ($4.7B FDV), Avail ($1.2B FDV), and KYVE ($24M FDV).

I anticipate the launch FDV to be between $300M and $500M.

#3: @0xMantle's $COOK

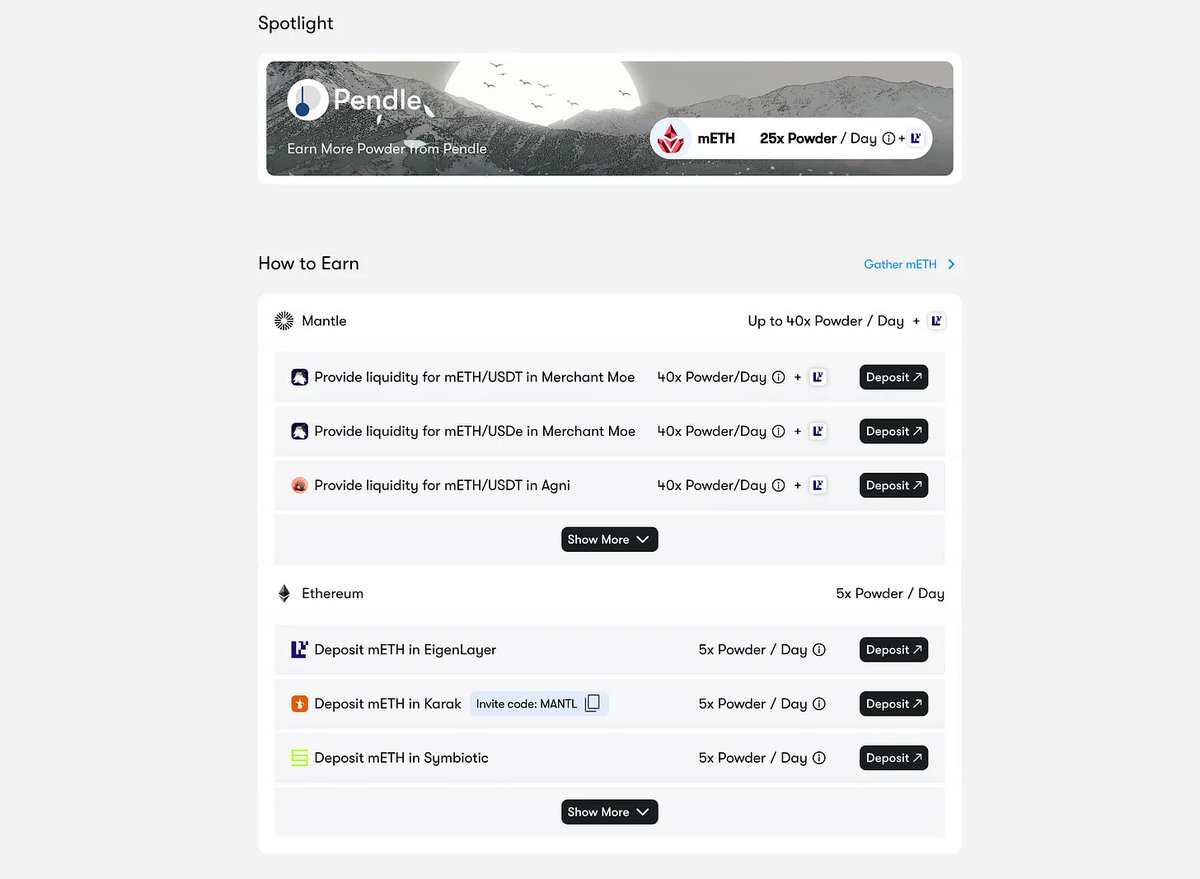

Mantle, an Ethereum L2, is currently running the Metamorphosis campaign, after which the new $COOK tokens will be distributed to the community. $COOK will serve as the future governance token for Mantle’s LST (mETH, one of the largest LSTs by TVL) and LRT (cmETH, a new liquid restaking primitive).

Mantle, an Ethereum L2, is currently running the Metamorphosis campaign, after which the new $COOK tokens will be distributed to the community. $COOK will serve as the future governance token for Mantle’s LST (mETH, one of the largest LSTs by TVL) and LRT (cmETH, a new liquid restaking primitive).

The process for farming the upcoming COOK is straightforward with various options available.

The key is to acquire some mETH (preferably on Mantle, as it earns more Powder per day) and then boost its rewards by participating in different DeFi activities.

The key is to acquire some mETH (preferably on Mantle, as it earns more Powder per day) and then boost its rewards by participating in different DeFi activities.

$mETH is currently the 5th largest LST, nearing Jito ($2.1B FDMC) and Marinade Finance ($100M FDMC) by TVL.

With $COOK serving as the governance token for both mETH and the upcoming cmETH, the launch FDV might range between $150M and $300M.

Hopefully, Mantle will avoid the low float, high FDV approach.

With $COOK serving as the governance token for both mETH and the upcoming cmETH, the launch FDV might range between $150M and $300M.

Hopefully, Mantle will avoid the low float, high FDV approach.

Other airdrops worth your attention include:

• @StoryProtocol

• @soneium

• @hyperlane

I've covered each of them more in detail in my Substack article.

Enjoy reading!stacymuur.substack.com/p/airdrops-to-…

• @StoryProtocol

• @soneium

• @hyperlane

I've covered each of them more in detail in my Substack article.

Enjoy reading!stacymuur.substack.com/p/airdrops-to-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh