@LayerZero_Fndn announced ZRO token reallocation to active wallets after TGE.

2/27

2/27

https://twitter.com/1793767363709403137/status/1837228529282334736

@LogX_trade announced the LOGX airdrop checker. Over 1.2M users who participated in incentive programs on LogX V1 and the LogX Network Testnet are eligible.

TGE: 12:30 UTC, Sep 24th

3/27

TGE: 12:30 UTC, Sep 24th

3/27

https://twitter.com/1659556952157097986/status/1837848353058799974

@ether_fi Season 3 claim checker is live. The claim portal is available on Sep 23-27th.

4/27

4/27

https://twitter.com/1790057507739643904/status/1837299489998016538

@Polkadot announced the release of Agile Coretime, an important product that paves the way for Polkadot 2.0 upgrades.

5/27

5/27

https://twitter.com/1595615893/status/1837093349292954008

The Re Member Fund, provided by @re and @Securitize is now live on @avax, introducing a new RWA class to the Avalanche ecosystem.

Avalanche is becoming a prominent powerhouse for RWAs.

6/27

Avalanche is becoming a prominent powerhouse for RWAs.

6/27

https://twitter.com/1532891/status/1836900465138663697

@FlareNetworks launched Flare Time Series Oracle v2 on the Flare Mainnet.

• SecureFTSOv2 is integrated into Flare’s core, enhancing overall network security.

• FastFTSOv2 updates every 1.8 seconds, ideal for DeFi applications like lending, trading, and cross-chain order books.

• ScalableFTSOv2 supports 1,000 feeds across various assets with 2 weeks of historical data.

• Decentralized with 100 independent data providers, ensuring integrity through strict penalties.

• Cost-effective: querying most block-latency feeds from FTSOv2 is free on Flare.

7/27

• SecureFTSOv2 is integrated into Flare’s core, enhancing overall network security.

• FastFTSOv2 updates every 1.8 seconds, ideal for DeFi applications like lending, trading, and cross-chain order books.

• ScalableFTSOv2 supports 1,000 feeds across various assets with 2 weeks of historical data.

• Decentralized with 100 independent data providers, ensuring integrity through strict penalties.

• Cost-effective: querying most block-latency feeds from FTSOv2 is free on Flare.

7/27

LRTs like @RenzoProtocol, @swellnetworkio and @ether_fi have launched Airdrop Claim pages for Stakedrop2, where eligible participants can claim $EIGEN.

$EIGEN will be available for transfer within September 30th and will likely be listed soon.

Other LRTs' airdrops are also available to check.

8/27

$EIGEN will be available for transfer within September 30th and will likely be listed soon.

Other LRTs' airdrops are also available to check.

8/27

@sanctumso announced Creator Coins and Cloud Card

- Creator Coins: a community-based SOL LST creation platform. For 1 SOL, you can create your own coin that supporters can hold.

- Cloud Card: a SOL debit card that lets you spend your SOL and stablecoins in over 100 countries.

- Sanctum Season 2 is coming

9/27

- Creator Coins: a community-based SOL LST creation platform. For 1 SOL, you can create your own coin that supporters can hold.

- Cloud Card: a SOL debit card that lets you spend your SOL and stablecoins in over 100 countries.

- Sanctum Season 2 is coming

9/27

@SkyEcosystem partnered with @wormhole to deploy $SKY $USDS and $sUSDS multichain with Wormhole's NTT framework.

Solana is the next destination.

10/27

Solana is the next destination.

10/27

https://twitter.com/1417845872436547587/status/1837117346403733951

@CelestiaOrg announced the Lemongrass update, introducing 1-click interactions over IBC, interchain accounts, and more.

11/27

11/27

https://twitter.com/1168944141449015296/status/1836412582082891821

@JamboTechnology introduced JampoPhone 2 on Solana.

12/27

12/27

https://twitter.com/951329744804392960/status/1837427571279179965

@circle's native USDC will soon be live on @SuiNetwork. Sui now boasts $900M in TVL, ranking #8 among all chains.

#Suitember is booming with top DeFi protocols on Sui.

13/27

#Suitember is booming with top DeFi protocols on Sui.

13/27

https://twitter.com/1428872926363754497/status/1836047601793405309

@JupiterExchange announced key product updates:

- Comprehensive liquidity APIs for Solana's builders.

- Jupiter RFQ.

- Perps V2

- Jupiter Mobile with onramp service

- Memecoin trading platform Ape Pro

14/27

- Comprehensive liquidity APIs for Solana's builders.

- Jupiter RFQ.

- Perps V2

- Jupiter Mobile with onramp service

- Memecoin trading platform Ape Pro

14/27

https://twitter.com/1446489618208067586/status/1836993405857190195

@0xfluid introduced @coinbase cbBTC markets on the Ethereum mainnet, offering $50K in incentives for borrowing stablecoins against $cbBTC.

A temper check is underway to transfer unused USDC from the Liquidity Layer to @SkyEcosystem $sUSDS and redistribute the generated yield back to lenders.

15/27

A temper check is underway to transfer unused USDC from the Liquidity Layer to @SkyEcosystem $sUSDS and redistribute the generated yield back to lenders.

15/27

@EverclearOrg the first Clearing Layer, went live on mainnet beta. Everclear aims to significantly improve the cross-chain UX.

16/27

16/27

https://twitter.com/872256542443134976/status/1836391877580669126

@WalletConnect introduced its token WCT, the native token of WalletConnect Network and its rebranding to @reown_.

17/27

17/27

https://twitter.com/977233881668648960/status/1835985897923162529

@1inch announced Fusion+ on dApp and soon coming to 1inchWallt. Fusion+ allows fast, efficient and secure cross-chain swaps.

18/27

18/27

https://twitter.com/1137038394503114753/status/1836292083428053057

@dYdX unveiled its plans to debut perpetual futures on prediction markets.

19/27

19/27

https://twitter.com/3404331/status/1836039907279818889

@hyperlane announced a new SVM expansion to Solana and @EclipseFND.

Eclipse, the first Ethereum SVM L2, now has facilitated routes on Nexus for USDC, SOL, and WIF transfers.2

20/27

Eclipse, the first Ethereum SVM L2, now has facilitated routes on Nexus for USDC, SOL, and WIF transfers.2

20/27

https://twitter.com/1489737129546551296/status/1836801989537370536

@ton_blockchain partnered with @CurveFinance to incubate a stablecoin swap project on TON.

21/27

21/27

https://twitter.com/1442437262663319565/status/1836010377639079967

@MeFndn announced Magic Eden's $ME will be launched on Solana.

22/27

22/27

https://twitter.com/1746878502152925184/status/1837355758050242710

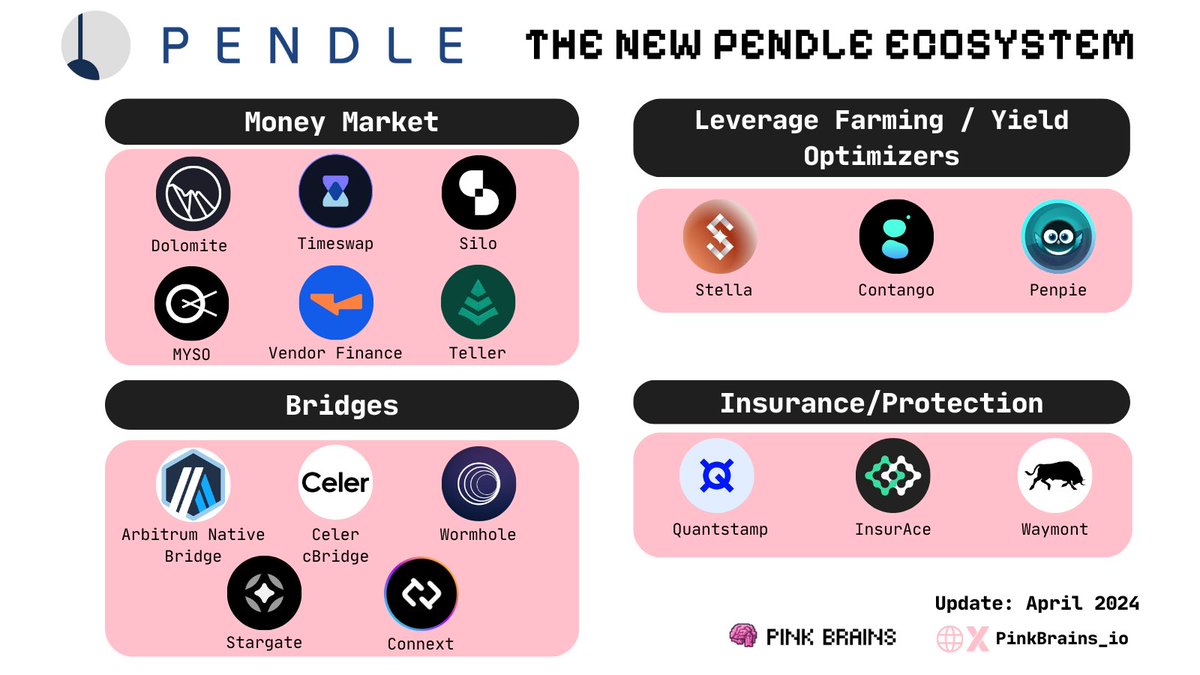

@pendle_fi is brewing to be the go-to yield trading on BTCFi ecosystem.

A new market was introduced: Solv x Corn SolvBTC.BBN (matured on 26 Dec). LPs earn on top of up to 32% LP APY:

- 14x Solv XP

- 3x Corn Kernel

- 1x Babylon Points

PTs earn 8.356% APY fixed yield.

23/27

A new market was introduced: Solv x Corn SolvBTC.BBN (matured on 26 Dec). LPs earn on top of up to 32% LP APY:

- 14x Solv XP

- 3x Corn Kernel

- 1x Babylon Points

PTs earn 8.356% APY fixed yield.

23/27

https://twitter.com/1377493693762969600/status/1836570784883769521

@eigenlayer introduced Programmatic Incentives 1.

Operators must be registered to at least one AVS and Stakers must be delegated to an operator that is registered to at least one AVS to be eligible for allocation.

24/27

Operators must be registered to at least one AVS and Stakers must be delegated to an operator that is registered to at least one AVS to be eligible for allocation.

24/27

https://twitter.com/1542947918709080065/status/1836111446092263453

@KyberNetwork deployed its DEX Aggregator on @0xSonicLabs.

25/27

25/27

https://twitter.com/977020204071792641/status/1836805936759111831

@OrderlyNetwork launched an AI bounty program in collaboration with Google Cloud to power Web 3.0 trading.

26/27

26/27

https://twitter.com/1483715378261815298/status/1836034913960874336

That's a wrap-up for a big week!

If you like this content, please follow us @PinkBrains_io for more DeFi and Web3 Marketing insights. 🧠

Like/RT the first tweet and bookmark to support us!

27/27

If you like this content, please follow us @PinkBrains_io for more DeFi and Web3 Marketing insights. 🧠

Like/RT the first tweet and bookmark to support us!

27/27

https://twitter.com/1690590578160132096/status/1838141380037947535

• • •

Missing some Tweet in this thread? You can try to

force a refresh